My end-of-week morning train WFH reads:

• When you shut the door on remote work, seasoned talent turns away: Veteran talent walks away the moment in-office work policy clashes with autonomy. McKinsey found 43% of prime-age employees, between 25 and 54, already work remotely, and nearly 60% want the option — an expectation gap of 17 percentage points that widens resignation risk. (The Hill)

• The Housing Market Is Already Terrible. A.I. Is Making It Even Worse. While digital staging is nothing new to real estate, bot-made listings are forcing homebuyers and professionals to ask themselves if this is a straight-up deceptive practice. (Slate) see also Zillow upgrades its outlook—here’s its home price forecast for more than 400 housing markets: Slightly upgrades its national home price outlook—predicting that over the next 12 months, U.S. home prices are likely to rise 1.9%. (Fast Company)

• A Short Seller’s AI Exercise Paints a Dire Picture of Private Equity: “The industry’s problems are hiding in plain sight,” according to Orso Partners cofounder Nate Koppikar. (Institutional Investor)

• Japanese convenience stores are hiring robots run by workers in the Philippines: Filipino tele-operators remotely control Japan’s convenience store robots and train AI, benefiting from an uptick in automation-related jobs. (Rest of World)

• 10 questions to answer before you die: Most people don’t plan for death. Here are the most important questions to answer and things to do now—so your people don’t suffer later. (Hello, Mortal)

• The AI Shift: Where are all the job losses? A macroeconomic change isn’t clear yet but payroll data shows some types of work are already being displaced. (Financial Times) see also Why the AI economy might not be 1990s redux: In the late 1990s, a surge in technology-fueled productivity enabled rapid growth, paired with subdued inflation, ample jobs, and low interest rates. Just maybe, the optimists say, AI might create the same happy conditions. Not so fast, say some leading economists. (Axios)

• The Great Reckoning: What the West Should Learn From China. Adam Tooze: “China isn’t just an analytical problem; it is the master key to understanding modernity.” China is “the biggest laboratory of organized modernizations there has ever been or ever will be at this level [of] organization.” (The Ideas Letter)

• Are Protesters Becoming Less Violent? ‘No Kings’ Survey Suggests So: Massive marches nationwide in the U.S. marked a turn against an increasing acceptance of political violence among protesters, report sociologists (Scientific American)

• Move over, doodles. There’s a new ‘It’ dog in town. Between their signature shape and viral appeal, dachshunds are inching closer and closer to becoming America’s favorite dog breed. (Business Insider) see also Doodlemania:How Doodles Became a Cutthroat Billion-Dollar Dog Industry: Goldendoodles, labradoodles and bernedoodles are everywhere. They’re now also a high-stakes, billion-dollar industry. (Businessweek)

• Study finds mRNA coronavirus vaccines prolonged life of cancer patients: Health records of more than 1,000 cancer patients receiving immunotherapy for lung and skin cancer showed they gained additional benefit after vaccination. (Washington Post)

Be sure to check out our Masters in Business interview this weekend with Liz Ann Sonders, Chief Investment Strategist, Charles Schwab & Co. Named “Best Market Strategist” by Kiplinger’s Personal Finance, she is also on Barron’s “100 Most Influential Women in Finance” every year since the list’s inception.

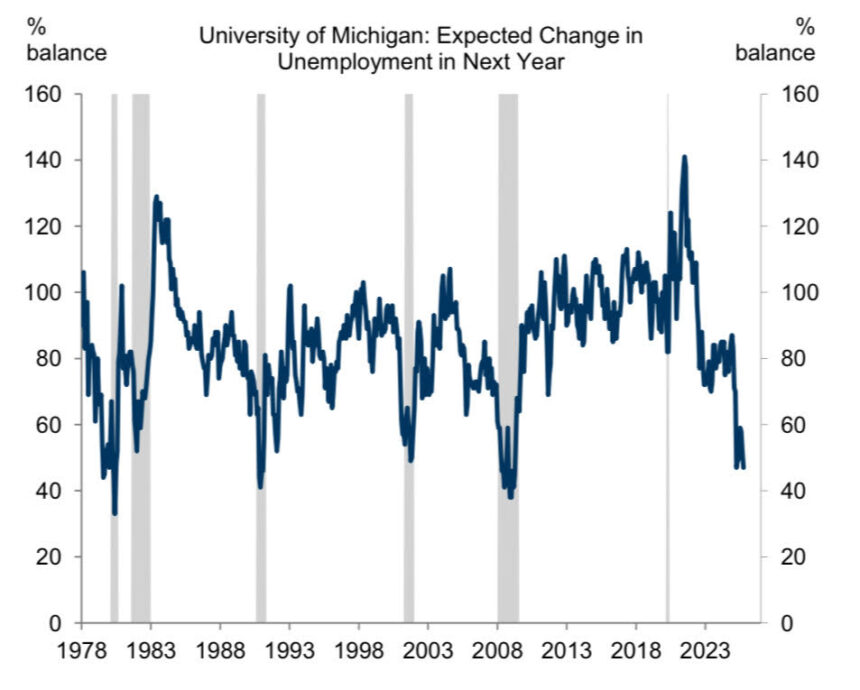

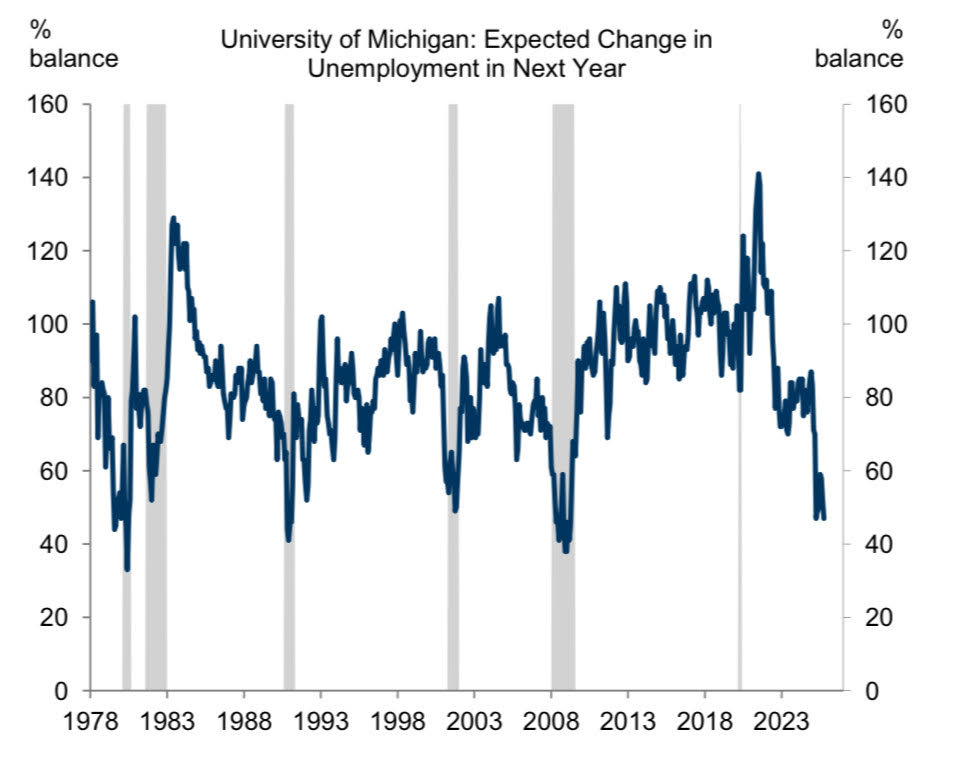

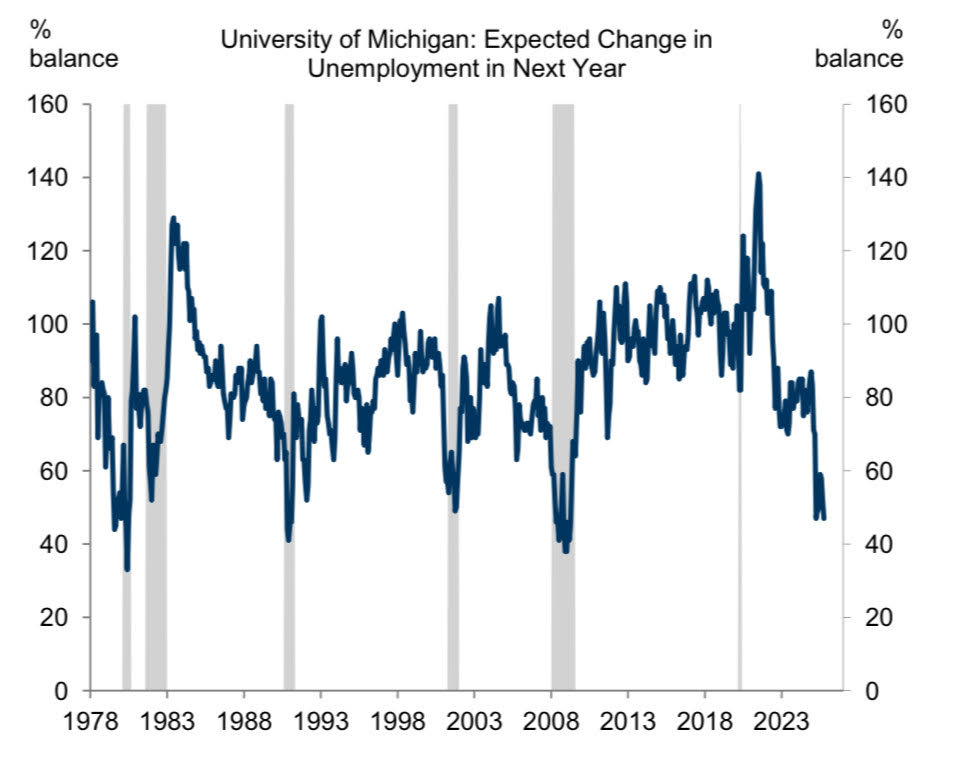

Expected change in the unemployment rate over the next year has never been this bad outside recessionary periods since the University of Michigan started asking the question in 1978

Source: Goldman Sachs via @carlquintanilla

Sign up for our reads-only mailing list here.