My morning train WFH reads:

• It Is Trump’s Casino Economy Now. You’ll Probably Lose. Step into the casino that now passes for the American economy. The casino economy was built on speculation and risk. Across markets and policy, wagers on the future are being made with other people’s money at a cost that could prove catastrophic. (New York Times)

• Ed Zitron Gets Paid to Love AI. He Also Gets Paid to Hate AI. He’s one of the loudest voices of the AI haters—even as he does PR for AI companies. Either way, Ed Zitron has your attention. (Wired)

• How Vanguard Stacks Up Against Its Fund Industry Peers: Where the low-cost powerhouse ranks versus other top asset managers by size, ratings, and manager ownership. (Morningstar)

• LOL Me: Who you gonna trust: Barry Ritholtz or Jim Cramer? A trio of new books from notable (and notorious) authors offer fresh insights on retirement investing. (MoneySense) see also Make ‘cents’ of financial literacy with these 4 podcasts: To get comfortable with money, I recommend listening to podcasts, which combine accessibility and personality. You can learn anywhere — on a walk, between classes or while doing chores — and still absorb complex ideas. Many financial podcasts use humor, storytelling and current events to make compound interest or credit scores sound less like lectures and more like conversations with a nerdy friend. (The Emory Wheel)

• Jesse Livermore & The Magnet of Dancing Stock Prices: There’s a lot of stuff in here that sounds eerily similar to today’s environment. It was the tail end of a glorious bull market. Retail investors were beating the pros. Investors were all in on the stock market. It felt like nothing could stop the runaway bull market train. (A Wealth of Common Sense)

• No, Ronald Reagan Didn’t Love Tariffs: Reagan did, in fact, repeatedly emphasize the virtues of free trade. Like all modern presidents, he nonetheless imposed some tariffs for political reasons. But Reagan always stayed within the boundaries of the law, using his right to impose discretionary tariffs as pressure release valves rather than abusing his authority to make tariff policy an instrument of his personal. (Paul Krugman)

• The Math Trick Hidden in Your Credit Card Number: Find out how this simple algorithm from the 1960s catches your typos. (Scientific American)

• Apple’s biggest iPhone overhaul in years ignites upgrade frenzy: Extended wait times and generous trade-in deals signal surging demand for newly redesigned device. (Financial Times) see also The right shortcuts can give your iPhone superpowers. Here’s how. Take the pain out of tedious tasks with Apple’s Shortcuts app.(Washington Post)

• U.S. Drops Out of Top 10 in Passport Power. Here’s Why: Adecade ago, the United States passport was seen as the most powerful in the world by the Henley Passport Index, which ranks nations based on the number of destinations a traveler can visit without needing a visa. In 2025, however, the U.S. passport has fallen from grace, dropping out of the top 10 most powerful passports globally for the first time in 20 years. (Time)

• He’s Baseball’s $325 Million Pitcher—and He Might Be Underpaid: Yoshinobu Yamamoto hadn’t pitched a single inning in American baseball when the Dodgers signed him to the richest contract ever given to a pitcher. After back-to-back playoff masterpieces, he’s beginning to look like a bargain. (Wall Street Journal)

Be sure to check out our Masters in Business interview this weekend with Jon Hilsenrath of Serpa Pinto Advisory. Previously, he was chief economics correspondent for Wall Street Journal for 26 years. Dubbed the “Fed Whisperer” by Wall Street traders for his scoops on the FOMC, he worked out of Hong Kong, NY, and D.C. He was part of the Pulitzer Prize-winning team for on-scene coverage of 9/11. He is the author of “Yellen: The Trailblazing Economist Who Navigated an Era of Upheaval.”

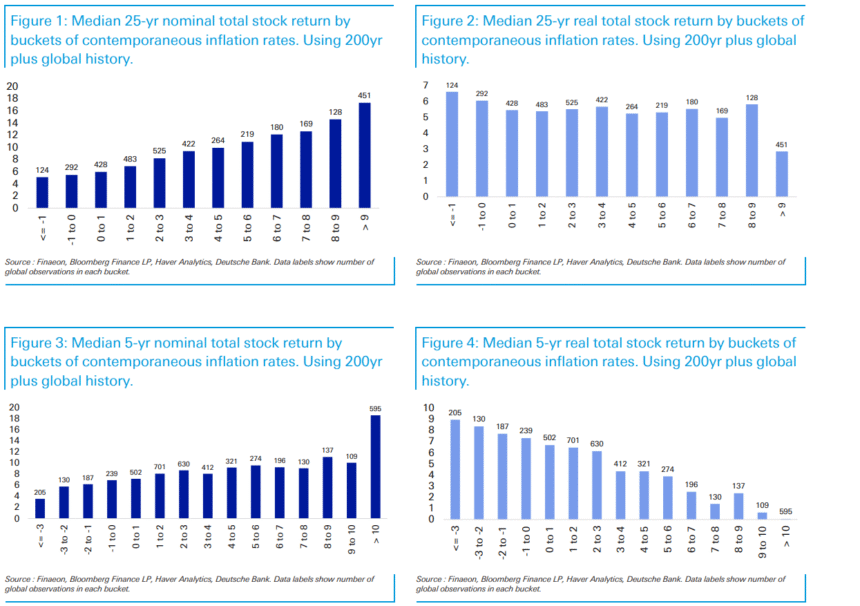

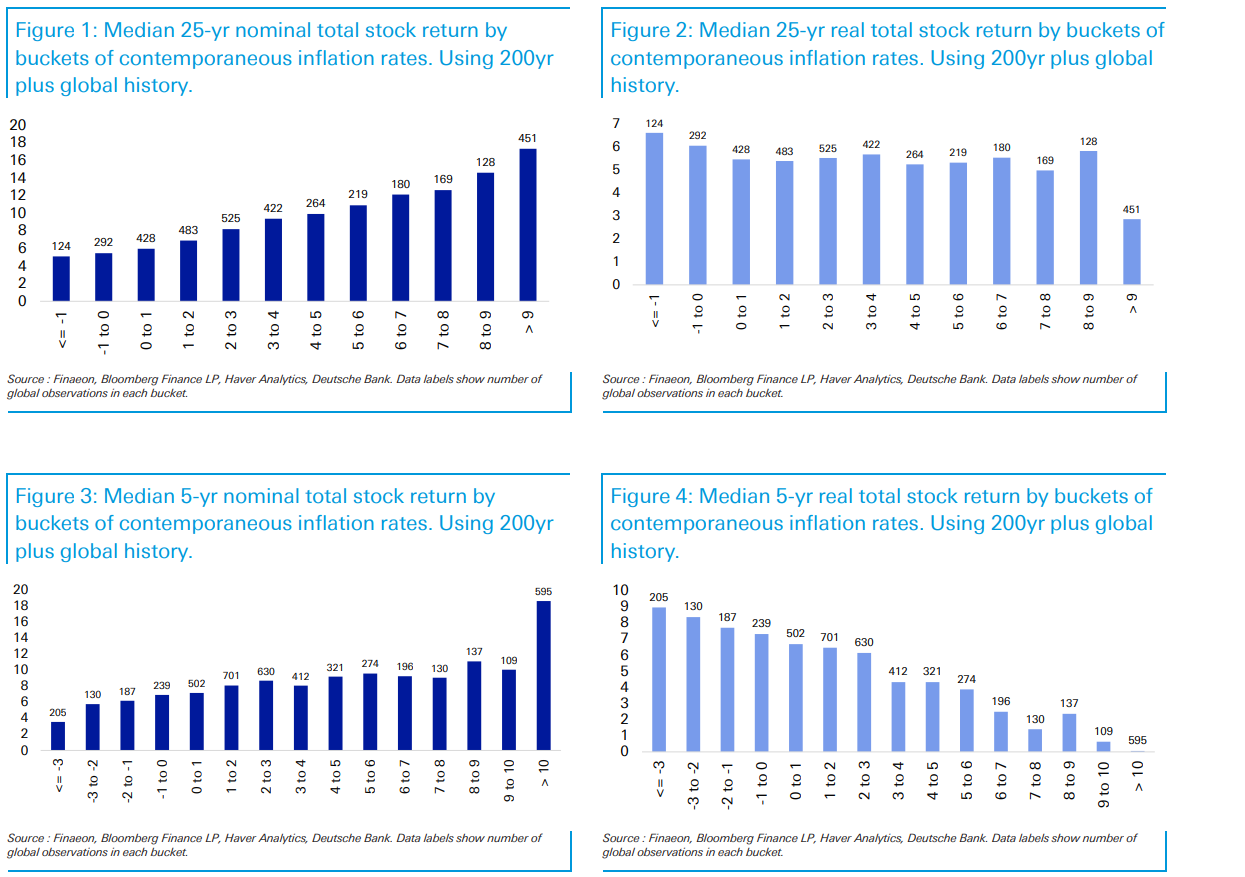

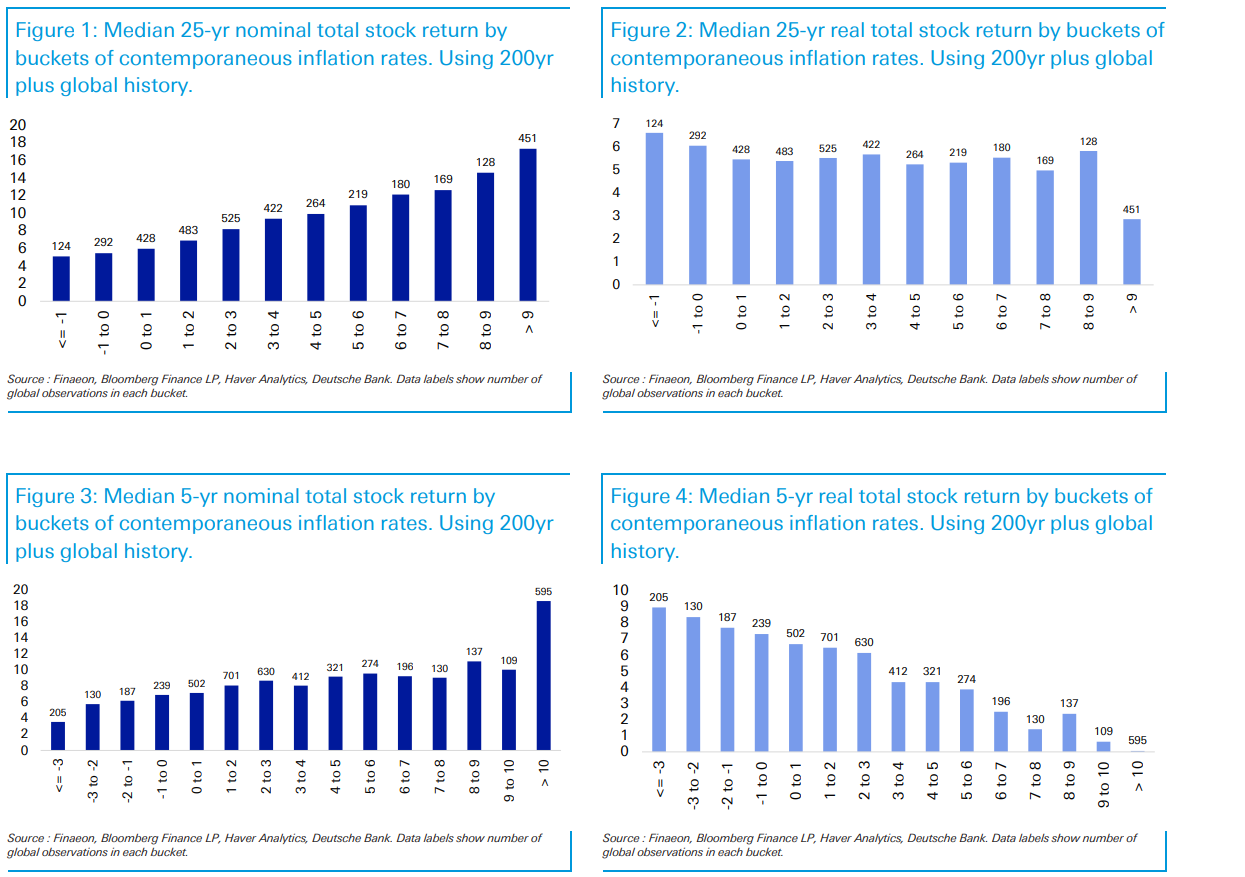

Nominal equity returns rise ~linearly with inflation — equities act as an effective inflation hedge. Real returns decline modestly when inflation rises a lot; Equities perform best in lower to moderate inflation environments

Source: Deutsche Bank Research Institute

Sign up for our reads-only mailing list here.