My back-to-work morning train WFH reads:

• Volatility Is Back in the Stock Market. Here’s the Zen Way to Handle It. The S&P 500 fell 2.7% this past Friday, ending a 33-day streak without a 1% move and highlighting renewed market volatility. Diversification beyond the S&P 500 is recommended, with international stocks up 26% year to date versus 13% for the S&P 500. (Barron’s)

• Apple’s biggest iPhone overhaul in years ignites upgrade frenzy: Extended wait times and generous trade-in deals signal surging demand for newly redesigned device. (Financial Times)

• How Palantir’s CEO forged a connection with investors by writing spicy shareholder letters that quote philosophers and skewer ‘technocratic elites’. Somewhere along the way, Karp changed his tune. He has done the earnings calls since Palantir went public, and about two years after that, Karp started carving out additional time to pen lengthy missives in the form of shareholder letters. Alongside the company’s financial results, Karp fills the letters with the sorts of topics most executives bend over backwards to avoid: global politics, philosophy, or even religion. You may not like what Karp has to say, but one thing is guaranteed: It’s going to be interesting.(Fortune)

• More Working-Class Americans Than Ever Are Investing in the Stock Market: For the first time, a majority of low earners have an investment account, and more than half of those new investors entered the markets in the past five years. (Wall Street Journal)

• Robinhood Is Banking on Babies and 401(k)s to Get Everyone Trading: After making its name on millennials and meme stocks, the popular brokerage app is riding its Trump bump into the S&P 500 and beyond. (Bloomberg)

• Setting the record straight: The truths about index fund investing: Index fund investing has numerous benefits, including lower costs, diversification, tax efficiency, and relative return predictability; The increased adoption of index fund investing has heightened emphasis on the binary labels of “passive” and “active,” as if all index funds can be described as a monolithic, homogeneous strategy. This has led to many faulty assertions about index fund investing; Our analysis dispels assertions tied to the growth of index fund investing and offers evidence that refutes key misperceptions. (Vanguard)

• Mad Libs: just fill in the blanks. the upshot is that 12-15 House seats could conceivably switch parties before the midterm elections, although the actual number is likely to be less than that. (JPM)

• Shohei Ohtani just played the greatest game in baseball history: On a night of legendary excellence, Ohtani hit three home runs and pitched six-plus scoreless innings to lift the Dodgers to the National League pennant. (Washington Post)

• The Exercise That Takes Off 20 Years: There are several simple tests that can be done at home in order to check our current strength level and to show us where we may need to improve. (Vogue) see also Wait, Are Carbs Actually Awesome? The carb is 180-years old this year. Why are we still so scared of it? (Men’s Health)

Be sure to check out our Masters in Business interview this weekend with Henry Ward, CEO and co-founder of Carta. The firm works with more than 50,000 companies, 8,500 investment funds, and 2.5+ million equity holders to manage capitalization tables, compensation, valuations, and liquidity, tracking over $2.5 trillion in company equity.

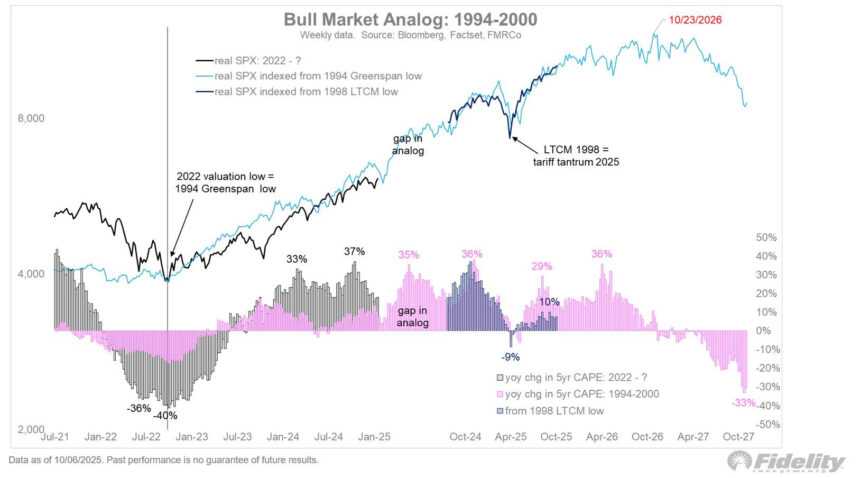

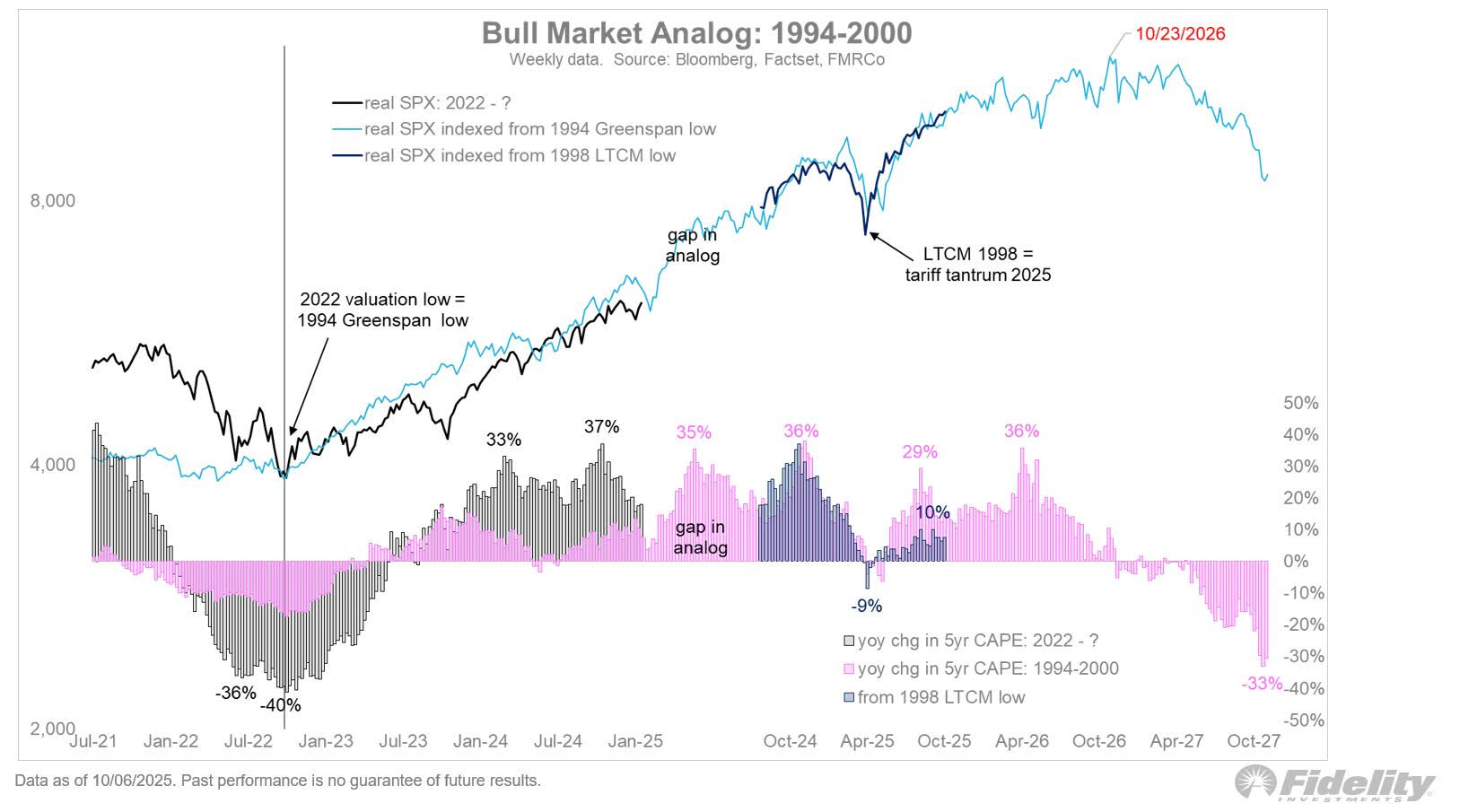

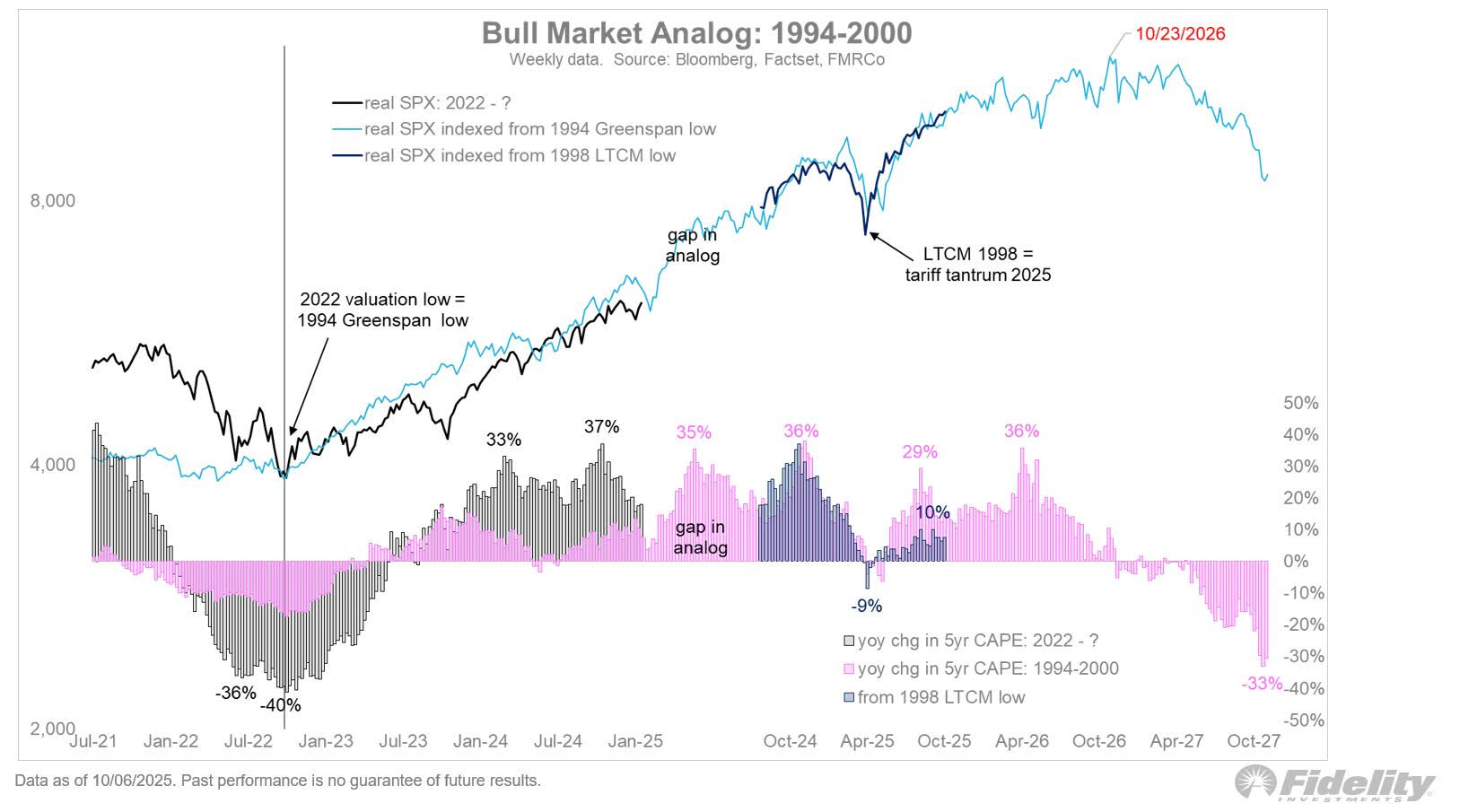

Like Greenspan in late 1998 (LTCM), Powell cut rates even as the S&P 500 was soaring to new highs and sentiment was getting frothy

Source: LinkedIn

Sign up for our reads-only mailing list here.