Join Our Telegram channel to stay up to date on breaking news coverage

The Bitcoin price slid 3% in the past 24 hours to trade at $111,910 as of 3:51 a.m. EST on trading volume that plunged 23% to $73.3 billion.

This comes as a whale investor, who earned close to $200 million by shorting Bitcoin and Ethereum just before Donald Trump’s tariff announcement against China on October 10, doubled down on another short against BTC with 10x leverage

Data from Hypurrscan shows that a the whale trader and possible ”Trump insider’ with the address “0xb317” on the decentralized derivatives exchange Hyperliquid deposited $40 million in USDC.

Shortly after that, the whale built a 10X short position in Bitcoin valued at around $340 million.

Based on the account’s entry price of $116,009, it has already amassed more than $700,000 in unrealized profits.

BREAKING: TRUMP INSIDER WHALE IS NOW SHORT $340M $BTC

The HyperUnit Bear Whale who shorted $700M of $BTC and $350M of $ETH right before Friday’s market crash (making ~$200M total) just deposited $40M USDC to HL and shorted another $127M $BTC.

He is now short $300M $BTC and has… pic.twitter.com/b2rpzmkofZ

— Arkham (@arkham) October 13, 2025

After some analysts suggested that the account belongs to former BitForex CEO Garret Jin, he confirmed that he’s connected to it, but said that the account is his “clients’ fund,” not his personal account.

Will the whale’s prediction prove right again or can the price hold support to recover?

Bitcoin Price Indicators Signal A Continued Bearish Move

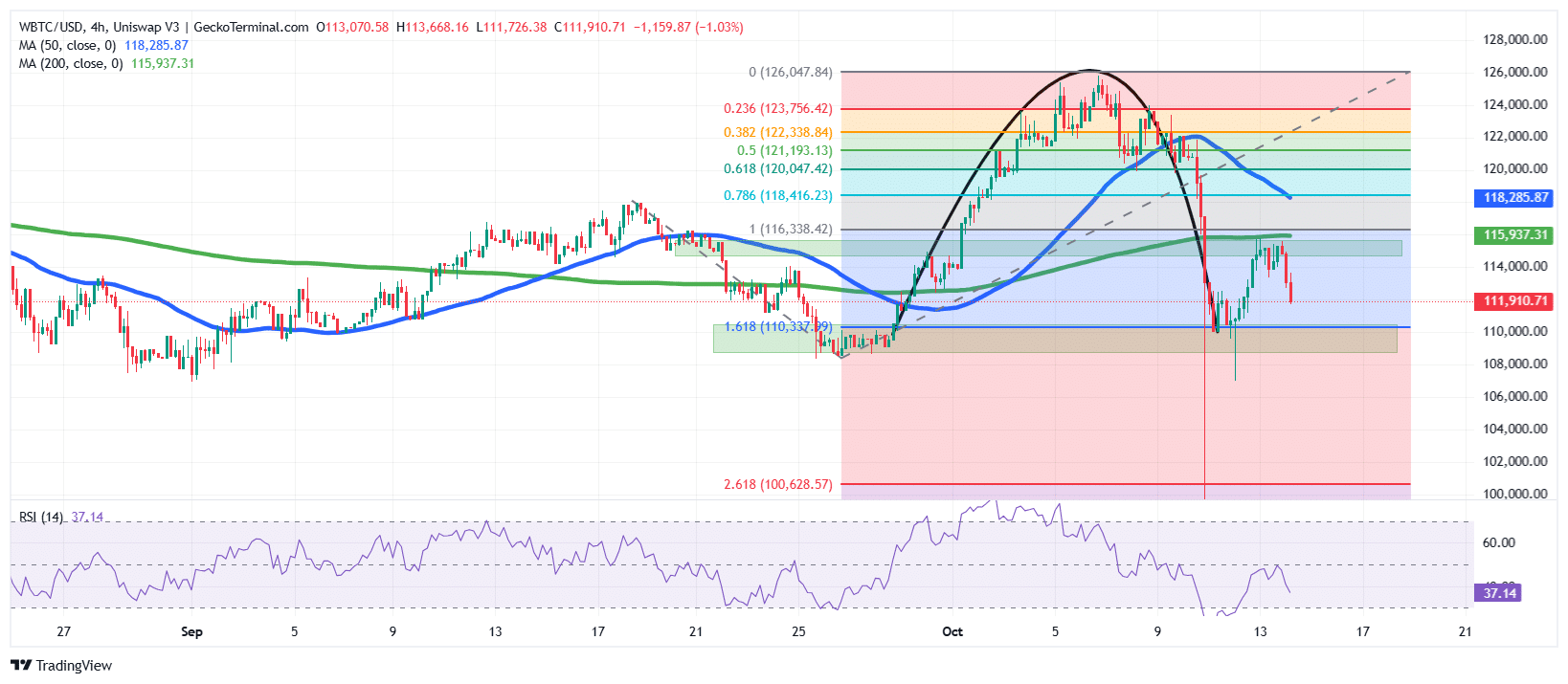

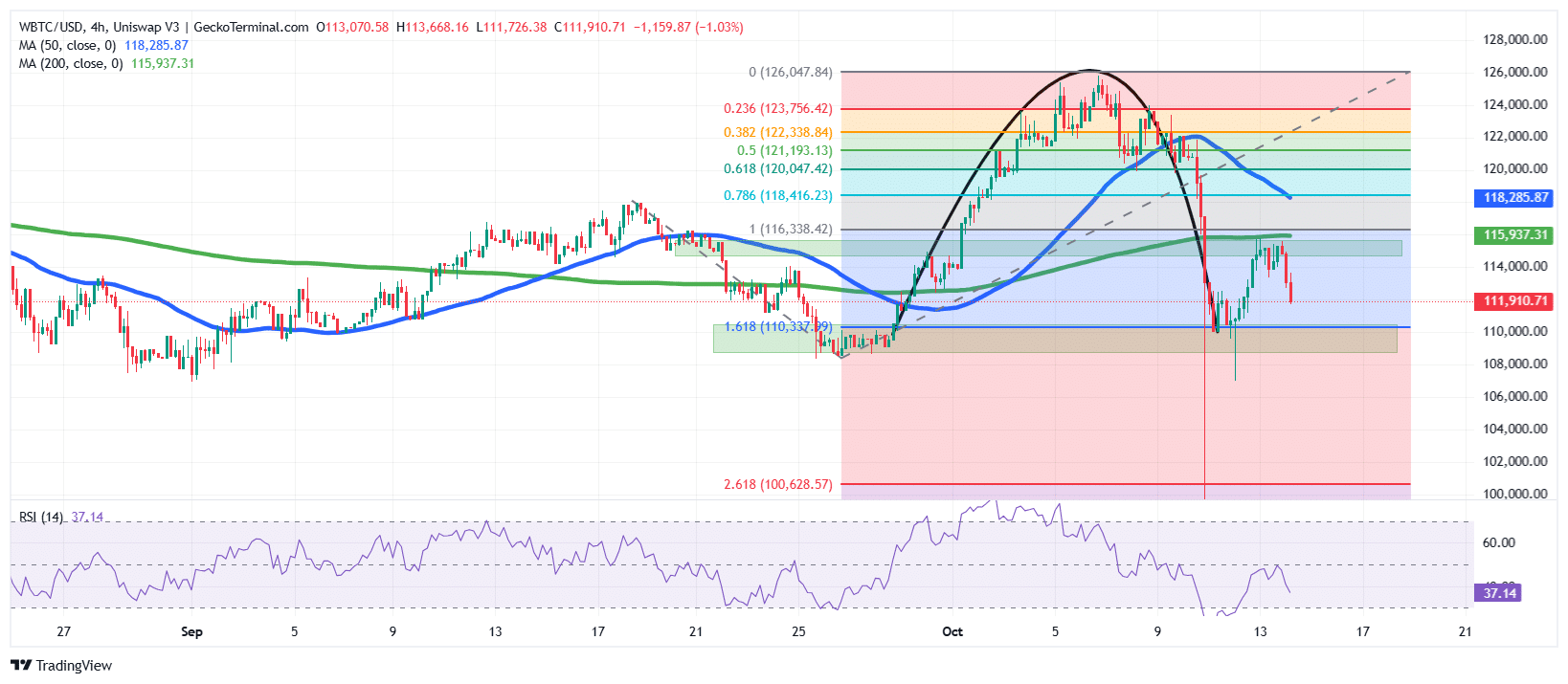

After a sustained drop from the $118,000 resistance to the $108,600 support in September, the BTC price recovered well by the end of the month.

This allowed the Bitcoin price to touch the all-time high (ATH) at $126,080 on October 6. However, BTC formed a rounding top pattern, which is generally a bearish pattern. This pushed the price of BTC to fall back to the support zone around $110,337 (1.618 Fib level).

Despite staging a recovery over this support, BTC was rejected around the $115,690 area, resulting in the current downtrend.

Bitcoin has also continuously traded below both the 50-day and 200-day Simple Moving Averages (SMAs), indicating that the leading cryptocurrency by market capitalization has been in a sustained bearish trend.

Meanwhile, the Relative Strength Index (RSI) is retracing back towards the 30-oversold level, currently at 37 from the 50-midline range, which could support the overall bearish trend.

The Trend-Based Fibonacci retracement on the BTC/USD 4-hour chart shows a strong rejection near the 0.382–0.5 levels (around $121K–$122K), confirming bearish momentum.

BTC Approaches $110K Support Zone

Based on the BTC/USD chart analysis, the BTC price is currently on a sustained bearish trend, which could see the asset plunge even more.

Support lies near the 1.618 extension ($110K). RSI at 37 indicates weakening momentum and potential oversold conditions. Unless the price of Bitcoin reclaims $118,000–$120,000, further downside toward $110K or even the 2.618 extension ($100,600) remains likely in the short term.

This comes as Ali Martinez, a popular crypto analyst on X, says that the price of BTC could revisit the $100,000 level.

If the bull finds support due to the oversold RSI, the Bitcoin price could rally towards the 1 Fib level at $116,338 or even higher at the 0.786 Fib level at $118,416.

For the bullish case, BitMEX co-founder Arthur Hayes stated on the X platform that bankers have received a hint from Jamie Dimon (CEO of JPMorgan Chase) that it’s time to create more credit for the American industry.

Banksters got the hint led by the Grand Master Jamie Dimon, time to create credit and lend to US industry. More dollars, more $BTC number go up! QE 4 Poor People in action. pic.twitter.com/dBI4fuiDoT

— Arthur Hayes (@CryptoHayes) October 14, 2025

Quantitative easing targeting the “poor” is underway, and the increased liquidity of the US dollar could drive up the price of BTC, he said.

Related News:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage