Join Our Telegram channel to stay up to date on breaking news coverage

The XRP price jumped 2% in the past 24 hours to trade at $3.09 as of 4:03 a.m. EST, as Ripple partners with DBS and Franklin Templeton to launch RLUSD-backed trading and lending.

In an announcement, Ripple said that the partnership was set to launch trading and lending using its RLUSD stablecoin and tokenized money market funds.

Introducing the next building block of onchain markets – we’re partnering with @DBSbank and @FTI_Global to establish repo markets powered by tokenized collateral and stablecoins: https://t.co/vFTL32XO8C

Investors will be able to use $RLUSD to trade for Franklin Templeton’s money…

— Ripple (@Ripple) September 18, 2025

The collaboration was formalized through a memorandum of understanding signed in Singapore.

Through the deal, DBS Digital Exchange (DDEx) will list Franklin Templeton’s tokenized money market product, sgBENJI, alongside RLUSD.

The signed Memorandum will allow Franklin Templeton to tokenize its money market fund, Franklin on-chain US dollar short-term money market fund, on the XRP Ledger, a public and enterprise-grade blockchain.

Meanwhile, the CME is preparing to launch options for Solana and XRP futures.

The next step in regulated crypto trading is almost here. 💥

Get ready for:

🔷 Options on SOL, Micro SOL, XRP and Micro XRP futures.

🔷 Trading at Settlement (TAS) mechanism on SOL and Micro SOL futures.➡️ https://t.co/ZL7c0fNUnh pic.twitter.com/N37cGDZAmn

— CME Group (@CMEGroup) September 17, 2025

The opening of XRP options responds directly to a booming institutional demand.

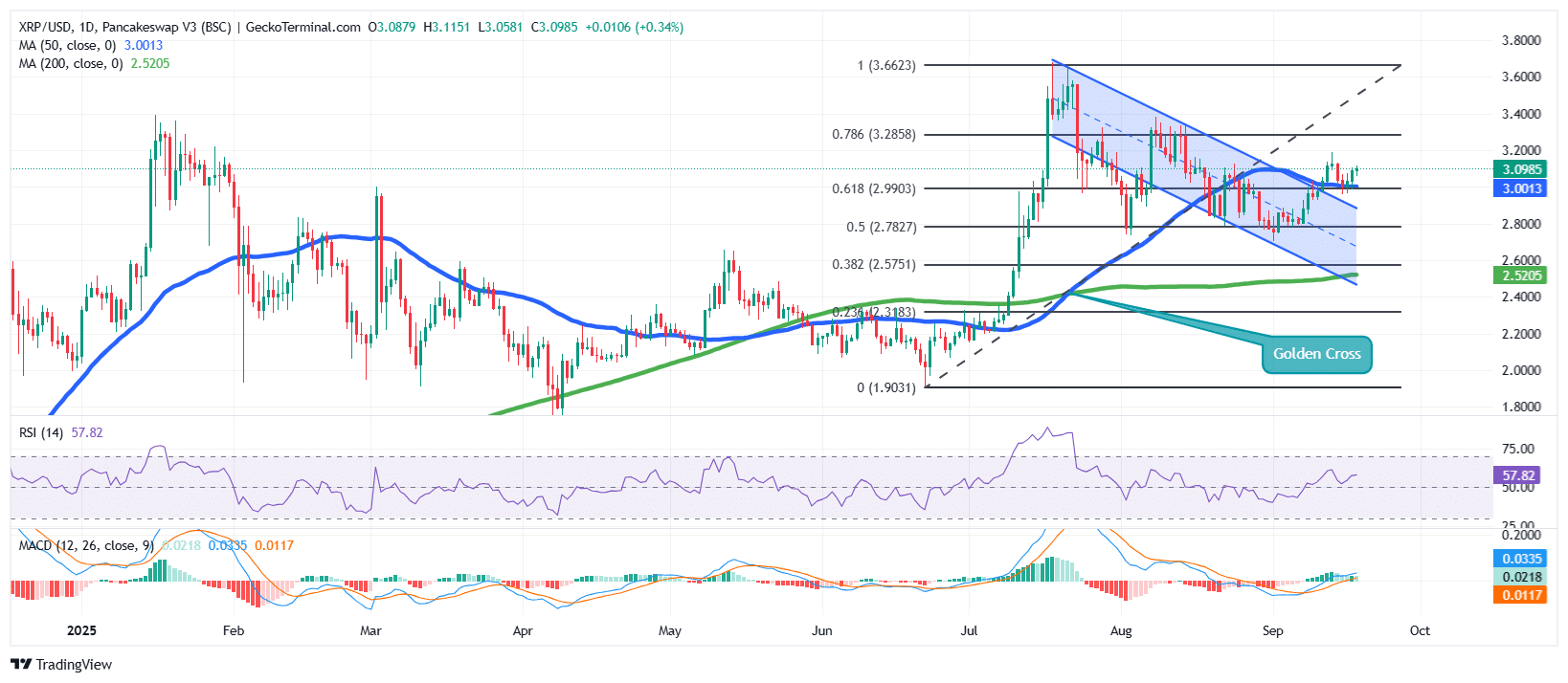

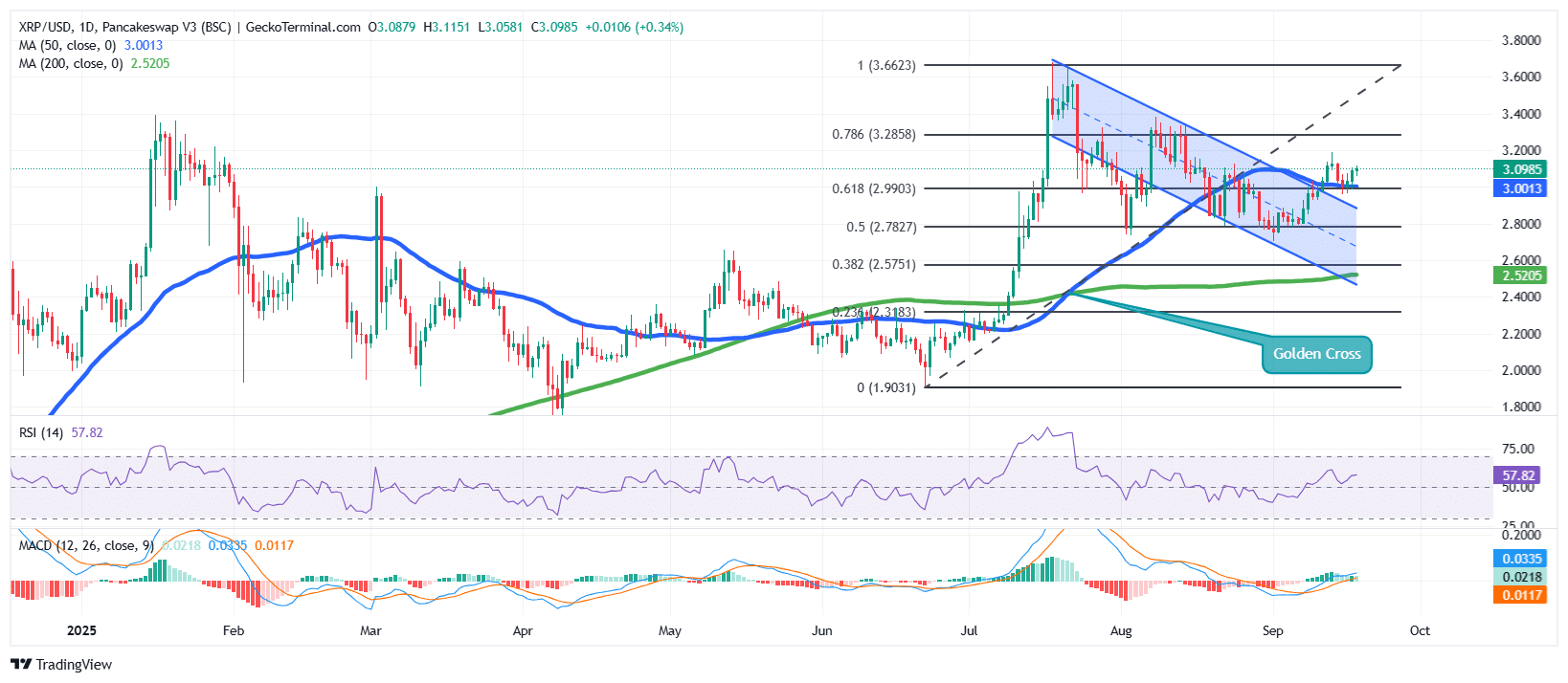

XRP Breaks Out Of Downtrend Channel As Golden Cross Signals Renewed Bullish Momentum

The XRP price has shown notable strength in recent weeks, recovering from its corrective phase and pushing higher.

After rallying from the $1.90 level to a peak near $3.66 earlier this year, the Ripple token price consolidated within a falling channel pattern. That corrective move now appears to be ending, as XRP has broken out of the channel and reclaimed the $3.00 level.

Significantly, XRP is trading above the 0.618 Fibonacci retracement at $2.99, a key support level that often acts as a springboard for further gains.

The chart also highlights a golden cross, where the 50-day Simple Moving Average (SMA) has crossed above the 200-day SMA. This long-term bullish signal suggests that XRP’s broader trend remains intact despite short-term pullbacks—the price trading above both SMAs, reinforcing the strength of this setup.

Technical indicators are aligning with the bullish case. The Relative Strength Index (RSI) currently sits at 57.82, indicating positive momentum without showing overbought conditions.

Meanwhile, the Moving Average Convergence Divergence (MACD) has turned bullish as the MACD line crossed above the signal line, with histogram bars flipping positive, both signs that momentum is shifting back to buyers.

XRP/USD daily chart (Source: TradingView)

If the price of XRP can maintain support above $2.99, the next key resistance levels lie at $3.28 and then $3.66, the recent high. A clean break above these levels could then open the path to new highs.

Conversely, failure to hold above $2.99 may trigger a pullback toward $2.78 or even the 200-day SMA at $2.52. Overall, momentum favors bulls, with upside potential outweighing downside risks.

According to X user and crypto analyst Ali Martinez, the Ripple token could find support around $2.78.

$XRP could find support around $2.78! pic.twitter.com/XJMUIc8JYU

— Ali (@ali_charts) September 17, 2025

Related News:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage