My back-to-work morning train WFH reads:

• The origin of Daylight Saving Time is all about business — not farmers: Farmers actually hated Daylight Saving Time. But it was and always has been good for one thing: selling stuff. (Quartz)

• How your cognitive biases lead to terrible investing behaviors: “Let me walk you through the biggest traps that you should be aware of that are a danger to your financial wellbeing.” (Big Think)

• Why Is Everything Turning into a Casino? I share seven rules of casino management—see how many apply now to legit businesses. (The Honest Broker)

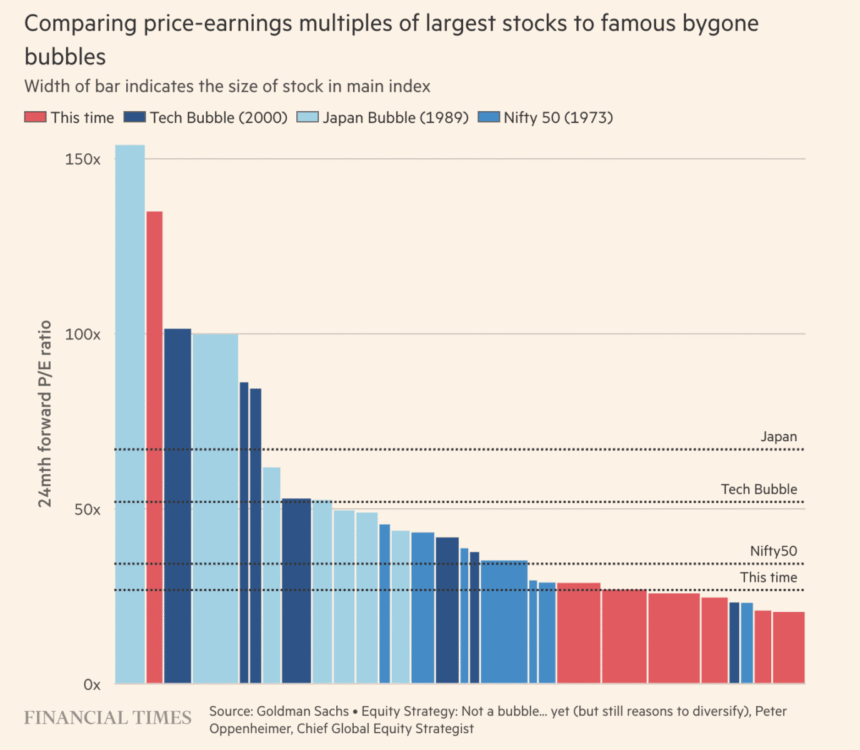

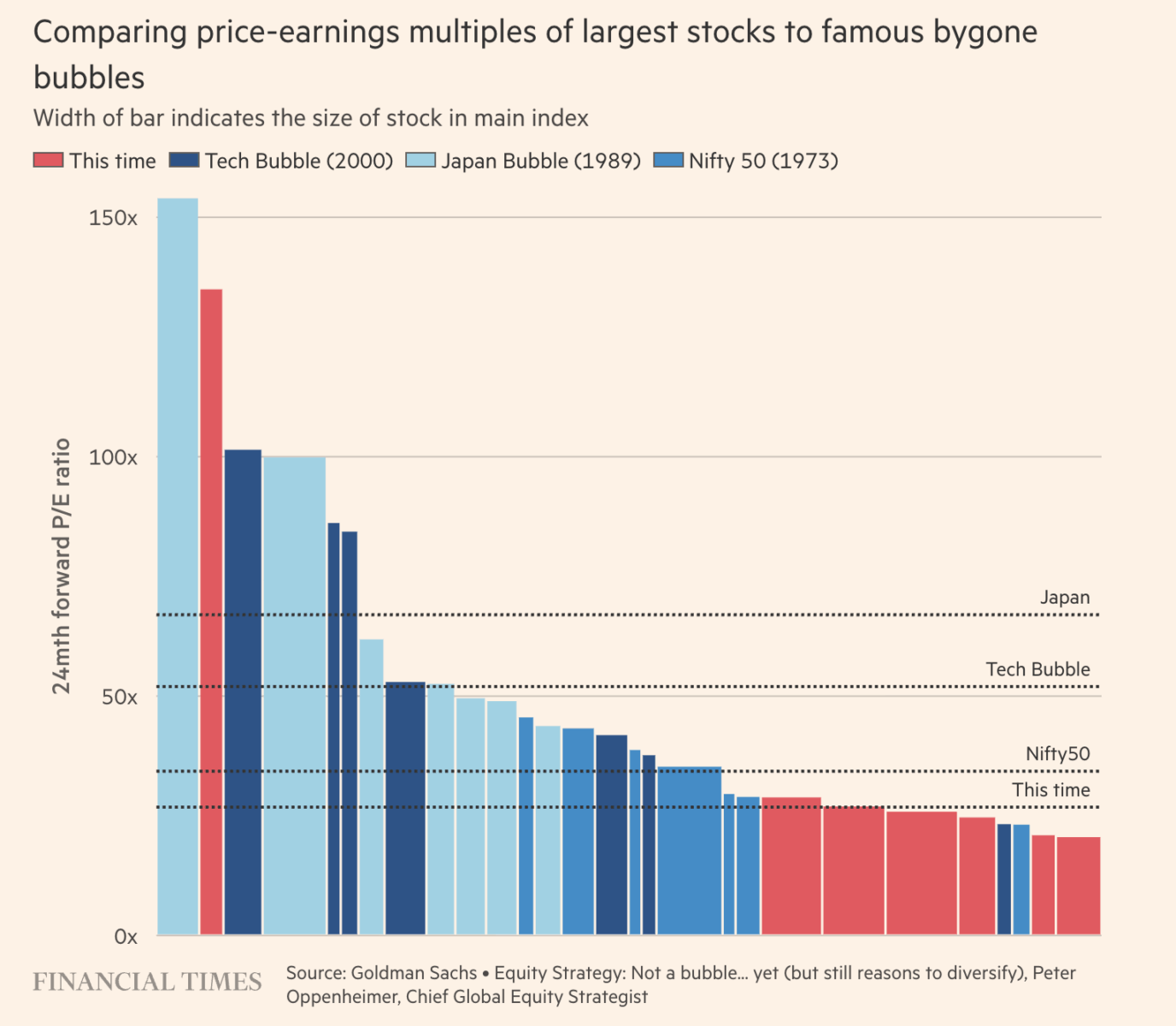

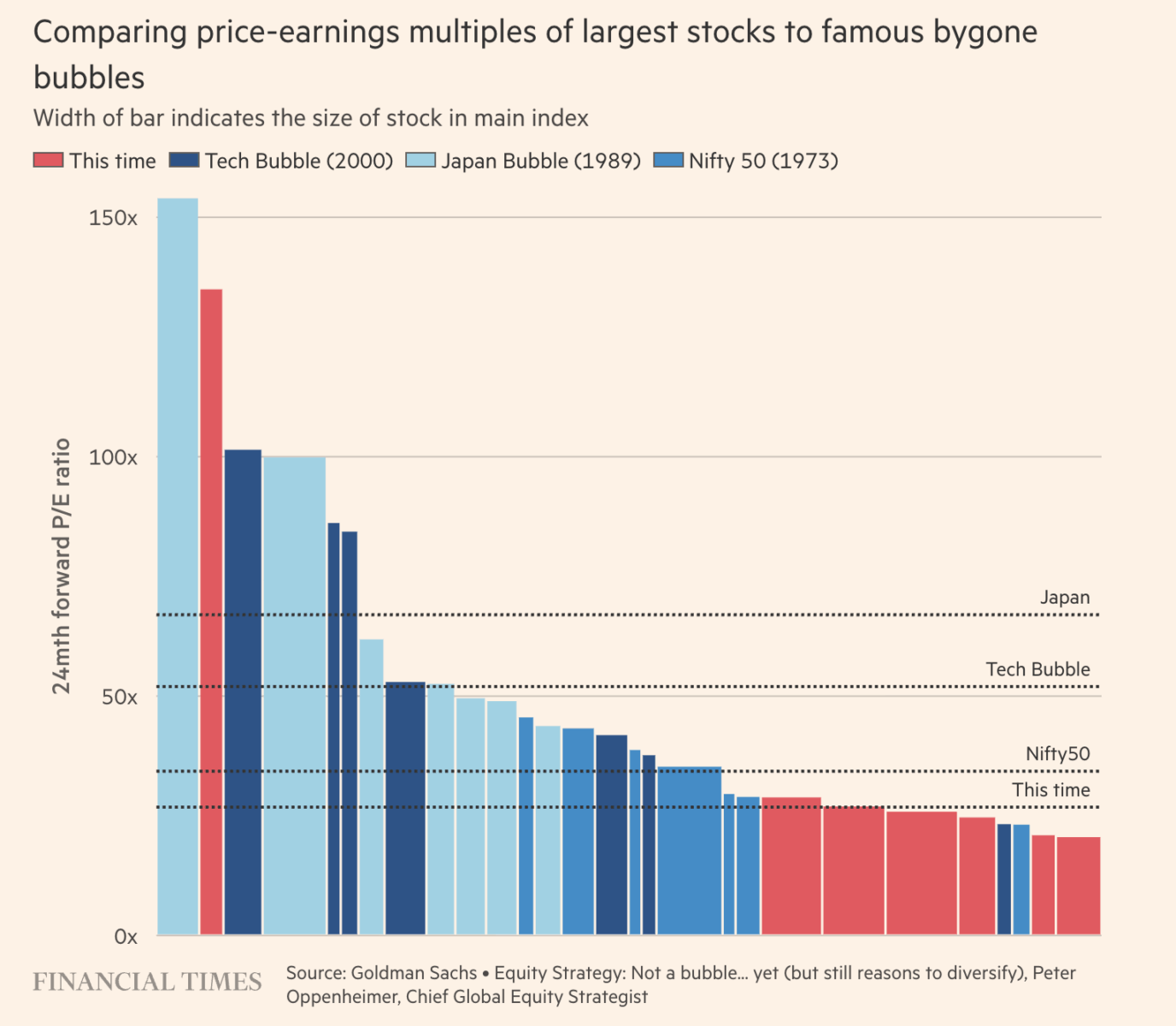

• Why we are not in a bubble… yet: History suggests that bubbles are often driven by exuberance that builds around a transformative technology, attracting investors, capital and new entrants. Typically, bubbles exhibit rapidly rising asset prices, extreme valuations and significant systemic risks driven by increased leverage. (Goldman Sachs)

• How Affluent Investors Are Using Options Math to Borrow on the Cheap: Box spread loans, also called synthetic borrowing, require sizable portfolios to back them and offer speed, flexibility, and often a lower cost than traditional bank credit, plus potential tax advantages. The approach is catching on among wealth advisers, with SyntheticFi bringing on over 100 financial advisers to guide clients through the process, and Vest Financial launching its synthetic-borrow platform, which delivers institutionally priced financing to the retail market. (free)(Bloomberg)

• Senate passes bill to nullify Trump’s sweeping global tariffs on more than 100 nations: Vote passes 51-47 in latest bipartisan effort to challenge tariffs, but House is unlikely to take any similar action. (The Guardian)

• We Spent the Night Shift With the Repo Man, Who Is Busier Than Ever: Car repossessions are on the rise as delinquency rates on some auto loans hit record levels; drivers hunt for cars and opportunity as business model shifts. (Wall Street Journal)

• Analysis of 150 U.S. Cities Shows One of the Greatest Drops in Gun Violence — Ever: The downward trend cuts across red and blue cities and states in every region of the country. A steep spike beginning in 2020 or slightly after, coinciding with the peak of the COVID-19 pandemic and Black Lives Matter protests. Then, a similarly high number of shootings in 2022, followed by steep decreases from 2023 on. Cities like Detroit and Philadelphia are now seeing the lowest rates of gun violence in decades. (The Trace)

• New evidence reveals dinosaurs were thriving right up to the moment the asteroid hit: Newly dated fossils from New Mexico challenge the idea that dinosaurs were in decline—and suggest instead they had formed flourishing communities. (National Geographic) see also A ferocious debate over teenage T. rex fossils may finally be settled: For decades, paleontologists debated whether fossils were of a young T. rex or a species called nanotyrannus. A new study settles it: Nanotyrannus is real. (Washington Post)

• Everybody Wants This! How a Netflix Rom-Com Went From Near Implosion to Cultural Obsession From a first season of scrapped scripts and sparring producers to a hit crackling with chemistry: The cast and creator of ‘Nobody Wants This’ reveal the backstory of fall’s most anticipated return. (Hollywood Reporter)

Be sure to check out our Masters in Business interview this weekend with Jon Hilsenrath of Serpa Pinto Advisory. Previously, he was chief economics correspondent for Wall Street Journal for 26 years. Dubbed the “Fed Whisperer” by Wall Street traders for his scoops on the FOMC, he worked out of Hong Kong, NY, and D.C. He was part of the Pulitzer Prize-winning team for on-scene coverage of 9/11. He is the author of “Yellen: The Trailblazing Economist Who Navigated an Era of Upheaval.”

Is it really a bubble?

Source: Financial Times

Sign up for our reads-only mailing list here.