It’s that time of year again when families gather to feast on bountiful harvests and to give thanks for all of our blessings.

This year, skip the “Vibes” and instead focus on market data. Don’t lose sight of nuances and shades of grey; they don’t make for great memes, but they do lead to a better understanding of what’s going on.

1. ARTIFICIAL INTELLIGENCE: Perhaps we are in the late stages of an AI-driven bubble; we could just as easily be in a once-in-a-generation transformational technology boom that will drive both the economy and the stock market higher for years to come.

Too many people fail to recognize how challenging it is to identify these generational market turning points in real time.

My favorite takes on AI have come from Derek Thompson and Timothy Lee, who looked into the 12 main arguments Pro & Con, and Benjamin Riley, who aims to “help people understand human cognition and artificial intelligence.”

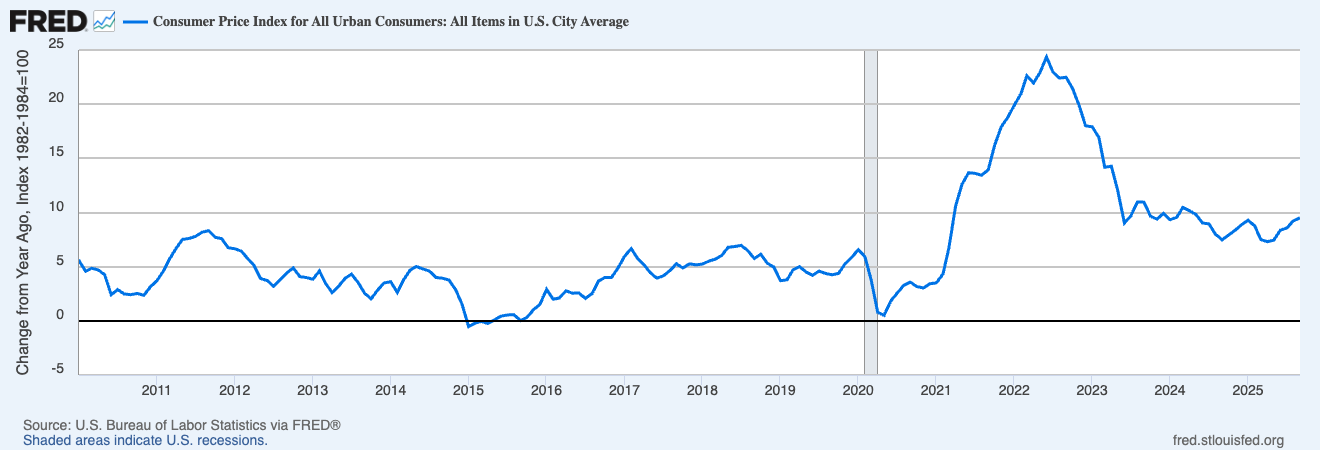

2. INFLATION: Everything costs more this year — except for the Turkey.

The largest fiscal stimulus since World War 2 led to the largest inflation surge since the 1970s. The rate of price increases rose by 9% (peaking June 2022) before falling back to 3% nearly as quickly. There were numerous causes of inflation, but the top of the list was the pandemic supply issues and the huge fiscal stimulus.

People confuse the rate of price change with prices. We had high inflation; today, we have low(ish) inflation, but we still retain higher prices. Everything is much more expensive today, even with inflation way down. Low Inflation and High Prices are not mutually exclusive.

CPI Inflation is in the 2-3% range today, but it is ticking upwards, creating difficulties for those on the FOMC who want to cut rates.

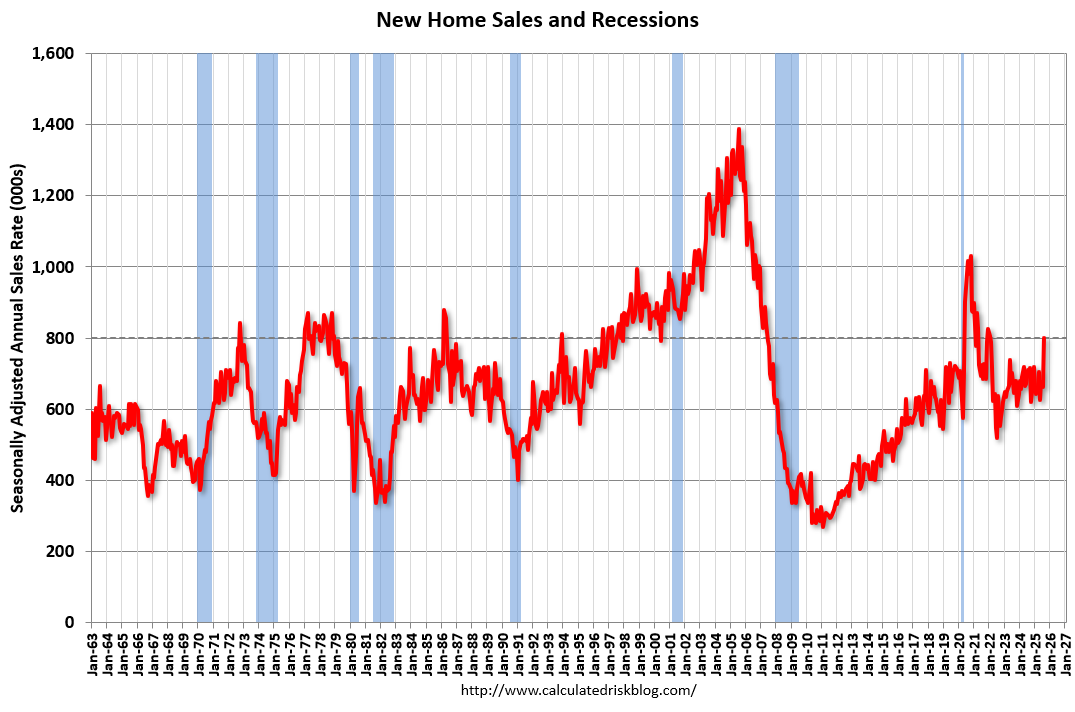

3. SUPPLY & DEMAND: We may not have structural inflation as we did in the 1970s, but we do have a structural imbalance in supply and demand of many critical goods and services.

A few significant examples:

- Single-family homes

- Used cars

- Skilled labor

- Rare Earth minerals

- Renewable energy

Until supply catches up with demand, those prices will remain high. And that is before we get to health care and education costs.

4. ENERGY: The inflation of the 1970s was structural, caused in large part by the Arab Oil Embargo. In contrast, the United States is a net energy exporter today. In the 1970s, energy accounted for about 10% of the average household budget; the Chicago Fed found it peaked at nearly 14% in the early 1980s.

Household energy costs are about half of those levels today (5-6%), even as energy consumption has increased significantly. Every power-hungry device, from automobiles to HVAC systems to appliances, is now many times more efficient than in the past.

The wildcard is increased demand from power-hungry data centers…

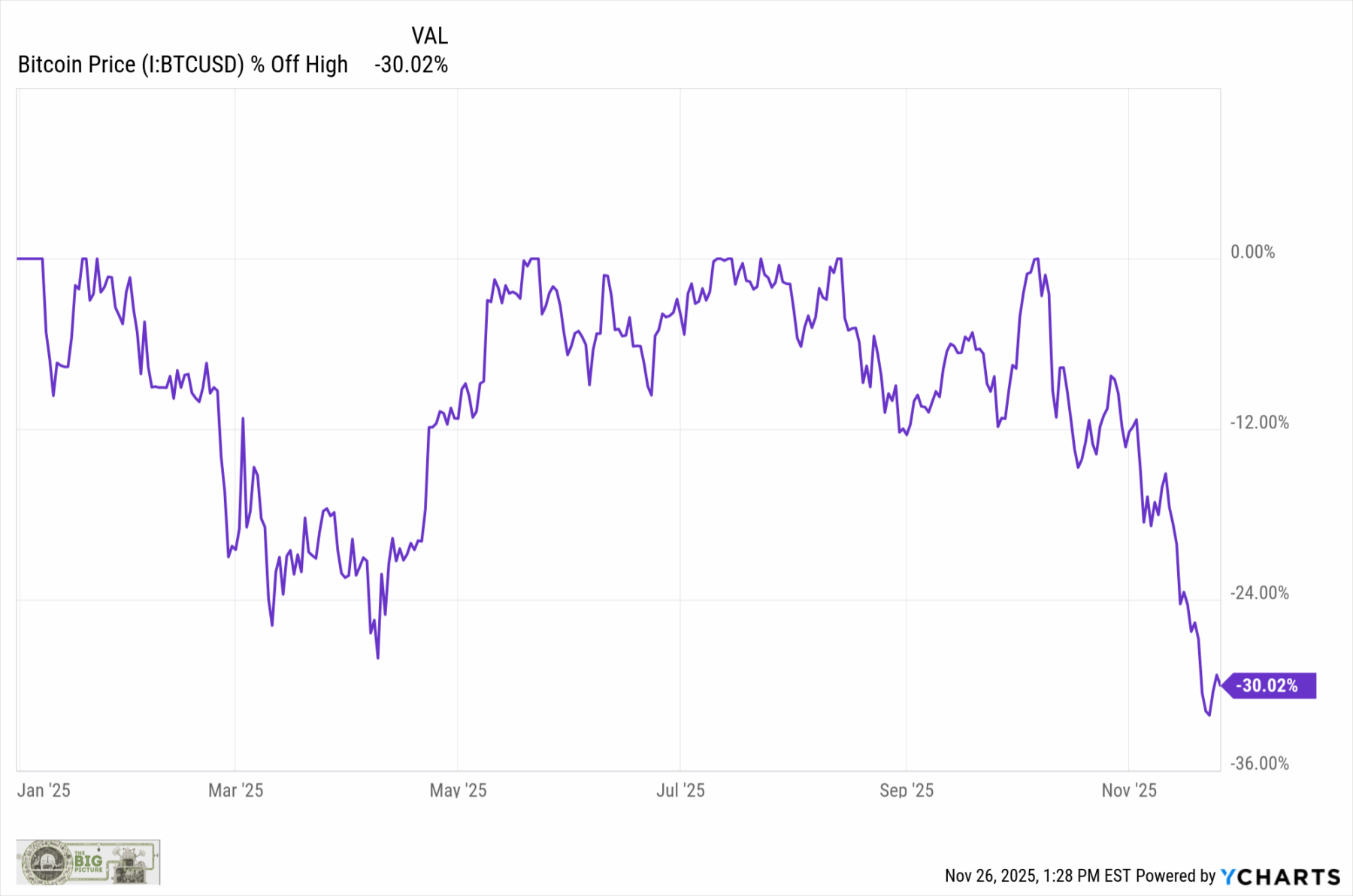

5. CRYPTO CRASH: Given the embrace of crypto by the President (and POTUS’s family), much of Bitcoin 2025 gains can be attributed to this administration’s policies. We should not be surprised by the correlation between the President’s political fortunes / approval ratings, and the price of Bitcoin.

The President has had a terrible month; from the election thumping to the fallout with MTG to losing multiple legal cases (Tariffs at SCOTUS, Comey / James case dismissals), it’s no surprise that Bitcoin has suffered a 30% crash this month as well:

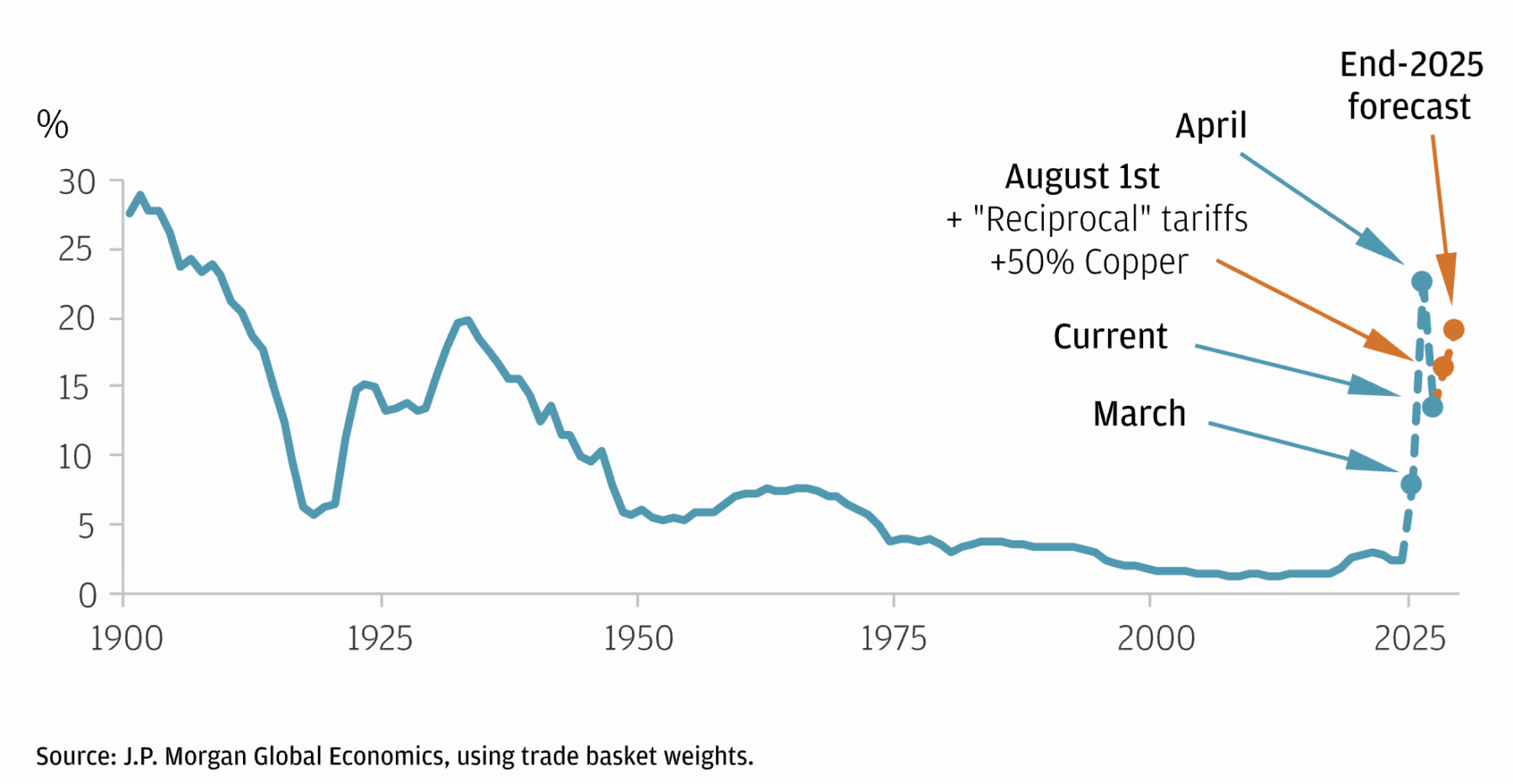

6. TARIFFS: Are fascinating: They cause temporary inflation spikes and permanent higher prices. There is no getting around it – any additional tax on imported goods is a source of increased prices. And as we have seen before, even domestic producers will raise prices (Greedflation) if they believe consumers won’t balk.

The good news: If the Supreme Court arguments were anything to go on, many of the Tariffs are likely to get struck down.

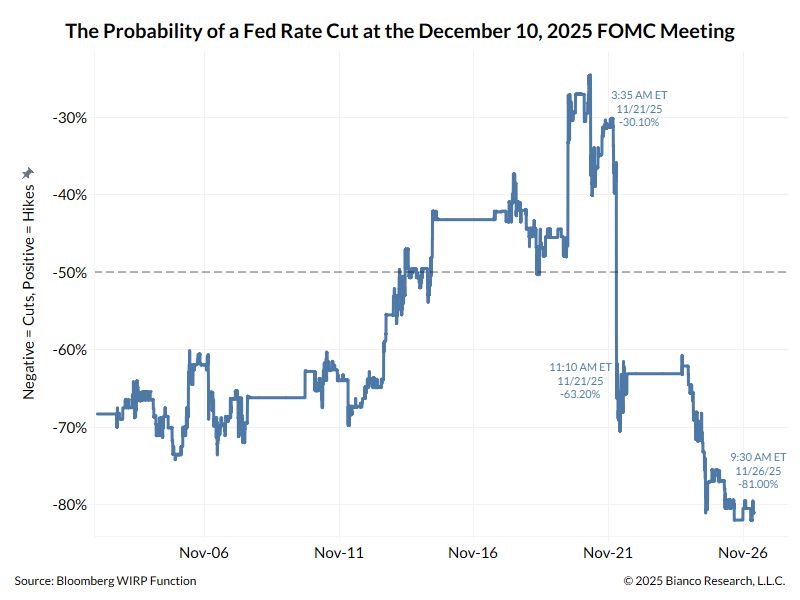

7. RATE CUTS: You can make a solid case either way – inflation remains stubborn at (or over) 3%, but there are signs of labor market softness, slowing consumer sales, and mediocre sentiment.

Expectations had fallen to a ~20% chance of a rate cut – until yesterday’s poor data. Now, we are back to an 80% chance of a December cut. Beyond that is anyone’s guess…

8. BUBBLES: By definition, it takes a crowd to create a bubble. Can you recall the public, the media, or even the Fed identifying a bubble on a timely basis? (Me neither).

Asked differently, can investors rationally believe that prices are not entirely irrational? If your answer is yes, then it’s likely not a bubble.

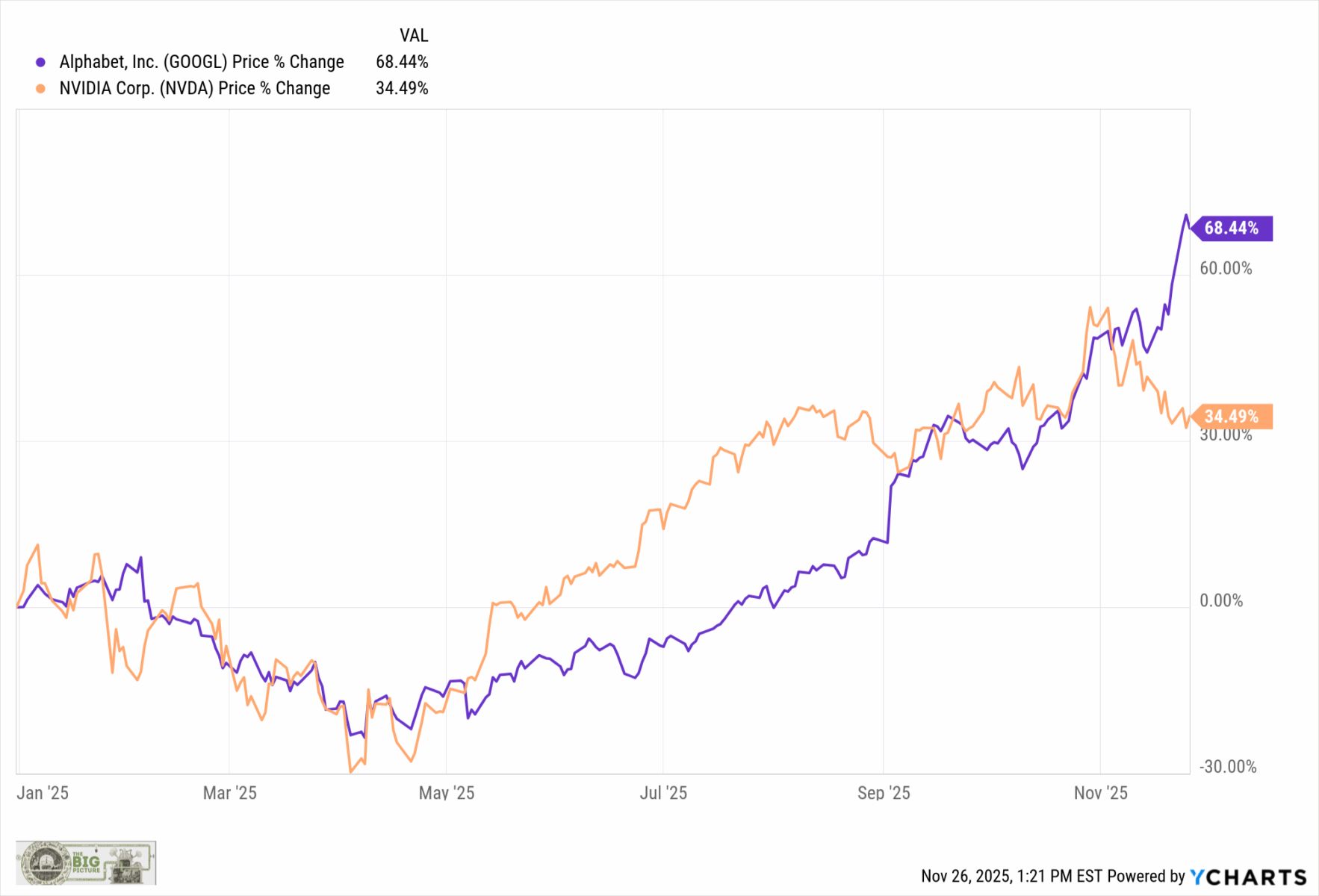

Perhaps the most interesting aspect of the AI bubble debate is Alphabet (GOOGL) passing Nvidia (NVDA) YTD returns:

9. RECESSION: People hate inflation, but the alternative was a deep and long-lasting pandemic recession. We avoided a 10-12% unemployment rate, but the cost was 9% inflation.

Consider the alternative, had both the Trump and Biden admins not cranked up the fiscal spend, people would have been furious at the failure to do anything1. It’s a Lose/Lose; whatever choice got made, half the population would have been furious.

As angry as people are over high prices, they would have been even angrier at a do-nothing government letting an ugly recession take hold.

10. VALUATIONS: The Mag 7 remains pricey, even as Nvidia slides 13% off its highs. Its expensive, but it also generates $57 billion in quarterly revenues! Some sectors are extremely overpriced, others are more reasonable. The S&P 493 — S&P 500 minus the Magnificent 7 — is at 20.7 P/E. Pricey, but not ridiculous.

Nuance is your friend.