I consistently hear many of the same questions about these markets. There are concerns about valuations, tariffs, inflation, Fed independence, and, most recently, the integrity of BLS data.

But the single question I hear most often is about market concentration. I want to explain why I don’t believe this is a fatal issue to the bull market, and what it might mean for equities going forward.

There are a few major lines of thought – a 30,000-foot view, a few specific facts on the ground, and some history– that are behind my thinking.

The big picture view? The title of this post: The Magnificent 493.

Lots of people are focused on choosing the companies that will most directly benefit from artificial intelligence, but this is both difficult and may miss the bigger picture. When we look at the history of major technological innovations, we see thousands of companies rushing into each generation’s newest technology. Some do well, most crash and burn, but the biggest beneficiaries are most often these firms’ customers.

Think of the hundreds of companies that produced PCs in the 1980s and ‘90s, or consider the thousands of American companies that entered the automobile industry. Perhaps the most accessible example is the Internet and the dot-com startups formed in the 1990s. Most people don’t remember Juniper Networks, Metromedia Fiber, or even Pets.com, all consigned to the dustbin of history, but huge in their day.1

When we think about Internet companies, we often imagine those narrow parts of the economy focused on specific web technologies. But today, because of these firms, every company is essentially an internet company. We all have email, websites, and use various internet-based tools for work. We share videos, audio, and written content online. We do our client updates via Zoom or Google Meet; new client inquiries are online, as are compliance filings, etc. Public companies host their quarterly calls on their websites; the SEC posts all required documents online.

What company today is NOT an internet company?

Now apply the same thinking the new new thing: Artificial Intelligence. Every company that thoughtfully applies AI is going to be more efficient, productive, and profitable.

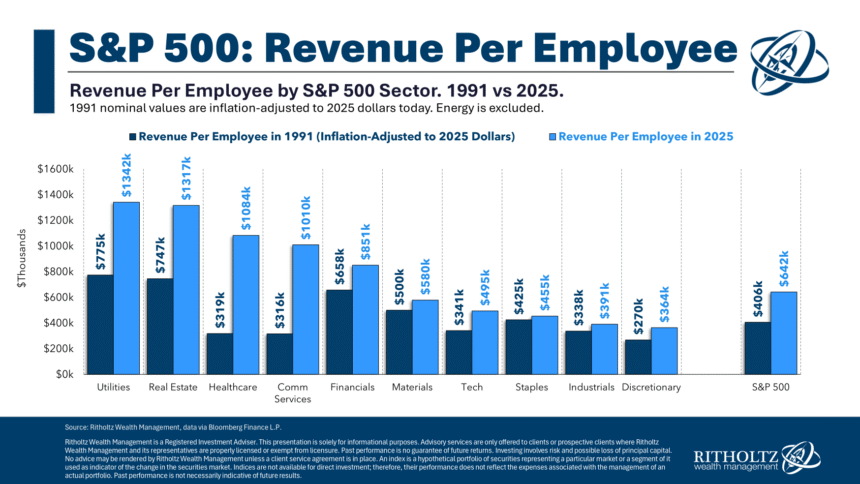

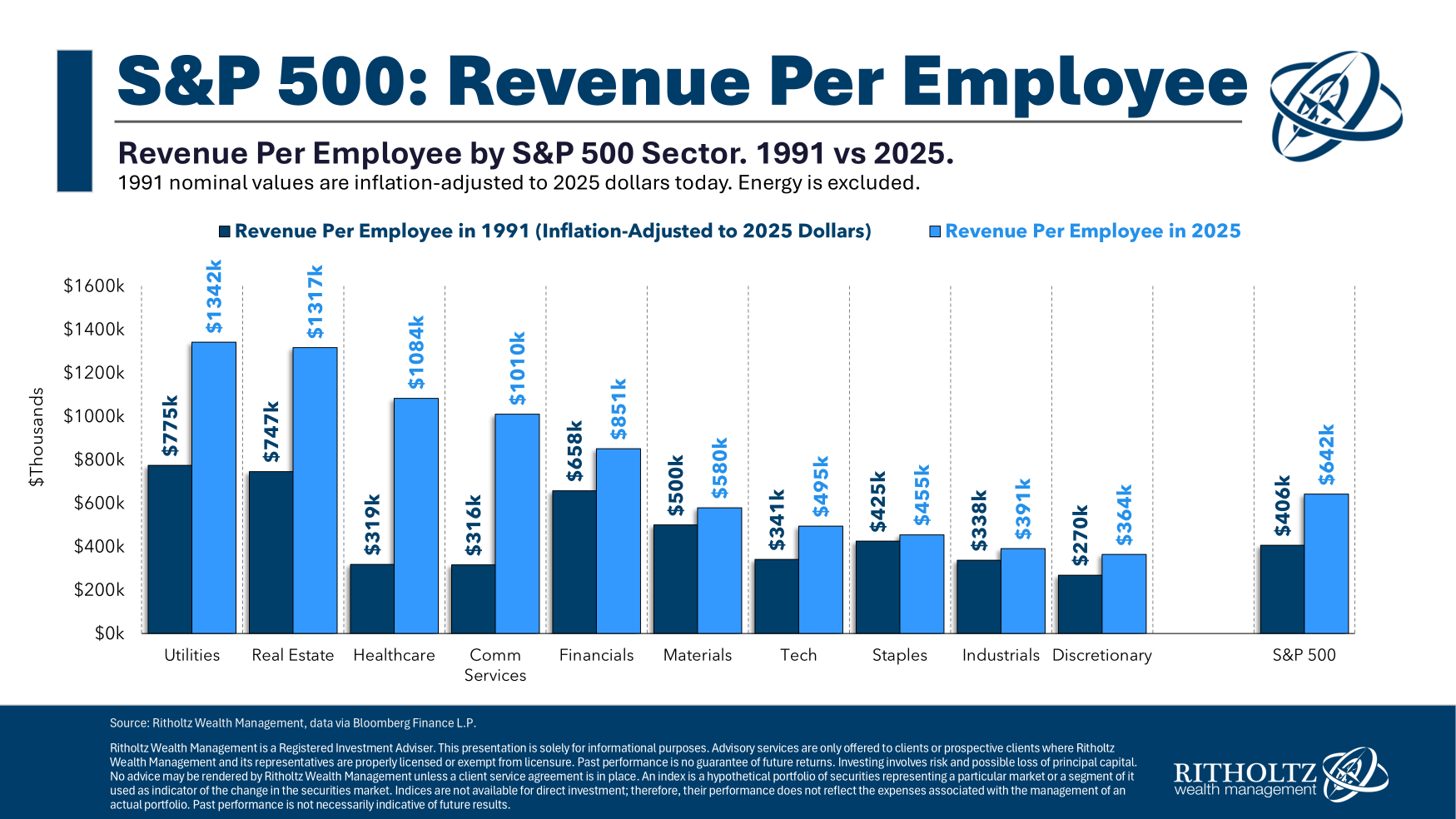

Have a look at the chart at the top. It compares the Revenue Per Employee by S&P 500 Sector in 1991 versus 2025 (inflation-adjusted). That period reflects a significant increase in the use of technology — computers, internet, mobile devices, apps, software, etc. The result was that corporate America has consistently increased revenue per employee over time.

This simply demonstrates how much efficiency drives the integration of innovation. Now recognize that we are still in the early days of AI< and you can get a grasp as to why some investors do not believe the market is wildly overvalued.

Some of you are thinking, “Fine, Ritholtz, I’ll give you enough rope to hang yourself on valuation issues, but what of market concentration?”

Let’s address that: While some people are deeply concerned about concentration in the S&P 500 due to the Magnificent 7, I have been more focused on those firms that are going to make every other company in the S&P 500, the Russell 2000, and the Wilshire 5000 so much better. At least, that’s my 30,000-foot view, let’s see what is actually going on at ground level.

My Bloomberg colleagues Eric Balchunas and Breanne Dougherty point out the details:

Magnificent 7? Think of them more as the Magnificent Seventy

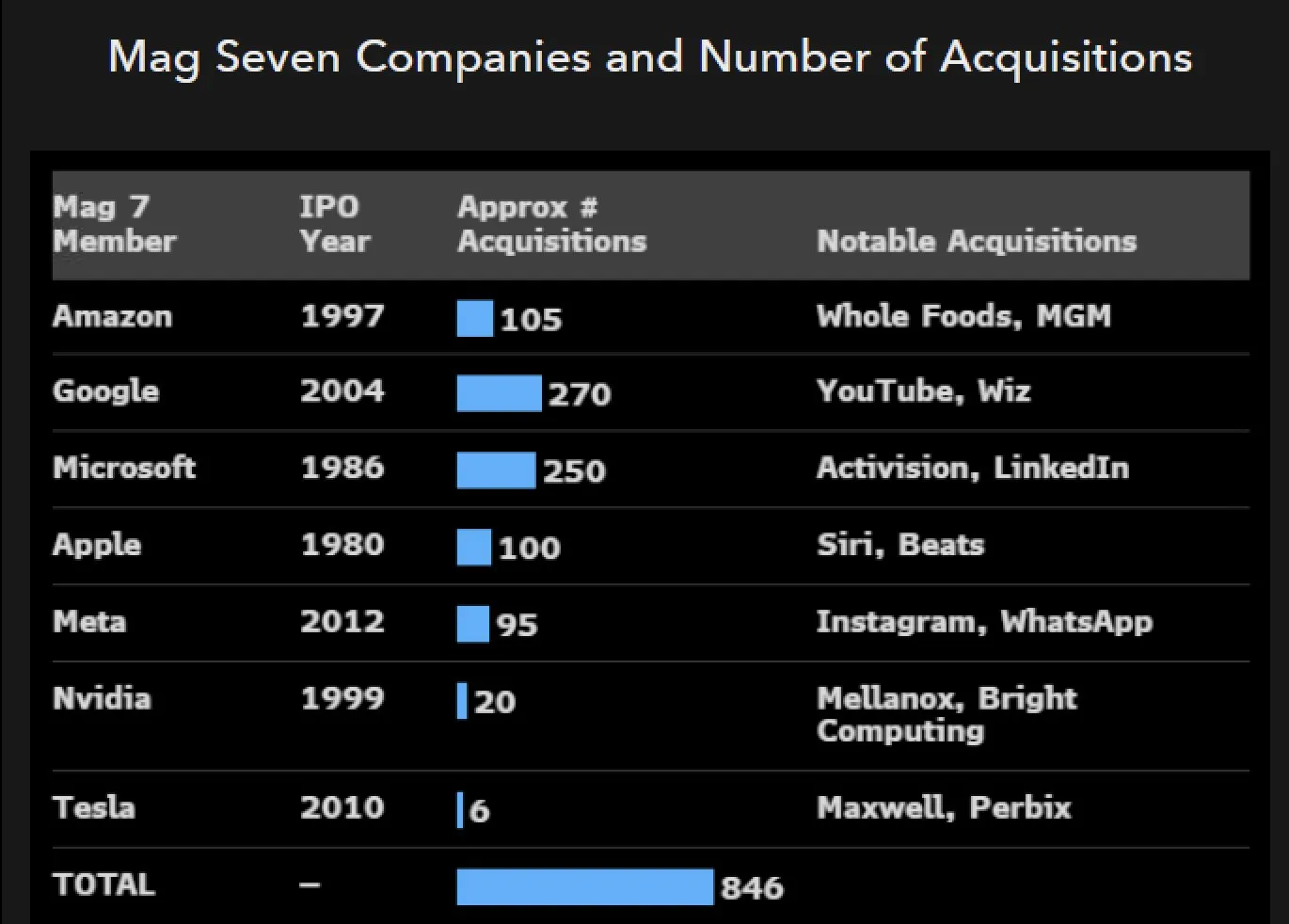

“They may go by the Magnificent Seven, but the truth is they act more like the Magnificent Seventy. Collectively, the Seven have acquired over 800 companies and expanded into a dizzying array of industries – effectively functioning as conglomerates of advanced technology, while still growing organically. Viewed this way – as dozens of companies within each one – concerns about their record 33% weighting in the S&P 500 miss the point: the index may still be as diversified as ever. (8/7/25)

Sam Ro described this phenomenon thusly:

“Nvidia, Microsoft, Apple, Alphabet, Amazon, Meta Platforms, and Tesla — the trillion-dollar companies collectively known as the “Magnificent Seven — account for about a third of the S&P 500’s combined market capitalization. This concentration among the most prominent companies makes some people nervous. Because what if one or more of these companies sees demand sour and investors dump the stocks?

My favorite counterargument to this concern is that these seven companies don’t operate just seven businesses.”

~~~

Finally, let’s consider what the historical record shows about concentration.

David Marlin (of Marlin Capital) points out that the Mag 7, AT 35% of the SPX, is not an outlier. Railroads were 63% of the U.S. Stock Market in 1881. A more recent example comes from the 1970s, long before passive indexing existed. Back then, the Nifty Fifty was more than 40% of the S&P 500.

~~~

Every cycle consists of people arguing across each other, rather than with each other. This one seems no different. If you want to find reasons to be out of this market, you can. If you want a rationalization to stay long (besides trend and average long-term returns), those exist as well.

I will gladly admit to this being an exercise in confirmation bias on my part. However, you have to admit, it is a fairly convincing one.

See also:

Eye-popping stats from the market’s big growth stories (Sam Ro, Aug 10, 2025)

The Week We All Found Out TCAF, Aug. 8, 2025

Previously:

All Time Highs Are Bullish (June 26, 2025)

A Spectacularly Underappreciated 15 Years (April 28, 2025)

Manage the Noise (June 17, 2025)

__________

1. Juniper Networks peaked in 2000 at $77 billion market cap; a quarter century later, it’s about $13.3 billion. Pets.com shut down in 2000, but today, Chewy is a thriving business in a similar space. Metromedia Fiber Network (MFN) filed for Chapter 11 bankruptcy in 2002 and was subsequently acquired by Zayo Group in 2012.