My morning train WFH reads:

• How to invest your enormous inheritance: What do you stand to inherit? It still feels like a question from a different age, despite its growing importance today. In 2025 people across the rich world will inherit some $6trn, or around 10% of GDP — a figure that has climbed sharply in recent decades. French bequests have doubled as a share of national output since the 1960s; those in Germany have tripled since the 1970s; Italian inheritances are now worth around 20% of GDP (The Economist via Elm)

• Once-in-a-Generation Copper Trade Upends a $250 Billion Market: The Aug. 1 deadline for Trump’s 50% copper tariffs signals the endgame for the most profitable trade that industry veterans say they have ever seen. (Bloomberg) see also Copper Fever Is Here. What to Know: The commodity’s price is near a record high because of Trump’s trade war. It might be wise for investors to wait for a dip before easing in. (Barron’s) see also The US Has More Copper Than China But No Way to Refine All of It: The industry will need to overcome high energy and labor costs, environmental regulations and a glut of cheap Chinese competition to make US copper smelting great again. (Businessweek)

• How a Reddit Rallying Cry Helped Amateur Traders Win in the Market: Individual investors were the ones who piled into stocks when they plunged in early April, while big Wall Street institutions missed out on the gains. (New York Times)

• Eye on the Market Outlook 2025. With questions about deregulation, deportations, tariffs, tax cuts, cost cutting…what could possibly go wrong? Chairman of Market and Investment Strategy Michael Cembalest guides us through the 2025 investment landscape, from AI to the nuclear renaissance, to crypto and beyond—and shares his Top Ten list for the new year. (JPMorgan)

• How Crypto Lobbying Won Over a President: The ‘Trump Pump’: The industry’s courtship of Donald J. Trump resulted in one of the great lobbying free-for-alls in recent Washington history. (New York Times)

• Can Americans Just Stop Building New Highways? A new book argues that the expansion of the US roadway network has exacted social and environmental costs that far outweigh the benefits. (Bloomberg)

• Trump’s Unsung Economic Booster: Deregulation: Nuclear power exemplifies how revamping dated and onerous rules could kick-start investment and innovation. (Wall Street Journal) but see Trump quietly claimed a power even King George wasn’t allowed to have: A truly scary new revelation about Trump’s effort to circumvent the TikTok ban. (Vox)

• How the Binding of Two Brain Molecules Creates Memories That Last a Lifetime: An interaction between two proteins points to a molecular basis for memory. But how do memories last when the molecules that form them turn over within days, weeks, or months? (Wired)

• Galloway: ICE Age: President Trump is no longer fighting inflation, China, or AI. Instead, he’s declared war on a manufactured threat: the “enemy within” — immigrants, journalists, and professors. Our biggest threat, apparently, isn’t Russian aggression or economic inequality; it’s your Uber driver or anthropology professor. This is not only cruel (and depraved) but stupid, as the chill being cast across the agriculture, services, and construction sectors will likely be more inflationary than the tariffs (more stupidity). Trump’s goal is to deport 4 million undocumented people over four years — that’s about 3% of the U.S. workforce; 10% to 15% in several sectors dependent on immigrant labor.(No Mercy / No Malice)

• Meet the Robot Using AI to Ink Your Next Tattoo: The startup Blackdot has installed a first-of-its-kind tattoo device in New York City and Austin. But will the customers come? (Wall Street Journal)

• The Biggest-Ever Digital Camera Is This Cosmologist’s Magnum Opus: Tony Tyson’s cameras revealed the universe’s dark contents. Now, with the Rubin Observatory’s 3.2-billion-pixel camera, he’s ready to study dark matter and dark energy in unprecedented detail. (Quanta)

Be sure to check out our Masters in Business next week with Richard Bernstein, founder of RBA. The firm focuses on Macro trends, and manages (or advises on) $15.7B AUM. Previously, he was Chief Investment Strategist at Merrill Lynch from 1988-2009. Bernstein was named to Institutional Investor’s “All-America Research Team” 18X, and inducted into the Institutional Investor “Hall of Fame.”

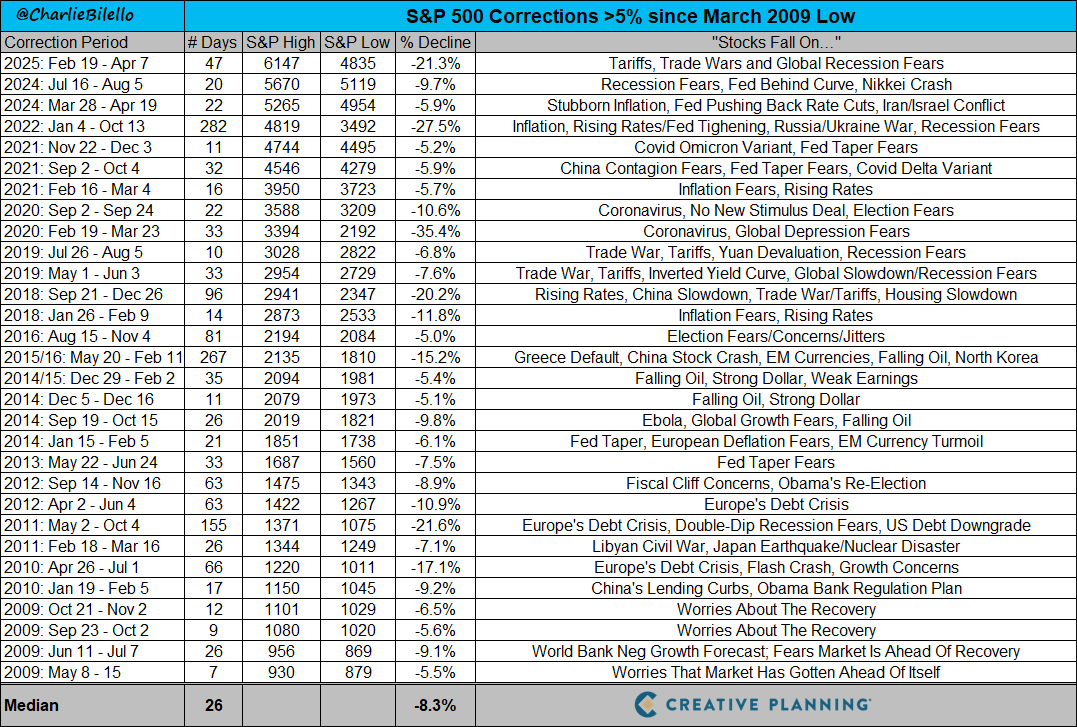

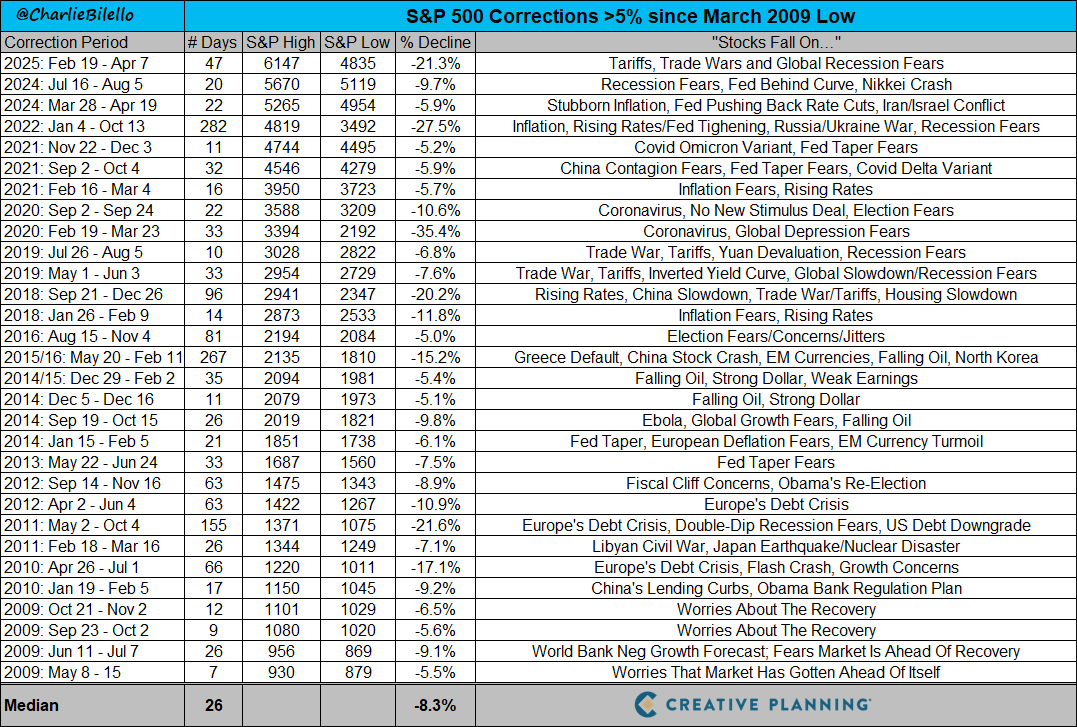

S&P500 gained 1,170% since March 2009 lows, despite 30 corrections >5%

Source: Peter Mallouk

Sign up for our reads-only mailing list here.