My morning train reads:

• How Vanguard Wants to ‘Nudge’ You to Be a Better Investor: The company has been pairing behavioral finance insights with investments in artificial intelligence and other technology. (Barron’s)

• Spending on AI Is at Epic Levels. Will It Ever Pay Off? Tech companies pour hundreds of billions into data centers, taking on heavy debt, as Silicon Valley watchers worry that enthusiasm for AI has turned into a bubble that has increasingly loud echoes of the mania around the internet’s infrastructure build-out in the late 1990s. (WSJ) but see There Are More Robots Working in China Than the Rest of the World Combined: China has embarked on a campaign to use more robots in its factories, transforming its manufacturing industries and becoming the dominant maker. (New York Times)

• Are 15 years of European underperformance coming to an end? For most of the past 15 years, the default position of investors was being overweight US and underweight European equities. In November of last year, “US exceptionalism” and negative sentiment on European equities led to a peak valuation difference. We expect US equities to continue to do well, but the relative attractiveness of the rest of the world looks increasingly good. (Deutsche Bank)

• The Making of a Market Maker: How Thomas Peterffy built the machines that killed the trading floor and made Interactive Brokers into a $100 billion business. (Colossus)

• YIMBY Has Gone Mainstream. Can It Stay That Way? The country’s most successful housing reform movement gathered in New Haven—and revealed its biggest vulnerability. (Slate)

• Is reading always better for your brain than listening to audiobooks? Reading books and listening to audiobooks tap into different elements of cognition, each with their own benefits. So which one should you choose, and when? (New Scientist)

• Trump’s Tariffs Are Damaging America’s Biggest Foreign Source of Screws: Taiwan has long been the top provider of screws to the United States. But its factories are struggling to survive under tariffs on steel and aluminum. (New York Times)

• The End of Thinking: The rise of AI’s “thinking” machines is not the problem. The decline of thinking people is. (Derek Thompson)

• Top Burger Spots in the US: Highbrow, lowbrow, or somewhere in between — each of these burgers makes its own argument for greatness. (Food & Wine)

• Stick To The Beat: How the drum machine, despite being a machine, proved just to have just enough heart to dominate the pop charts. (Tedium)

Be sure to check out our Masters in Business interview this weekend with Dmitry Balyasny, co-founder of Balyasny Asset Management, and the firm’s managing partner and chief investment officer. BAM nmanages $28B for clients. Balyasny began his trading career with Schonfeld Securities in 1994; he just received Institutional Investor’s 2025 Hedge Fund Lifetime Achievement Award.

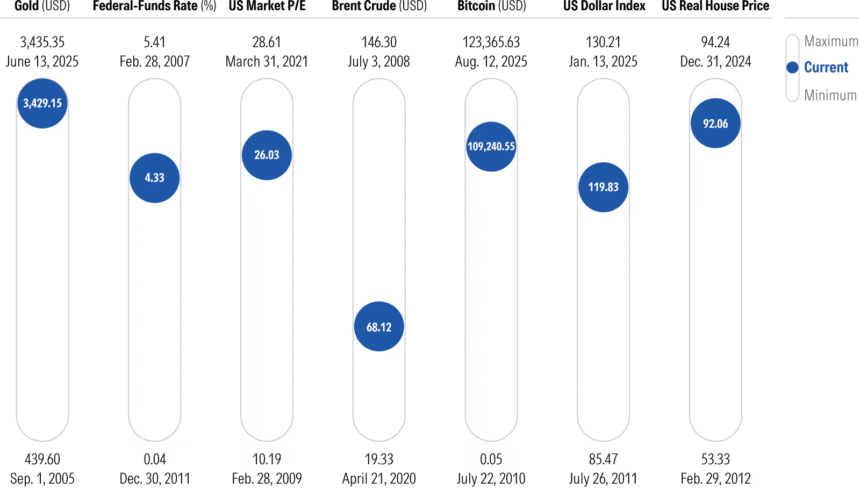

What 7 Key Indicators Are Saying About the Market

Source: Morningstar

Sign up for our reads-only mailing list here.