Join Our Telegram channel to stay up to date on breaking news coverage

The Bitcoin price climbed a fraction of a percent in the last 24 hours to trade at $111,582 as of 3:40 a.m. EST on a 25% increase in daily trading volume to $29.05 billion.

Bitcoin is back in the news after two big pieces of information hit the market. First, Strategy, Metaplanet and El Salvador all made fresh Bitcoin purchases, showing that institutional and state-level interest in BTC remains strong.

🟠 NEW: #Metaplanet bought 136 $BTC, raising its total to 20,136, while El Salvador also added more Bitcoin. pic.twitter.com/OhrYCikH4Q

— Coinpaper (@coinpapercom) September 8, 2025

Second, stablecoin giant Tether quickly moved to deny rumours about a large-scale Bitcoin sell-off, trying to calm market fears. As these major headlines swirl, traders and analysts are watching the Bitcoin price closely to spot the next big move.

El Salvador is already famous as the world’s first country to make Bitcoin legal tender, and every extra purchase sends a strong message that its Bitcoin bet is long-term. Meanwhile, Metaplanet is becoming known for copying Strategy, stacking Bitcoin for long-term gains.

Each time these big players buy, it sends a positive signal to other investors that BTC remains the top digital gold.

But not all the news was bullish. A rumour spread across social media that Tether, one of the world’s largest stablecoin companies, was preparing to dump a sizable amount of Bitcoin. The rumour claimed Tether needed to sell to manage its reserves.

🚨 No, Tether didn’t dump its Bitcoin

👉 Q1: 92,650 BTC → Q2: 83,274 BTC (looked like a sell)

👉 Reality: ~19,800 BTC moved to XXI (Jack Mallers’ platform)

👉 Adjusted: Tether now holds 100,521 BTC = $11.17BMore: https://t.co/RFSuEVD2qC pic.twitter.com/bkRtAWKUVF

— Fomos News (@fomos_news) September 7, 2025

Tether responded fast, firmly denying the claim and saying its BTC holdings are secure and long-term.

Bitcoin Price Faces Key Levels After Recent Moves

Turning to the daily technicals, Bitcoin price is hovering around $111,400. The chart shows BTC recently bounced off a major support zone near $101,800, which is the 200-day simple moving average (SMA). This long-term trendline is a crucial level; whenever BTC holds above the 200-day SMA, bulls are generally in control.

BTCUSD Analysis Source: Tradingview

The 50-day SMA now acts as short-term resistance at $114,860. So far, repeated attempts to push above this average have run into selling pressure. Bitcoin price will need to reclaim this level to ignite further bullish momentum.

The current price action is stuck between a Fibonacci support at $101,800 and resistance near $123,860, which lines up with the next key retracement level. If bulls can drive BTC above $115,000, the next target is $123,800, followed by the $142,000 zone.

The ultimate upside target, as marked by the chart, sits much higher near $170,000, but it would take a strong rally to get there.

Technical indicators show a mixed mood. MACD is still slightly bearish, but a bullish crossover could be building if momentum continues. RSI is at 47, indicating Bitcoin is neither overbought nor oversold at this point. That means there’s plenty of room for a strong move in either direction.

The ADX indicator sits at 15, a low reading, showing this is not a strong trend phase. It could mean the current sideways range is likely to last a little longer, unless a new catalyst, like another major buy or a confirmed breakout, pushes the BTC price out of this range.

Support zones are clear: $101,800 is the main floor, with deeper support at $90,200 and $82,800 based on Fibonacci lines. If the price loses the 200-day SMA, bears could gain control quickly.

For now, as long as Bitcoin price holds above $101,800, the bias is neutral to slightly bullish.

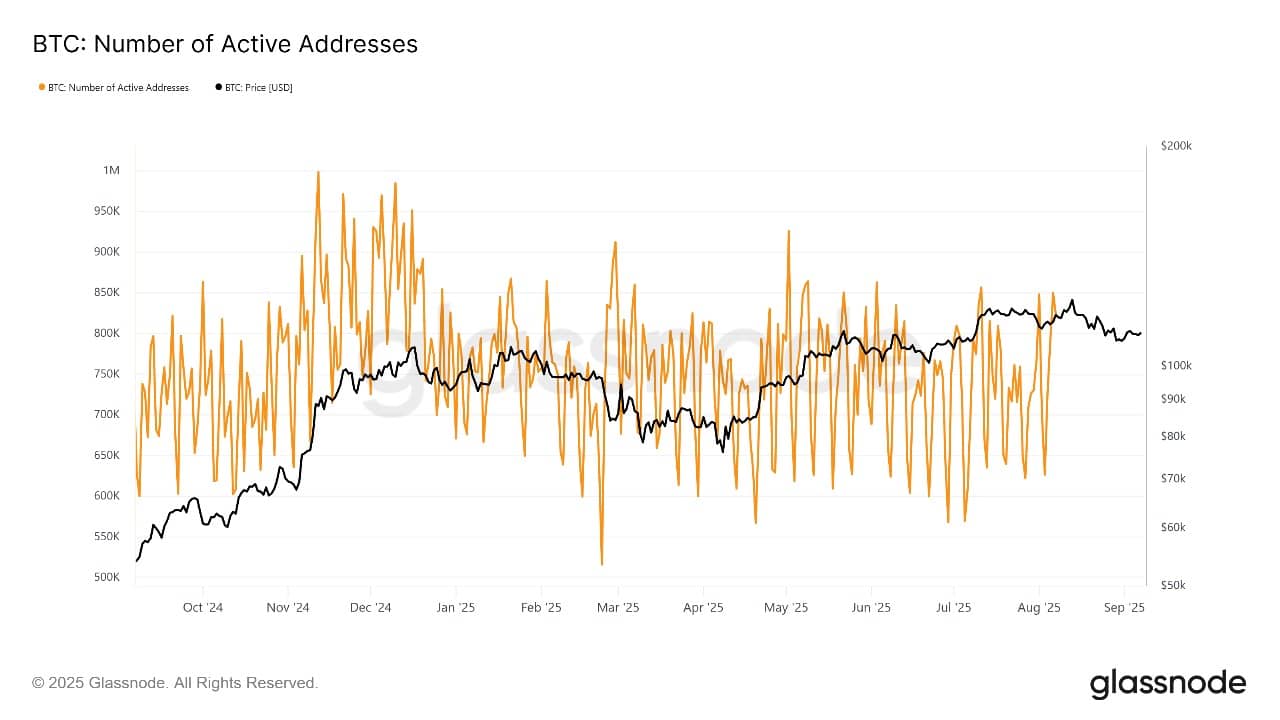

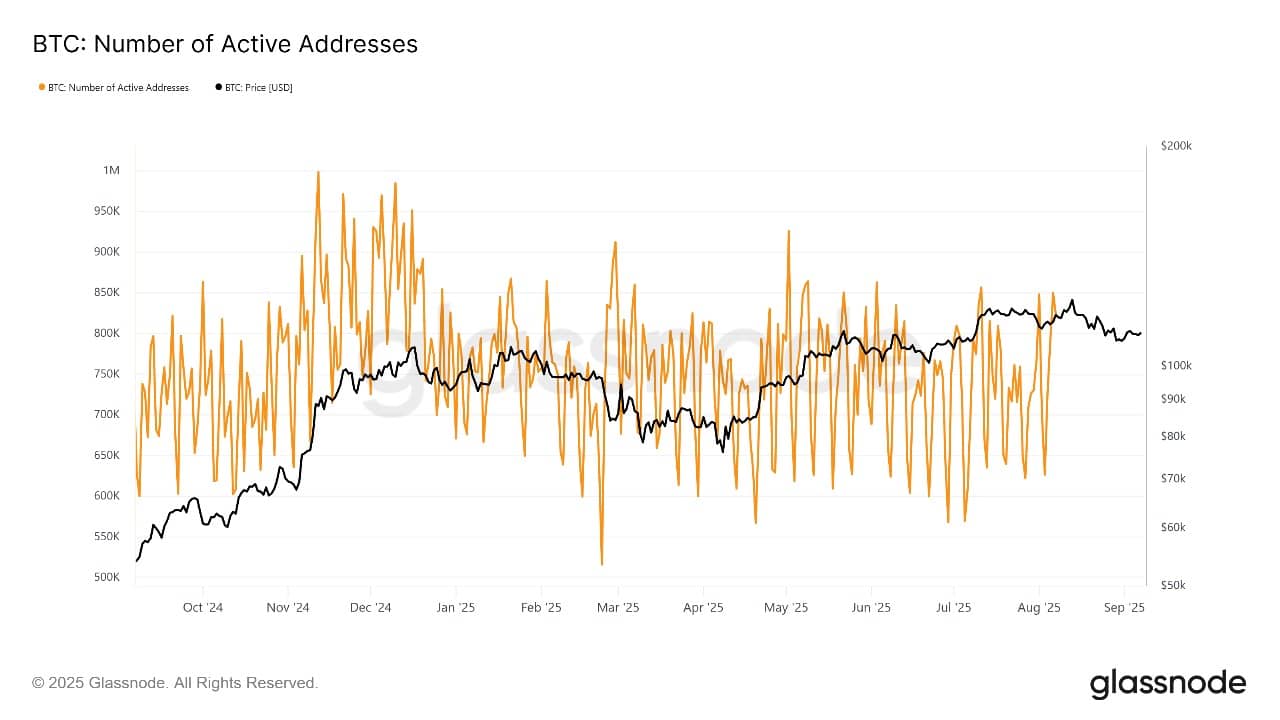

Bitcoin Price: On-Chain Data Flashes Mixed Signals

Looking at the on-chain analysis, the Bitcoin network is showing both strength and signs of caution. The total number of active wallet addresses is rising, an important bullish signal. This means more people are using and moving BTC, which usually comes before a big price move.

Bitcoin Number of Active Addresses Source: Glassnode

Meanwhile, data from blockchain explorers shows that “outflows” from exchanges are increasing. This means more Bitcoin is being taken off trading platforms, typically a bullish sign, as long-term holders are sending coins to cold storage.

When Bitcoin supply on exchanges goes down, price tends to find support or even rally, since there’s less available for instant selling.

However, some short-term traders appear nervous. Right after the Tether rumour, there was a quick spike in “inflows,” or coins sent to exchanges, as some users prepared to sell or hedge.

But this slip did not last long; soon after Tether’s denial, inflows cooled down, and the balance of BTC on exchanges began to fall again.

Also, miner flows remain stable, suggesting big mining companies aren’t rushing to offload new coins. All in all, on-chain fundamentals for Bitcoin remain neutral to bullish, especially with support from news about major institutional buying.

Related Articles:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage