My back-to-work morning train WFH reads:

• Sell Rosh Hashana; Buy Yom Kippur: This seasonal stock-market trading pattern is coming up — and worth observing The Wall Street adage — ‘Sell Rosh Hashana; buy Yom Kippur’ — focuses on the market’s performance between these two Jewish holidays. (Marketwatch)

• Low-income Americans slash spending, a worrying sign for the economy: Spending is softening in a “fragmented way,” analysts warn, and even wealthy Americans are scaling back. (WaPo) see also The Two-Speed Economy Is Back as Low-Income Americans Give Up Gains: High-earners and older Americans are faring better than ever, while fortunes are sliding again for low-wage and young workers. (Wall Street Journal)

• Cash Yields Are Going Down. Here’s Where to Move Your Money. The Fed’s expected rate cuts will squeeze yields on cash while borrowers may get a break on loans. How to make the most of it. (Barron’s)

• ‘Underwater’ car trade-ins are at a 4-year high: What that means when buying a new vehicle: Edmunds notes that about 26.6% of trade-ins toward new car purchases had negative equity in the Q2 2025. That is up from 26.1% in the first quarter of the year. Being “underwater,” “upside down” or having negative equity on a car loan is when someone owes more on the auto loan than what the vehicle is worth. (CNBC)

• Brendan Carr Isn’t Going to Stop Until Someone Makes Him: In the wake of Jimmy Kimmel’s suspension, experts say the FCC commissioner’s conduct is flatly unconstitutional. They also expect him to keep going. (Wired) see also The Billionaire Trump Supporter Who Will Soon Own the News: Larry Ellison is already a major stakeholder in CBS and Paramount. Now CNN, HBO and a major share of TikTok are in his sights. If all goes as anticipated, this tech billionaire, already one of the richest men in the world and a founder of Oracle, is poised, at 81, to become one of the most powerful media and entertainment moguls America has ever seen. (New York Times)

• Demand for Data Centers, Energy Creates a Gold Rush for Infrastructure Investors: Asset owners and managers are pouring hundreds of billions into the construction of infrastructure for the AI ecosystem, although the horizon is not entirely clear. (Chief Investment Officer)

• Legal Eagle’s Specialty is Writing Ironclad PBM Contracts that Preclude Egregious Pricing: A veteran PBM litigator explains how she uses airtight contracts to help employers fight PBM shell games, inflated rebates and hidden markups.(Health Care Un-Covered)

• Scientists went hunting for freshwater deep beneath the Atlantic Ocean. What they found could have global implications: The existence of freshwater beneath the Atlantic has been known for decades, but it had remained virtually unexplored. In the 1960s and 70s, scientific expeditions and companies drilling the ocean for resources such as oil would sometimes hit fresh water. (CNN)

• The Forever-35 Face: The face-lift is better than ever, and everybody wants one. Deep inside the uncanny world of the surgically ageless. (The Cut)

• The Interview What Happened to Cameron Crowe? He Has Answers. Cameron Crowe’s adolescence was, figuratively and literally, the stuff of a Hollywood movie. As a teenager in the ’70s, he started writing for Rolling Stone, going on the road and hanging out with the likes of Led Zeppelin, the Eagles and David Bowie. Crowe would eventually turn those experiences into his classic 2000 film, “Almost Famous,” which he wrote and directed and which won him an Academy Award for best original. (New York Times)

Be sure to check out our Masters in Business this week with Jaime Magyera, Head of U.S. Wealth & Retirement Business at BlackRock. She has driven the firms adoption of alternatives as a fast growing part of the Blackrock platform for advisors and RIAs. The firm manages over $11 trillion in client assets, and Magyera’s Wealth and Retirement divisions are a substantial portion of that.

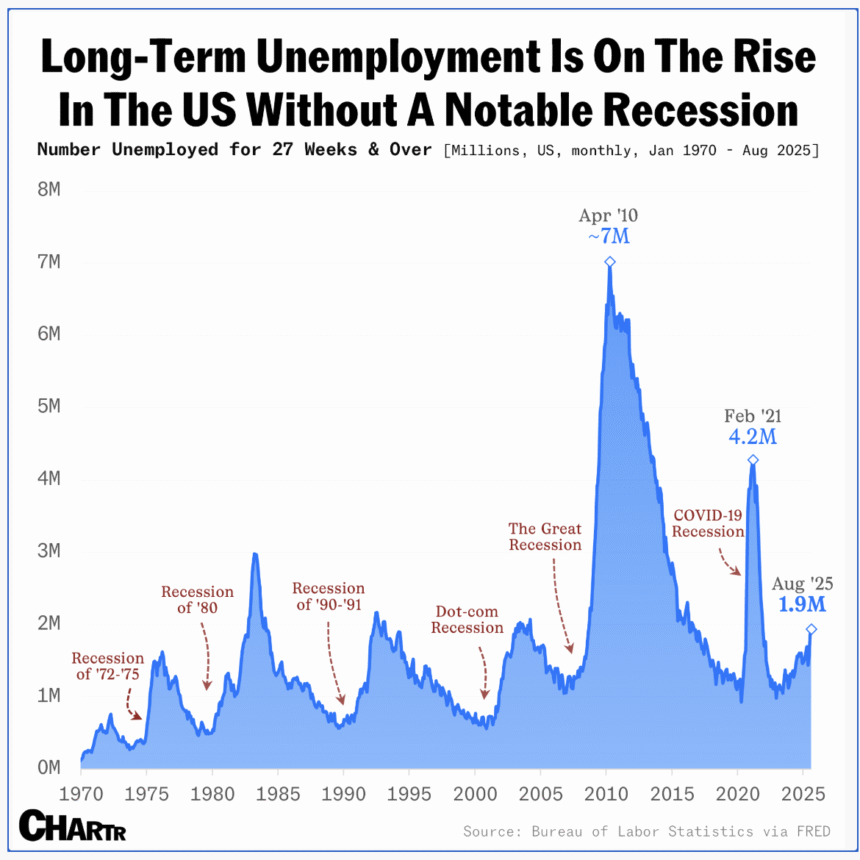

Long-term unemployment in the US has risen to a postpandemic high

Source: Sherwood

Sign up for our reads-only mailing list here.