Join Our Telegram channel to stay up to date on breaking news coverage

The Trump family’s World Liberty Financial (WLFI) and Bitmine Immersion Technologies, the Ethereum treasury firm led by Fundstrat’s Tom Lee, seized the chance to buy the Ethereum dip amid the altcoin’s latest price plunge.

As of 1:06 a.m. EST, the largest altcoin by market cap trades at $4,449.71, down more than 3% in the past 24 hours.

Ethereum price chart (Source: CoinMarketCap)

Despite the recent pullback, ETH is still up over 6% in the past week, when it came to within 4% of its all-time high (ATH) of $4,891.70 that it set on Nov. 16, 2021.

World Liberty Financial Buys The Ethereum Dip

According to on-chain data from Arkham Intelligence that was cited by Lookonchain in an X post earlier today, the Trump family’s WLFI project spent 8.6 million USD Coin (USDC) to purchase 1,911 ETH tokens.

Trump’s World Liberty(@worldlibertyfi) spent another 10M $USDC to buy 84.5 $WBTC at $118,343, and spent 8.6M $USDC to buy 1,911 $ETH at $4,500 an hour ago.https://t.co/0qWkRUhTQbhttps://t.co/awJFLTae1N pic.twitter.com/PzucpjMjRD

— Lookonchain (@lookonchain) August 16, 2025

That ETH was purchased when the altcoin leader was trading at $4,500, Lookonchain said. It also follows the platform’s much smaller June 29 purchase. Back then, WLFI bought 256.75 ETH for 1 million USDC.

According to Arkham Intelligence data, WLFI currently holds 1.914 ETH valued at $8.53 million at current prices. Overall, the project holds $99,256,138.80 in crypto.

WLFI’s biggest holdings are in Aave v3 WETH (AETHWETH) and Aave v3 WBTC (AETHWBTC). It currently holds 10.218K AETHWETH valued at $45.57 million, and 230.002 AETHWBTC worth around $27.08 million at current prices.

Tom Lee’s Bitmine Bolsters Its Ethereum Treasury

Along with WLFI, Bitmine Immersion Technologies has also added to its Ethereum holdings during the recent ETH price dip.

In another X post, Lookonchain noted that the company purchased 28,650 ETH worth about $130 million.

According to the Arkham data, the transaction was executed via an over-the-counter (OTC) address before the ETH was moved to a WalletSimple storage system owned by Bitmine.

With the latest buy, the company’s holdings in the altcoin have been increased to 1.174 million ETH, Arkham Intelligence data shows. This has cemented its position as the largest Ethereum treasury company globally, with Bitmine’s holdings now worth $5.23 billion even after ETH’s recent price drop.

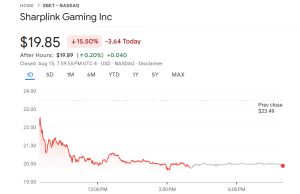

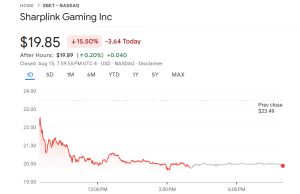

Bitmine’s biggest competition is SharpLink Gaming, the company backed by Ethereum co-founder Joseph Lubin. Its holdings stand at 728,804 ETH, according to the company’s second quarter earnings report.

SharpLink yesterday reported a $103 million net loss for the second quarter that ended on June 30. But $87.8 million of this loss was attributed to non-cash impairment on the firm’s liquid staked ETH holdings.

This is due to the Generally Accepted Accounting Principle (GAAP) requirement to recognize the lowest price ETH traded at during the second quarter, which was $2,300.

Following news of the loss, SharpLink shares slumped 15.5%, according to Google Finance.

SharpLink Gaming share price (Source: Google Finance)

Related Articles:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage