Join Our Telegram channel to stay up to date on breaking news coverage

Tom Lee’s BitMine is seeking to raise $20 billion through an expanded stock offering to buy Ethereum, aiming to become ETH’s Michael Saylor with the largest corporate acquisition of the asset to date.

According to a filing on Tuesday, BitMine has expanded its at-the-market (ATM) stock offering, which allows it to sell shares gradually at prevailing market prices, from about $4.9 billion to $24.5 billion, a fivefold increase, with all proceeds expected to go toward ETH purchases.

BitMine stock surged almost 6% on the news yesterday and has climbed a further 4.9% in premarket trading to reach $65.29 as of 8:09 a.m. est.

Tom Lee is raising $20B to buy more Ethereum

oh my goodness$BMNR $ETH pic.twitter.com/7g3W5a8N7C

— amit (@amitisinvesting) August 12, 2025

This comes as Ether climbed above the $4,600 level, its highest since December 2021, as it closed on its previous high of $4,891 that it set in Nov. 2021.

ETH has surged 9.7% in the past 24 hours to trade at $4,697 as of 8:21 a.m. EST, according to CoinGecko. Trading volume also surged 45% to $59.7 billion, showcasing rising interest in ETH.

US spot Ethereum ETFs (exchange-traded funds) saw another $524.9 million in inflows yesterday after a record-breaking day on Monday.

Tom Lee Sets Sights On Unprecedented 5% Ethereum Grab

Under Tom Lee, BitMine has grown to become the largest corporate holder of Ethereum, hoarding 1.2 million ETH worth nearly $5 billion.

The legendary Wall Street investor and Fundstrat CEO is determined to acquire 5% of ETH’s total supply, up from about 0.95% now.

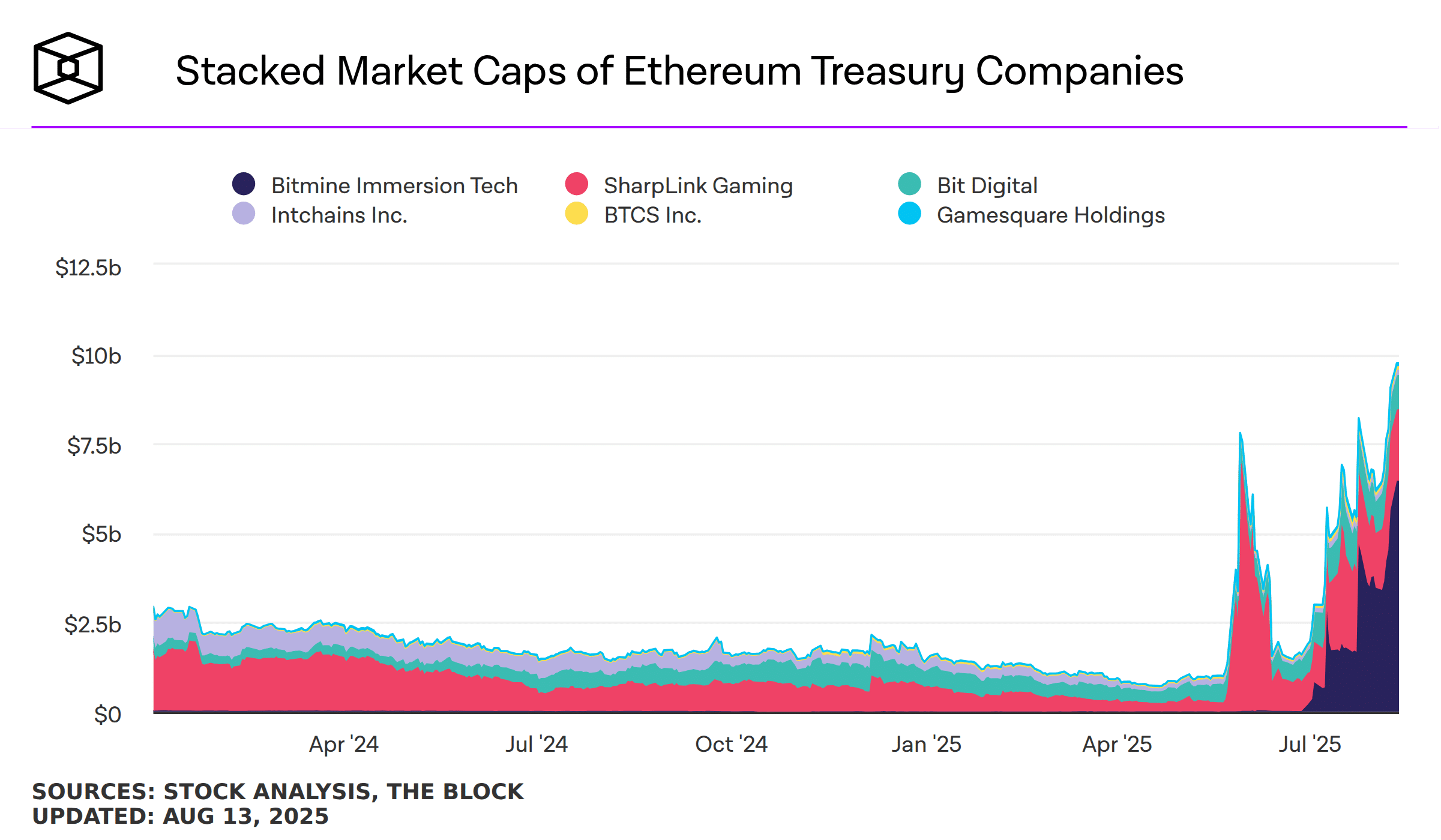

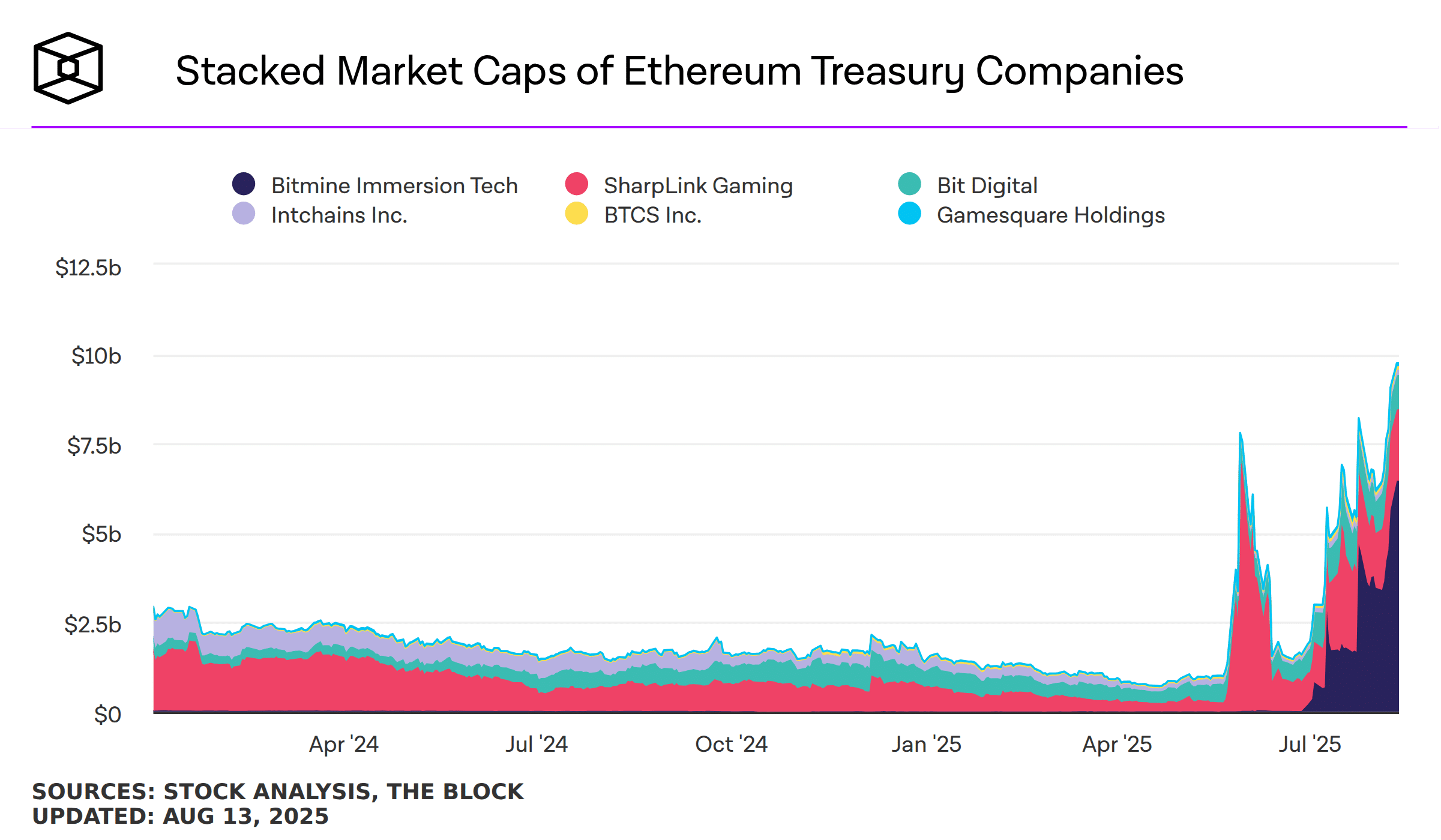

Meanwhile, other ETH-focused digital asset treasuries are also scaling up, with 2.2 million ETH (1.8% of the ether supply) accumulated in the last 2 months.

Most ETH treasuries are taking an active on-chain approach, as they aim to deploy capital through staking and DeFi to enhance returns. They do this while supporting network security and liquidity.

This borrows from Michael Saylor’s Strategy playbook, where the company raises funds through equity and convertible debt issuance to buy Bitcoin. This has allowed Strategy to amass over 628,946 BTC (2.9% of BTC’s supply).

Strategy has acquired 155 BTC for ~$18.0 million at ~$116,401 per bitcoin and has achieved BTC Yield of 25.0% YTD 2025. As of 8/10/2025, we hodl 628,946 $BTC acquired for ~$46.09 billion at ~$73,288 per bitcoin. $MSTR $STRC $STRK $STRF $STRD https://t.co/bx0814RI1w

— Michael Saylor (@saylor) August 11, 2025

However, the Ethereum treasuries differ from their BTC counterparts in their ability to tap into Ethereum’s staking and DeFi ecosystem.

The race to acquire a larger share of ETH is now accelerating, as these companies build reserves at a favorable cost basis, according to data from The Block.

Meanwhile, Joseph Lubin’s Sharplink Gaming also announced a $400 million registered direct offering, alongside $200 million in existing ATM proceeds ready to deploy, which could push its Ethereum holdings past $3 billion.

Now, the two leading ETH treasury firms are exerting significant buying pressure on Ethereum.

Inflows Into ETH ETFs Extended To Six Days

The corporate acquisition of ETH comes at a time when the market is also experiencing rising inflows for US spot Ethereum ETFs.

These investment vehicles recorded $523.9 million in daily inflows on Tuesday, following Monday’s record-setting $1.02 billion.

Data from CoinGlass shows that six of the nine ETFs recorded positive flows, led by BlackRock’s ETHA with $318.70 million in inflows.

This extends the ETH ETFs’ positive streak to six consecutive days, attracting $2.33 billion in net inflows. As a result, spot ETH ETFs now account for $24.84 billion in net assets, which is roughly 4.8% of Ethereum’s total market capitalization.

According to Nate Geraci, President of NovaDius Wealth, the latest inflows into ether ETFs mark a notable shift from BTC ETFs that dominated last year and earlier this year.

Another half bil into spot eth ETFs…

5th best day since launch.

Now $2.3bil over past 5 trading days.

Since beginning of July, spot eth ETFs have taken in nearly $1.5bil more than spot btc ETFs.

Notable shift.

— Nate Geraci (@NateGeraci) August 13, 2025

Ethereum Price Signals Breakout Momentum Beyond ATH

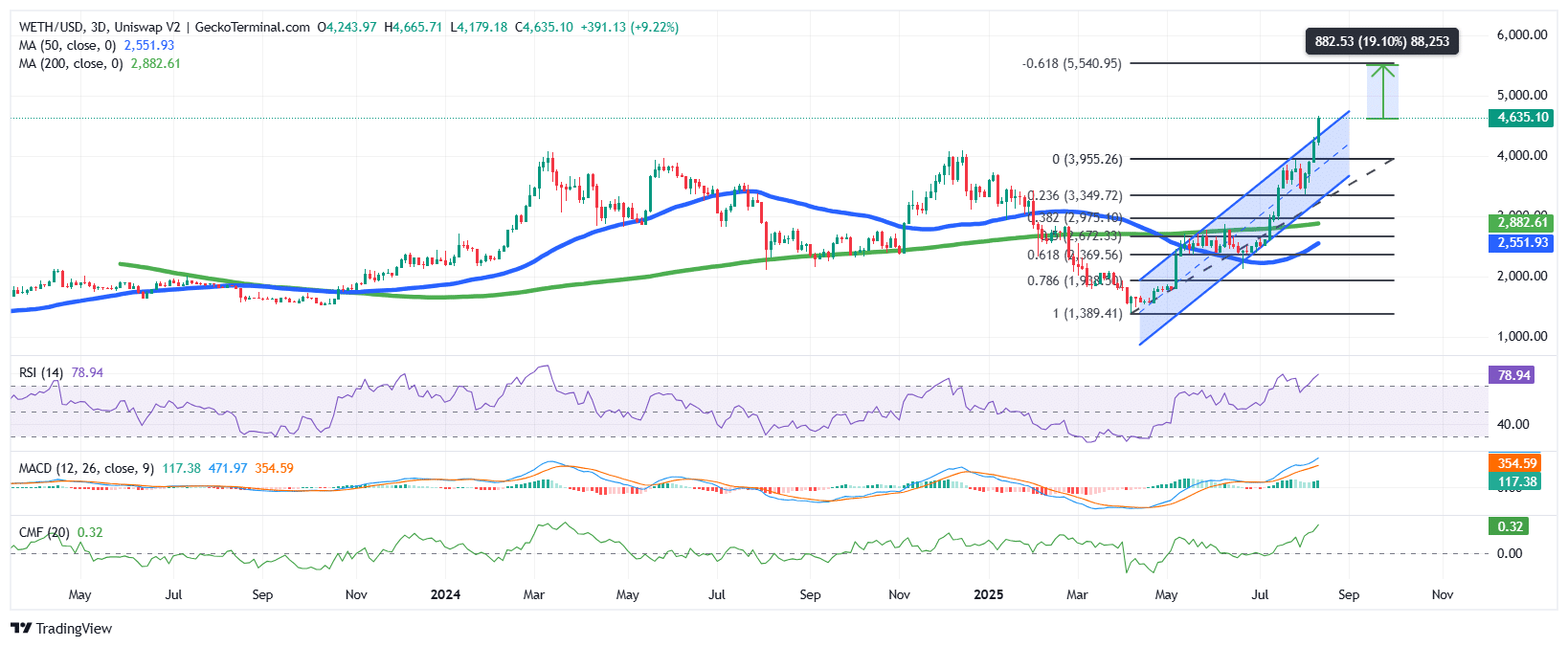

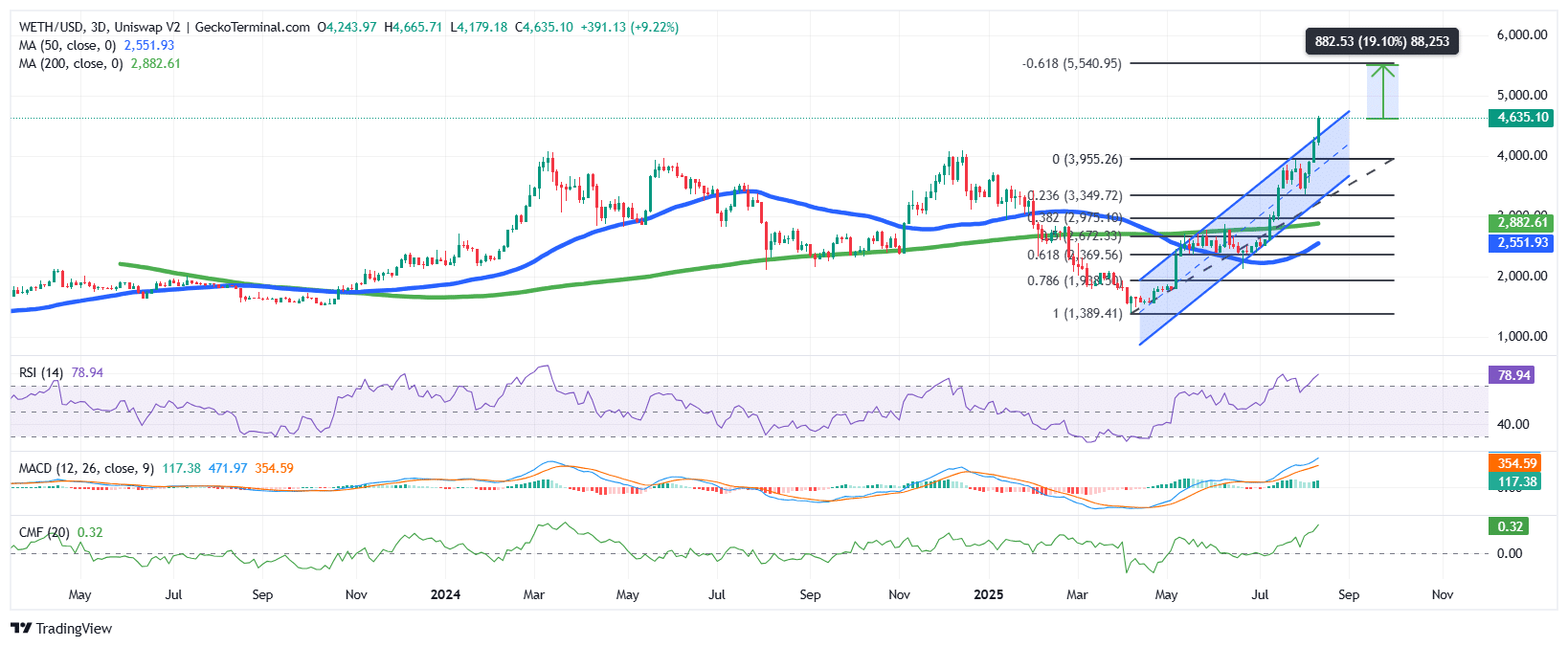

The ETH price on the 3-day timeframe shows that the asset is on a strong bullish trend.

It’s trading well above both the 50-day and 200-day Simple Moving Averages (SMAs). The price of ETH has also broken out of a rising channel pattern to the upside, signaling strong momentum.

Meanwhile, Fibonacci retracement levels indicate ETH has surpassed the 0% retracement at $3,955, which acted as a long-term resistance level, according to GeckoTerminal data.

The Relative Strength Index (RSI) also supports the crypto space sentiments, which shows that traders are actively buying ETH.

Moreover, the Moving Average Convergence Divergence (MACD) remains firmly bullish, with the blue MACD line well above the orange signal line, confirming upward momentum.

ETH/USD appears poised to test the $5,500 level in the coming weeks, which could surpass its ATH.

The Chaikin Money Flow (CMF), which sits at 0.32, reflects strong buying pressure and positive capital inflows into the asset.

However, caution is warranted, as the RSI reading at 78 shows overbought conditions, meaning buyers may soon be exhausted. In this scenario, the consolidation level and the previous resistance level at $3,955 could act as support.

The broader Ethereum trend remains bullish, and the probability of reaching new highs remains strong if current momentum holds and corporate acquisitions increase.

Related News:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage