Join Our Telegram channel to stay up to date on breaking news coverage

The Ethereum price has dropped 1.6% in the last 24 hours to trade at $4,439.05 as of 5:20 a.m. EST on a 37% increase in daily trading volume to $31.7 billion.

The slump in the ETH price comes even after an OG Bitcoin whale with over $5 billion in BTC converted more than $400 million worth of Bitcoin into Ethereum in recent days. The whale sold 4,000 BTC, followed by another 1,000 BTC, then used the funds to buy over 96,000 ETH in one batch.

This lifted the whale’s Ethereum holdings to more than 800,000 ETH, worth over $4 billion, with most of it staked, signaling long-term commitment.

I am 100% aligned with almost all of what Tom @fundstrat says here.

Yes, Wall Street will stake because they currently pay for their infrastructure and Ethereum will replace much of the many siloed stacks they operate on (e.g. JPMorgam probably operates on several siloed stacks… https://t.co/bW93kkX1gW

— Joseph Lubin (@ethereumJoseph) August 30, 2025

This high-stakes rotation from BTC to ETH comes as Ethereum demand among institutional investors grows, helping ETH outperform BTC recently. Asset managers like BlackRock and VanEck, with new ETH ETF approvals, have brought billions of dollars into Ethereum for clients’ portfolios.

Major technology and gaming firms, as well as treasury companies such as Sharplink Gaming, now hold billions in ETH on their balance sheets as they set up ETH treasury firms.

BlackRock just filed for a $ETH Staking ETF.

This will attract a new wave of institutional investors.

What comes next could be absolutely massive. pic.twitter.com/6vj8PIi3gV

— Crypto Rover (@rovercrc) July 18, 2025

On the prediction front, Ethereum co-founder Joseph Lubin and Fundstrat’s Tom Lee both envision Ethereum’s value multiplying 100x in the years ahead, thanks largely to institutional adoption.

Lubin believes that as Wall Street moves business infrastructure to the Ethereum blockchain, and as more major banks participate, ETH will cement its role as the primary digital asset for institutional treasuries worldwide.

Joseph Lubin and Tom Lee have blazed the trail for ETH Treasury companies. It can’t be overstated how bullish this is for $ETH.

Just getting started. Unfathomably higher.

Track ETH treasury company industry at https://t.co/27787dmiRp pic.twitter.com/IsmfimLfFL

— 🅿🅴🅿🅴🐸🦧🅺🅾🅽🅶(🪈,🪈) (@ThePepeKong) August 8, 2025

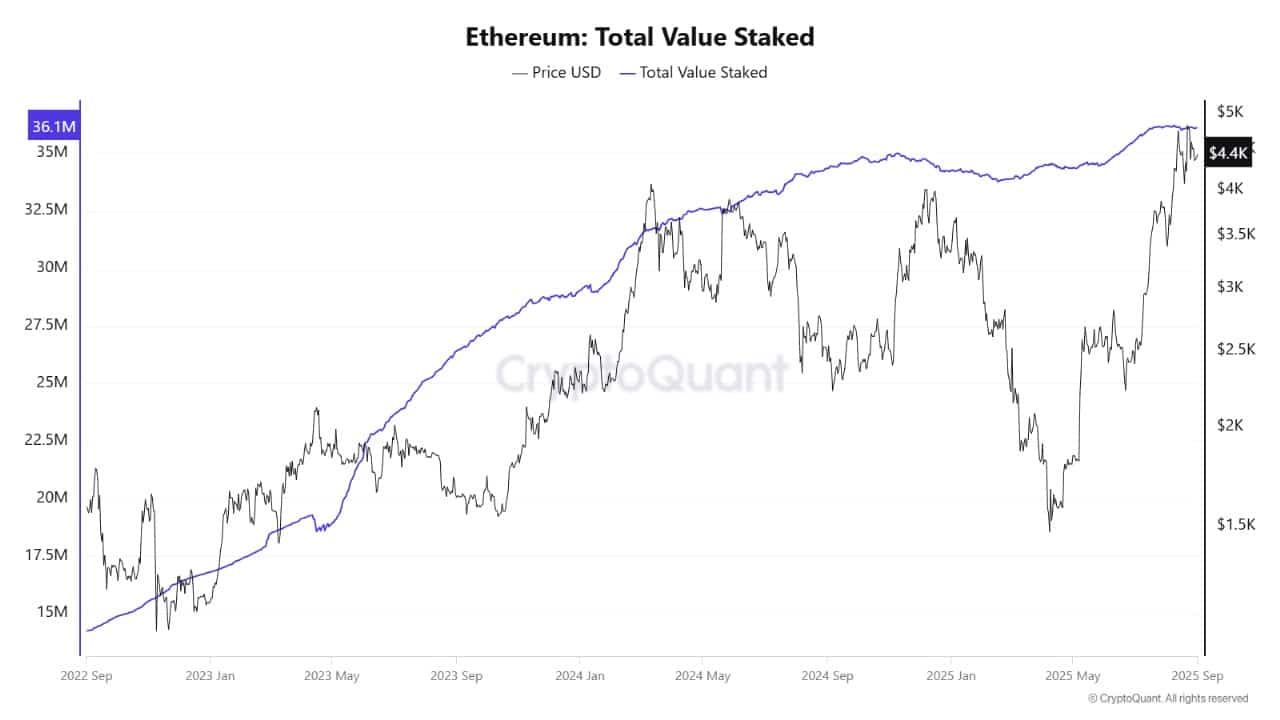

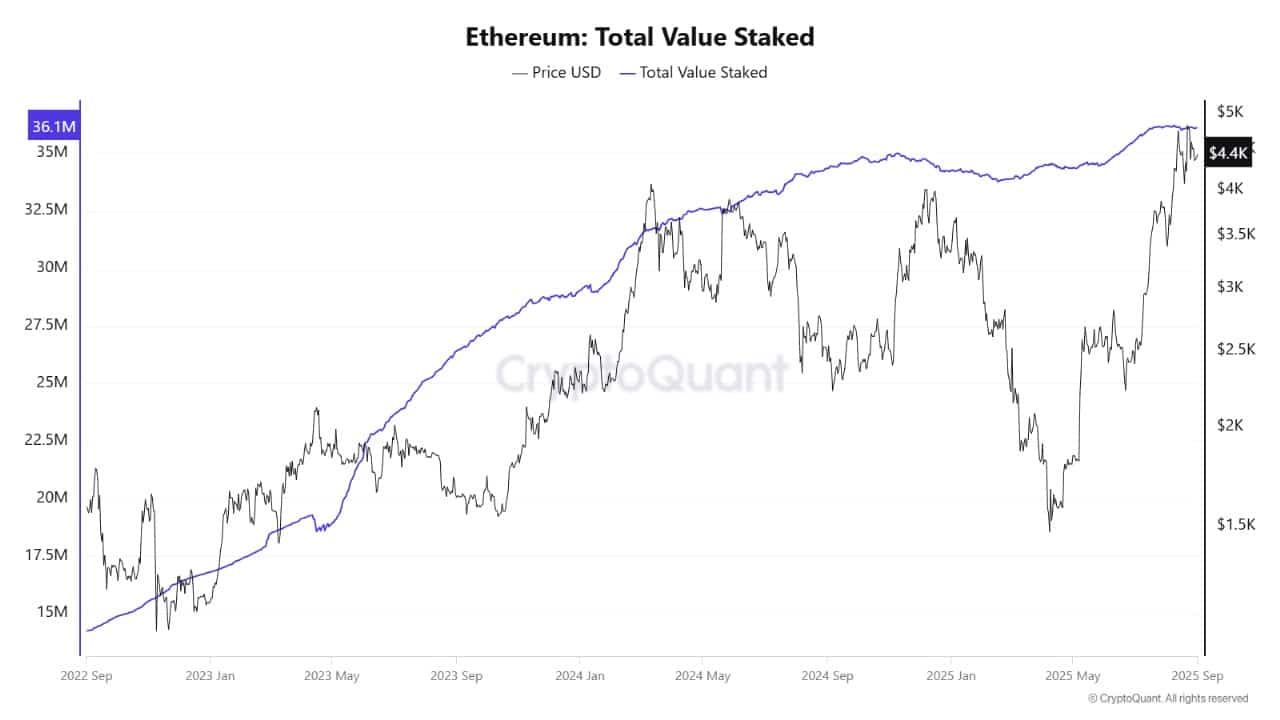

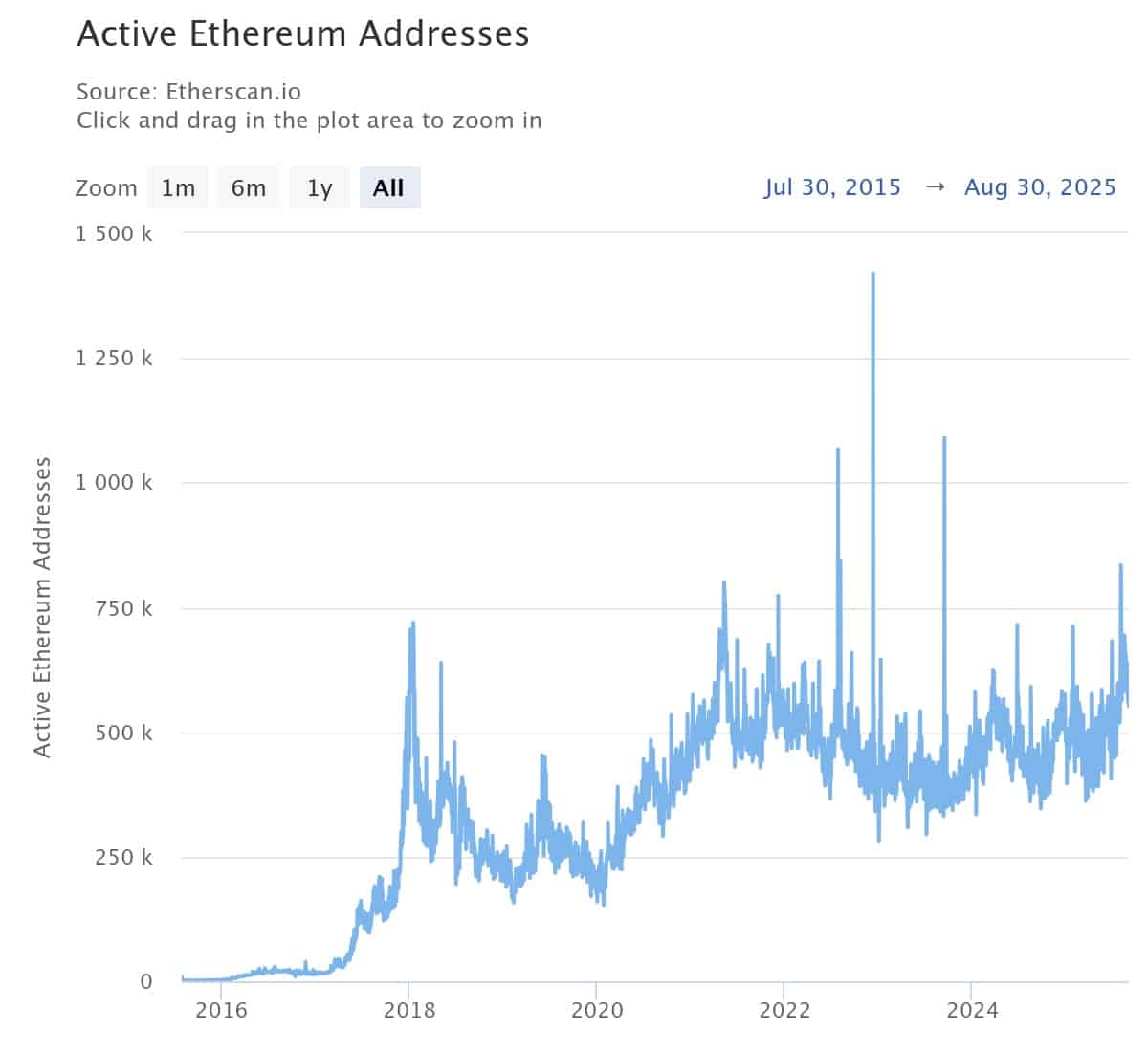

Ethereum Price, Wallet Growth, and Staking Activity

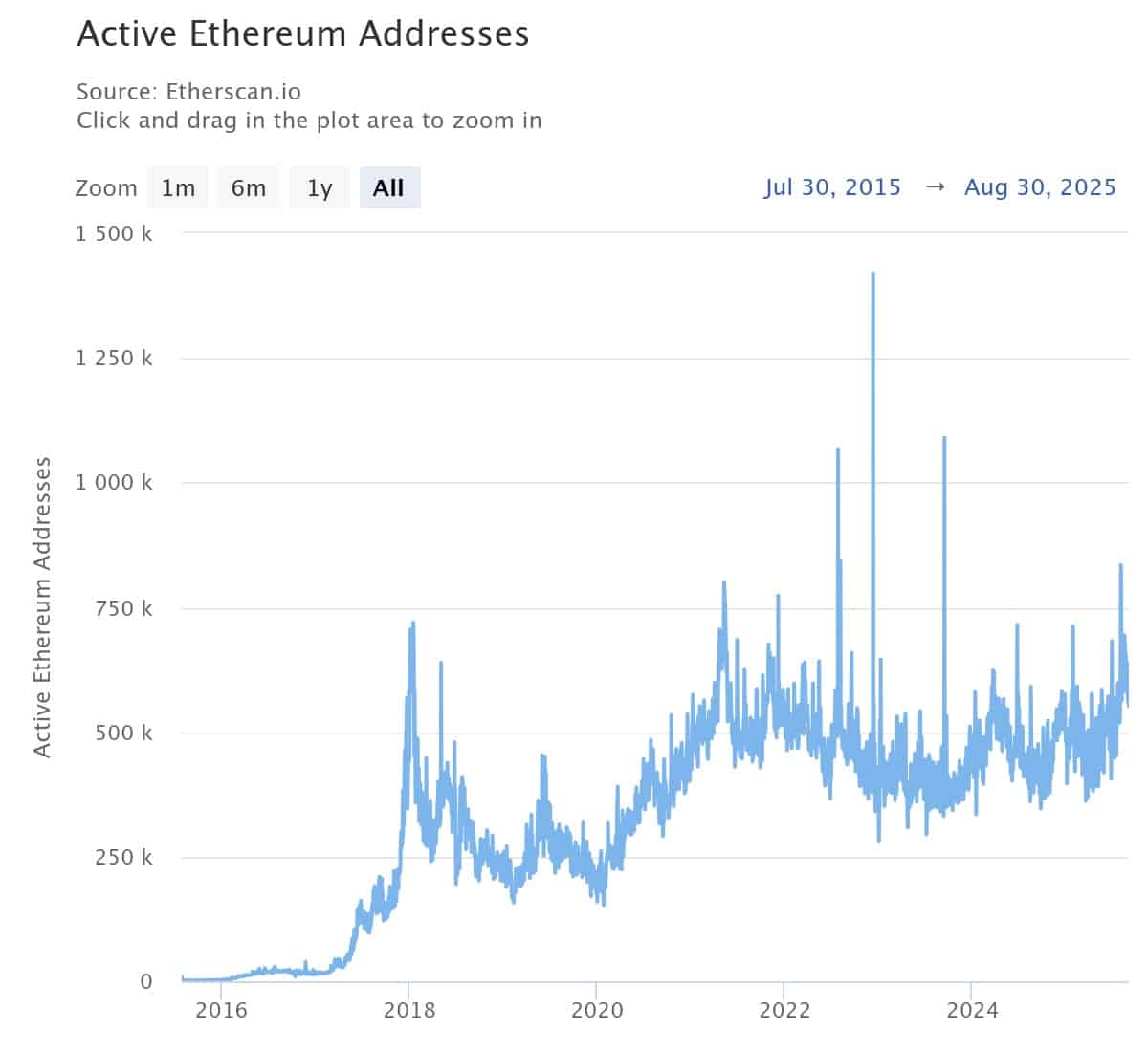

On-chain metrics show strong signs supporting the latest ETH price trend. Large holders are increasingly staking their coins, reducing liquid ETH on exchanges and tightening supply. Nearly 5% of Ethereum’s total circulation has moved into treasury and fund holdings since the start of the year.

Ethereum Total Value Staked Analysis Source: CryptoQuant

This means fewer ETH are available for sale, fueling stability and pushing prices upward. Network participation is high, as reflected in strong transaction volumes and active addresses. Staking continues to rise, which appeals to both individual and institutional investors looking for yield and long-term growth.

Analysts also note increasing wallet diversification, showing that not only whales but many new participants are joining the Ethereum ecosystem. These trends combine to keep the ETH price buoyant, even if the broader market faces turbulence.

Ethereum Price: Set To Test New Highs?

Looking at the weekly ETH/USD chart, the Ethereum price is trending upward and recently closed around $4,438. The coin has rebounded hard from earlier 2025 lows, making higher highs with every move.

ETH currently trades above key support levels: the 50-week simple moving average at $2,901 and the 200-week at $2,446, highlighting a healthy long-term uptrend.

The immediate support zone sits between $4,323 and $4,375, while resistance is visible near the $4,482 to $4,592 range. The critical $5,000 level is the next psychological barrier and could soon come into play if the bullish momentum continues.

ETHUSD Analysis 1-Week Chart. Source: TradingView

Momentum indicators back the positive view. The Relative Strength Index (RSI) has risen to 67.2, a sign of strong buying but not yet extreme overbought conditions. The MACD remains in bullish territory, though traders are watching for any turn in these indicators that might signal a pause or correction.

Volume spikes on breakouts through resistance confirm real demand. If ETH stays above its support levels, analysts see a strong chance of testing $4,850–$5,000 in the coming weeks. On the downside, a drop below $4,323 could trigger selling that might test the lower averages near $2,900.

The Ethereum price is gaining strength from major whale buys, institutional inflows, and bullish predictions from industry leaders. With Joseph Lubin’s 100x prediction echoing across Wall Street, the ETH price may soon test new highs.

Related Articles:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage