Join Our Telegram channel to stay up to date on breaking news coverage

Cathie Wood’s ARK Invest has filed multiple applications for new Bitcoin ETFs (exchange-traded funds) with the Securities and Exchange Commission (SEC).

According to Oct. 14 filings, the asset manager has submitted preliminary prospectuses for products including the ARK Bitcoin Yield ETF, ARK DIET Bitcoin 1 ETF, and the ARK DIET Bitcoin 2 ETF.

The filings come after the SEC approved generic listing rules for crypto ETFs, which is expected to streamline the approval process for such products.

ARK Invest Looks To Expand On Its Bitcoin ETF Offerings

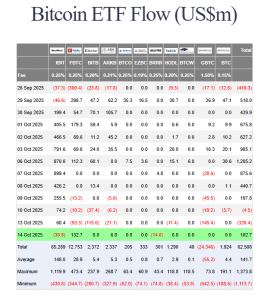

ARK Invest already has a spot Bitcoin ETF in the US market that trades under the ticker symbol “ARKB.” It has accumulated $2.337 billion, according to data from Farside Investors.

US spot BTC ETF flows (Source: Farside Investors)

Now it’s adding a range of additional products.

The ARK Bitcoin Yield ETF aims to provide yield to investors from Bitcoin-linked strategies and not solely track the leading crypto’s price. ARK framed this product as a way for investors to generate an income from BTC while reducing volatility.

That income will come from the sale of options and collecting options over time. The fund will also be able to invest in up to 25% of its total assets in ARK Invest itself, according to the filings.

Meanwhile, the ARK DIET Bitcoin 1 ETF will offer investors 50% downside protection but will only participate on the upside after a 5% increase in BTC’s price.

The ARK DIET Bitcoin 2 ETF will offer downside protection to investors for the first 10% decline. It will participate in Bitcoin’s upside when the crypto is above its value at the beginning of a specified outcome period.

SEC Approves Generic Listing Rules For Crypto ETFs

ARK Invest’s latest filings come after the SEC approved generic listing standards for certain commodity-based exchange-traded products (ETPs) on Sept. 18.

Under the new rules, qualifying products can be listed by any exchange under generic standards. This means that they no longer require a separate SEC review under Section 19(b), which slashes the time it takes for new products to enter the market.

Before the generic listing rules were approved, each new crypto ETF application often underwent a full SEC review that could take as long as 240 days with no guarantee of approval.

Now, the timeline is expected to be around 75 days.

With the streamlined process, analysts have said that the move could lead to a flood of new crypto products, especially for ETFs that extend beyond Bitcoin and Ethereum.

When the SEC approved the generic listing rules in September, Bloomberg ETF analyst James Seyffart said the market should prepare for “a wave of spot crypto ETP launches in coming weeks and months.”

WOW. The SEC has approved Generic Listing Standards for “Commodity Based Trust Shares” aka includes crypto ETPs. This is the crypto ETP framework we’ve been waiting for. Get ready for a wave of spot crypto ETP launches in coming weeks and months. pic.twitter.com/xDKCuj41mc

— James Seyffart (@JSeyff) September 17, 2025

Related Articles:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage