Join Our Telegram channel to stay up to date on breaking news coverage

US spot Bitcoin ETFs (exchange-traded funds) outperformed their spot Ethereum ETF rivals yesterday, bringing an end to the ETH funds’ recent dominance in the market.

Data from Farside Investors shows spot BTC ETFs recorded $332.8 million in net inflows in the latest trading session, compared to $135.3 million in net outflows for ETH ETFs.

In August, spot Ethereum ETFs recorded $3.87 billion in inflows, while Bitcoin funds experienced $751 million in outflows.

Last week, both the BTC and ETH ETFs were on multi-day net inflows streak. The US spot Bitcoin ETFs saw net daily inflows for every day except Friday last week, with their total inflows for the week reaching $440.8 million. This was less than half of the over $1.24 billion that flowed into spot ETH ETFs during the same period.

Fidelity’s FBTC Sees More Inflows Than BlackRock’s IBIT

Much of the net inflows for the spot Bitcoin ETFs was posted by Fidelity’s FBTC, which saw investors pour $132.7 million into the fund’s reserves. This was more than the $72.9 million inflows that were recorded by BlackRock’s IBIT, which has been the most popular BTC ETF among investors.

The Farside Investors data shows that IBIT has recorded $58.379 billion in cumulative outflows since the BTC funds were approved in the US in January last year. Fidelity’s FBTC is the second-biggest fund in this regard, but has only seen a fraction of IBIT’s cumulative inflows. Currently, the ETF’s inflows to date stand at $11.894 billion.

During the latest trading session, other US spot Bitcoin ETFs, including Bitwise’s BITB, ARK Invest’s ARKB, Invesco’s BTCO, VanEck’s HODL and Grayscale’s BTC all saw net inflows.

The biggest of those inflows was recorded by ARK Invest’s ARKB, which saw $71.9 million enter its reserves. Meanwhile, BITB, BTCO, HODL, and BTC posted net daily inflows of $39.1 million, $2.2 million, $4.7 million, and $9.3 million, respectively.

On the same day, Fidelity’s spot Ethereum ETF (ETHW) suffered the biggest net daily outflows of the ETH products. Bitwise’s ETHW, 21Shares’ TETH, and Grayscale’s ETHE also posted net daily outflows of $24.2 million, $6.6 million, and $5.3 million, respectively.

The remaining ETH ETFs, including BlackRock’s ETHA, recorded no new flows on the day.

Yesterday was the second consecutive day of net outflows for the Ethereum products as well. Just the day before, investors pulled $164.6 million from the ETFs.

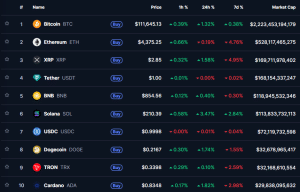

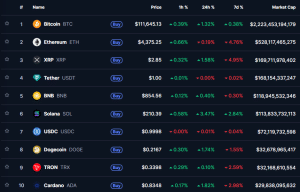

BTC’s outperformance of ETH was not limited to just US ETF flows, the crypto king also saw its price rise more than ETH’s in the last 24 hours, when BTC jumped over 1% and Ethereum saw its price drop a fraction of a percentage.

On the longer-term 7-day time frame, BTC is also up, while ETH has dropped more than 7% in the last week, according to data from CoinMarketCap.

Top ten cryptos by market cap (Source: CoinMarketCap)

Crypto Funds Rebound

The renewed inflows for spot Bitcoin ETFs follows the rebound crypto investment products saw last week. After $1.4 billion flows out of digital asset investment products between Aug. 18 and Aug. 22, inflows resumed last week with $2.48 billion being pumped into crypto products.

Year-to-date, inflows into the products stand at $35.5 billion. This is a 58% increase compared to the same period in 2024.

Whales Are Starting To Bet Against ETH

Formal institutional investors are not alone in their apparent exit out of ETH. According to on-chain analytics platform Lookonchain, several large investors known as whales have been betting against the leading altcoin as well.

In an X post earlier today, Lookonchain said “some whales have started selling $ETH to take profits.”

Some whales have started selling $ETH to take profits.

Whale 0x3e38 deposited 7,500 $ETH($32.33M) into #Binance an hour ago.

From July 20 to Aug 12, he withdrew 15,202 $ETH($58.8M) from #Binance at $3,869 avg.

He still holds 7,702 $ETH($33M), with a total profit of $6.7M.… pic.twitter.com/VAkhvzIPKv

— Lookonchain (@lookonchain) September 3, 2025

Whale “0x3e38” deposited 7,500 ETH worth $32.33 million to Binance in recent hours, Lookonchain wrote.

That’s after the same whale withdrew 15,202 ETH from Binance between July 20 and Aug. 12, when the investor purchased ETH at an average price of $3,869. The whale still holds 7,702 ETH worth $33 million, with a total profit of $6.7 million.

In an earlier X post, Lookonchain said that another whale opened a $3.25 million short on ETH with 25X leverage.

Related Articles:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage