Join Our Telegram channel to stay up to date on breaking news coverage

JPMorgan says Ethereum is set to soar on the ‘’meteoric growth’’ of stablecoins, which mostly run on its network.

The outlook follows US President Donald Trump’s signing of the GENIUS Act in July, a landmark law giving stablecoin issuers clear rules.

The move has prompted titans like Amazon, Citigroup and Mastercard to ramp up stablecoin plans, following the blockbuster IPO of USD Coin issuer Circle.

“We think ether is emerging as a direct way to gain exposure to the expected meteoric growth in stablecoins as the Ethereum network hosts most of these stablecoin assets, directly as the L1 or indirectly through some L2s,” analysts at the bank wrote in a note on Thursday.

Stablecoin Market Cap Soars

The market cap of stablecoins rose for an eighth consecutive month in July to $272.6 billion and surged almost $3.8 billion in the past week. The sector’s year-to-date growth is outpacing that of the broad crypto market.

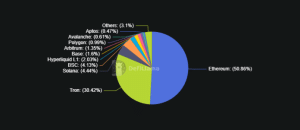

Data from the decentralized finance (DeFi) aggregator DefiLlama shows that Ethereum currently holds around a 50% market share worth $138.595 billion. That’s well ahead of the 30% held by Justin Sun’s Tron blockchain, putting it in prime position to benefit.

Stablecoin market share breakdown (Source: DefiLlama)

Ethereum’s native ETH token has not set a new all-time high (ATH) price since Nov. 16, 2021. Back then, the altcoin reached $4,891.70.

It came within 4% of that peak yesterday, but a broader market selloff after a hotter-than-expected US PPI release dashed traders’ hopes that a new record price will finally be achieved.

While ETH has been able to recover from yesterday’s daily low of $4,461.28 to trade at $4,634.63 as of 5:50 a.m. EST, it’s still down more than 2% on the 24-hour time frame.

GENIUS Act And Pro-Crypto Policies In The US Ignite Stablecoin Frenzy

The catalyst for an expected stablecoin boom is the regulatory framework established by the GENIUS Act. It lays out clear rules around reserve backing, disclosures, AML policies, licensing and compliance.

Already Circle’s IPO has set the market alight. It went public on the New York Stock Exchange (NYSE) on June 5 after raising about $1.1 billion by selling 24 million shares at $31 each.

Circle shares, with the ticker “CRCL,” opened at $69, more than double the IPO price. They reached an intraday high of $100 before closing the first day’s session at $83, marking a debut gain of 168%.

Even the Trump family is getting into the stablecoin business, with its World Liberty Financial project launching USD1 in March this year. It is already listed on Binance.

Data from CoinMarketCap shows that USD1 is currently the 5th biggest stablecoin with a market cap of $2.18 billion.

Largest stablecoins by market cap (Source: CoinMarketCap)

The current leader by a substantial margin is Tether’s USDT, with a capitalization of $165.95 billion. Circle’s USDC is the next biggest, with a market cap of around $67.75 billion.

Related Articles:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage