Join Our Telegram channel to stay up to date on breaking news coverage

The Hyperliquid price has climbed 24% in a week to trade at $55.27 as of 4:05 a.m. EST on a 7% decrease in trading volume in the last 24 hours to $392 million.

That coincides with news that Ethena Labs is joining the race to secure a major position in Hyperliquid’s $5 billion USDH stablecoin ecosystem with a bid that involves asset management giant BlackRock.

🚨 LATEST: Ethena becomes the 6th contender for Hyperliquid’s USDH stablecoin bid, pledging to return 95% of reserve revenue to the community, cover migration costs from USDC to USDH and committed at least $75M in ecosystem incentives. pic.twitter.com/AwEL9l14hK

— Cointelegraph (@Cointelegraph) September 10, 2025

Ethena Labs proposed a version of USDH to be backed by USDTb, the project’s stablecoin that has 100% backing by BlackRock’s BUIDL fund.

🌐Ethena Labs, the developers of the synthetic dollar protocol, have introduced a proposal for the Hyperliquid stablecoin.

USDH will be indirectly backed by BlackRock’s tokenized fund, BUIDL.🏦

🛫Ethena will direct revenue from USDH back into the Hyperliquid ecosystem.#Ethena… pic.twitter.com/DIsXXgrniB

— Crypto Research Network (@CrResearchNet) September 10, 2025

With more major DeFi and financial names circling USDH, traders and analysts are increasingly bullish on the HYPE price, at least in the short term.

HYPE Price Tests Highs With Technicals Signalling More Upside

The HYPEUSDT daily chart shows the full strength of the move. The Hyperliquid price opened at $53.35, ran to highs of $55.68, and is holding above $55.

That’s a powerful, bullish move away from support at the 50-day SMA ($44.13). The longer-term 200-day SMA at $30.99 is well below the current price and acts as a strong trend base.

HYPEUSDT Analysis Source: Tradingview

A breakout above the key Fibonacci resistance at $51.18 has opened the way for further upside, with the next target near $60. The last major move saw HYPE price stuck under $51; clearing this now suggests strong momentum.

Support sits at $47.48 and the round-number $44 zone, both previous resistance lines now flipped into support. Momentum indicators match the bullish vibe. RSI stands at 69.43, just under the “overbought” line, meaning there could be more fuel for the trend before a pause.

MACD shows bullish continuation, with both lines above zero and diverging. ADX is at 20.25, which signals that the current trend is gaining strength but is not yet extreme. Volume is also above normal, helping confirm that this rally isn’t running on fumes.

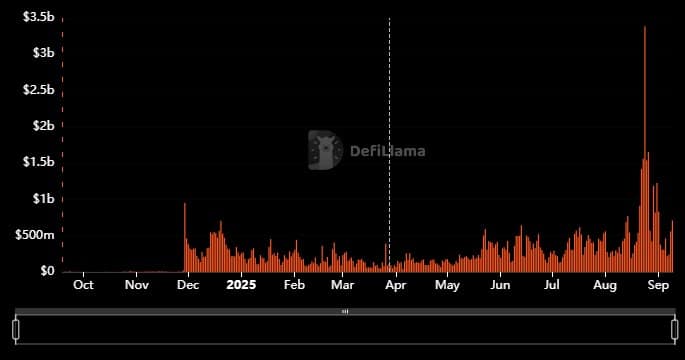

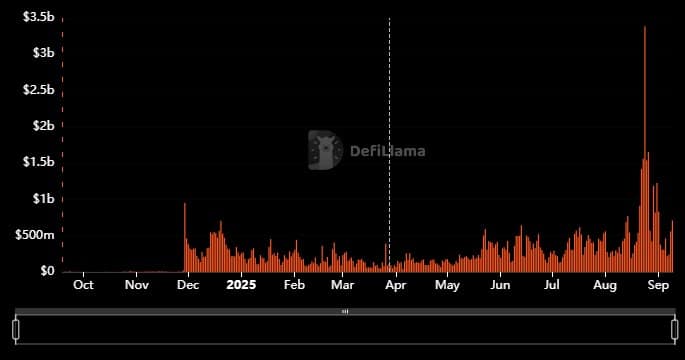

HYPE Price: On-Chain Action Confirms Fresh Demand

On-chain data backs the bullish story for Hyperliquid price. Blockchain explorers show a big increase in wallet addresses and daily transfers. Much of this activity is new buyers moving HYPE from exchanges to private wallets.

Showing confidence and a willingness to hold in hopes of further gains. There’s also been a spike in decentralised exchange (DEX) volume involving HYPE and USDH pairs. In previous rallies, on-chain metrics such as spikes in new wallets, high transaction numbers, and larger-than-average DEX trades have signalled healthy coin price momentum rather than pure speculation.

Whale movements appeared around $50, but there have not yet been signs of widespread profit-taking. Instead, most major wallets are sitting tight, with only small outflows, a bullish sign for coin price support.

New interest from giants like Ethena, with BlackRock alongside it, in the USDH stablecoin ecosystem have energised the market.

On-chain data shows more wallets, greater DEX activity, and no worrying whale sell-offs, confirming the foundation for the HYPE price rally.

The chart paints a bullish picture: breaking above $51 and holding $55 puts Hyperliquid price on track for further highs, provided buyers remain active and new headlines support the growing excitement for HYPE and USDH.

Related Articles:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage