Join Our Telegram channel to stay up to date on breaking news coverage

Japan-based Metaplanet has acquired 103 BTC worth $11.7 million, bringing it close to surpassing Riot Platforms as the world’s sixth-largest corporate Bitcoin holder.

The company’s CEO, Simon Gerovich, said in an Aug. 25 X post that the latest BTC purchase was executed at an average buy price of $113,491 per BTC. Following the recent acquisition, Metaplanet’s holdings in the largest crypto by market cap now stand at 18,991 BTC.

Metaplanet Looks To Climb Bitcoin Treasury Rankings

Gerovich added that Metaplanet’s holdings were acquired for a total cost of around $1.95 billion, with the overall average price for the acquisitions standing at approximately $102,712 per BTC. So far, the company has also achieved a year-to-date (YTD) BTC yield of 479.5%, Gerovich said.

That’s as the company looks to double down on its BTC strategy. Earlier this month, the firm unveiled its Bitcoin-backed yield curve and its “Metaplanet Prefs” program to take on Japan’s bond market as well as further weaponize its BTC treasury.

Gerovich also shared in another X post today that Metaplanet has been added to the FTSE Japan Index in the September review. According to the CEO, this is “another important milestone on our journey as Japan’s leading Bitcoin treasury company.”

✅ Metaplanet has been added to the FTSE Japan Index in the September review. Another important milestone on our journey as Japan’s leading Bitcoin treasury company. https://t.co/rZfWWgQyoe pic.twitter.com/k3rnIz3CDd

— Simon Gerovich (@gerovich) August 25, 2025

Currently ranked as the largest corporate BTC holder in Asia and the seventh-biggest holder globally, Metaplanet is now less than 300 BTC away from overtaking Riot Platforms in the BTC treasury rankings.

According to data from BitBO, Riot Platforms holds 19,287 BTC on its balance sheet valued at $2.18 billion at current prices.

The current leader, Strategy, led by Michael Saylor, takes the number one spot with a comfortable margin. With 629,376 BTC in its reserves worth more than $71 billion, Strategy holds just under 3% of BTC’s total supply.

The second-biggest Bitcoin treasury firm is Marathon Digital, with its holdings of 50,639 BTC.

Saylor has also hinted that Strategy will add to its lead. In an X post yesterday, he posted a screenshot of the SaylorTracker chart with the caption, “Bitcoin is on sale.”

Bitcoin is on Sale pic.twitter.com/azJIYk2xDe

— Michael Saylor (@saylor) August 24, 2025

Posts with that chart have been followed by announcements of Bitcoin purchases in the past.

If history repeats itself and Strategy announces a new BTC buy, it would be the third Bitcoin acquisition by the company in August.

Strategy’s most recent purchase was on Aug. 18, when it bought 430 BTC for $51.4 million.

Strategy is now sitting on an unrealized gain of more than $24.7 million as well, which equates to around 53.52%, according to data from SaylorTracker.

Bitcoin Price Stalls Even Amid The Continued Corporate Buying Spree

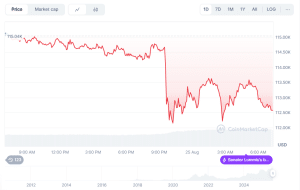

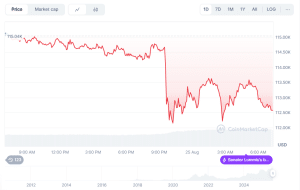

Despite the fact that companies like Strategy and Metaplanet continue to purchase more BTC, the crypto king’s price has dropped over the past month.

In the last 30 days, BTC has slid over 4%. This is mainly due to the more than 2% drop over the last week, data from CoinMarketCap shows.

BTC price chart (Source: CoinMarketCap)

The drop in BTC’s price even as institutions keep buying is likely due to Bitcoin’s oldest whales taking profit.

Bitcoiner Willy Woo said in an Aug. 24 X post that the “BTC supply is concentrated around OG whales who peaked their holdings in 2011.”

This differential in cost basis, the supply they hold and their rate of selling has profound impacts on how much new capital that needs to come in to lift price.

You can look at this as BTC going through growing pains until these 10,000x gain investors are absorbed.

— Willy Woo (@woonomic) August 24, 2025

“They bought their BTC at $10 or lower,” Woo said, adding that it now takes more than $110K of “new capital” to absorb each BTC that those whales sell.

One such whale has also been blamed for BTC’s flash crash in the last 24 hours. This large investor started transferring BTC to the decentralized crypto perpetuals platform Hyperliquid on Aug. 16, and sent 24,000 BTC worth $2.7 billion across six transfers, Blockchain.com data shows.

Of that amount, 18,142 BTC valued at $2 billion has already been sold. Many crypto community members on X believe this activity triggered a cascade of sell orders across the market.

As a result of that, BTC’s price dipped to as low as $111,060.54 yesterday. It has since recovered to trade at $112,497.43 as of 1:28 a.m. EST.

Related Articles:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage