Join Our Telegram channel to stay up to date on breaking news coverage

Metaplanet gained shareholder approval to raise as much as $3.7 billion for more BTC buys, paving the way for a further expansion of its massive Bitcoin treasury.

The shareholder vote at an extraordinary general meeting that was attended by Eric Trump clears the way for Metaplanet to issue up to 2.7 billion new shares and introduce a dual-class preferred stock system, giving it new fundraising options while limiting dilution for existing investors.

While the approvals move Metaplanet closer to its goal, the company must still finalize issuance terms, secure regulatory clearance, and convince investors to back its buying plan in a challenging market.

The Japan-based firm, already Asia’s biggest corporate BTC holder, has its sights set on accumulating 210,000 BTC by 2027. It currently holds 20,000 BTC, ranking sixth globally and ahead of companies like Tesla and Coinbase.

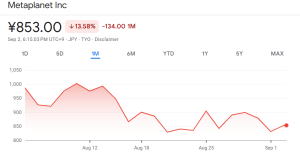

Metaplanet Shares Tick Up After 13% Plunge In A Month

The approvals from the company’s shareholders saw Metaplanet’s share price climb 2.6% in the past 24 hours, according to Google Finance. That’s after a grim month in which its shares tumbled more than 13%.

Metaplanet’s share price over the past month (Source: Google Finance)

Three Key Amendments Approved By Metaplanet Shareholders

The first resolution by the company’s shareholders was to increase the number of authorized shares to 2.7 billion. This gives Metaplanet the ability to raise additional capital to buy more Bitcoin in the future.

A new dual-class preferred stock system was also introduced and approved, formally establishing both Class A and Class B shares. This will make it possible for the company to attract different types of investors without impacting current investors’ control.

The Class A shares will come with a fixed dividend, which will cater to investors that are more income-focused and are looking for relatively stable returns. Meanwhile, the Class B shares would be a riskier bet, but give investors the option to convert their shares into common stock.

The dual-class preferred stock system provides investors with potential upside if the company’s Bitcoin strategy succeeds.

According to Metaplanet, the new classes of shares also provide a sort of “defensive mechanism” that shields common shareholders from excessive dilution, while still giving the company the ability to potentially raise $3.7 billion in funding.

The remaining resolution introduced new rules enabling virtual-only shareholder meetings.

Metaplanet Is Closer To Achieving Its Bitcoin Accumulation Goals

The recently-approved amendments follows Metaplanet’s Aug. 1 announcement of plans to raise $3.7 billion to buy more Bitcoin. This is part of the company’s goal of acquiring 210K BTC by the end of 2027.

Last week, Metaplanet’s board of directors resolved to issue new shares overseas, which then led to the latest shareholder meeting.

Although shareholders have approved the new framework, Metaplanet’s board of directors still needs to authorize the specific issuance terms. The company must also submit detailed registration statements to local regulators.

What’s more, Metaplanet will also need to go out and find investors that can actually help it achieve the $3.7 billion raise. With the recent drop in crypto prices and the company’s share price down more than 13% in the last month, raising the capital could prove challenging.

$3.7 Billion Raise Could See Metaplanet Climb The Bitcoin Treasury Rankings

Metaplanet recently overtook Bitcoin miner Riot Platforms in terms of the number of BTC held in its reserves.

The company currently holds 20K BTC after it bought 1,009 BTC yesterday for approximately $112.2 million. This ranks Metaplanet as the sixth-largest Bitcoin treasury company globally, according to data from Bitcoin Treasuries. Metaplanet is also the biggest corporate BTC holder in Asia.

*Metaplanet Acquires Additional 1,009 $BTC, Total Holdings Reach 20,000 BTC* pic.twitter.com/kwvUkQaFth

— Metaplanet Inc. (@Metaplanet_JP) September 1, 2025

Metaplanet also holds more BTC than US crypto exchange Coinbase, Elon Musk’s electric car manufacturer Tesla, and the Hut 8 mining firm.

According to Metaplanet’s CEO Simon Gerovich, the average purchase price for the latest acquisition was $111,162 per BTC.

The company has also achieved a year-to-date (YTD) BTC yield of 486.7%. Overall, Metaplanet’s Bitcoin holdings cost around $2.06 billion to acquire, with the average price for all of the buys at around $103,138 per BTC.

Metaplanet is now just 4K BTC away from overtaking the Peter Thiel-backed crypto exchange platform Bullish as the fifth-largest Bitcoin treasury globally. With the resolution to let Metaplanet issue more shares to potentially raise additional capital, the company could soon surpass Bullish as well.

Adding to the company’s momentum is the FTSE Russell’s upgrade of Metaplanet’s stock from small-cap to mid-cap in its September 2025 Semi-Annual Review. This has bumped the company up for inclusion in the flagship FTSE Japan Index.

Metaplanet’s inclusion in the FTSE Japan Index means it is automatically added to the FTSE All-World Index, which gives it greater exposure among global index investors and may bolster its fundraising efforts.

Related Articles:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage