Join Our Telegram channel to stay up to date on breaking news coverage

The Bitcoin price has tumbled 0.8% in the last 24 hours to trade at $111,637.11 at 12:45 a.m. EST on a 2.5% increase in trading volume to $50.71 billion.

Despite that, former Goldman Sachs executive Raoul Pal says this cycle may run longer. He predicts a likely top in the second quarter of next year as global liquidity and business activity continue supporting Bitcoin.

Pal, co-founder of financial media company Real Vision, says his economic models show a possible stronger surge in the BTC price if US business activity, as measured by the ISM index, picks up,

Raoul Pal: “The 4-year cycle is now the 5-year cycle… #Bitcoin should peak in 2026. Probably Q2.” pic.twitter.com/0dQI8OA3CT

— $WEN BURN? (@wen_burn_wen) September 25, 2025

Bitcoin Price Dips Below $112K

Bitcoin’s pullback follows a long rally and comes just as monthly trading options worth $22.6 billion are expiring, creating extra volatility for traders.

On the price chart, Bitcoin managed to climb above both the 50-week and 200-week Simple Moving Averages, which sit at $98,950 and $53,100, respectively. These moving averages help traders spot longer-term directions and show that Bitcoin is still in a bullish phase despite the recent pullback.

Strong horizontal support areas stand at $111,000 and just above $100,000. The 50-week MA near $99,000 offers extra protection if prices dip further. Historically, September has been a tricky month for Bitcoin, with average losses of about -3.77% since 2013.

BTCUSD Analysis Source: Tradingview

Market data shows that fiscal year-end selling by large funds can create added pressure, leading to “Red September” for cryptocurrencies. Despite these risks, some analysts still see hidden bullish signals.

A “hidden bullish divergence” in the RSI suggests the market may not be as weak as simple price charts indicate. Multiple experts, including those at Altcoin Daily, expect that after a period of re-accumulation and possible dips, Bitcoin could retest its all-time high above $124,500 in the coming weeks.

The RSI (Relative Strength Index) recently hovered between 55 and 62, pointing to neutral momentum. The MACD (Moving Average Convergence Divergence) is also showing signs of cooling, as buyers appear to be pausing after an intense run-up.

Bitcoin has hit turbulence after its latest all-time high, but analysts still see a path to new records if support levels hold and macro trends remain positive. The next couple of months could be bumpy, but the longer-term outlook remains hopeful, especially with Pal pointing to 2026 as the most likely peak window for this cycle.

Bitcoin On-Chain Metrics Show Market Strength

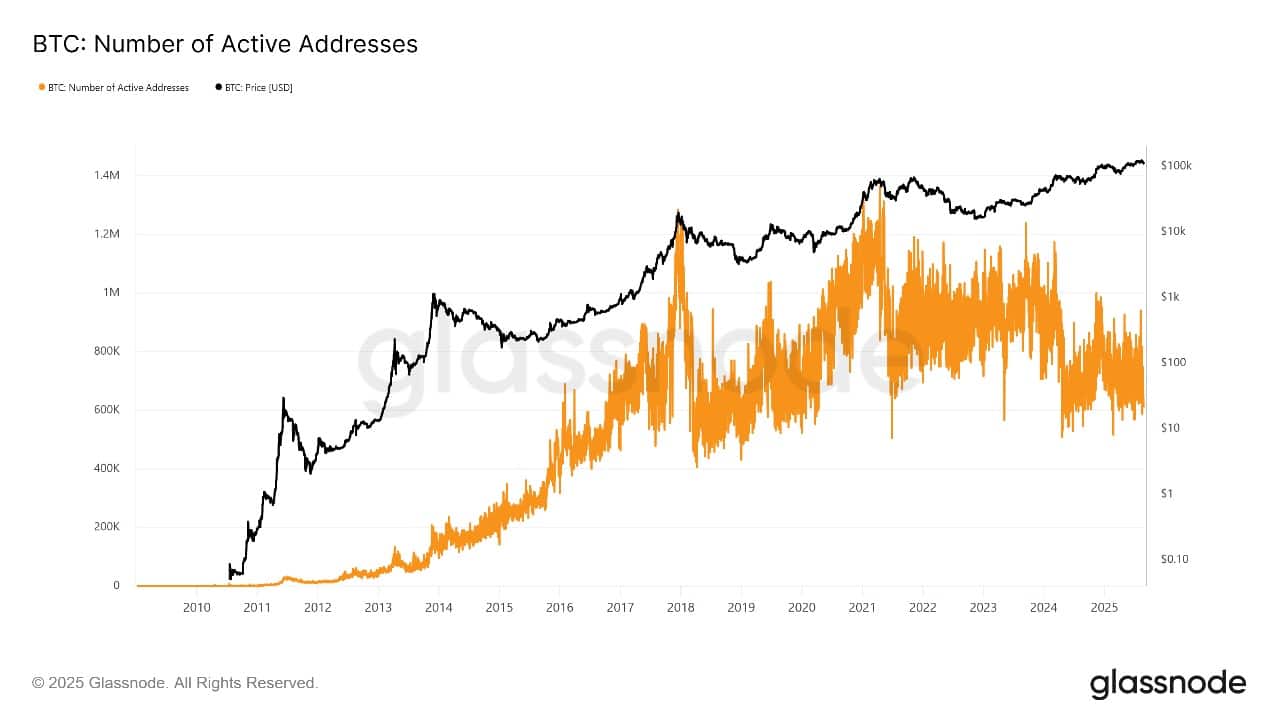

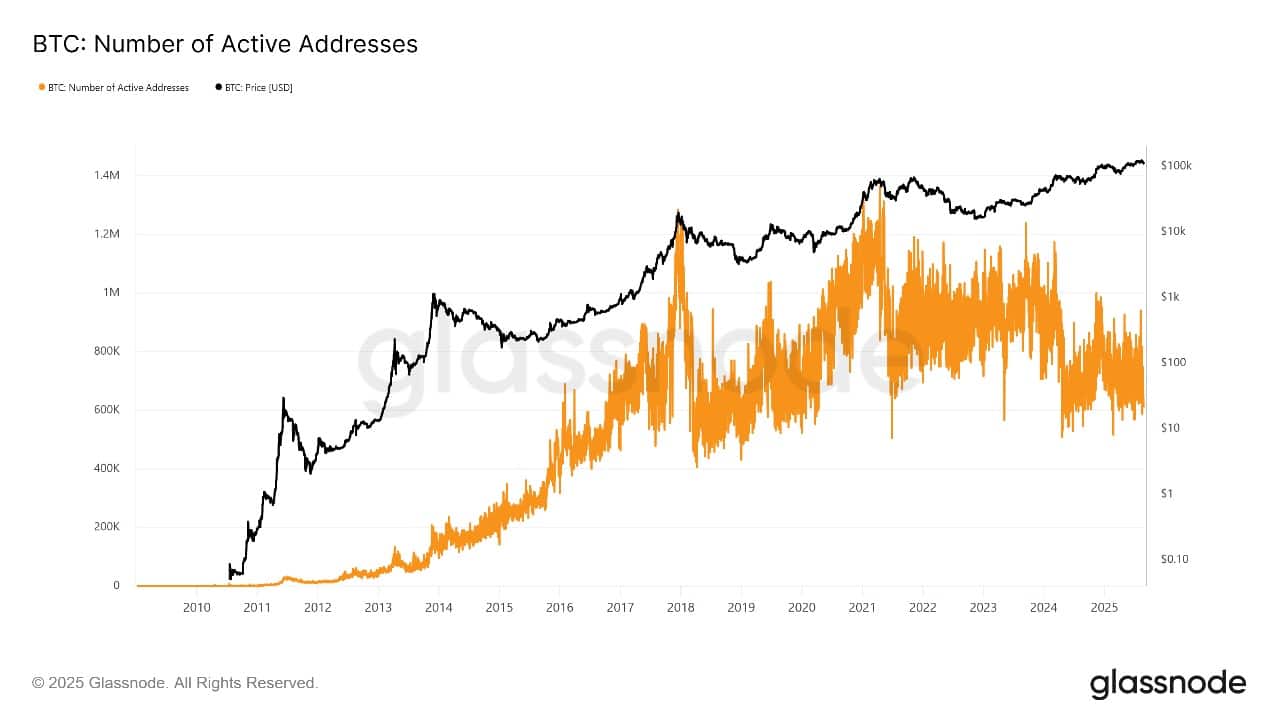

Bitcoin’s on-chain data shows important clues about market health. The number of active addresses recently went up to nearly $110,000, meaning more people were buying and selling. This shows the price drop brought both sellers and new buyers into the market.

Bitcoin Active Addresses Source: Glassnode

Over 70% of the Bitcoin supply is held long-term. This means many holders are confident and not selling now. At the same time, Bitcoin stored on exchanges is dropping, as holders move coins into private wallets for long-term safety.

Other data, like miner activity and transaction volume, are steady, indicating the network is strong. These signs suggest the recent dip is a pause in a longer bull run. Buyers might find good entry points near $110,000 as strong holders hold firm, supporting a positive outlook toward 2026.

Related Articles:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage