Happy August! My end-of-week morning train WFH reads:

• Almost Every Corner of Emerging Markets Is Surging as Dollar Sinks: After more than a decade as an afterthought in investing circles, developing assets are having a moment as Trump roils the dollar. (Bloomberg)

• 2024 Private Equity Fundamentals. An analysis of private equity companies showed they are smaller, more leveraged, pay higher interest rates, and have lower margins than public companies. (Verdadcap) see also Foie Gras Retirement plan participants shouldn’t be force-fed private assets: Private equity and credit managers desperately want access to retirement plan participants. And steps are reportedly being taken to make that happen. I feel ambivalent at best about this. (Basis Pointing)

• As Consumers Lose Their Appetite, Food Brands Fight to Keep Wall St. Happy: Packaged food companies are struggling to adjust — and profit — as tastes, waistlines and wallets change. (New York Times)

• The Texas Economy Ain’t All That: If Texas were a country, it would have the world’s 8th largest economy, with its sights on overtaking France at No. 7. It is also, according to the personal-finance website WalletHub, the state with “the most people in financial distress.” For all the impressive economic statistics, Texas doesn’t generate sufficient income or security for its residents. (Bloomberg)

• Scapegoating the Algorithm: America’s epistemic challenges run deeper than social media. (Asterisk)

• Why Smart People Deliberately Kill Their Status: The Art of Strategic Disappearance “Status Death”: the deliberate decision to walk away from recognition, followers, and prestige to start fresh. From Roman Emperor Diocletian retiring to grow cabbages, to modern founders abandoning million-follower accounts, we’ll dive into why this counterintuitive move is often the secret to long-term success. (Listen Notes)

• Norway should buy Harvard: Academic excellence has never been more affordable. (DN)

• Trump’s imaginary numbers, from $1.99 gas to 1,500 percent price cuts: The president likes to cite specific numbers to bolster his claims. They are often wildly improbable — or just impossible. (Washington Post)

• ‘Real-life Happy Gilmore’: Meet the hockey player who inspired the Adam Sandler movies. (New York Times)

• I Drank Every Cocktail: The International Bartenders Association, or IBA, maintains a list of official cocktails, ones they deem to be “the most requested recipes” at bars all around the world. It’s the closest thing the bartending industry has to a canonical list. As of 2025, there are 102 IBA official cocktails, and as of July 12, 2025, I’ve had every one of them. (Adam Aaronson)

Be sure to check out our Masters in Business interview this weekend with Erik Hirsch, Co-CEO Hamiliton Lane, which manages or advises on $958 billion in client assets. Previously, he was an M&A banker at Brown Brothers Harriman, and a municipal financial consultant with Public Financial Management, specializing in asset securitization, strategic consulting and sport stadium financings.

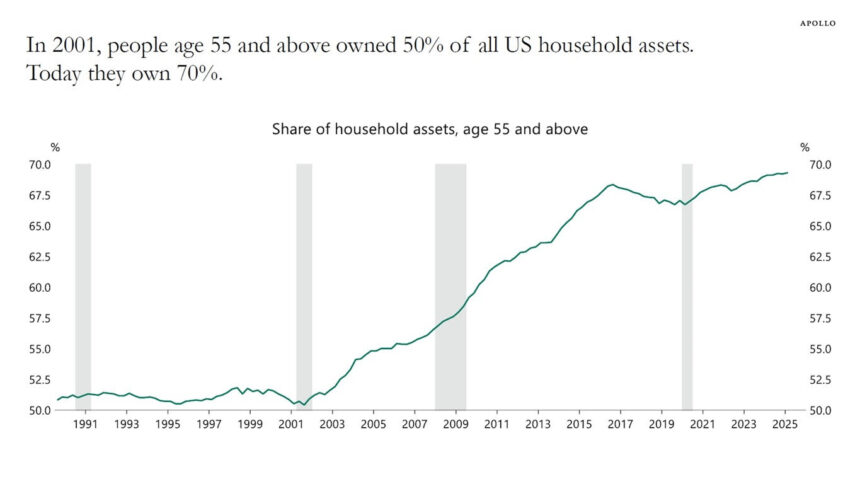

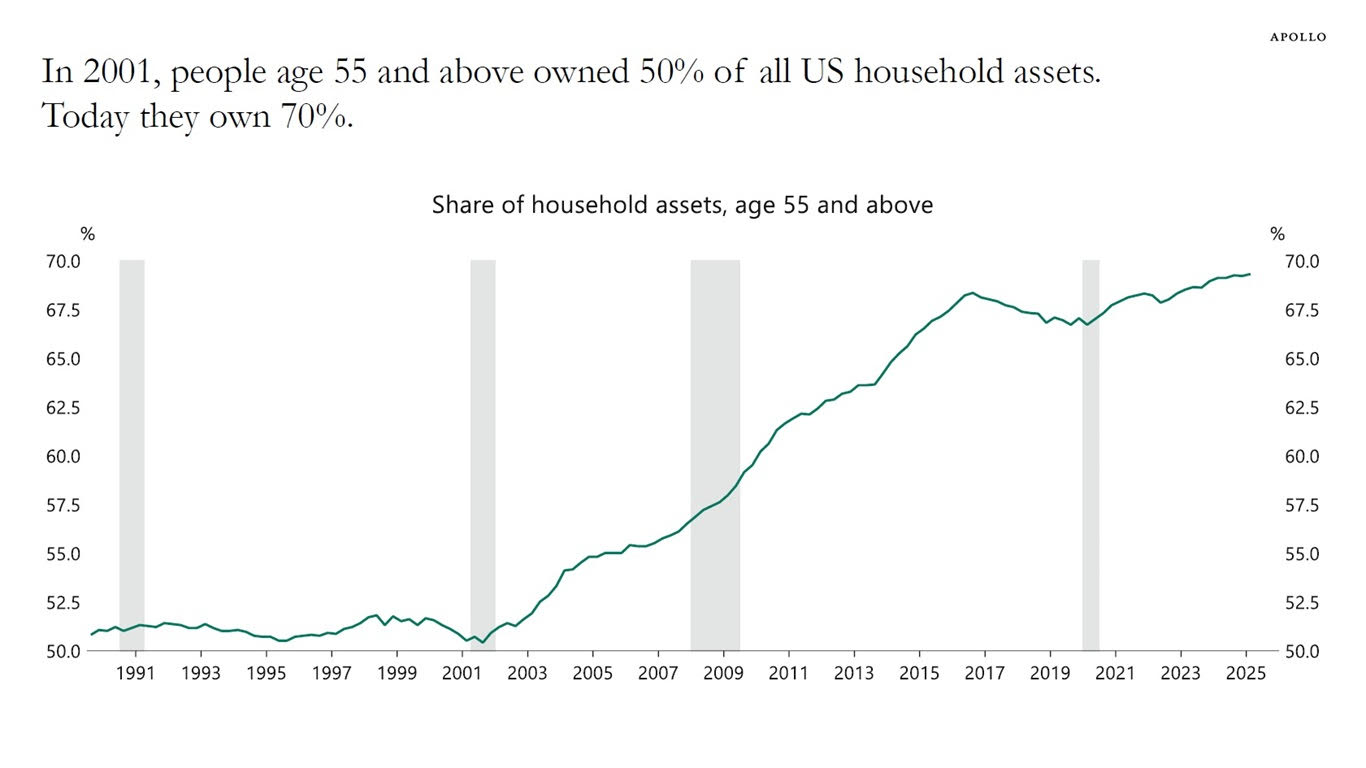

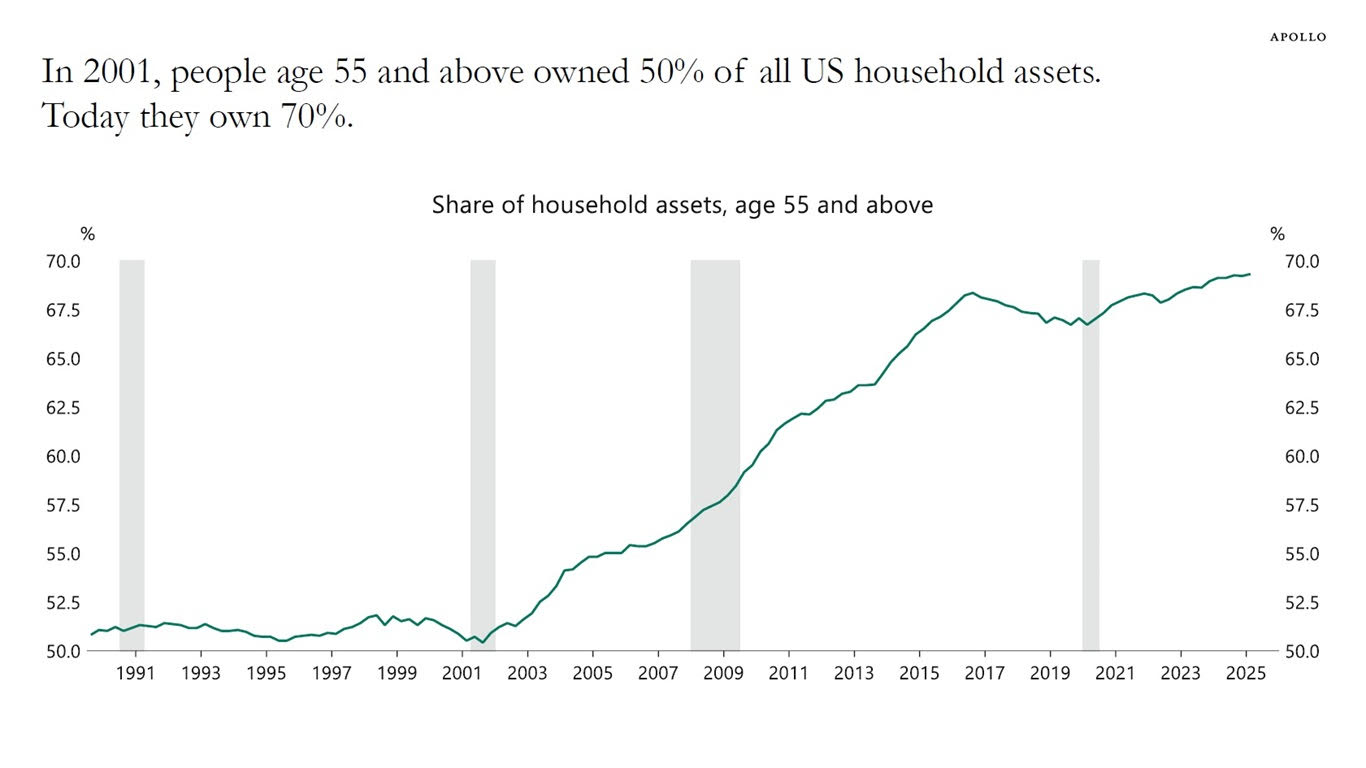

A growing share of US household assets is owned by people age 55+

Source: Apollo

Sign up for our reads-only mailing list here.