Join Our Telegram channel to stay up to date on breaking news coverage

The Bitcoin price rose over 1% in the past 24 hours to trade at $115,025 as of 3:49 a.m. EST, as over half a billion dollars returned to spot BTC exchange-traded funds (ETFs) amid growing interest rate cut optimism.

Spot Bitcoin ETFs in the US recorded a total daily net inflow of $552.7 million, according to Coinglass, as institutional investors turn to BTC in a renewed wave of confidence.

BlackRock’s IBIT led what is the fourth day of consecutive positive flows with $36.2 million, followed by $134.7 million into Fidelity’s FBTC.

Meanwhile, investors are now watching the Federal Open Market Committee Meeting (FOMC) on Sept. 16, with growing optimism of an interest rate cut.

𝗝𝗨𝗦𝗧 𝗜𝗡: US CPI comes in at 2.9%, as expected.

Rate cuts are confirmed! pic.twitter.com/iiEVtDi5AK

— Lark Davis (@TheCryptoLark) September 11, 2025

CME’s FedWatch tool shows a 92.7% odds of a 25 basis point rate cut, while chances of a half-point rate cut hovers around 7.3%.

The optimism comes as the US Consumer Price Index (CPI) data landed on target, rising 2.9% year-on-year in August, while core CPI advanced 0.4% from July.

With the cooler US inflation data, BTC briefly touched a 19-day high of $116,300 before retracing to the current price, showing that sellers remain active at this key resistance.

Bitcoin Price Poised For Wave 5 Rally

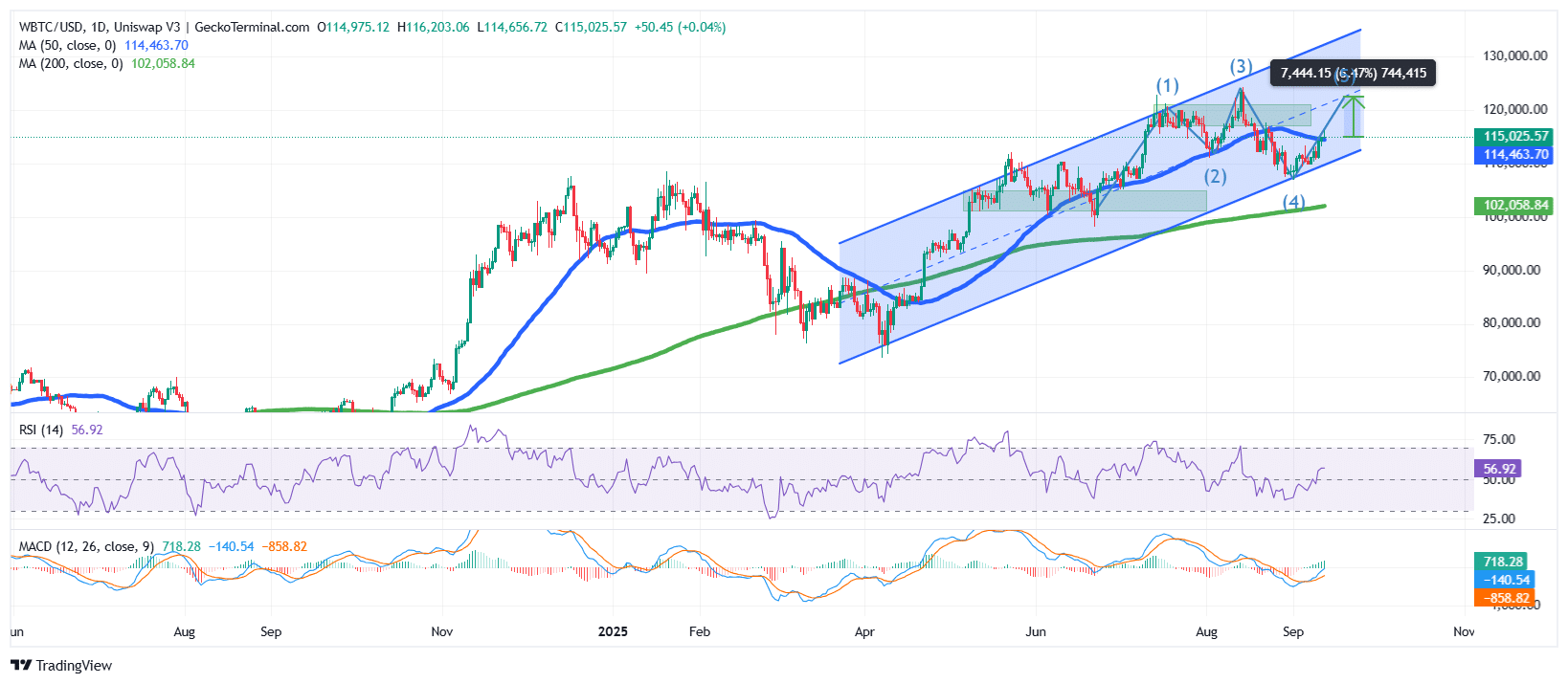

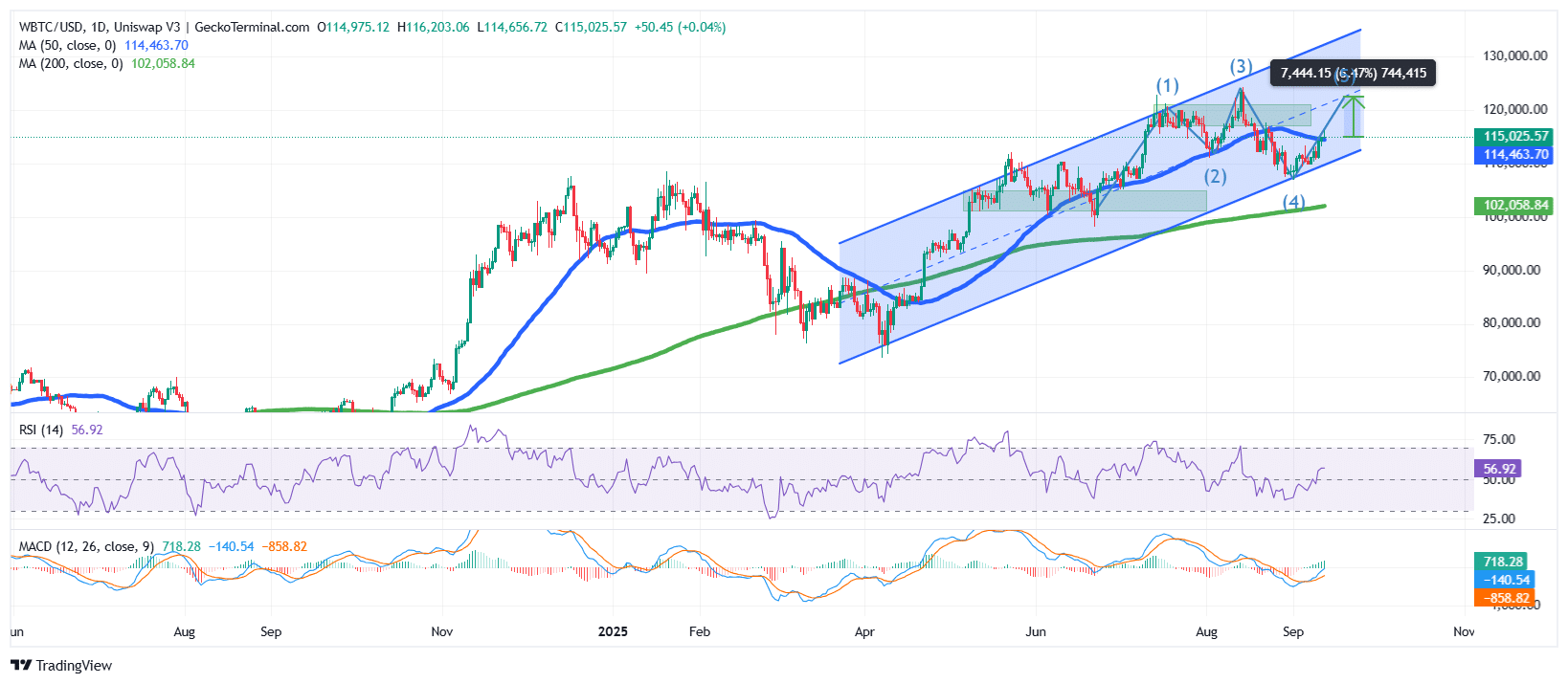

The BTC/USD analysis on the daily timeframe shows a strong bullish structure within a well-defined rising channel pattern.

The BTC price is moving higher after bouncing off the lower boundary of the channel, which coincided with the 200-day Simple Moving Average (SMA).

The market also appears to be following an Elliott Wave sequence, with waves (1), (2), (3), and (4) already completed, and wave (5) potentially in progress. This suggests that the market may be entering its final impulsive leg to the upside, which typically completes the cycle before a deeper correction.

Bitcoin’s price has also reclaimed the 50-day SMA as support, a bullish sign that confirms short-term strength within the larger uptrend.

WBTC/USD chart analysis (Source: TradingView)

Momentum Indicators Align For Continued Upside

The Relative Strength Index (RSI) is currently at 56.92, which sits in neutral territory but leans slightly bullish. This indicates that momentum is favoring buyers, but the market is not yet overbought, which may give the price space to soar even higher.

Moreover, the Moving Average Convergence Divergence (MACD) also shows signs of strengthening momentum.

The histogram has flipped back into positive territory, while the blue MACD line is crossing above the orange signal line, which is a bullish crossover.

Based on the channel structure, Elliott Wave projection, and bullish indicator alignment, the price of Bitcoin is likely in the early stages of wave (5), which should target the upper boundary of the channel.

The move places the next potential resistance zone in the $124,000 range. If bullish momentum accelerates, BTC could even soar toward $130,000.

On the downside, the $114,000–115,000 region now serves as immediate support, supported by the 50-day SMA. If this level holds, the bullish scenario remains intact.

A breakdown below the $110,000 zone would weaken the structure and potentially retest the 200-day SMA near $102,000.

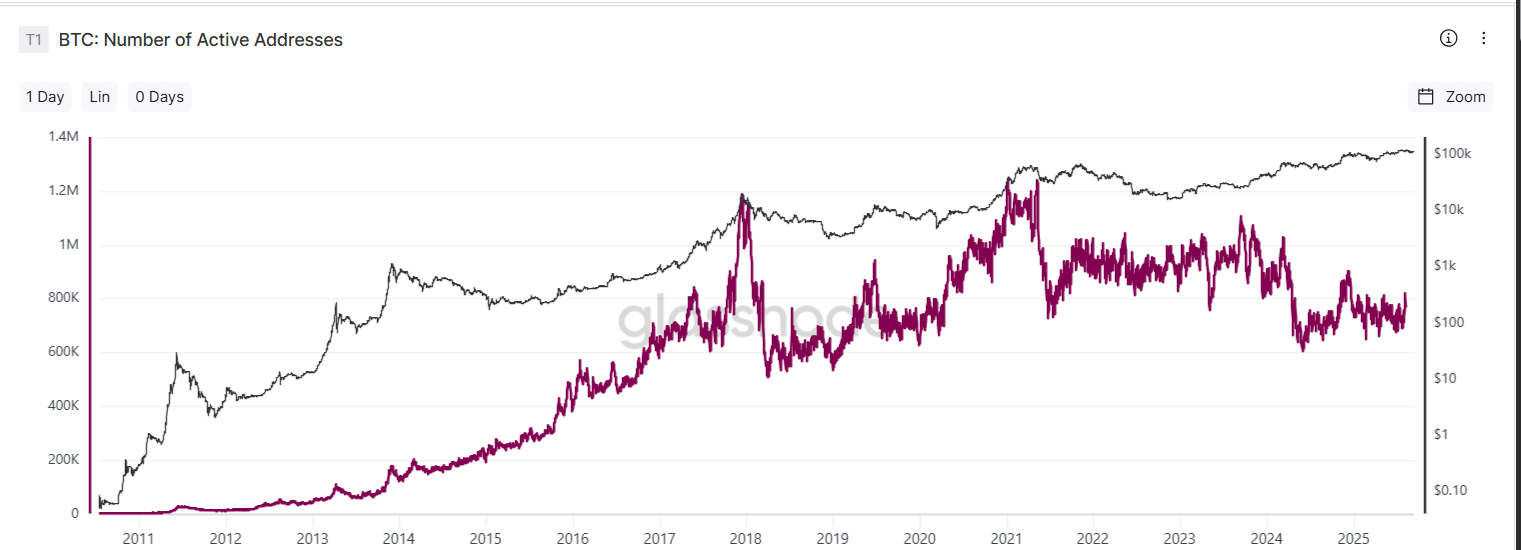

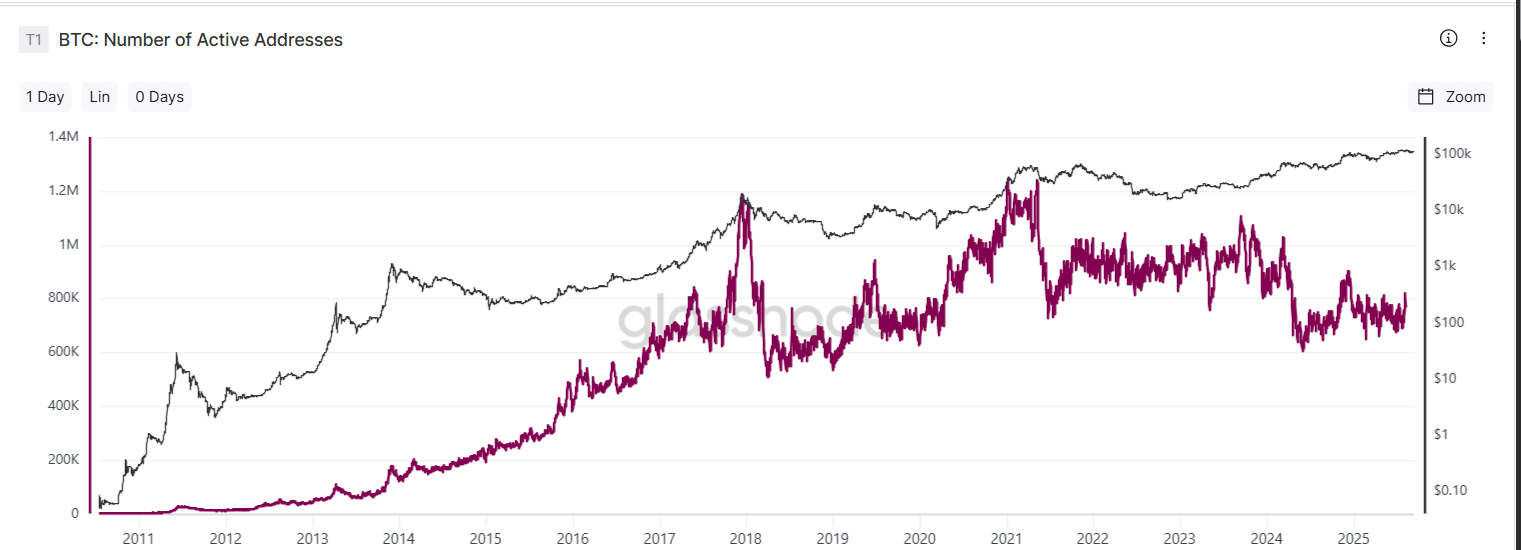

With all factors pointing to a surge in 2025, data from Glassnode shows that the number of investors adding BTC to their hoard continues to grow.

Meanwhile, X user Ted Pillows believes that if BTC reclaims the $117,000 level, it’ll be heading towards a new ATH.

$BTC has fully reclaimed the $113,500 level.

$117,200 is the next important level for Bitcoin and it also has a CME gap.

If BTC fully reclaims this level, the doors towards the new ATH will open.

In case of a rejection, BTC could revisit monthly lows. pic.twitter.com/DSFgDFNsEg

— Ted (@TedPillows) September 12, 2025

Furthermore, $4.3 billion of Bitcoin monthly options expire today, favoring neutral-to-bullish bets.

Related News:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage