Join Our Telegram channel to stay up to date on breaking news coverage

The Ethereum price has surged 3% in the last 24 hours to trade at $4,137 as of 3.30 a.m. on an 11% increase in trading volume to $61.4 billion.

This move comes as the Bhutan government, in collaboration with the Ethereum Foundation, said it would become the first nation to anchor its national digital identity system on the Ethereum blockchain.

The new system is expected to go fully live by early 2026 and covers Bhutan’s entire population of nearly 800,000.

The launch ceremony included high-profile attendees including Bhutan’s Prime Minister, the Crown Prince, and Ethereum co-founder Vitalik Buterin.

Aya Miyaguchi, president of the Ethereum Foundation, called the milestone “not just a national accomplishment, but a global advancement towards a more open and secure digital future.”

1/ Today, Bhutan celebrates a historic milestone, becoming the first nation to anchor its national digital identity system on Ethereum. 🇧🇹@VitalikButerin and I were honored to join the launch ceremony on behalf of the Ethereum community, graced by His Royal Highness. pic.twitter.com/KA4tOYbsJ4

— Aya Miyaguchi (@AyaMiyagotchi) October 13, 2025

The system was previously on Polygon but is now anchored to Ethereum for greater transparency and security.

Ethereum On-Chain Signals Point To Growing Strength

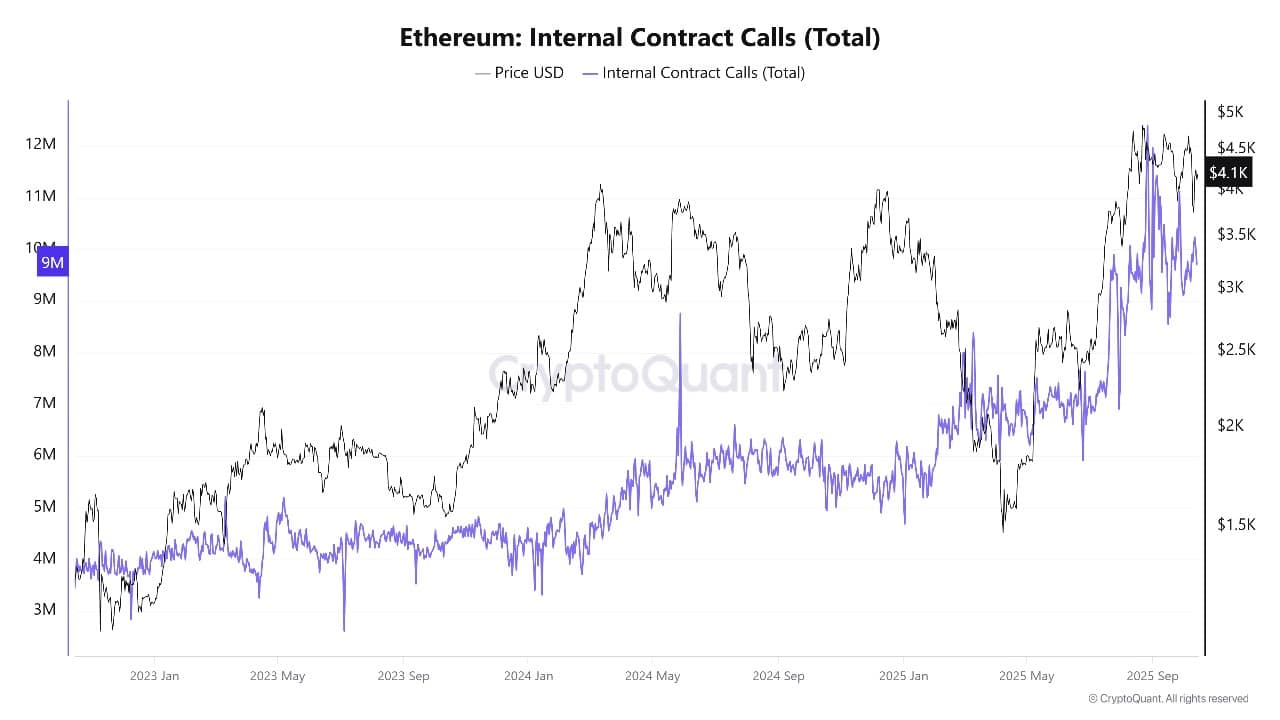

Besides that news, on-chain data supports ETH’s bullish price move. Network activity on Ethereum has hit “new normal” highs, with daily internal contract calls rising from 7 million to over 9.5 million since July. This means more users are interacting with smart contracts, DeFi, and real-world asset tokenization.

ETH Internal Contract Calls Source: CryptoQuant

Ethereum’s network is leading the way in tokenizing real-world assets (RWAs). Over $11.7 billion in value is represented as RWAs on ETH, giving it a dominant 56% market share in this fast-growing sector. Big names like BlackRock are fueling the trend. (Its BUIDL fund alone holds over $2.4 billion in tokenized assets on Ethereum).

Institutional interest is also strong. Grayscale recently staked 857,600 ETH, sending a clear message of confidence in long-term network growth. Meanwhile, gas use and staking participation rates are at record highs.

These metrics indicate a vibrant ecosystem where both retail and institutional players are investing in Ethereum’s future.

Ethereum Faces Key Levels With Bullish Setup

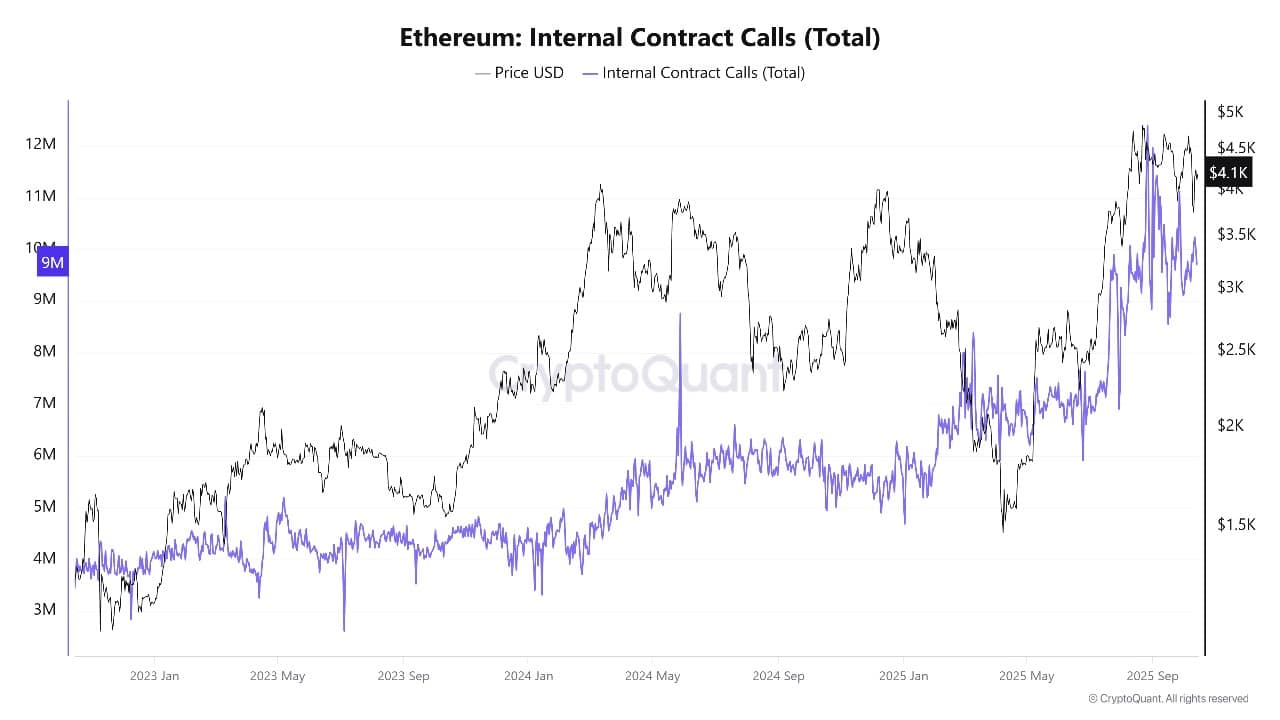

Looking at the weekly ETH price chart, ETH has bounced from the 0.236 Fibonacci retracement level at $4,112 and is currently trading just above it at $4,187. The area around $4,112 is immediate support, while the next notable resistance is around the recent high at $4,955.

If ETH breaks above this resistance, momentum could drive it towards a new all-time high. The technical indicators are mostly positive: The 50-week Simple Moving Average (SMA) sits at $3,113, a strong support. While the 200-week SMA is further down at $2,448.

The Relative Strength Index (RSI) at 58 shows that ETH is in positive momentum, but not overbought yet. The MACD is still bullish, with the main line above the signal, and the Average Directional Index (ADX) at 28 indicates a strengthening trend.

ETHUSD Analysis Source: Tradingview

If Ethereum holds support at $4,112 and attracts more buyers, it could attempt another push above $4,955. In the event of a pullback, major buying interest is likely to emerge at the $3,500–$3,100 area, with the $3,113 50-SMA providing a technical floor.

A breakdown below $3,100 may open up tests of the 200-SMA and the $2,100 level. The latest on-chain and technical signals, combined with a historic real-world use case like Bhutan’s digital ID project, suggest the ETH price could remain strong and volatile.

Related Articles:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage