Wintermute, a trading firm involved in cryptocurrency markets, has requested that US regulators officially declare that certain blockchain tokens should not be subject to securities laws.

In a letter to the Securities and Exchange Commission (SEC), the company argued that clearer definitions are necessary to prevent confusion regarding the regulation of blockchain tokens.

Wintermute focused specifically on “network tokens”, digital assets that are essential to running decentralized platforms. These tokens help blockchain systems operate by enabling functions such as transaction validation and access to services.

Did you know?

Subscribe – We publish new crypto explainer videos every week!

What Is Chia? | Crypto Finally Explained

According to Wintermute, this distinguishes them from financial instruments like stocks or bonds, which are typically the primary focus of securities regulations.

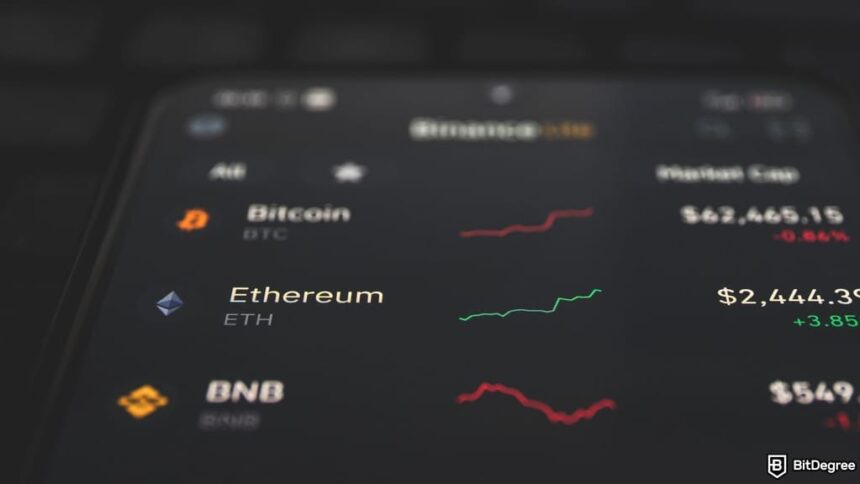

Bitcoin

Wintermute also noted that labeling these tokens as securities could push developers and investors to relocate their activities to countries with more favorable regulations.

The company compared these tokens to items like real estate or rare collectibles, which people buy to earn money later, but that are not classified as securities.

According to Wintermute, the main difference is that network tokens are designed to facilitate system functionality, rather than granting ownership or profit rights to individuals.

Recently, a group of international regulators and exchange associations has asked the SEC to take a stance on tokenized stocks. What did they say? Read the full story.