Join Our Telegram channel to stay up to date on breaking news coverage

The SUI price has surged 3% in the last 24 hours to trade at $3.60 as of $4:15 a.m. EST on a 7% increase in trading volume to $1.16 billion.

The jump in the SUI price comes as Google named the blockchain a launch partner for its new Agentic AI-powered payment systems, and Tuttle Capital filed for the launch of its Tuttle Sui Income Blast ETF

The deal with Google means that the way people pay using Google will become faster and smarter, thanks to SUI’s technology.

💥 JUST IN: @GOOGLE PARTNERS WITH @SUINETWORK AND @WALRUSPROTOCOL TO LAUNCH ITS AGENTIC PAYMENTS PROTOCOL!

GOOGLE × $SUI + $WAL = AI PAYMENTS AT SCALE 🌐 pic.twitter.com/ZcT00jb4ND

— Matteo.sui (@matteodotsui) September 16, 2025

Google’s new AP2 system lets AI handle payments, and picking Sui as a partner has raised its profile in both AI and finance.

On-chain Activity Indicates Steady Growth for SUI Price

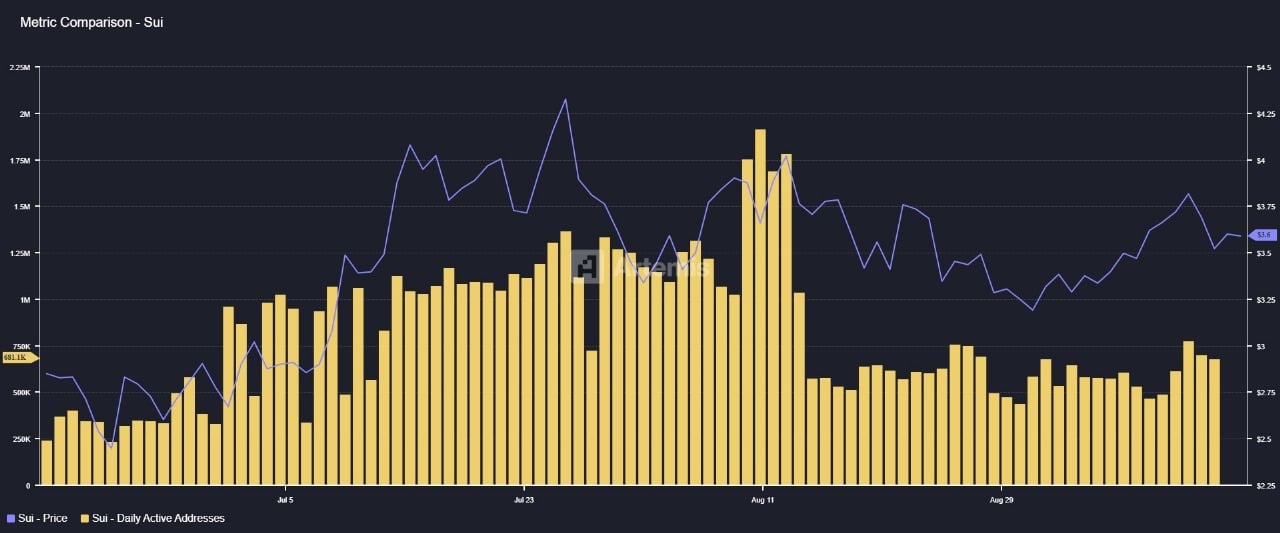

On-chain data further validates the positive sentiment around SUI. Active wallet addresses remain steady. This means people are using SUI regularly, not just buying and selling fast.

SUI Daily Active Addresses Source: Artemis

Daily transaction volumes show stability, suggesting that real network usage is growing along with investor interest. Large holders have held onto their coins, showing long-term confidence and reducing the likelihood of sharp selling.

Also, on decentralised exchanges, there is enough SUI to trade smoothly without sudden price jumps. All these points build a strong base for the recent price increase.

SUI Price Analysis Highlights Key Support and Resistance Zones

SUI currently trades close to $3.59 and has strong support near the 50-day moving average at about $3.31. This moving average acts as a price floor, preventing major dips.

At the same time, resistance lingers near the 38.2% Fibonacci retracement level at $3.59, which SUI needs to breach for upward momentum. If it succeeds, the next major target could lie near the previous high of around $5.34.

The MACD indicator hints at mild bullish momentum, with the MACD line sitting slightly above the signal line. Meanwhile, RSI holds steady near 52, indicating that the coin is not overbought or oversold and may still have room to run higher.

However, the low ADX value around 18 suggests that the current trend is weak, signalling traders to keep an eye on any shift in momentum.

SUIUSDT Analysis Source: Tradingview

If SUI’s price falls below $3.31, look at the next supports at $3.05 (50% Fibonacci) and $2.51 (61.8% Fibonacci). These levels may stop further falls. But if those break too, the price could fall to as low as $1.73 or $0.75.

However, with the positive news and strong usage data, these low prices might be good buying opportunities. Traders should look for a clear break above $3.59 or a drop below $3.31 to know what may happen next.

If the price keeps going up, more buyers may come in and push SUI toward its last highs soon. The mix of great partnerships, strong user data, and a good technical setup makes SUI an interesting coin to watch for those following crypto’s future growth.

While the price is still testing important levels, the outlook for SUI looks hopeful as it stands to benefit from combining blockchain with artificial intelligence in new and powerful ways.

Related Articles:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage