Join Our Telegram channel to stay up to date on breaking news coverage

Ethereum ETFs (exchange-traded funds) posted their highest net daily outflows in a month, extending their negative streak to five days.

According to data from Farside Investors, $446.8 million left the funds’ reserves on Sept. 5, the largest net daily outflow since Aug. 4, when $465.1 million flowed out of the products.

BlackRock’s Spot Ethereum ETF Takes The Biggest Blow

The ETH ETF that saw the largest net daily outflow was BlackRock’s ETHA. Investors withdrew $309.9 million from the ETF on Sept. 5. It had chalked up an inflow of $148.8 million a day earlier.

Fidelity’s FETH, 21Shares’ TETH, and both Grayscale’s ETHE and ETH funds also recorded outflows.

Grayscale’s ETHE suffered the second-biggest daily outflow, with $51.8 million exiting the fund, while the asset manager’s ETH product saw $32.6 million leave its reserves.

Meanwhile, Fidelity’s FETH recorded $37.8 million in outflows and investors pulled $14.7 million from 21Shares’ TETH. The remaining four funds recorded no new flows for the day.

Over the past five days combined, $952.2 million has left the funds.

Investors Also Retreat From Bitcoin Funds

BTC ETFs are also bleeding, racking up their second consecutive day of net daily outflow after shedding $160.1 million yesterday. BlackRock’s IBIT, Bitwise’s BITB, and Grayscale’s GBTC all recorded outflows, while the remainder recorded no news flows on the day.

𝗕𝗶𝘁𝗰𝗼𝗶𝗻 𝗘𝗧𝗙 𝗙𝗹𝗼𝘄 (𝗨𝗦$ 𝗺𝗶𝗹𝗹𝗶𝗼𝗻) – 2025-09-05

TOTAL NET FLOW: -160.1

IBIT: -63.2

FBTC: 0

BITB: -49.6

ARKB: 0

BTCO: 0

EZBC: 0

BRRR: 0

HODL: 0

BTCW: 0

GBTC: -47.3

BTC: 0For all the data & disclaimers visit:https://t.co/Wg6Qpn0Pqw

— Farside Investors (@FarsideUK) September 6, 2025

Most of the negative flows came from IBIT, with $63.2 million leaving the fund, while BITB and GBTC saw $49.6 million and $47.3 million in outflows, respectively.

On Sept. 4, $222.9 million had exited the Bitcoin products collectively.

Investor Sentiment Remains Neutral

In the last 24 hours, the total crypto market cap dropped by a fraction of a percent with almost all of the top ten cryptos recording losses. Only Binance Coin (BNB), Dogecoin (DOGE) and Cardano (ADA) managed gains.

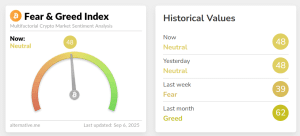

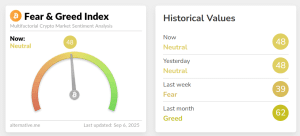

Despite capital flowing out of Bitcoin and Ethereum ETFs, and the market undergoing a minor pullback, crypto investor sentiment remains neutral, according to the Crypto Fear and Greed Index.

Crypto Fear and Greed Index (Source: alternative.me)

The “Neutral” reading of 48 is an improvement from a week earlier, when the index dipped to a “Fear” level of 39. The index has though slumped from a “Greed” score of 62 a month ago.

Related Articles:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage