My back-to-work morning train WFH reads:

• How Many Stocks Outperform the Stock Market? By my calculations, 149 stocks outperformed the index in the five years ending 2020. That’s around 30% of the total. That’s a fairly low number. In the last 5 years, 241 stocks outperformed the S&P 500’s return. That’s more like 50% of the total. That’s not bad. So how many outperformed over both periods? (A Wealth of Common Sense)

• Gambling. Investing. Gaming. There’s No Difference Anymore. This industry has been gamifying the investing experience; on brightly colored smartphone apps, risking your money is as easy and attractive as playing Candy Crush. On the app of the investment brokerage Robinhood, users can now buy stocks on one tab, “bet” on Oscars outcomes on another and trade crypto on a third. (New York Times) see also Popular Leveraged Funds Shock Investors With Huge Losses: Some funds offering to double single-stock moves have veered sharply off course from the shares they track. (Wall Street Journal)

• Are Investors Ignoring Red Flags in the Stock Market? Stocks keep marching higher, but there are signs of strain under the surface. (Morningstar)

• USA’s EV retreat is a huge win for No. 1 trade rival China. EV sales in the US are expected to fall since President Donald Trump ended a $7,500 consumer tax credit. Elsewhere in the world, EV sales by Chinese rivals are gaining steam. (CNN)

• The Tariff Vindication That Wasn’t: Matthew Lynn would have us believe that tariffs are being paid almost entirely by foreign countries, but really, tariff revenues come straight from the American people. (Law & Liberty)

• Largest study of its kind shows AI assistants misrepresent news content 45% of the time – regardless of language or territory: New research coordinated by the European Broadcasting Union (EBU) and led by the BBC has found that AI assistants – already a daily information gateway for millions of people – routinely misrepresent news content no matter which language, territory, or AI platform is tested. (BBC)

• Michigan’s Cheap Weed Just Went Up in Smoke: The 24% tax may only be the beginning of a wider crackdown for the Wolverine State’s marijuana industry. (Slate)

• Your Brain’s Memory of a Story Depends on How It Was Told: Telling the same story in different ways can change the brain networks that the listener uses to form memories (Scientific American)

• Holy Warrior: Pete Hegseth is bringing his fundamentalist interpretation of Christianity into the Pentagon. (The Atlantic) see also Pentagon announces a new right-wing press corps after mass walkout: A new crop of conservative media and influencers — including the Gateway Pundit, the Post Millennial, Human Events and the National Pulse — signed an agreement with the Defense Department. (Washington Post)

• Out to Pasture: Why Hollywood’s Animal Actors Can’t Find Work: They’ve helped fetch Oscars, boosted box office and upstaged their A-list co-stars — but these days, Hollywood’s animals can’t seem to book a gig. (Hollywood Reporter)

Be sure to check out our Masters in Business interview this weekend with Liz Ann Sonders, Chief Investment Strategist, Charles Schwab & Co. Named “Best Market Strategist” by Kiplinger’s Personal Finance, she is also on Barron’s “100 Most Influential Women in Finance” every year since the list’s inception.

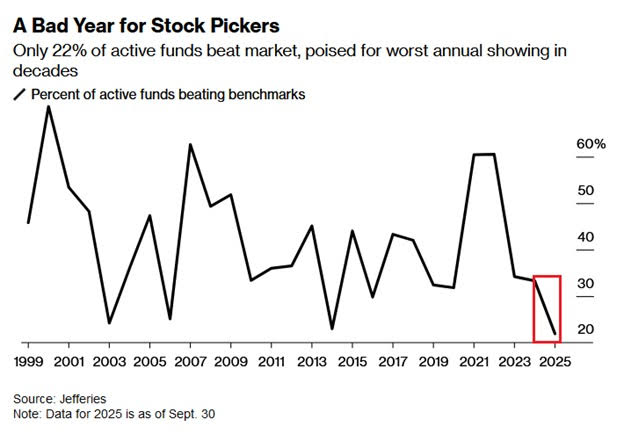

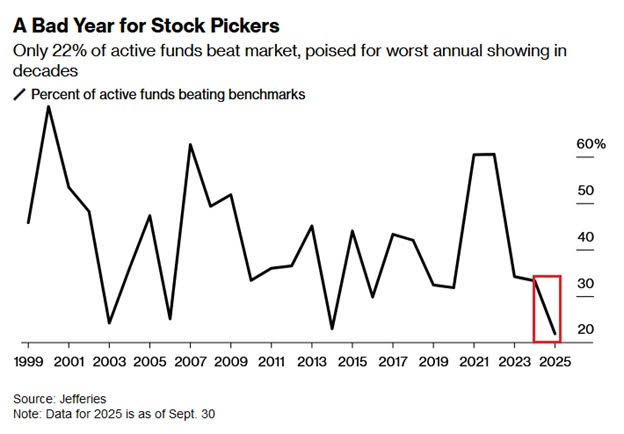

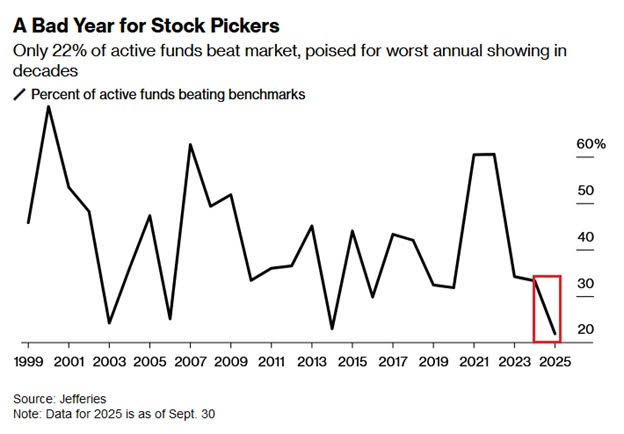

Only 22% of active funds have beaten the market YTD, the worst performance in at least 26 years

Source: Bloomberg

Sign up for our reads-only mailing list here.