Public companies that invest in cryptocurrencies are entering a more competitive phase, according to a report from Coinbase on September 10.

The period when firms could benefit just by holding digital assets appears to be over. Instead, companies need stronger strategies to stand out and attract investor interest.

$2.42B

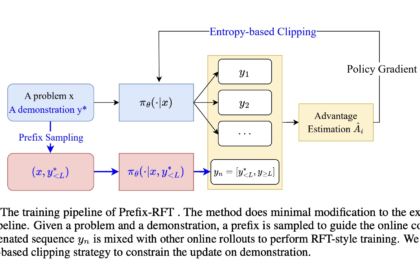

researchers David Duong and Colin Basco explained that earlier adopters of crypto treasury strategies, like Strategy, once received high market valuations for holding large amounts of Bitcoin. However, those advantages have faded.

Did you know?

Subscribe – We publish new crypto explainer videos every week!

What is Polkadot in Crypto? (DOT Animated Explainer)

The researchers noted that success in this new phase will depend less on following past examples and more on how well a company can differentiate itself. Timing, operational choices, and differences from others will be key factors.

The report also touched on Bitcoin’s

However, Duong and Basco noted that this pattern did not persist in 2023 or 2024.

Furthermore, the researchers expect the US Federal Reserve to lower interest rates soon, possibly at its next two meetings. Bitcoin, in particular, may benefit from current economic conditions, including ongoing inflation and liquidity.

Recently, Coinbase helped boost support for a UK petition that calls for stablecoin rules and blockchain pilot programs. How? Read the full story.