Today’s market update includes something that you haven’t heard in four years:

Ethereum hit a new all-time high 🚀

The rally started Friday after Fed Chair Jerome Powell suggested that interest rates might be cut soon.

But J Pow’s comment wasn’t the only reason – several other factors have been building pressure under ETH lately:

1/ ETF demand

US spot ETH ETFs recorded more than $1B in inflows in a single day recently – the biggest amount since they launched.

And not only that – for weeks now, ETH ETFs have actually been outperforming Bitcoin ETFs.

2/ Corporate buying

Companies are starting to hold large amounts of ETH in their treasuries:

👉 BitMine holds ~$6.7B worth of ETH;

👉 SharpLink holds ~$3.2B in ETH.

That kind of demand adds constant upward pressure on the price.

3/ Whale buying

According to CryptoQuant contributor Darkfost, large Binance traders – aka whales – have been increasing their ETH positions since July, both in spot and futures markets.

They started buying after ETH’s price trend reversed upward, which shows they waited for confirmation before entering.

Their buying increases demand, which pushes the price higher.

4/ Clearer regulation

👉 The SEC said liquid staking services can keep paying rewards without registering as securities;

👉 The GENIUS Act passed. It set up a legal framework for stablecoins in the US, and since most stablecoins run on Ethereum, that strengthens ETH.

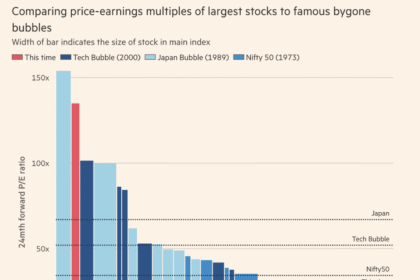

And now, the million-dollar question: where to next?

Crypto Jelle pointed out that ETH has turned its old high around $4,650 into support, and is now in price discovery – in other words, the market is exploring new territory where no one knows the limits yet.

Stay tuned 👀