Join Our Telegram channel to stay up to date on breaking news coverage

Cardano, XRP, and Dogecoin led a sell-off in the crypto market, which dropped more than 1% in the last 24 hours as the Crypto Fear Index slumped into ”Fear” territory.

ADA fell 8.25% as of 4:11 a.m. EST, followed by POL (7%) Sei (5%), and XRP (4.4%). Dogecoin slipped over 2%, despite news that Trump family-backed crypto firm Thumzup Media plans to acquire mining company Dogehash.

Meanwhile, the Bitcoin price tumbled over 1.5% to trade at $113,499 ahead of a potentially pivotal speech by Fed Chair Jerome Powell at the Jackson Hole Summit on Friday. Investors will watch closely for signals on whether the Fed is preparing to cut rates in September or remain focused on taming inflation.

In 2022, a hawkish Fed speech that reaffirmed the tightening of monetary policy led to a 10% weekly drop in the Bitcoin price.

📌 This Week’s Key Market Events

🔹 FOMC Minutes + Fed Speakers (Wed, Aug 20)

Insight into Fed’s discussions & policy shifts.

Hawkish = crypto weakness 🟥

Dovish = crypto rally 🟩🔹 Powell’s Speech @ Jackson Hole (Thu, Aug 21)

Markets price in ~84–85% chance of Sept. rate cut… pic.twitter.com/RdALXa4Axc— BitOpex.io (@BitopexIO) August 19, 2025

There will also be other weighty news, with the Fed due to release minutes from the FOMC meeting held July 29-30 today, August 20. That will shed more light on opinion within the Fed on whether rates should be cut or not.

Crypto Fear Index Sinks As Powell’s Jackson Hole Speech Looms

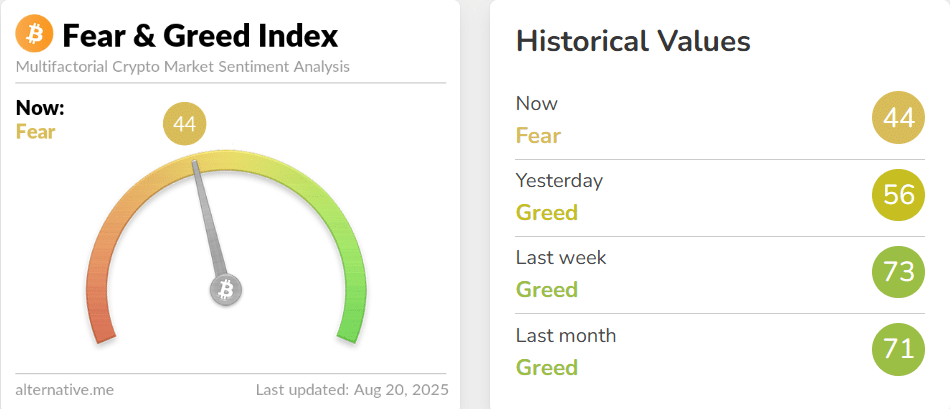

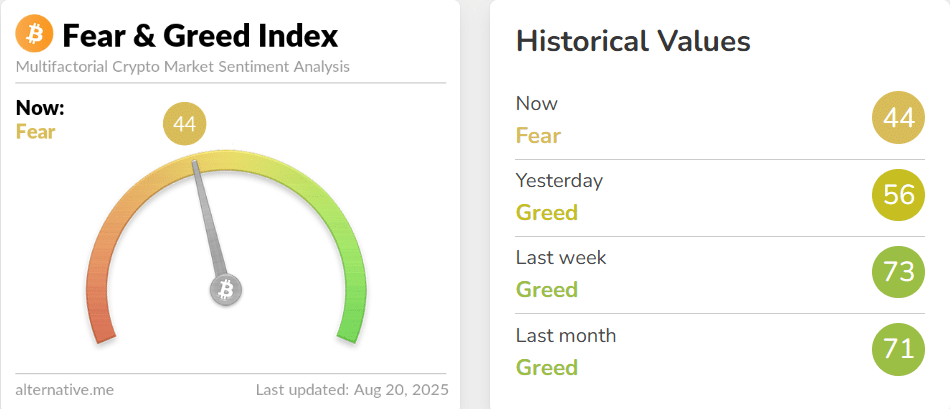

Meanwhile, the Crypto Fear and Greed Index has dropped to 44, from yesterday’s 56, with sentiment turning to ”Fear.”

The falling market led to 120,855 trader liquidations totaling $441.49 million in the last 24 hours, with the largest single order of $9.70 million on Binance, according to Coinglass.

Pump.fun Leads Gainers With 7% Surge

Pump.fun (PUMP) led gainers with a 7% surge, followed by Mantle (MNT) with 6%, Aerodrome Finance (AERO) 5%, and Morpho (MORPHO) 4.8%, according to CoinMarketCap.

📌 This Week’s Key Market Events

🔹 FOMC Minutes + Fed Speakers (Wed, Aug 20)

Insight into Fed’s discussions & policy shifts.

Hawkish = crypto weakness 🟥

Dovish = crypto rally 🟩🔹 Powell’s Speech @ Jackson Hole (Thu, Aug 21)

Markets price in ~84–85% chance of Sept. rate cut… pic.twitter.com/RdALXa4Axc— BitOpex.io (@BitopexIO) August 19, 2025

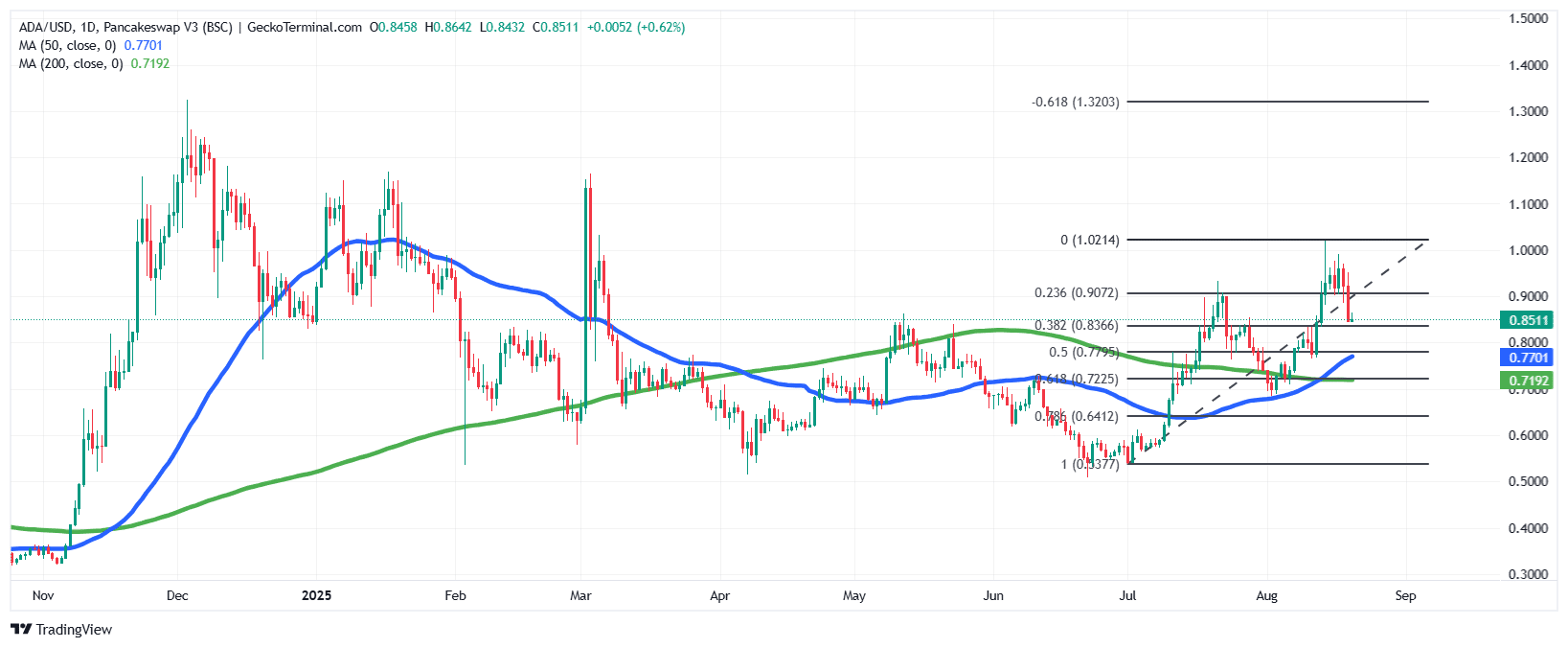

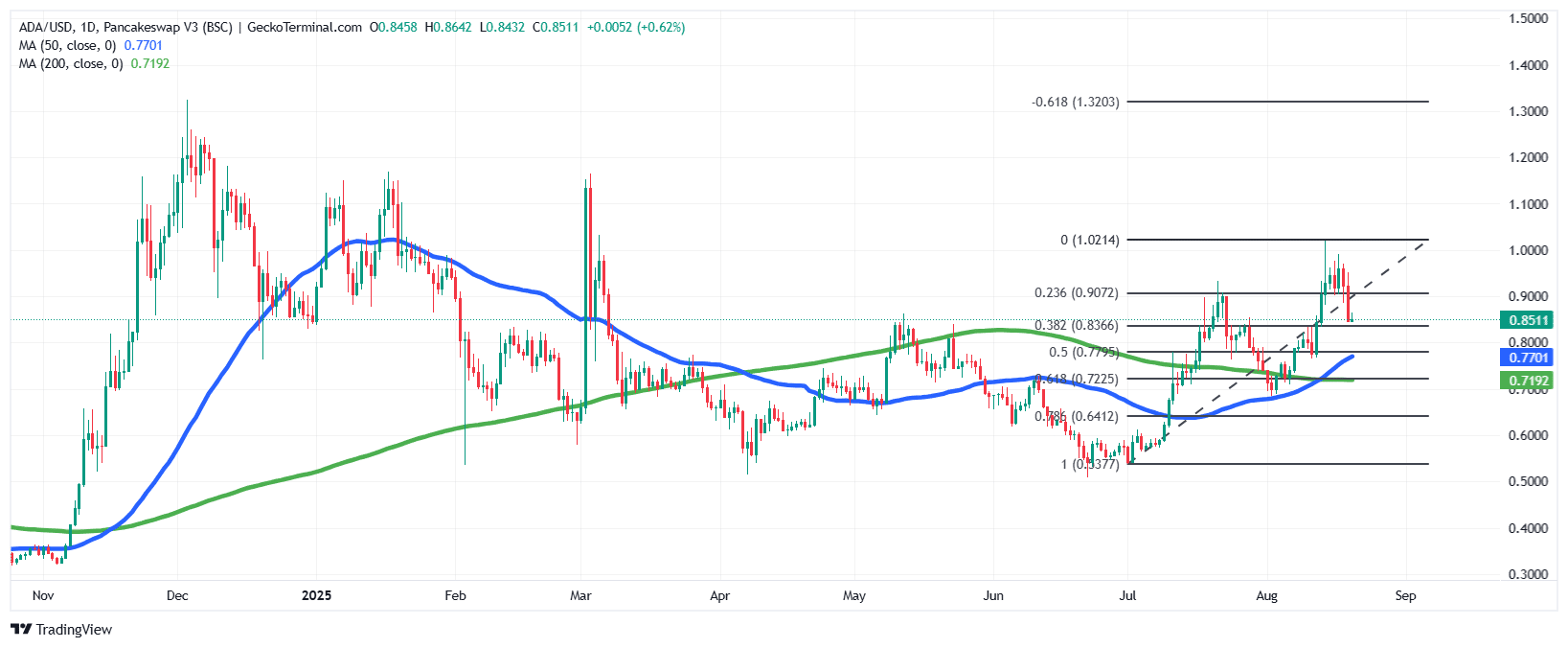

Cardano And Bitcoin Testing Key Support Levels

Cardano recently rejected the $1.02 Fibonacci resistance. Support now lies around $0.83 (Fib 0.382) and $0.77 (50-day SMA), which will be key levels to hold for continuation.

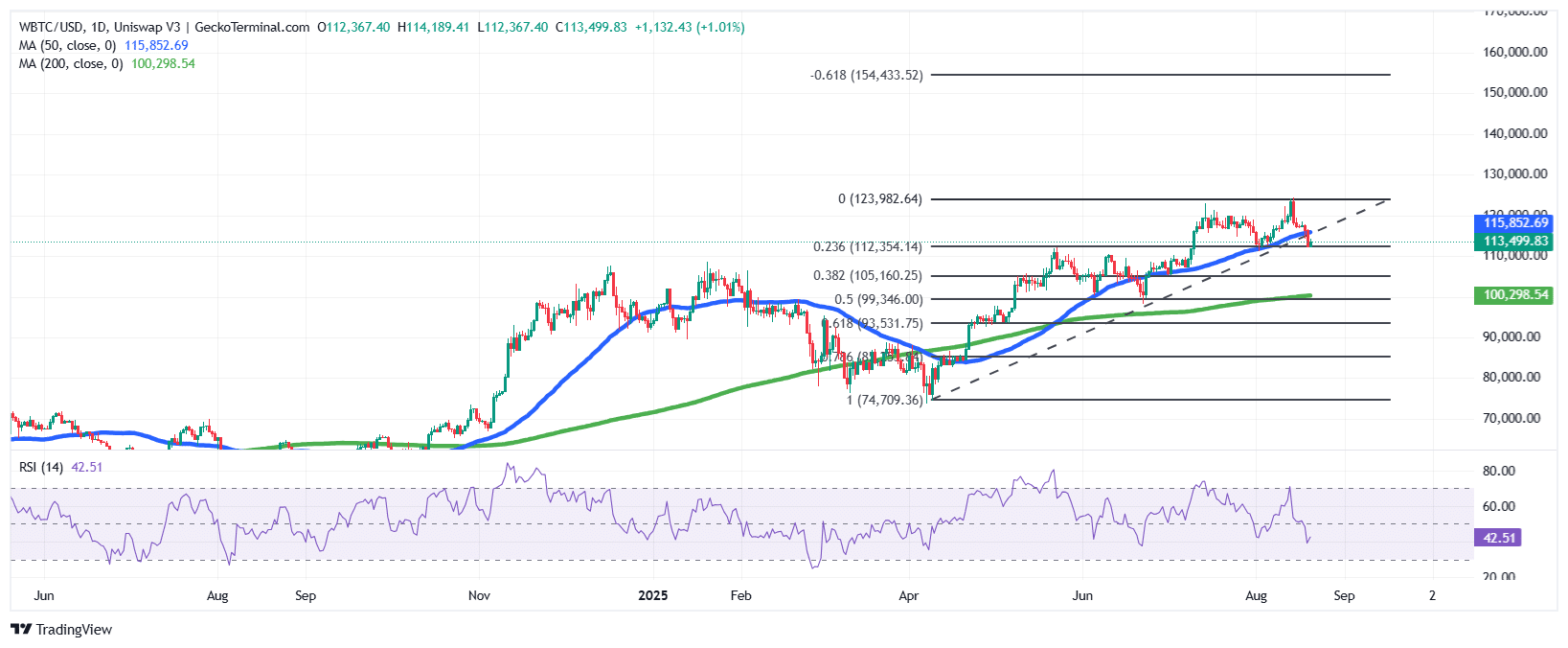

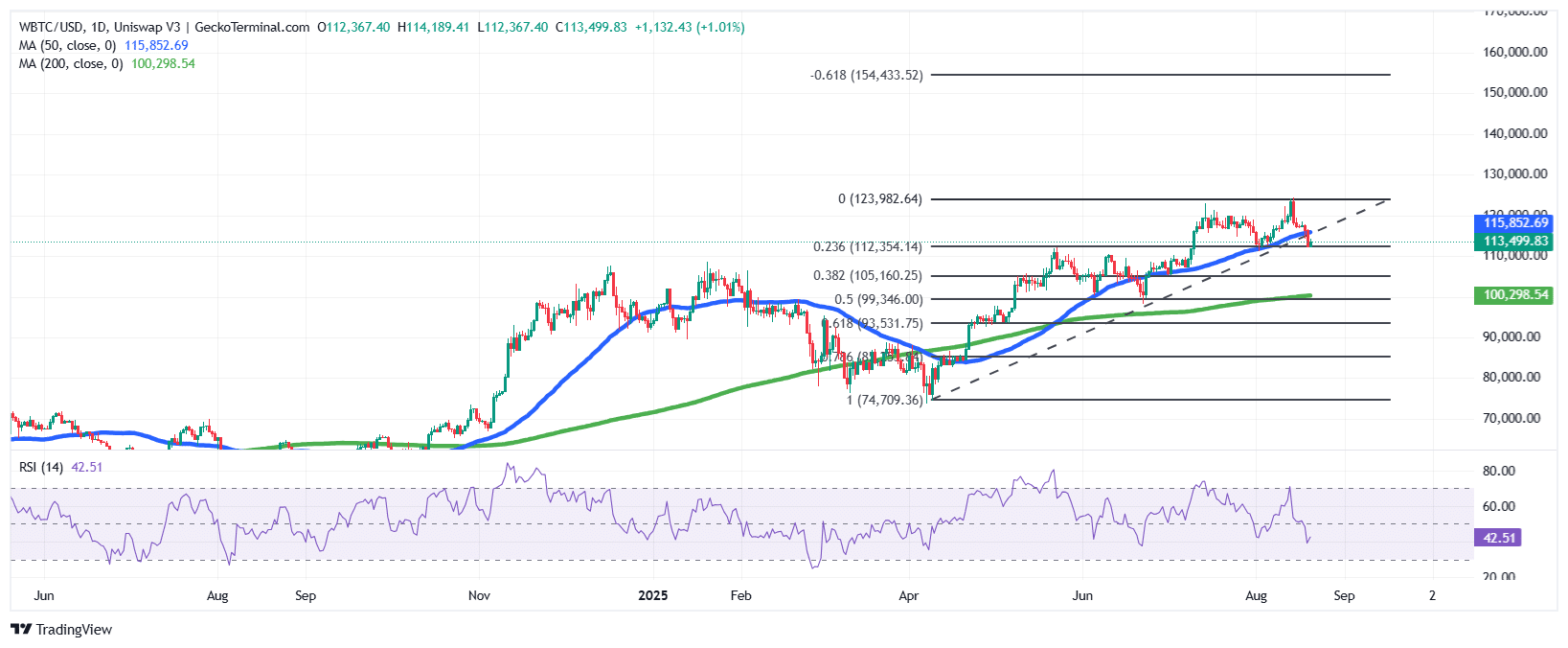

The price of BTC has recently pulled back from its local high above $124,000, retracing toward the $113,000 zone.

The 1-day chart shows that it is still respecting the broader uptrend structure, but the correction is testing the short-term ascending trendline and sitting just below the 50-day Simple Moving Average (SMA) around $115,800.

Meanwhile, the 200-day SMA at $100,300 remains far below as a strong longer-term support, keeping the overall trend bullish despite the current pullback.

The Relative Strength Index (RSI) is at 42, suggesting that momentum has cooled and the market is nearing oversold territory.

Fibonacci retracement levels highlight $112,300 as a necessary 0.236 support, with deeper levels at $105,000 and $99,300 if selling pressure continues.

If buyers defend the current zone, Bitcoin could rebound toward $120,000 and retest resistance near $124,000.

However, a sustained breakdown below $112,000 may open the way for a decline toward $105,000, aligning with the 0.382 Fibonacci support.

Overall, the medium-term trend remains bullish, but near-term price action is corrective and dependent on holding key support levels.

SkyBridge’s Anthony Scaramucci maintains a $180K – $200K Bitcoin price target by year-end. Scaramucci says institutions are piling in while whales reshuffle with demand now crushing supply.

WATCH: SKYBRIDGE CAPITAL FOUNDER ANTHONY SCARAMUCCI SAYS “WE STILL MAINTAIN OUR PRICE TARGET BETWEEN $180K AND $200K BY YEAR END.” pic.twitter.com/9T6zhtEspQ

— The Wolf Of All Streets (@scottmelker) August 19, 2025

Scaramucci’s prediction is also supported by Bernstein analysts, who say that the crypto bull market could run through 2027, with BTC reaching $150k to $300k, with altcoins like ETH and SOL driving the next phase.

However, Japan’s 10-year bond yield has risen above 1.61% to the highest level since 2008, may signal tightening global liquidity, which could pressure risk assets like Bitcoin and reduce cryptocurrency demand.

Dogecoin Slides Despite Trump-Backed Acquisition Deal

Dogecoin dropped despite a Trump-backed cryptocurrency treasury firm, Thumzup Media, planning to acquire Dogehash Technologies, a North American Dogecoin mining company.

Dogehash shareholders will exchange their shares for 30.7 million Thumzup shares in an all-stock deal. Once completed, the merged entity will operate as Dogehash Technologies Holdings Inc. and list on Nasdaq under the ticker XDOG.

Trump junior backed Thumzup Media Corporation has expanded into a utility-scale #Dogecoin mining operation.

Being a direct producer of $Doge. pic.twitter.com/uVFDflsz57

— dogegod (@_dogegod_) August 19, 2025

The partnership is focused on creating one of the world’s largest Dogecoin mining operations. According to the company, the acquisition could be a doorway towards using Dogecoin’s speed and low transaction costs to make the asset more widely accessible.

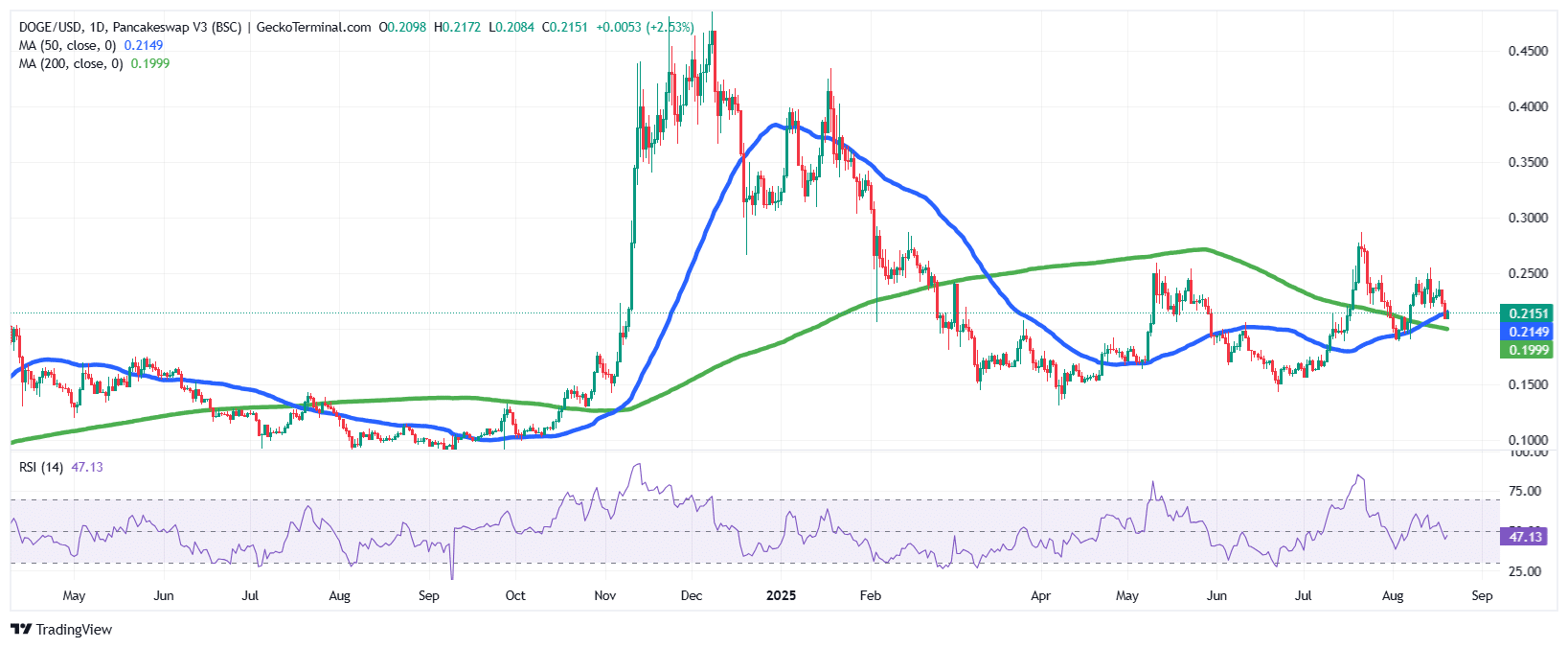

Meanwhile, DOGE is currently trading just above both the 50-day and 200-day SMAs, suggesting a neutral-to-slightly bullish trend as long as it holds the $0.20 support zone.

Related News:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage