Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin slid toward $115K as $500 million in liquidations shook the crypto market, Dogecoin tumbled on the Qubic community’s planned attack, and Pump.fun topped losers.

After touching new all-time highs last week, BTC dropped to $115,297 at 4:47 a.m. EST after tumbling 2.3% in the last 24 hours.

Meanwhile the Dogecoin price slid 5% despite being up 10% in the last two weeks after the Qubic community voted to target it in their next 51% attack.

The broader crypto market capitalization fell 3.4% to $3.96 trillion, signaling a sharp decline across major assets.

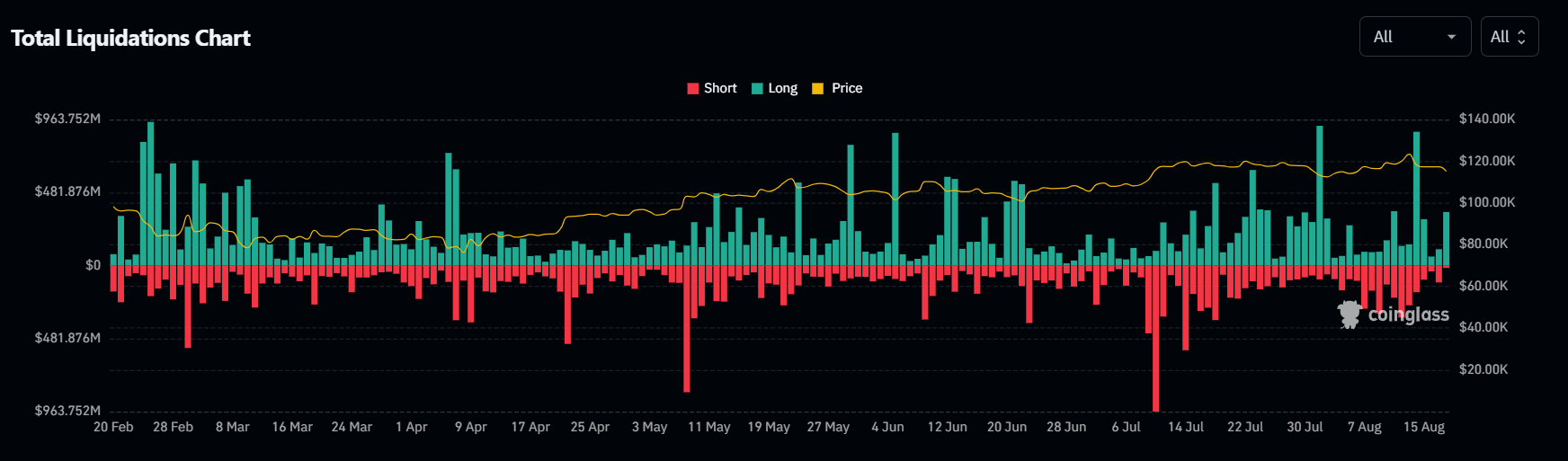

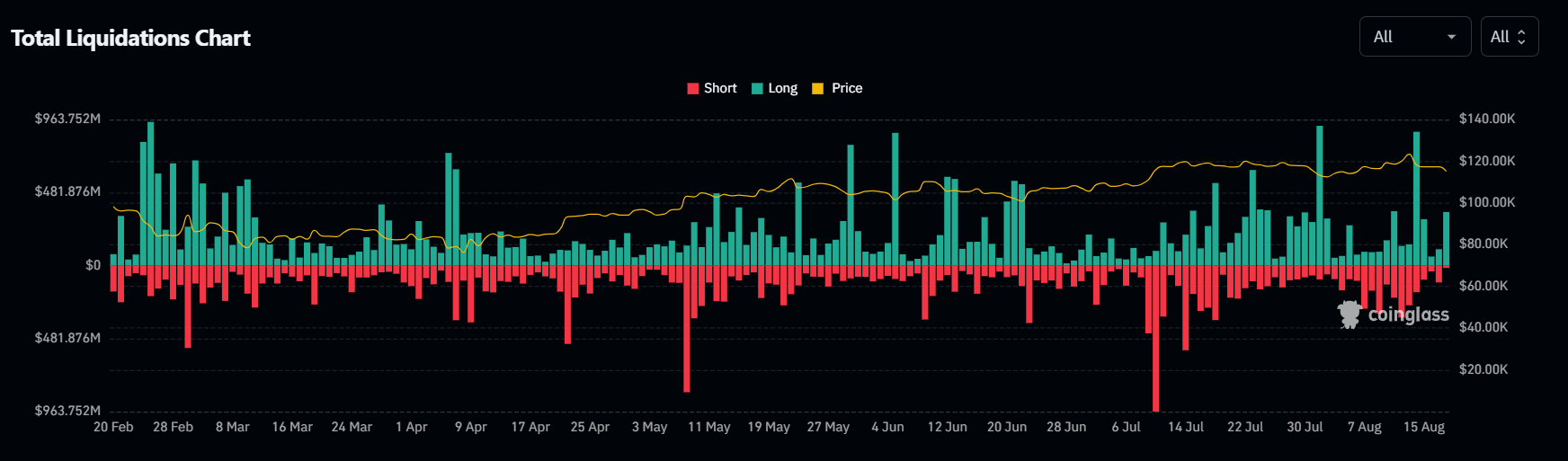

CoinGlass data shows over $535.95 million was liquidated in the last 24 hours.

Bitcoin Price Slides Toward $115K As Crypto Market Cap Sheds $140 Billion

Bitcoin dropped over 5% on the weekly timeframe and is likely to test key support at $115,000. BTC and major altcoins had a troubled time after hotter-than-expected US PPI data reignited macro concerns last week.

After hitting an all-time high above $123K, Bitcoin has faced persistent selling pressure that dragged the price below $120,000.

BTC’s current pullback reflects a healthy consolidation after recent highs, which could allow the market to reset without breaking its bullish structure.

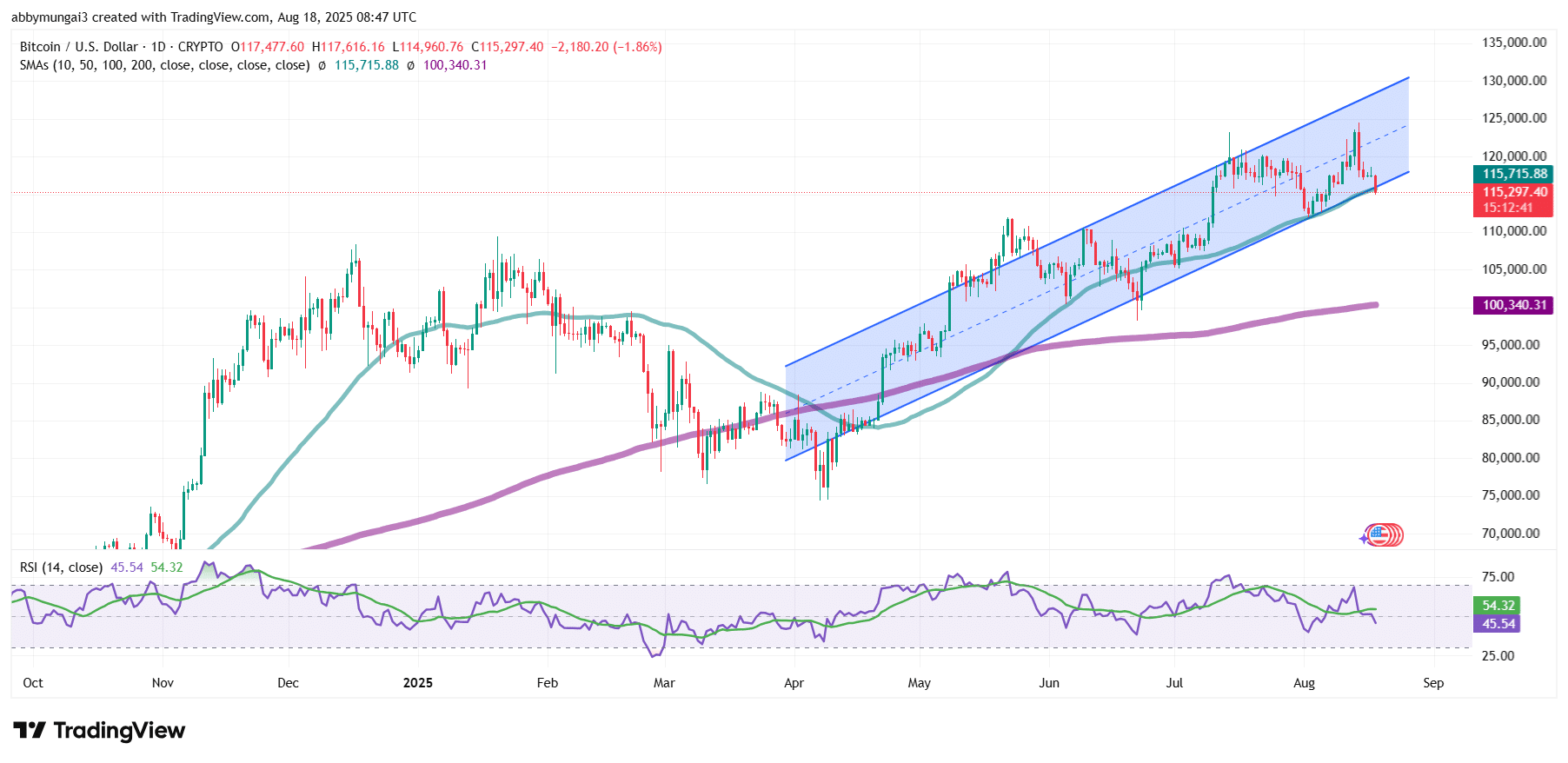

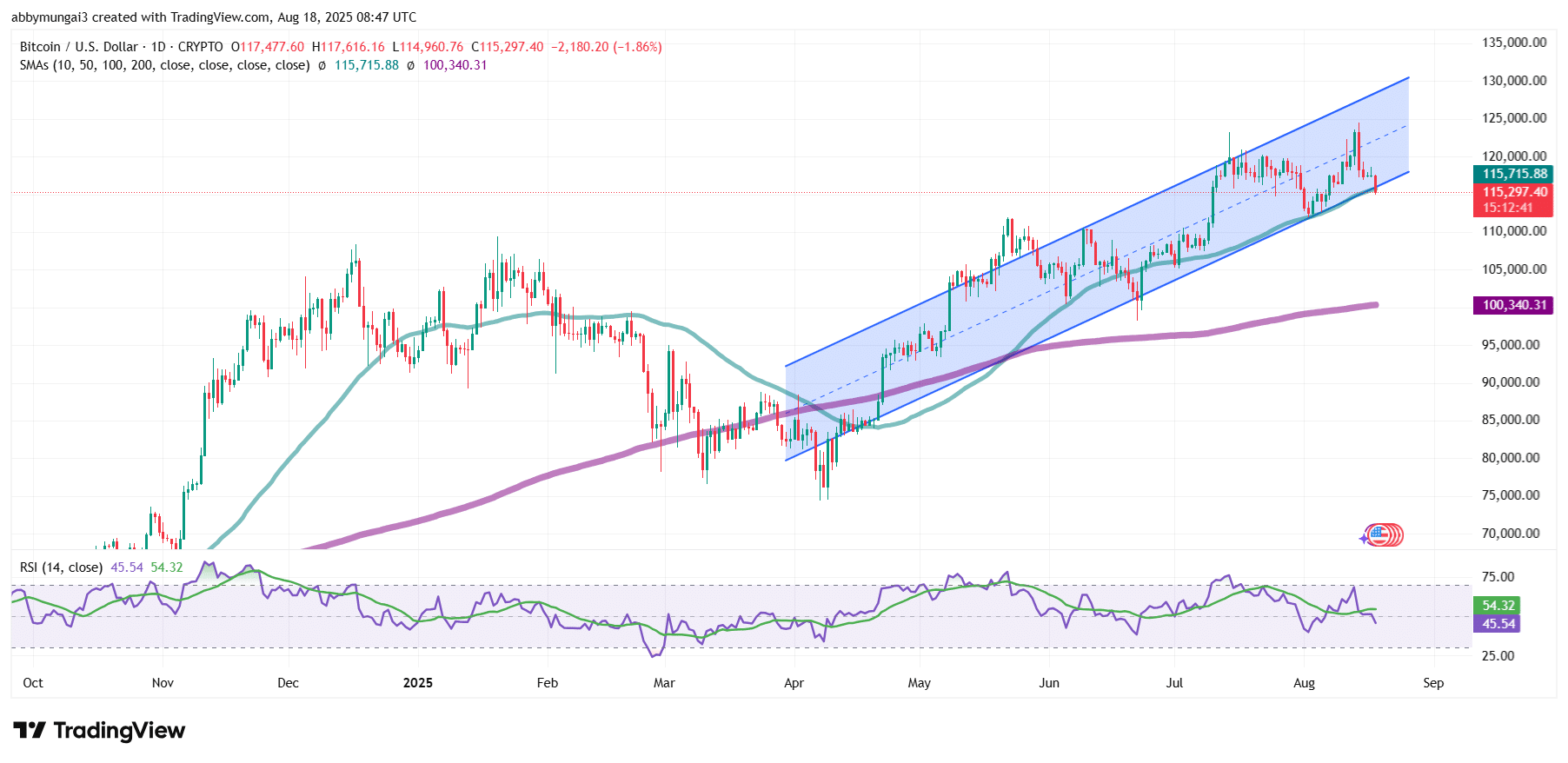

According to the BTC/USD chart analysis on the daily timeframe, the Bitcoin price has dropped below the rising channel pattern.

The last candle has also dropped below the 50-day Simple Moving Average (SMA), which cements the current market outlook.

Meanwhile, the Relative Strength Index (RSI) has dropped below the 50-midline level, supporting the sentiment that sellers are in control of the price.

As the Bitcoin price dropped, the crypto’s market capitalization also took a plunge, shedding over $140 billion in the last day from above $4 trillion.

The meme coin space also took a massive 4% hit take its market down to $73 billion.

Pump.Fun (PUMP) was the biggest loser among major cryptos in the last day with a 9.8% drop, followed by Mantle (MNT), Aerodrome Finance (AERO), and Hyperliquid (HYPE), recording 9.04%, 9.01%, and 7.92% drops, respectively, according to CoinMarketCap data.

The top performers among the largest cryptos were Monero (XMR), Chainlink (LINK), and POL (POL), posting 4.9%, 2%, and 1.7% gains, respectively.

As a result of the broader market drop, over 125,632 traders were liquidated, according to CoinGlass data, with the largest single liquidation of $4.03 million happening on the Binance exchange.

Institutions Buy Bitcoin As Sentiment Remains Unclear

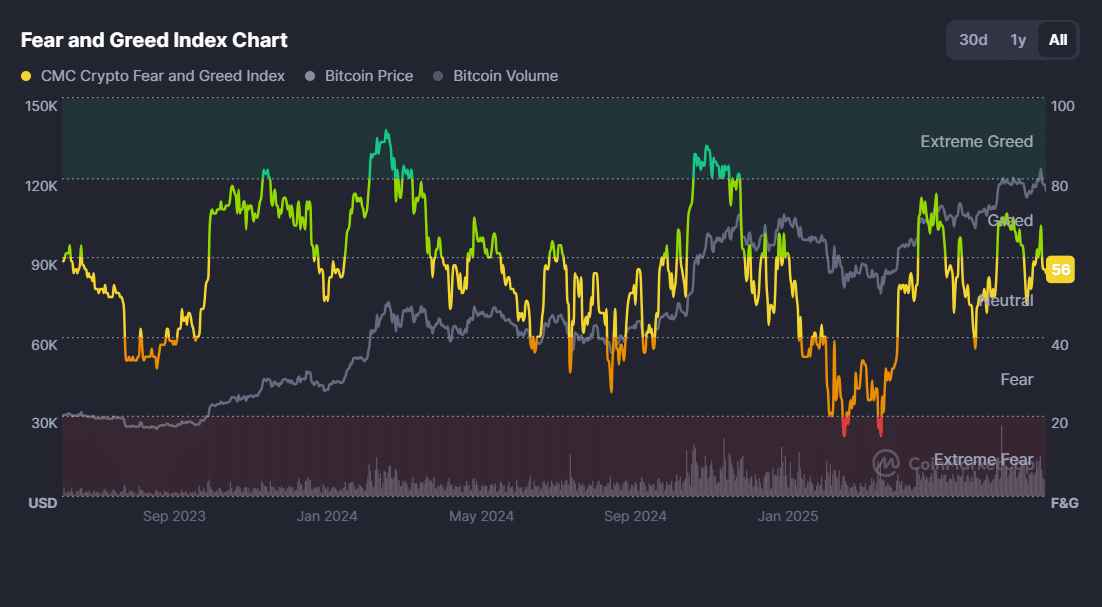

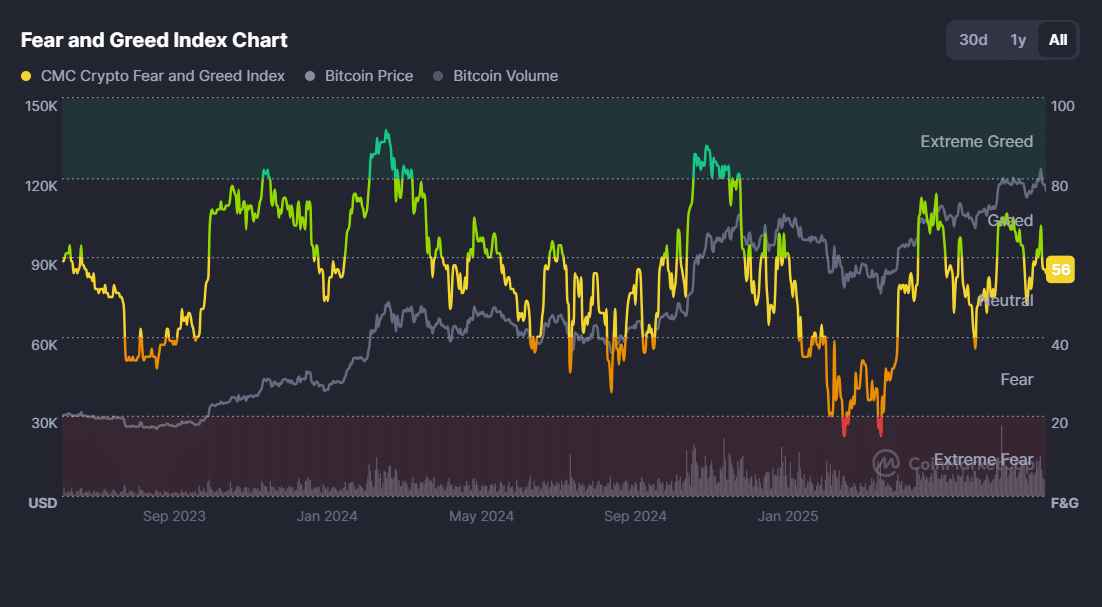

CMC’s Crypto Fear and Greed Index stands at a neutral level of 56, showing that the market’s direction remains unclear.

However, some institutions are still buying the dip to grab more Bitcoin. Metaplanet bought another 775 BTC for $93 million at an average price of $120,006 each, according to Metaplanet CEO Simon Gerovich.

Metaplanet has acquired 775 BTC for ~$93 million at ~$120,006 per bitcoin and has achieved BTC Yield of 480.2% YTD 2025. As of 8/18/2025, we hold 18,888 $BTC acquired for ~$1.94 billion at ~$102,653 per bitcoin. $MTPLF pic.twitter.com/9r1law8jyH

— Simon Gerovich (@gerovich) August 18, 2025

Metaplanet now has a total of 18,888 BTC in its hoard, bought for $1.94 billion.

Meanwhile, Strategy’s Michael Saylor has hinted at another BTC buy, after posting the company’s portfolio tracker on an X post with the caption, “Insufficient Orange,” likely indicating a plan to buy yet more BTC to add to its 628,946 Bitcoin hoard.

Moreover, new addresses holding BTC have increased from around 288,449 on June 23 to around 325,172 on August 18, according to Glassnode data.

According to crypto analyst Rekt Capital, with more than 557k followers on X, BTC could be on the move toward a price discovery, but it would need to hold the $114,000 support zone successfully.

Bitcoin could be on the cusp of Price Discovery Correction 2

But it would need to convincingly lose $114k first

And seeing as the final pullbacks in the cycle have been shorter & shallower…

It’s key this one becomes shorter & shallower as well$BTC #Crypto #Bitcoin https://t.co/ONprKhpUvs pic.twitter.com/dyG9ti1CcA

— Rekt Capital (@rektcapital) August 18, 2025

Qubic Community Votes To Target Dogecoin

Meanwhile, meme coin Dogecoin (DOGE) is under pressure following a vote by the Qubic community to target it in their next 51% attack.

Qubic, an AI-centric proof-of-work blockchain, recently took control of the Monero network by reorganizing six blocks through its mining pool. Following that, Qubic founder Sergey Ivancheglo asked users to vote on their next target.

Following this, Qubic’s founder, Sergey Ivancheglo, known as Come-from-Beyond, initiated a community vote to select the next ASIC-enabled proof-of-work blockchain to target.

Options included Dogecoin (DOGE), Kaspa (KAS), and Zcash (ZEC). On August 17, 2025, Ivancheglo announced that Dogecoin, with a $35 billion market capitalization, received over 300 votes, surpassing other contenders, making it the community’s chosen target next in line.

The #Qubic community has chosen #Dogecoin. pic.twitter.com/EnevIZUAw5

— Come-from-Beyond (@c___f___b) August 17, 2025

Qubic network’s latest vote signals growing risks for major proof-of-work chains.

After gaining majority control over the computing power used to secure the Monero network on Monday, Qubic’s mining pool successfully reorganized six blocks following a month-long war with other Monero miners for control of the network’s hashrate.

“The Monero network’s core functionality remains intact,” the Qubic team wrote following the takeover. “Its privacy, speed, and usability have not been compromised.”

However, many in the crypto space have already raised concerns over potential risk in network integrity.

Related News:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage