Join Our Telegram channel to stay up to date on breaking news coverage

The Ethereum price jumped 3% in the last 24 hours to trade at $4,436 as of 3:33 a.m. EST after BitMine bought $200 million ETH and as the US Securities and Exchange Commission (SEC) delayed a decision on staking for BlackRock’s Ethereum ETF.

Tom Lee’s BitMine expanded its ETH holdings for the second time this week. Data from Lookonchain shows that the firm has acquired an additional 46,255 ETH valued at approximately $200.43 million.

Bitmine(@BitMNR) bought another 46,255 $ETH($200.43M) 5 hours ago and currently holds 2,126,018 $ETH($9.27B).https://t.co/8wNYBL84rk pic.twitter.com/McHcKYX8S5

— Lookonchain (@lookonchain) September 11, 2025

BitMine had already purchased 202,500 Ether on Monday, which sent its stash past 2 million ETH for the first time.

With the latest purchase, BitMine now holds an impressive 2.1 million ETH that’s currently worth around $9.27 billion.

The firm has the largest ETH holdings of any public company, and it is now widened the gap f the second-largest ETH holding company, Sharplink Gaming, which has more than 837,000 ETH in its treasury, according to Strategic ETH Reserve data.

SEC Delays Decision On BlackRock ETH Staking

In another development, the US SEC has once again delayed decisions on a handful of crypto ETF applications.

It said it needs more time to review applications to allow staking for Ethereum ETFs issued by BlackRock, Fidelity, and Franklin Templeton.

The agency has now set a new deadline of November 13 for Franklin’s Ethereum staking amendment, and November 14 for its Solana and XRP ETFs.

Meanwhile, a proposal seeking to permit staking in BlackRock’s iShares Ethereum Trust is now slated for October 30.

While the SEC chairman, Paul Atkins, has remained vocal in his support of digital assets, the agency continues to delay decisions on many ETFs.

Still, at the OECD Roundtable in Paris, he said, “We must admit that crypto’s time has come,” signaling a bullish stance.

According to a chart by Bloomberg, over 90 crypto ETFs are awaiting SEC approval.

In case you missed it, there are over 90 crypto ETFs pending SEC approval (see chart below via @JSeyff )

At this rate we’ll have one for every top 30- 40 #crypto inside 12 months, even with delays. Inflows may surprise for some, but others are still bottom bouncing on LT charts. pic.twitter.com/Q6HSl8xNYT

— James McKay (@McKayResearch) September 10, 2025

Meanwhile, spot ETH ETFs have recorded two consecutive days of positive net inflows, according to data from Coinglass.

Ethereum Price Riding The Bullish Channel

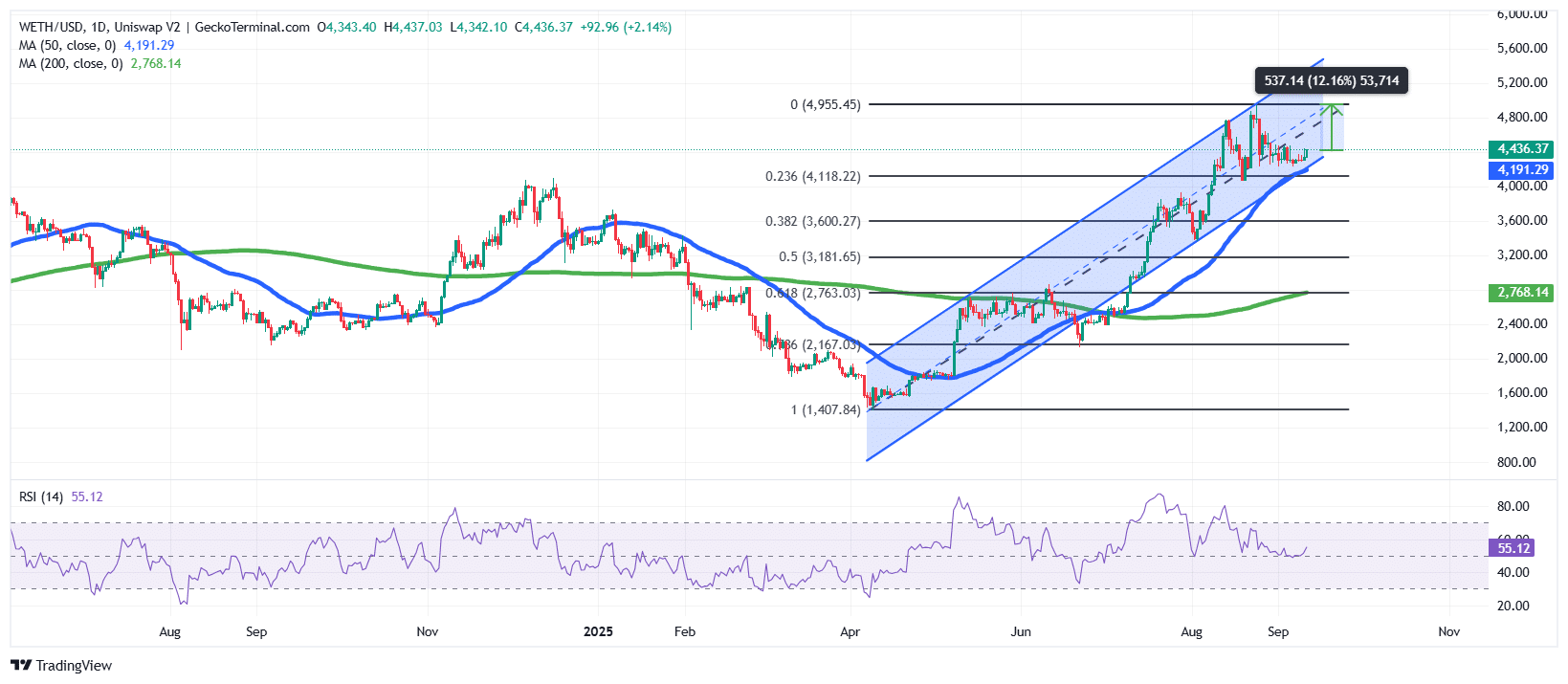

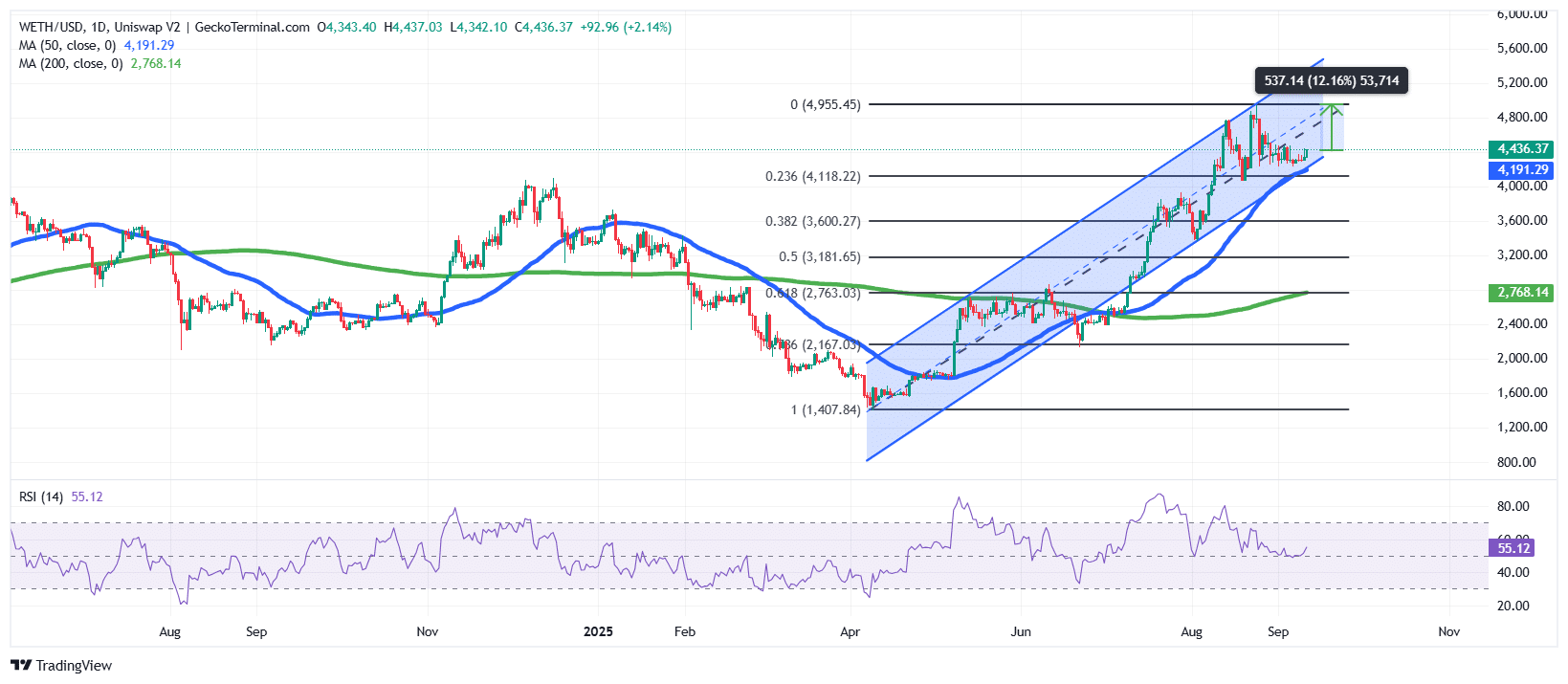

The ETH price has been moving inside a clear rising channel pattern since April 2025, signaling strong bullish momentum.

After climbing from lows near $1,400, the Ethereum price is now trading around $4,436, with the channel providing consistent support and resistance levels.

The recent pullback from the upper boundary near $4,950 has not broken the bullish structure, as the price of Ethereum quickly found support and remains within the channel.

The Fibonacci retracement levels reinforce this trend, with the key 0.236 retracement at $4,118 acting as an important level that has now turned into support.

Meanwhile, the 50-day Simple Moving Average (SMA) ($4,191) has been acting as dynamic support, while the 200-day SMA at $2,768 remains far below the price of ETH, highlighting strong separation and trend strength.

ETH Indicators Point To More Room For Growth

The Relative Strength Index (RSI) sits at 55.12, a neutral-to-bullish reading that shows momentum is healthy without turning overbought. This suggests that Ethereum has room for further upward movement before a major correction becomes likely.

ETH is positioned to retest the upper channel boundary near $4,950. If this resistance breaks, the next target lies around $5,200, offering about a 17% upside from current levels.

On the downside, if momentum weakens and the price of Ethereum loses the 50-day SMAs, the $4,118 Fibonacci support and the mid-channel line could be the following support levels.

Basing his analysis on Bollinger Bands, Ali Martinez believes that the ETH price can see a bigger move.

Expect a big move for Ethereum $ETH soon as the Bollinger Bands squeeze! pic.twitter.com/5KgYzuF3Vb

— Ali (@ali_charts) September 10, 2025

Another analyst on X, ‘AltGem Hunter,’ believes that the Ethereum price action is similar to that of Bitcoin in 2021, and could be preparing for a massive rally.

$ETH is repeating Bitcoin price action from 2021.

If history repeats…

A massive pump is coming! pic.twitter.com/vSzoliM2w2

— AltGem Hunter ⚡🥷 (@AltGemHunter) September 10, 2025

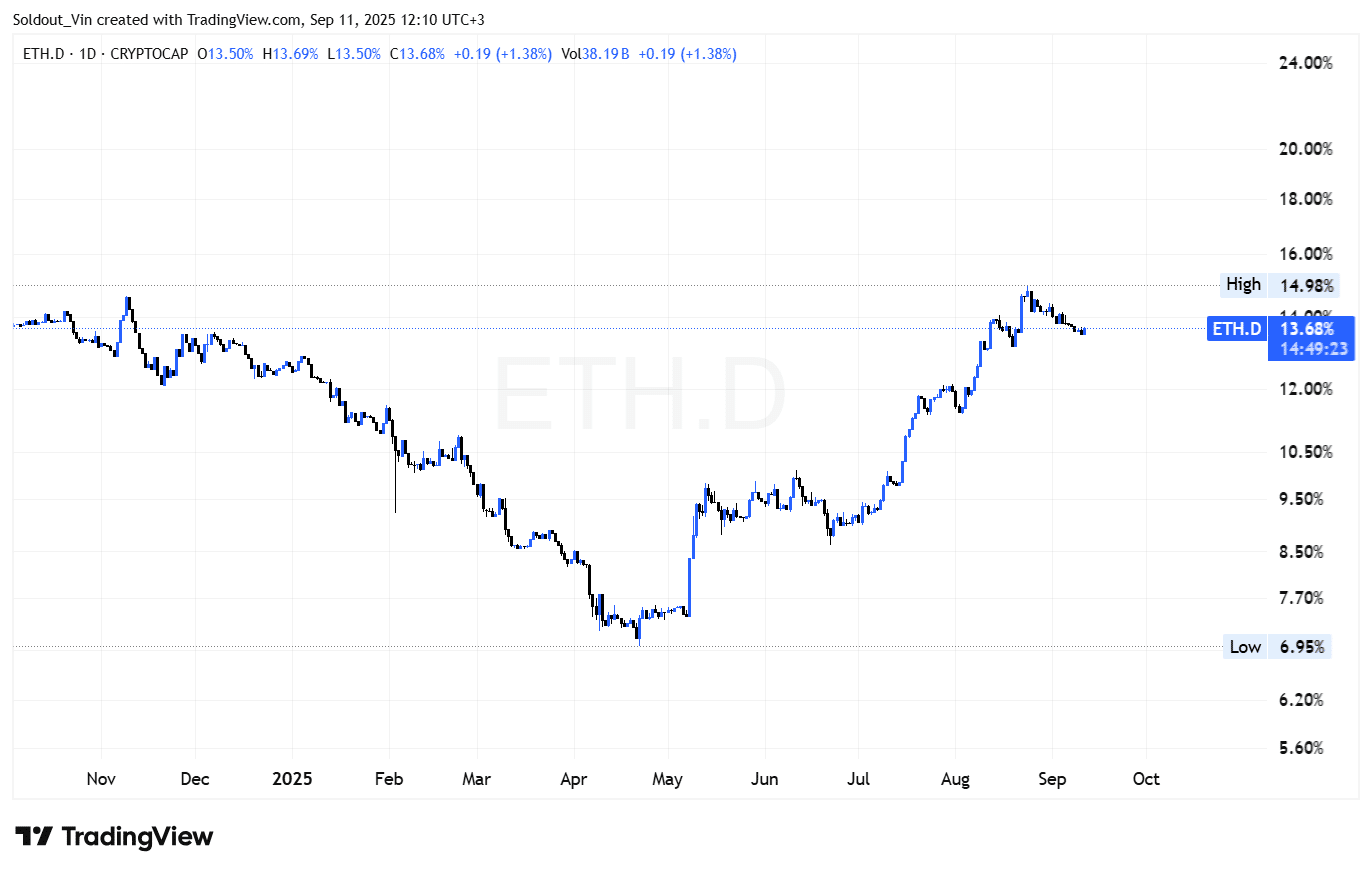

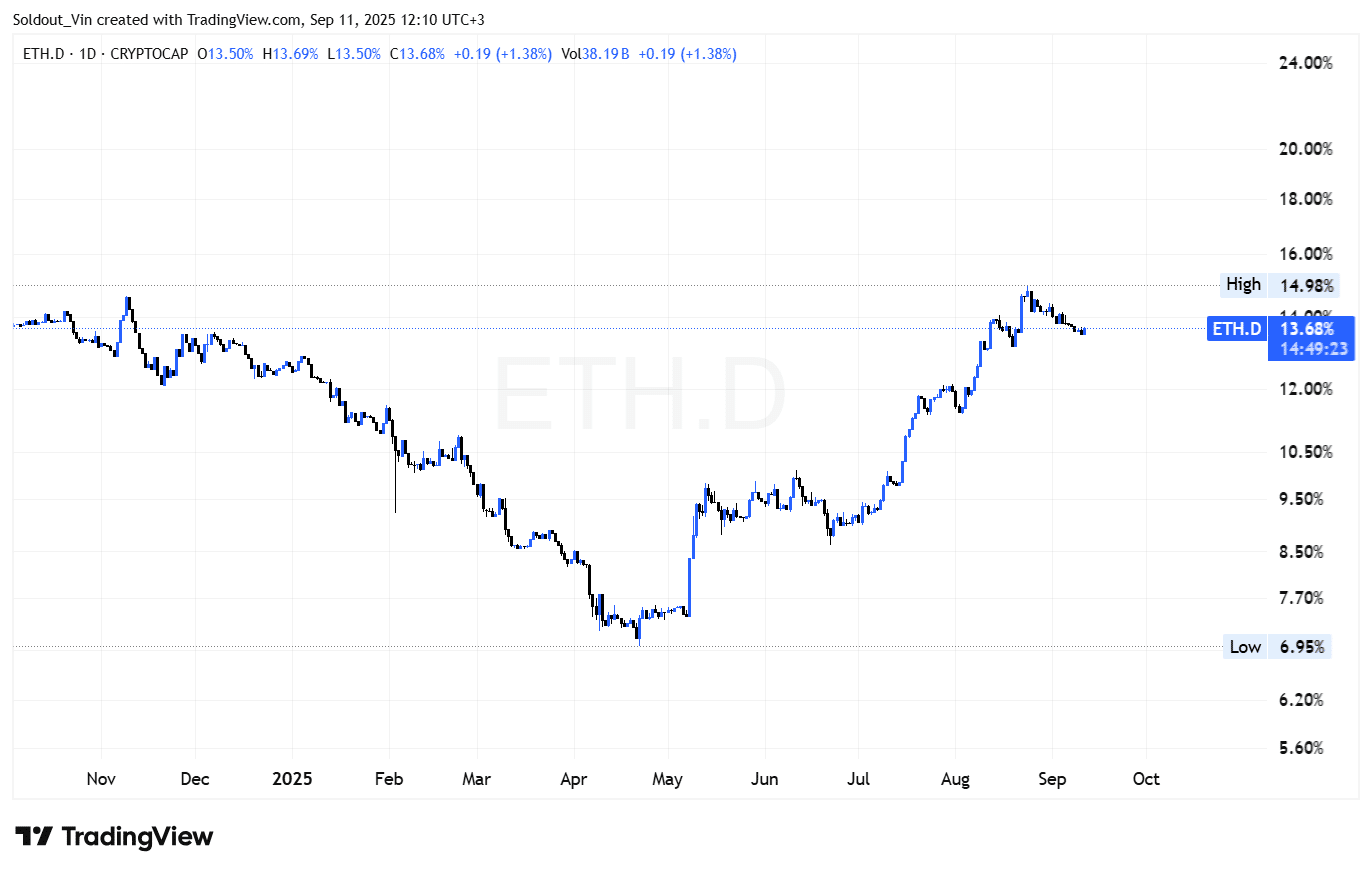

Ethereum dominance (ETH.D) has rebounded strongly from its April low of 6.95% to a September peak of 14.98%, but is now slightly pulling back to around 13.68%. ETH has still been outperforming most other cryptos.

Positive Ethereum price sentiment is supported by the CMC Altcoin Season Index, which shows that the altcoin season is nearing with the index now at a high for the year.

Related News:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage