Join Our Telegram channel to stay up to date on breaking news coverage

The Ethereum price plunged 2% in the last 24 hours to trade at $4,013 as of 3:33 a.m. EST on trading volume that dropped 28% to $41.6 billion.

Tom Lee’s BitMine Immersion Technologies took the opportunity buy the dip, snapping up 104,336 ETH worth about $417 million from Kraken and BitGo, according to on-chain data from Lookonchain.

The fresh acquisition follows the company’s $828 million purchase last week.

It looks like Bitmine(@BitMNR) just bought another 104,336 $ETH($417M).

Over the past 7 hours, 3 new wallets received 104,336 $ETH($417M) from #Kraken and #BitGo.

Despite the crypto market crash, Tom Lee still predicts $ETH will hit $10K by year-end.https://t.co/KewyZ4cAeP… pic.twitter.com/Vn5b9ijP2Z

— Lookonchain (@lookonchain) October 16, 2025

“The crypto liquidation over the past few days created a price decline in ETH, which BitMine took advantage of,” said BitMine chairman Lee. “Volatility creates deleveraging, and this can cause assets to trade at substantial discounts to fundamentals.”

Meanwhile, according to recent data from Bitwise, nearly all of the Ethereum accumulated by public companies to date occurred within a three-month window between July and September.

95% of all ETH held by public companies was purchased in the past quarter alone.

Watch this space.

Corporate ETH Adoption, Q3 2025 Edition pic.twitter.com/9hDARuo9vQ

— Bitwise (@BitwiseInvest) October 15, 2025

Of the 4.63 million ETH held on public company balance sheets as of September 30, roughly 4 million were added during the third quarter, it said.

Sharplink Gaming co-CEO Joseph Chalom said on Wednesday that he is “bullish” about Ethereum as it is “the best choice for institutions.”

“It’s decentralized, secure and continuously growing its network,” Chalom said.

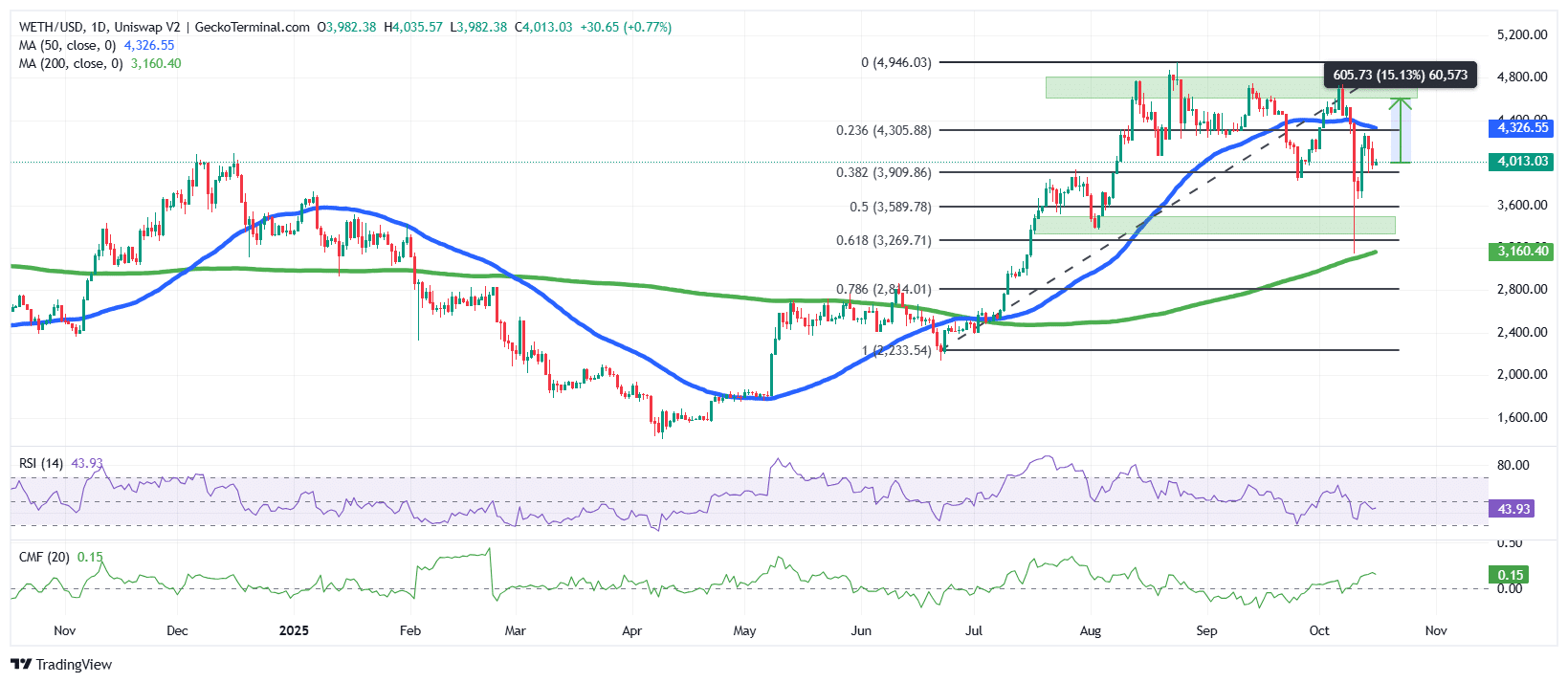

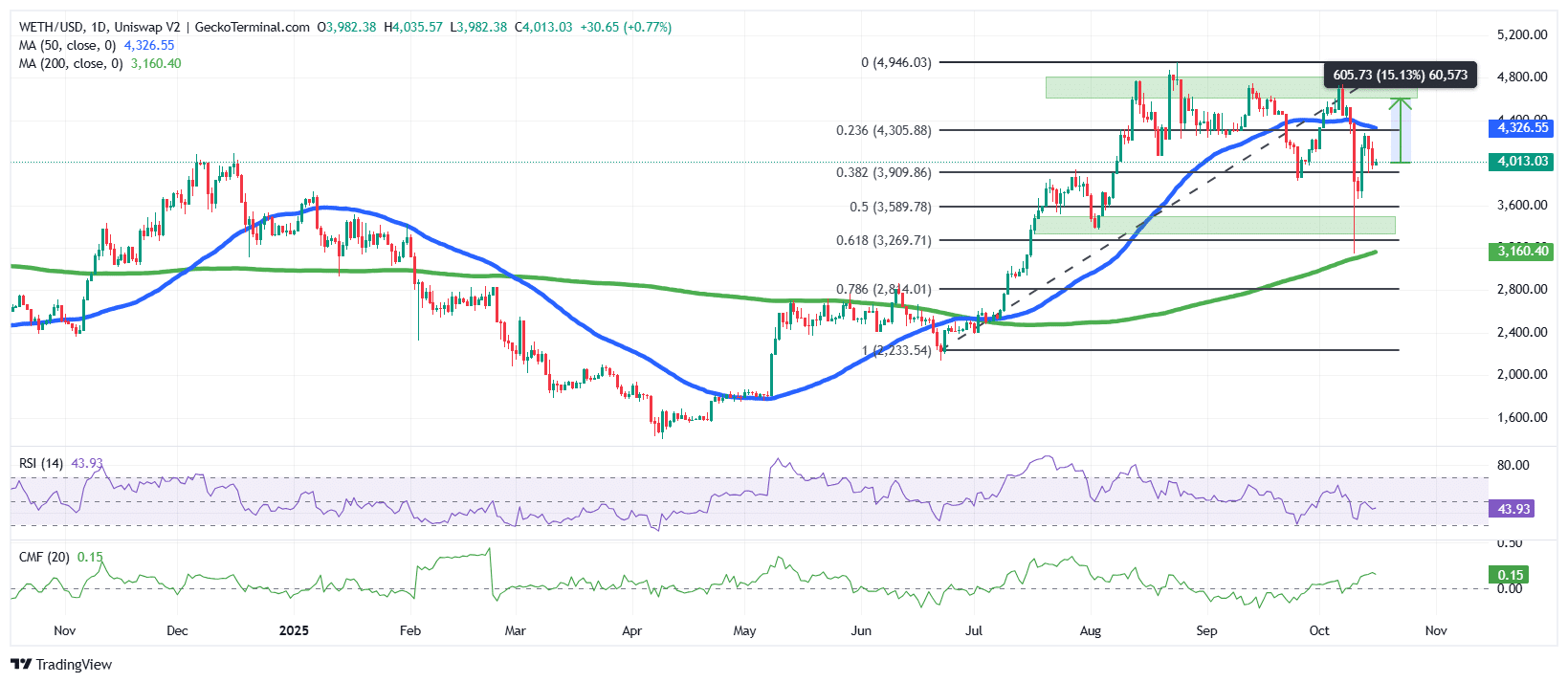

Ethereum Price Regains Its Footing After Sharp Correction

The ETH price has recently found stability after a volatile period that tested the $3,600 support zone.

The Ethereum price daily chart shows that ETH is now trading around $4,013, recovering steadily after dipping below its short-term support at the 0.382 Fibonacci retracement level ($3,909). This sharp rebound from this region indicates strong buying interest, particularly around the mid-Fibonacci zone between 0.382 and 0.5.

Meanwhile, the broader structure reflects a bullish recovery within a medium-term uptrend, though recent ETH price swings have introduced short-term uncertainty.

The 50-day Simple Moving Average (SMA) at $4,326 currently acts as dynamic resistance, while the 200-day SMA near $3,160 provides a solid base of long-term support. The 50-day SMA remaining above the 200-day SMA suggests that the trend remains positive, even as the price of Ethereum tests crucial resistance levels.

The Relative Strength Index (RSI) currently sits at 43.93, suggesting that the market is emerging from mildly oversold conditions. This level often precedes recovery phases when accompanied by supportive price action.

Moreover, the Chaikin Money Flow (CMF) indicator reads +0.15, reflecting renewed capital inflows after a brief period of outflows. A positive CMF typically indicates that buying pressure is building, which aligns with the recent price stabilization above $4,000.

ETH Targets $4,600 as Bulls Regain Confidence

ETH appears poised for a potential retest of the $4,600–$4,900 zone, representing a 15% upside from current prices. Sustained momentum above the 50-day MA would confirm the continuation of the broader bullish structure.

However, if the price of Ethereum fails to maintain support above $3,900, a retest of $3,600 or even the 0.618 Fibonacci level near $3,270 remains possible.

This bearish sentiment is supported by crypto analyst Ali Martinez, who says that the Ethereum price is on the verge of a MACD crossover.

Ethereum $ETH is on the verge of a bearish MACD crossover on the weekly chart. The last two times it happened, the price dropped 43% and 61%. pic.twitter.com/RRIjFeR63k

— Ali (@ali_charts) October 16, 2025

Overall, the trend remains cautiously bullish. A breakout above $4,326 would mark a renewed uptrend, potentially paving the way for a retest of yearly highs near $4,946.

Related News:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage