Real gross domestic product (GDP) increased in 48 states in the second quarter of 2025 compared to the first quarter, according to the U.S. Bureau of Economic Analysis (BEA). Mississippi and Arkansas reported declines, while the District of Columbia reported no change during this time. Growth was geographically broad but varied considerably in magnitude, ranging from a 7.3 percent increase in North Dakota to a 1.1 percent decline in Arkansas.

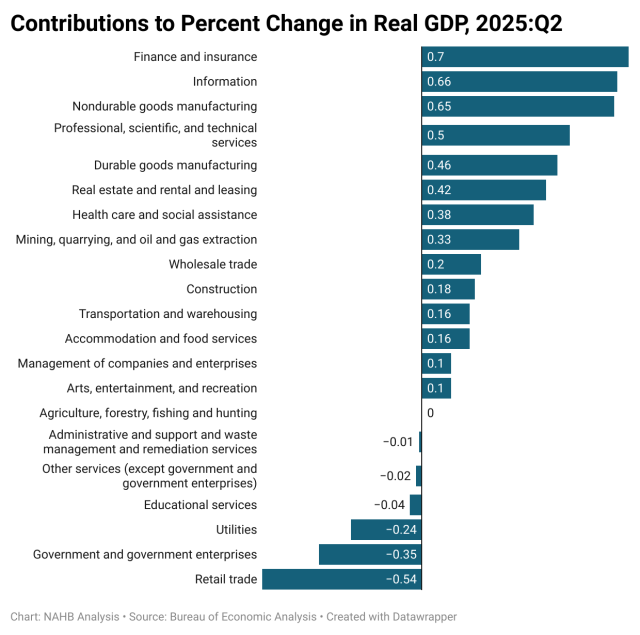

Nationwide, growth in real GDP (measured on a seasonally adjusted annual rate basis) increased 3.8 percent in the second quarter of 2025. The leading contributors to the increase in real GDP across the country were finance and insurance; information; and nondurable-goods manufacturing.

Regionally, real GDP increased in all eight regions between the first and the second quarter of 2025. The percent change in real GDP ranged from a 2.9 percent increase in the Southeast region to a 6.0 percent increase in the Southwest region.

The strong performance in North Dakota, Texas, Kansas, New Mexico, and Wyoming reflected outsized contributions from mining, quarrying, and oil and gas extraction, underscoring the continued importance of the energy sector in driving state-level outcomes. At the same time, finance and insurance, information, and nondurable-goods manufacturing provided steady growth contributions across most regions, supporting broad-based gains.

While the majority of states experienced moderate to strong expansion, a small number of states in the South and Midwest posted flat or declining GDP, highlighting ongoing sectoral challenges such as weaker agricultural output, subdued consumer spending, or slower goods production.

At the industry level, finance and insurance, information services, and nondurable-goods manufacturing were the most consistent contributors to state-level GDP growth nationwide, while mining and energy extraction provided a particularly strong lift in western and energy-rich states. However, several sectors weighed on growth in specific regions. Agriculture, forestry, fishing, and hunting contracted in parts of the Midwest and Plains, offsetting gains elsewhere and contributing to weaker results in states with heavy reliance on farm output. In addition, durable-goods manufacturing was a mixed performer, with softness in transportation equipment and machinery limiting growth in certain industrial states.

The divergence in growth rates illustrates the uneven distribution of economic momentum across the country, shaped largely by differences in industrial composition. Energy-producing states continued to benefit from elevated demand and investment in extraction industries, while states with less exposure to these sectors showed more modest gains. Overall, the data point to an economy that remains resilient at the national level but with significant regional disparities, emphasizing the influence of industry-specific factors on state growth trajectories.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.