Join Our Telegram channel to stay up to date on breaking news coverage

Cronos soared 39% in the last 24 hours to trade at $0.223 as of 4:24 a.m. EST after Trump Media and Crypto.com unveiled a $6.4 billion CRO Treasury plan, while ETH jumped 4% as Standard Chartered said it’s still cheap.

Other top gainers include Hyperliquid (HYPE) with an almost 10% pump, Story (8.7%), and Solana with close to a 7% gain. The crypto market overall climbed 1.5% to a market capitalization of $3.92 trillion. ETH recovered to surge over 4% to trade at $4,571.

The top losers among major cryptos were Pendle (PENDLE) with a 3% tumble, Arbitrum (2.3%), and XDC Network (2.2%).

Cronos Token Soars After Trump Media Plan To Unveil CRO Treasury

Trump Media and Technology Group (TMTG), Crypto.com and Yorkville Acquisition Corp. announced a plan to form Trump Media Group CRO Strategy Inc., a digital asset treasury that is set to acquire $6.42 billion worth of CRO.

After the CRO treasury is established, it’ll become the largest public CRO treasury to date. The company will also operate its own Cronos validator, allowing it to generate staking rewards and compound its holdings over time.

According to Kris Marszalek, CEO of Crypto.com, “CRO will become the PLATFORM TOKEN of Truth Social as a part of this broad, strategic partnership.”

– A historic day for $CRO. Trump Media Group CRO Strategy announced a $6.42b U.S. Dollar treasury play. See the press release for more info on the proposed Business Combination and important info about $YORK, $YORKW and $YORKU. Here’s what you need to know:

– A definitive… pic.twitter.com/kgMC1GEVHn— Kris | Crypto.com (@kris) August 26, 2025

CRO soared after the news, with investors buying into the idea that a CRO treasury positions the Cronos token as a serious contender in the race to institutionalize blockchain finance.

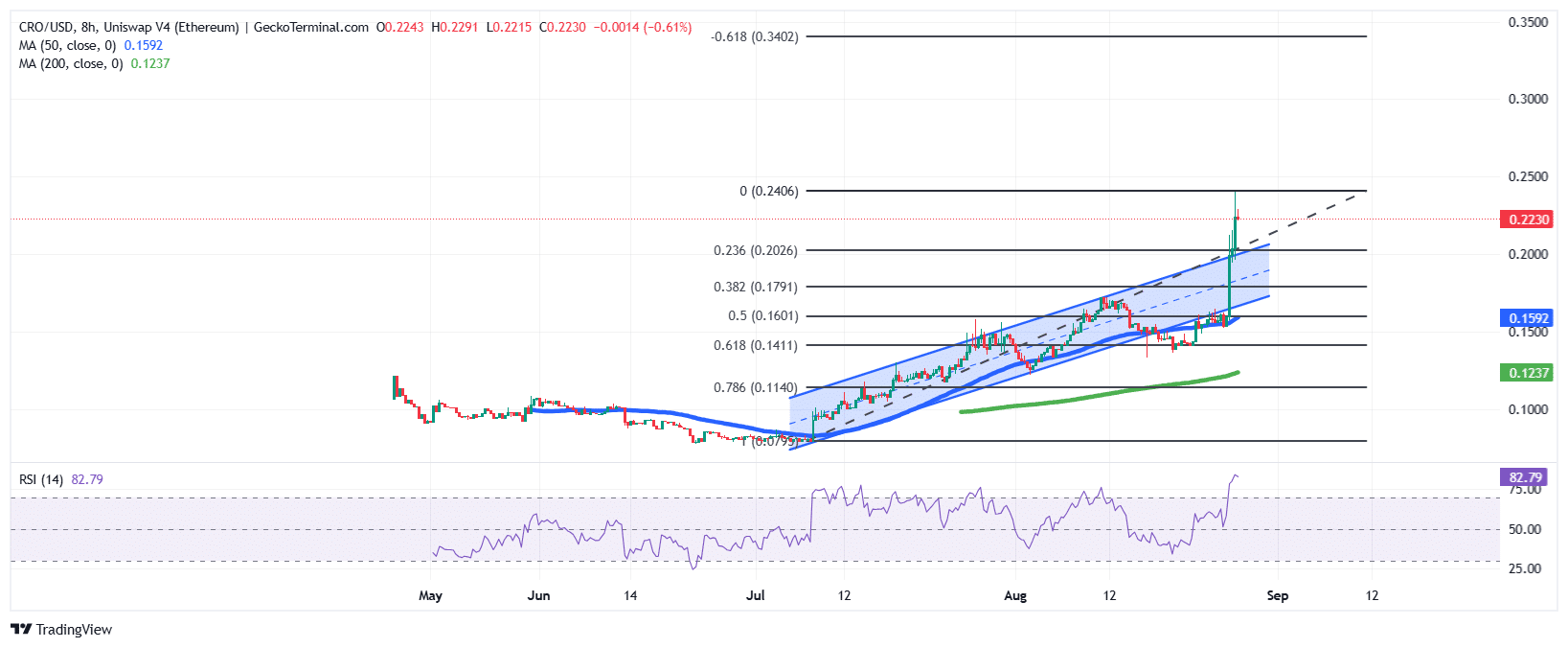

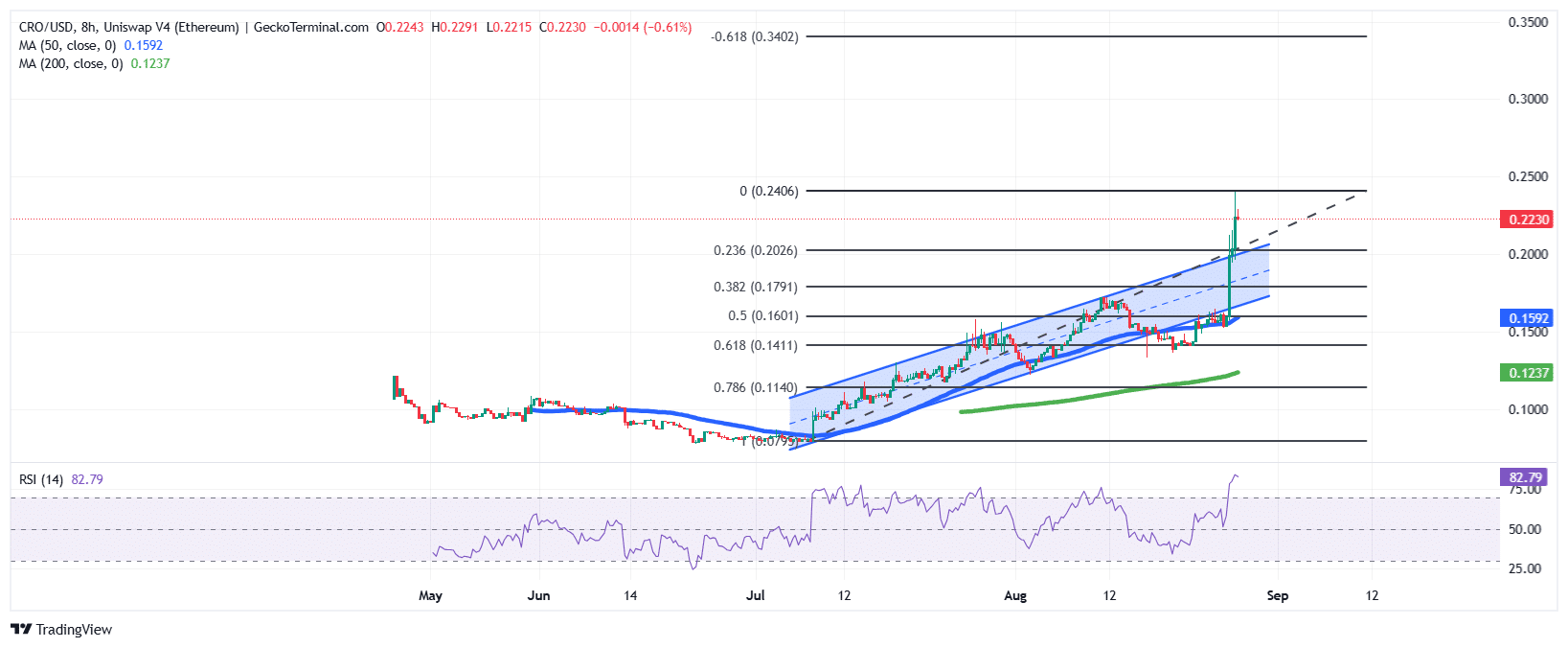

The CRO/USD chart shows a strong bullish breakout after weeks of steady upward movement within a rising channel pattern.

The Cronos price surged past the channel resistance and currently trades at $0.223, just below the $0.240 Fibonacci level.

The 50-day Simple Moving Average (SMA) at $0.159 and the 200-day SMA at $0.123 confirm a strong uptrend, with the shorter 50-day SMA well above the 200-day SMA.

Meanwhile, the Relative Strength Index (RSI) at 82.79 signals extreme overbought conditions, hinting at possible short-term pullbacks.

If momentum holds, the price of CRO could retest $0.240 and potentially extend toward $0.34 (-0.618 Fib level). However, consolidation back toward $0.202 support remains likely before the next leg higher.

According to a Pseudonymous user on X, Don, the CRO price is set for prices above the $0.38 level.

nice W pattern for $CRO

38 cents is the target pic.twitter.com/S5hGAIrLJV

— Don (@TheDonOfApes) August 27, 2025

ETH Jumps 4% As Standard Chartered Says It’s Still ”Cheap”

The Ethereum token is up 68% in the last three months, which pushed it to a new all-time high (ATH) on August 24.

Even after such a massive rally, Standard Chartered believes that the token and ETH corporate treasury firms remain undervalued.

The ETH price may soar to $7,500 at the end of this year, said head of digital assets research Geoff Kendrick, adding that treasury companies and ETFs (exchange-traded funds) have together absorbed nearly 5% of all ETH in circulation since June.

STANDARD CHARTERED’S GEOFF KENDRICK DESCRIBES ETHEREUM AND $ETH TREASURY COMPANIES AS “CHEAP” AT CURRENT LEVELS, WHILE REAFFIRMING HIS $7,500 YEAR-END PRICE TARGET. https://t.co/Ongwc9Xooh pic.twitter.com/kQCxIM7L3V

— Mario Nawfal’s Roundtable (@RoundtableSpace) August 27, 2025

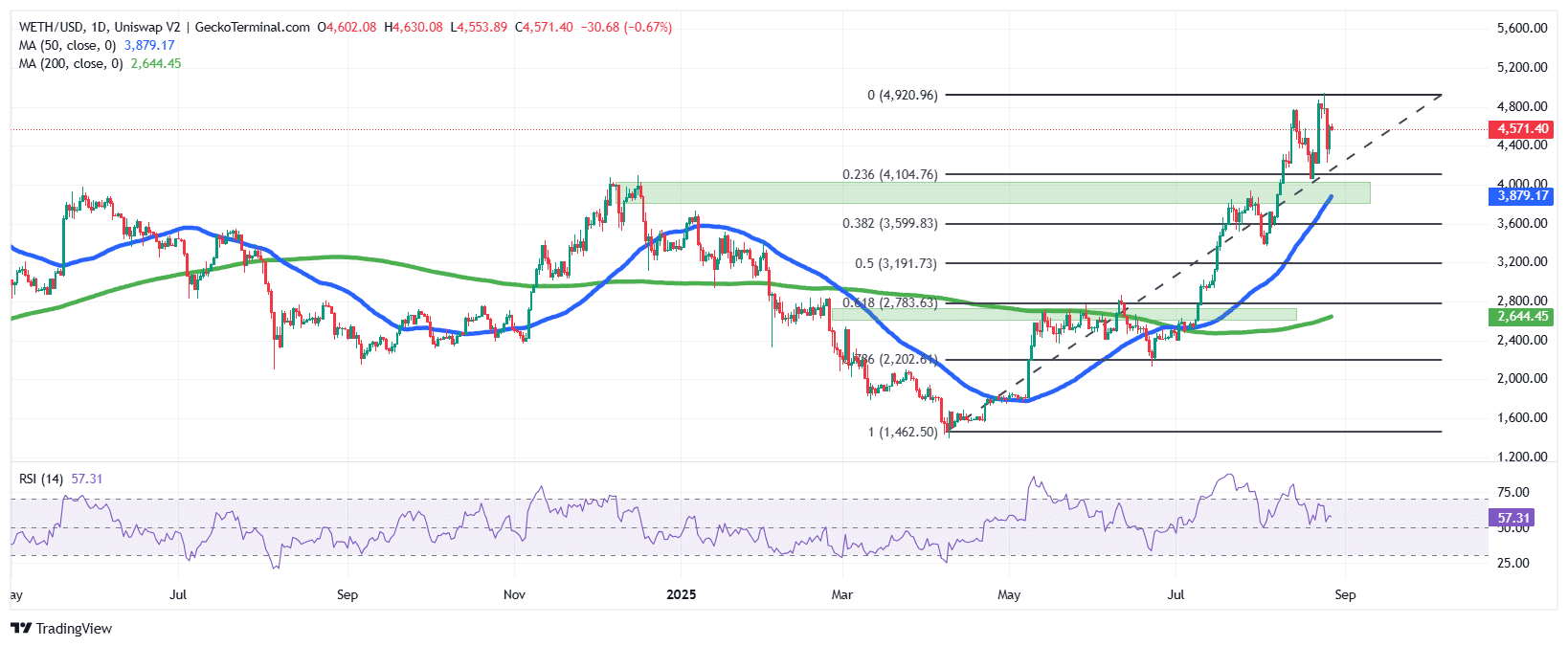

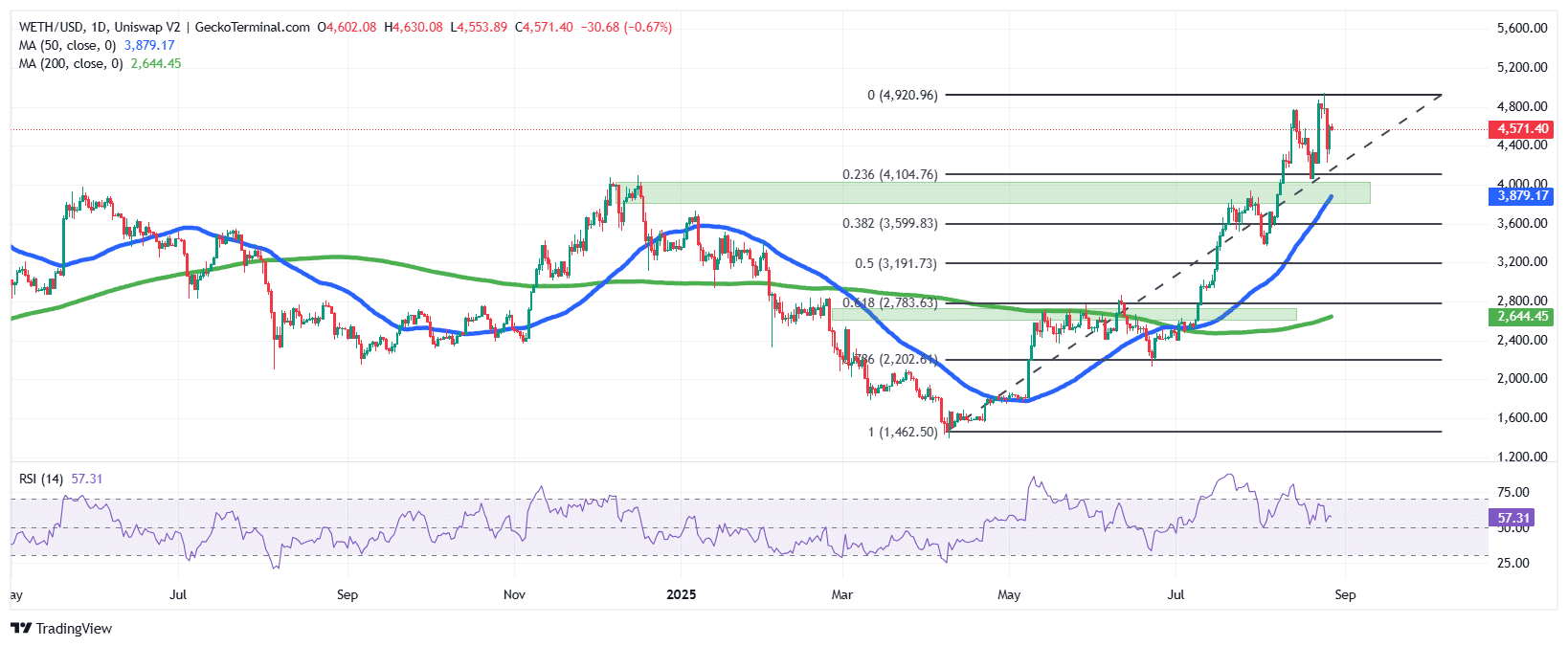

ETH has been in a strong bullish trend, climbing from its March lows and recently testing resistance near $4,920 before pulling back to around $4,571.

The Ethereum price remains above both the 50-day SMA at $3,879 and the 200-day SMA at $2,644, confirming a sustained uptrend.

Fibonacci retracement levels show key support around $4,104 and $3,599, where prior resistance has now turned into support. RSI sits at 57.31, suggesting healthy momentum without being overbought.

If bullish momentum continues, the price of Ethereum could retest $4,920 (0 Fib level) and aim for new highs, while a breakdown may revisit the $4,100–$3,900 support zone, near the 0.236 Fib level.

According to Tom Lee, ETH could hit $5,500 in a couple of weeks and $10K-$12K by the end of this year.

TOM LEE @fundstrat predicts $ETH at $5.5K in a couple of weeks… and $10-12K by year-end!

HODLERS, this one’s for you. 💎🙌 pic.twitter.com/JhKEv4wFmX

— Wise Advice (@wiseadvicesumit) August 26, 2025

Meanwhile, Sharplink Gaming has boosted its Ether treasury again, acquiring $252 million in ETH and raising $360.9 million through its at-the-market (ATM) equity program.

The company now holds 797,794 ETH worth about $3.64 billion. ETH ETFs have also recorded over $455 million in net inflows on August 26, according to Coinglass.

Separately, Japan’s Metaplanet announced plans to raise an additional $880 million from overseas markets to buy more Bitcoin.

Related News:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage