It has been 15 years since I first addressed why the “Wealth Effect” is a simple correlation error:

“The basic premise of the wealth effect is well known: As the value of stock portfolios rise during bull markets, investors enjoy a feeling of euphoria. This psychological state makes them feel more comfortable — about their wealth, about debt, and most of all, about spending and indulgences. The net result, goes the argument, is that consumers spend more, stimulate the economy, thus leading to more jobs and tax revenues. A virtuous cycle is created. The problem is, the theory is mostly nonsense.” The Big Picture, Nov 16, 2010

It is amazing that the Federal Reserve continues to make policy based on what I argue is a fundamental misunderstanding of both economics and psychology.

No, spending doesn’t go up because stocks are up; rather, the factors that underpin higher consumer spending – increases in employment, wages, credit, and even modest inflation, plus anything else underpinning economic expansion1 – tend to also drive up revenues, profits, investor sentiment, and therefore stock prices.2

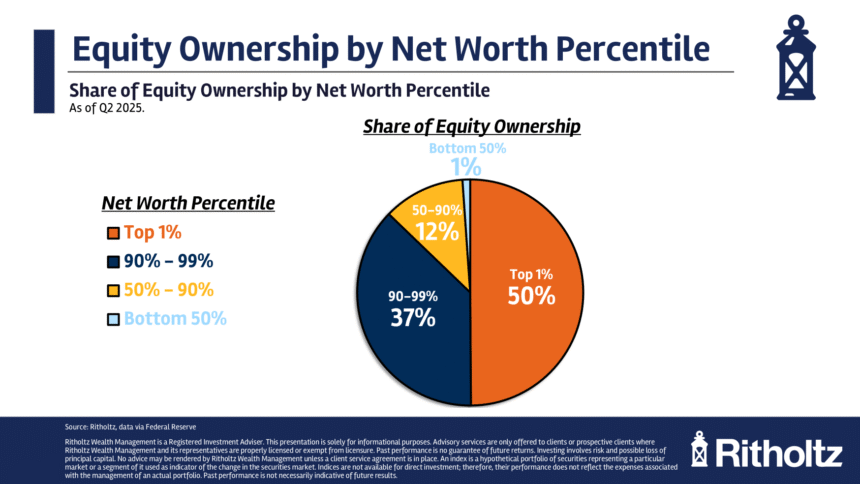

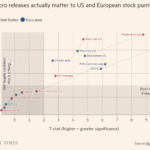

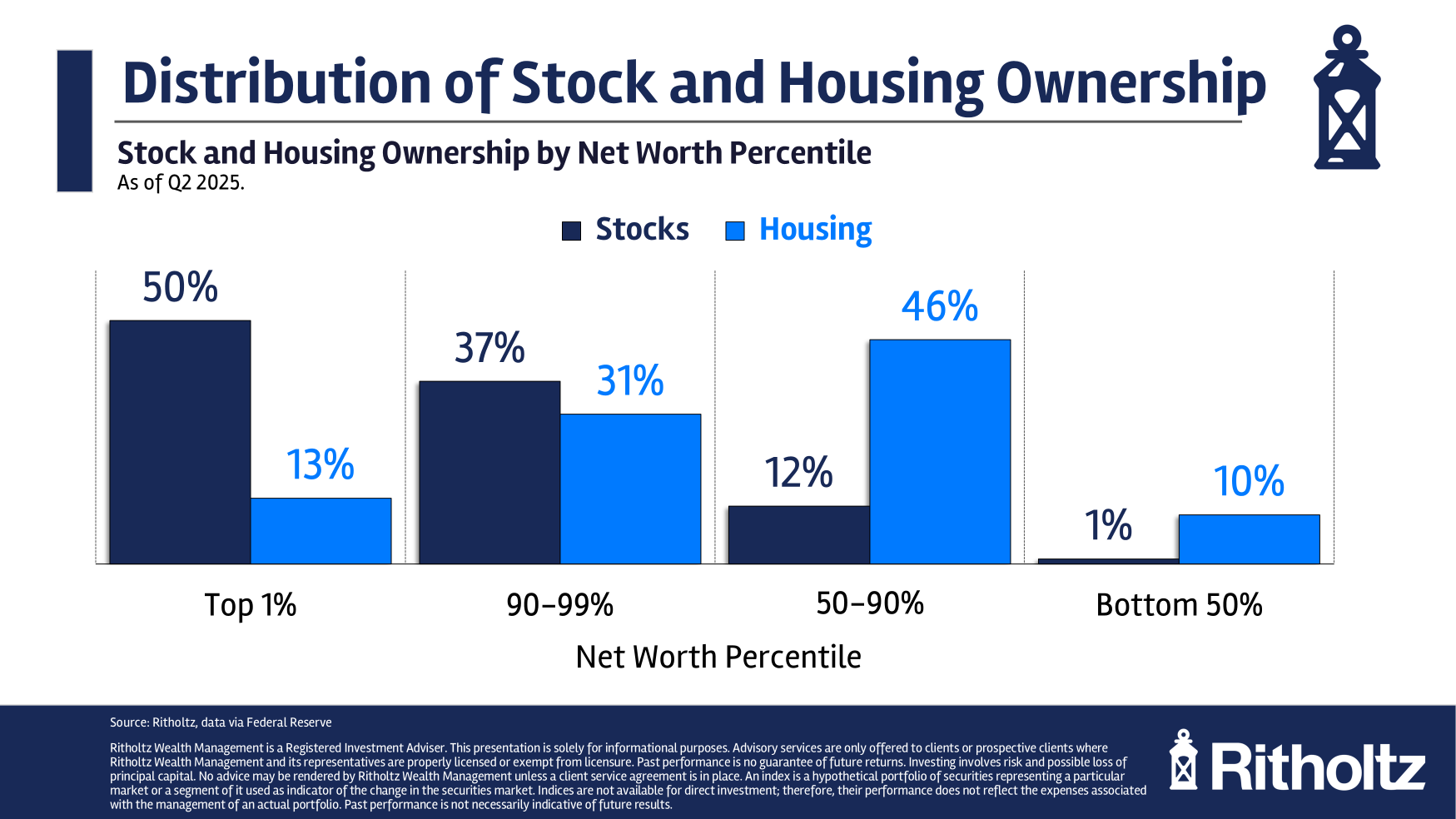

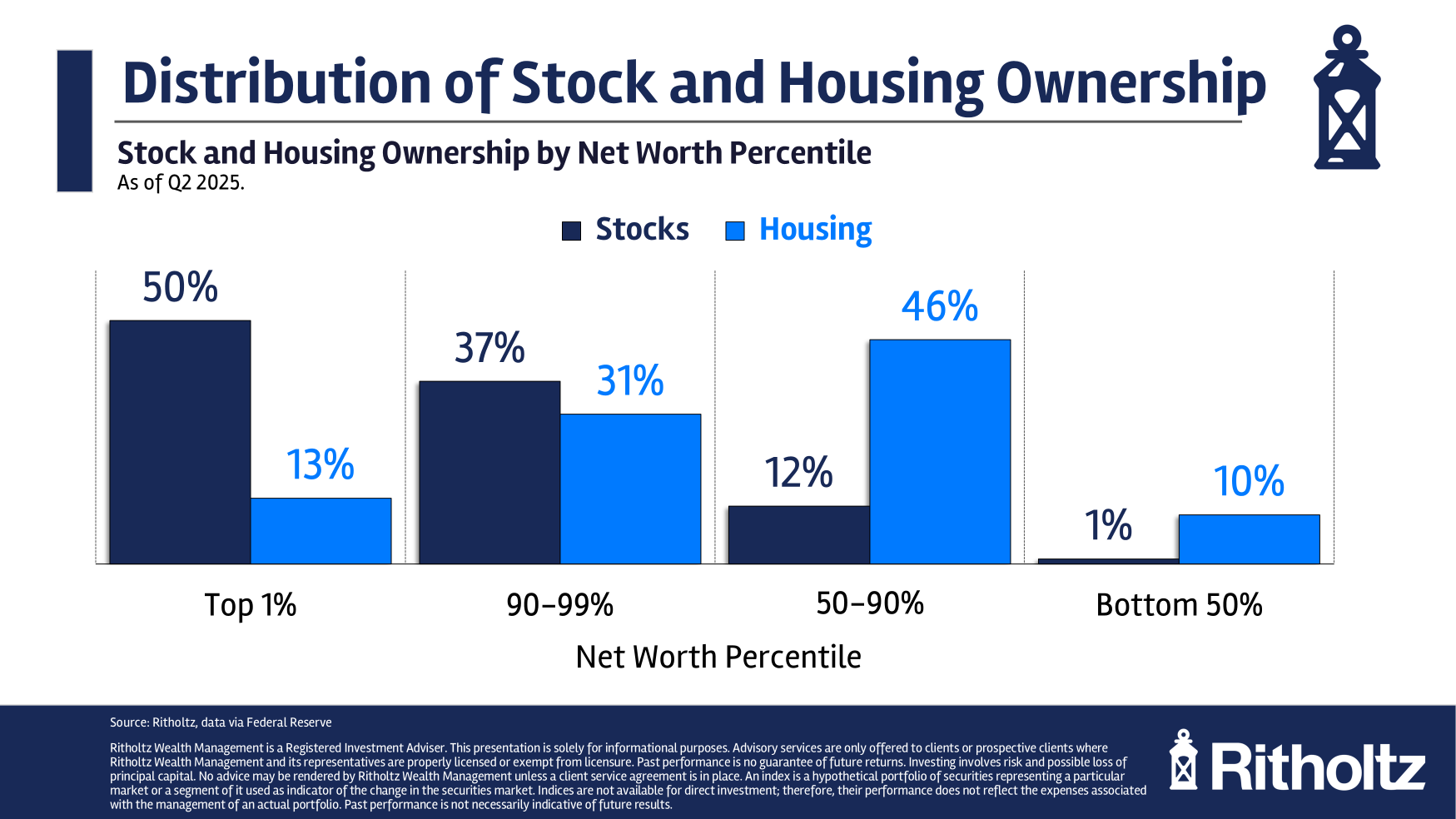

But that is only the first half of the Wealth Effect conundrum; the other half is that most people in the country own very little in equities. You have seen the data before: The top 10% own 87% of the stock market while the bottom 90% own just 13%.

Does anyone really believe the stock market is what drives spending for the 90% who only own 13% of equities?

There IS a real wealth effect with housing – the bottom 90% own 87% of the houses – pretty close to what you expect. But even those numbers are skewed; the lower half of households – AKA renters – only own 10% of the housing stock. So even the wealth effect of housing is somewhat muted.

What really drives consumer spending higher?

Plentiful jobs, wage increases, economic expansion, labor mobility, and bountiful credit availability have explained the past behavior of consumers. It is not a secular bull market in stocks that causes consumer spending to increase; it is the same contemporaneous elements that power a bull market that also drive spending.

If anyone has persuasive data showing that equity bull markets create a real wealth effect that is more than a correlation, and is genuinely causative, I would love to see it…

Previously:

Wealth Effect is a Bad Correlation Fantasy (April 25, 2016)

Fed is Too Focused on Wealth Effect, Equity Markets (February 6, 2014)

Wealth Effect Rumors Have Been Greatly Exaggerated (November 16, 2010)

See also:

Economy Wall Street has a consumer spending problem (Axios, September 9, 2025)

Wealthy Americans Are Spending. People With Less Are Struggling. (New York Times, October, 19, 2025)

Updates weekly U.S. Consumer Confidence Tracker (Morning Consult, October, 20, 2025)

Washington May Be Missing Signs of Economic Trouble: Why Republicans and Democrats alike get fooled by the stock market. (Politico, October 21, 2025)

__________

1. You can add another wrinkle to the causation correlation issue: The reversal of ordinary spending patterns in goods versus services during the pandemic, followed by the eventual return to near normal in the past few years…

2. I have discussed previously that most sentiment measures are broken; regardless, sentiment is useful primarily at extremes.