My back-to-work morning train WFH reads:

• Powell Is Giving the Market What It Wants, Not What It Needs: By any measure, the markets are partying hearty, with stocks hitting records, corporate credit spreads at quarter-century lows, plus myriad signs of speculative fervor. Those include margin debt topping $1 trillion for the first time, the revival of initial public offerings (most of which have experienced big opening-day price pops), record options activity, and even the revival of special purpose acquisition companies (SPACs), or blank-check companies for the next big thing. Those are hardly the circumstances suggesting the need for easier money. (Barron’s)

• Big Pharma Has a New Vision for Selling Drugs. It’s Going to the Mattresses. Amid pressure from the White House, U.S. drug companies are experimenting with direct-to-consumer sales models that cut out the middlemen. (Barron’s)

• Mortgage Amounts Relative To Housing Values Are Lowest Since Elvis. Housing narrative has shifted from sellers’ strength to buyers’ weakness; Home Equity has surged due to rising prices; Distressed Real Estate remains a rounding error. (Housing Notes)

• Trade Deal Could Give Japanese Cars a Leg Up in U.S. Market: President Trump’s 15 percent tariff on cars from Japan has angered U.S. automakers, which make cars in Canada and Mexico subject to 25 percent tariffs. (New York Times)

• Big Tech’s A.I. Data Centers Are Driving Up Electricity Bills for Everyone: Electricity rates for individuals and small businesses could rise sharply as Amazon, Google, Microsoft and other technology companies build data centers and expand into the energy business. (New York Times) see also AI Boom Reshapes Power Landscape as Data Centers Drive Historic Demand Growth: “The energy narrative in 2024 shifted from focusing on the urgency of the energy transition to the urgency of energy security,” (Power)

• We’ve Reached the Sad Cracker Barrel Stage of Cultural Evolution: Hey, I love American traditions as much as the next bumpkin. But Cracker Barrel isn’t a tradition by any stretch of the imagination. The company was founded on September 19, 1969. That’s exactly one month after the end of Woodstock. (The Honest Broker)

• Steve Wozniak on fighting internet scams. Wozniak was the inventor, Jobs was the master salesman; and when Wozniak created the Apple II, Jobs had something new to sell: the first personal computer to display color. “That was the machine that really made personal computers go, because it was so fun,” Wozniak said. “So many breakthroughs in there that are just so far out-of-the-box.” (CBS News)

• A New Discovery Might Have Just Rewritten Human History: Long before modern supply chains, ancient hominins were moving stone across long distances, potentially reshaping what we know about our evolutionary roots. (404)

• How Gavin Newsom trolled his way to the top of social media: Inside the MAGA-parodying strategy that has rocketed the California governor to algorithmic dominance — while annoying leading Republicans. (Politico) see also MAGA World Is So Close to Getting It: Gavin Newsom’s parodies are riling people up—and they don’t quite seem to understand why. (The Atlantic)

• How Your Phone Gets the Weather: The more weather observations meteorologists can rely on, the more precise their forecasts will be. Here’s what goes into an accurate forecast. (New York Times)

Be sure to check out our Masters in Business this week with Ellen Zentner, Chief Economic Strategist and Global Head of Thematic and Macro Investing for Morgan Stanley Wealth Management. The firm manages over $7 trillion in assets.

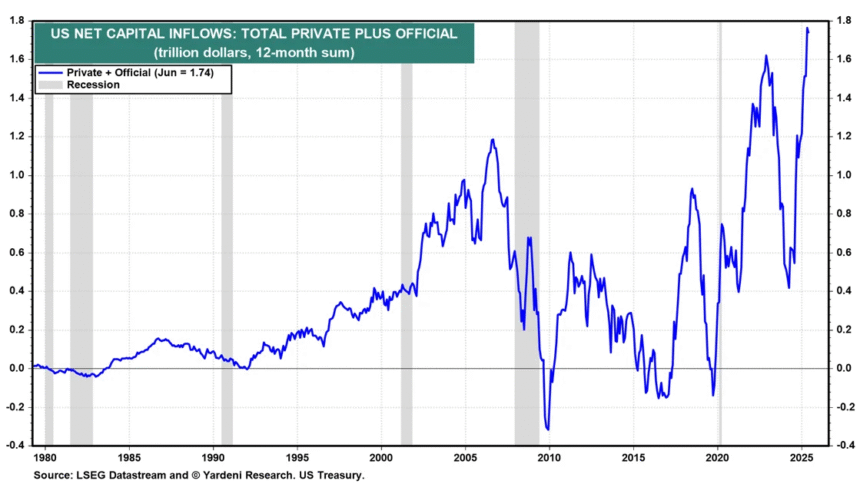

Foreign Investors Aren’t Following The Dollar-Is-Bad Script

Source: Yardeni Research

Sign up for our reads-only mailing list here.