Join Our Telegram channel to stay up to date on breaking news coverage

The non-fungible token market has recorded a significant surge today, marked by increased trading sales and floor price surges. The non-fungible token market surge is linked with the increased buyer and seller activity, a rebound in market capitalization, and a significant rise in Ethereum’s price. In this article, we shall explore factors fueling the surge in crypto and non-fungible tokens in detail.

Daily NFT Sales Pump +36%

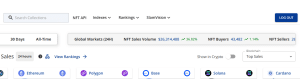

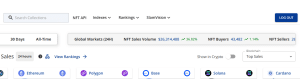

Data compiled by the cryptoslam, an on-chain crypto market data aggregator and a non-fungible token explorer that tracks non-fungible token collections from more than 20 blockchain networks, shows the NFT market has surged in trading sales volume today. In the past 24 hours, the NFT market has amassed a trading sales volume of +$26 million. During this period, the NFT trading sales volume has increased by 36% from the past day.

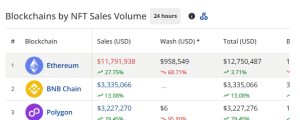

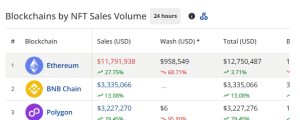

Ethereum, the blockchain network known in the NFT market for hosting the majority of the blue-chip non-fungible token collections, is the most traded blockchain network today. In the past 24 hours, the Ethereum-based NFT collection has amassed a trading sales volume of $11.7 million. During this period, the Ethereum NFT trading sales volume has increased by 27% from the past day.

BNB Chain, a blockchain network from the crypto exchange platform Binance, and Polygon, an Ethereum scaling solution, are today’s second and third most-traded blockchain networks in the NFT market. In the past 24 hours, the BNB Chain-based NFT collections have recorded a trading sales volume of $3.3 million, while the Polygon NFT series has raised a trading sales volume of $3.2 million.

Factors Fueling The NFT Market Growth

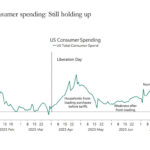

The non-fungible token market growth experienced today is associated with the surge in the ETH prices. Earlier today, the Ethereum (ETH) price skyrocketed to a new all-time high of $4,887 after the Fed chair hinted at rate cuts. Jerome Powell, the head of the US central bank, has given a rocket boost to expectations that there will be an interest rate cut in September, a move President Trump has been demanding for months. His remarks have fueled a surge in Ethereum NFTs.

CryptoPunks, a globally acknowledged non-fungible token collection featuring a fixed supply of 10,000 pixilated NFTs created on the Ethereum blockchain network by the digital asset firm Larva Labs but now managed by Infinite Node Foundation, is one of the NFT collections that reacted to Ethereum’s ATH and Fed remarks. In the past 24 hours, the Punks NFT collection has amassed a trading sales volume of $2.2 million, up 244% from the past day.

Source: cryptoslam.io

Moonbirds, another globally acknowledged non-fungible token collection featuring a fixed set of 10,000 pixilated owl-themed profile pictures created on the Ethereum blockchain network by the Proof Collective but now managed by the Orange Cap games, is another NFT collection that has somewhat reacted to Ethereum’s ATH. In the past 24 hours, the Moonbirds have raised a trading sales volume $1.2 million, up 107% from the past day.

CryptoPunks V1, a non-fungible token collection featuring original CryptoPunks wrapped with an ERC-721 token standard, and Pudgy Penguins, a non-fungible token collection featuring a fixed supply of 8,888 penguin birds pfps hosted on the Ethereum blockchain network, are other NFTs impacted by the recent Fed chair remarks and Ethereum ATH. In the past 24 hours, the Punk V1 NFTs have amassed a sales volume of $1.1 million, while Pudgy Penguins NFTs have recorded a trading sales volume of $775,250.

Related NFT News:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage