My morning train WFH reads:

• The Rush to Return to the Office Is Stalling: Microsoft, Paramount and other companies are stepping up calls to get back to the workplace. Many of their employees are still phoning it in. (Wall Street Journal)

• Beef Prices Are at a Record. The Winners: Cattle Ranchers: After years of struggles, and shrinking the U.S. beef supply, cattle raisers are raking in cash. (Wall Street Journal) see also Beef prices are the new egg prices. They’re soaring: Beef prices are hitting records, rising almost 9% since January, according to the Department of Agriculture, and retailing for $9.26 a pound. June’s consumer price index showed steak and ground beef prices are up 12.4% and 10.3%, respectively, over the last year. (CNN)

• What Is the Average 401(k) Balance? It Varies by Age & Income: 401(k) account balances and contribution rates vary greatly by age, and income with people in their 60s racking up the largest balance on average. (Investopedia)

• Trump’s Commerce Secretary Loves Tariffs. His Former Investment Bank Is Taking Bets Against Them: A subsidiary of Cantor Fitzgerald, which is run by the sons of US Commerce Secretary Howard Lutnick, is letting clients essentially bet that President Donald Trump’s tariffs will be struck down in court. (Wired)

• Inside the big boom in ‘business development companies’. One way investors can get exposure to loans has been through “Business Development Companies” — weird US legal structures set up in the 1980s to encourage venture capital, but which now serve overwhelmingly as a portal into the private credit industry. Their assets under management have exploded over the past few years and are attracting increasing numbers of regulatory eyeballs. (Financial Times)

• China Road Trip Exposes List of Uninvestable Assets in the West. China’s advances in clean tech are attributed to its goal of energy independence, with the country manufacturing a large portion of the world’s solar panels, wind turbines, and batteries, and dominating the supply chain for critical minerals. (Bloomberg)

• Is the Jimmy Kimmel Saga a Sign that the Tide is Turning? Why we may not be Russia or Hungary (Paul Krugman) see also Jimmy Kimmel Rose to the Occasion. “As I was saying before I was interrupted” Mr. Kimmel’s well-tempered monologue prioritized clarity but not undue contrition. (New York Times)

• Wars of deception are coming for America. It isn’t ready. Costly, outdated weapons are no match for cheap drones and high-tech misdirection. (Washington Post)

• How the Supreme Court Could End This Bull Market: The biggest risk for Wall Street today isn’t a potential recession or a tech earnings bust. It is the Supreme Court, which has been asked to issue rulings with the reach to reshape the U.S. economy, from interest rates and budgets to regulations and tariffs. That so many crucial economic decisions land in court indicates the country’s rising political dysfunction (Barron’s)

• The One Person in F1 That Max Verstappen Actually Listens To: The only thing the Formula One world champion can hear over the roar of his 200 mph engine is the British accent in his ear. It belongs to Gianpiero Lambiase, and he’s the closest thing Verstappen has to a co-pilot. (Wall Street Journal)

Be sure to check out our Masters in Business interview this weekend with Dmitry Balyasny, co-founder of Balyasny Asset Management, and the firm’s managing partner and chief investment officer. BAM nmanages $28B for clients. Balyasny began his trading career with Schonfeld Securities in 1994; he just received Institutional Investor’s 2025 Hedge Fund Lifetime Achievement Award.

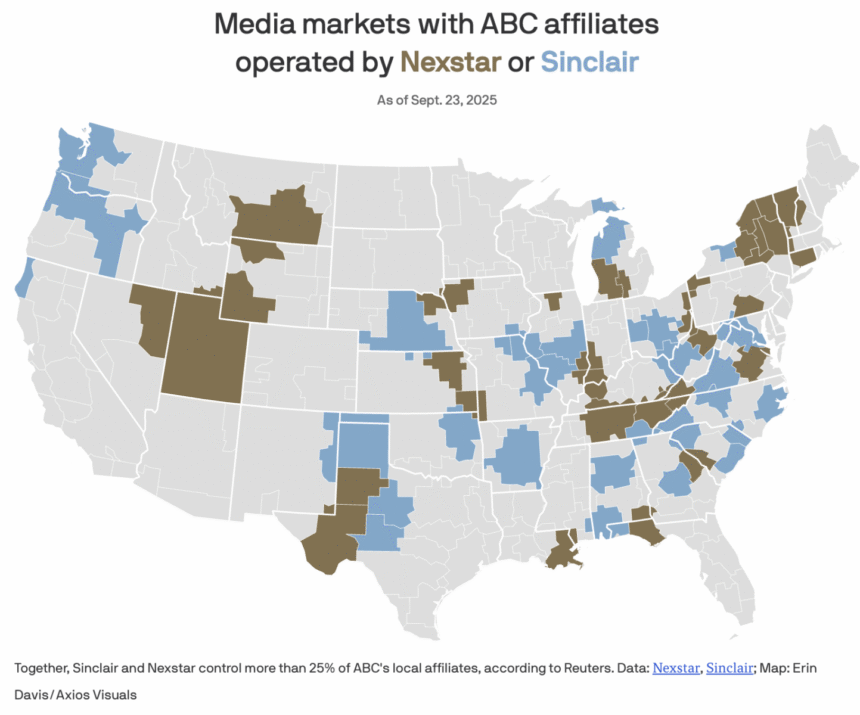

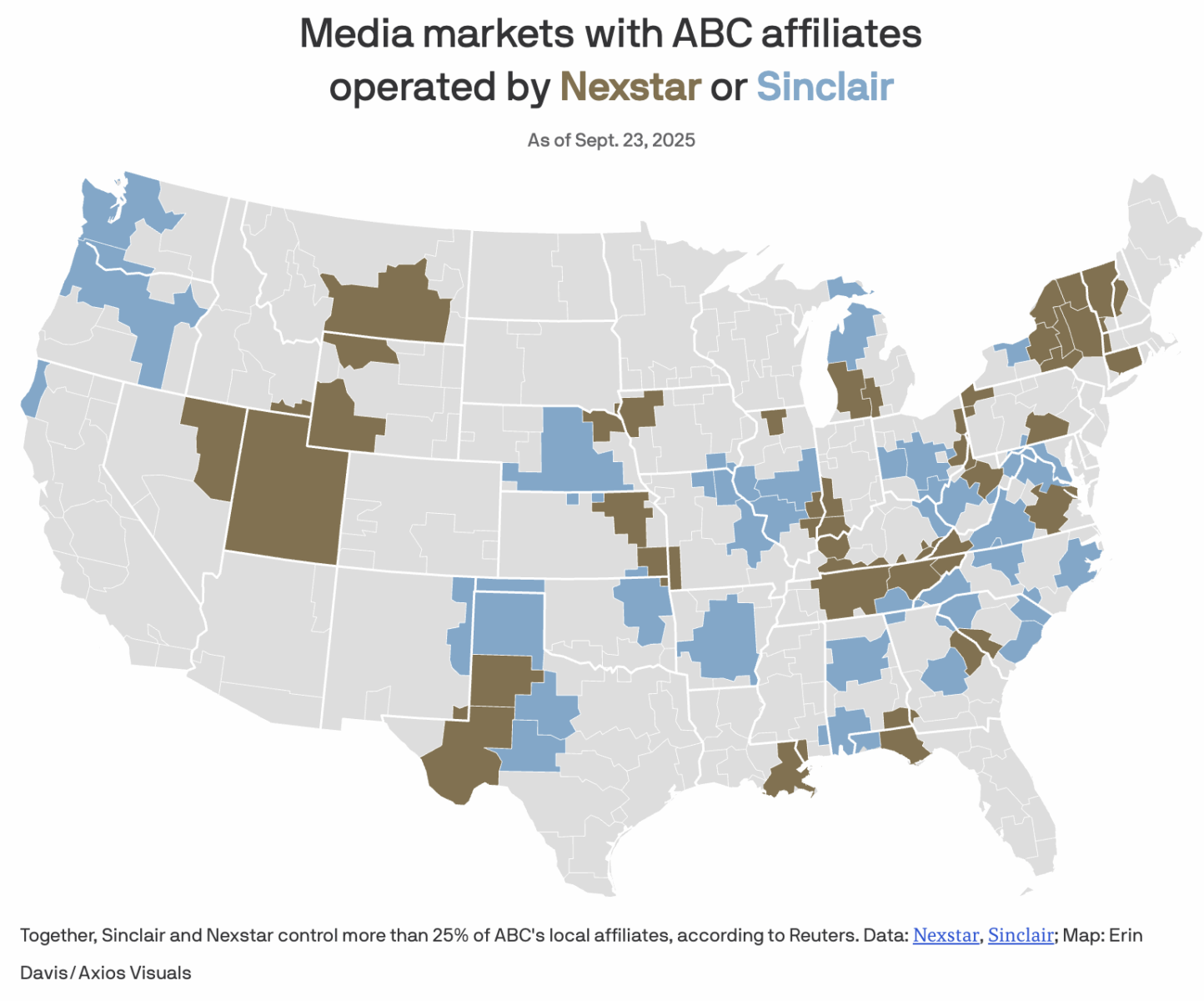

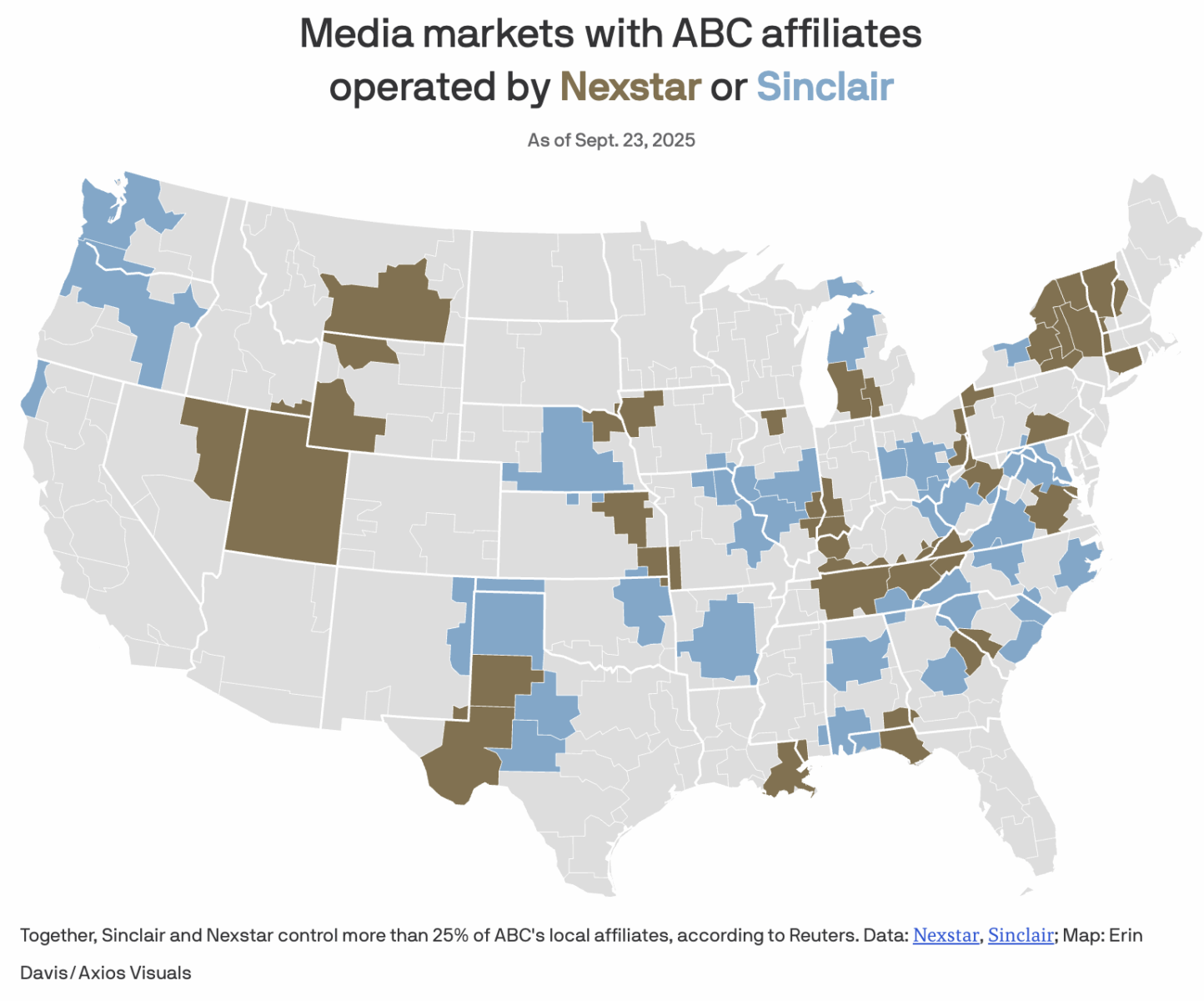

Where you can’t watch Jimmy Kimmel, mapped

Source: Axios

Sign up for our reads-only mailing list here.