My off-to-vacation morning plane reads:

• The Concentration Bears Have Steered You Wrong: This consistently misguided argument against staying invested is looking dumber than ever. (Downtown Josh Brown)

• Tesla is the most unreliable used car brand in America, even behind Jeep and Chrysler: Older Teslas rank dead last in Consumer Reports study, but newer models show improvement (Techspot) see also Tesla’s Cybertruck is turning 2. It’s been a big flop. CEO Elon Musk once described the Cybertruck as Tesla’s ‘best ever’ product. But demand for the controversial pickup truck has dried up. (Marketwatch)

• Great Income Squeeze Begins as Fed Spells End to Easy Yields. The days of easy returns for income investors are vanishing as the Federal Reserve is cutting rates, dragging yields down from their post-pandemic highs. Conventional alternatives, such as corporate bonds and global equities, look richly priced, leaving less cushion and fewer obvious paths forward for income-focused portfolios. Investors are looking to alternative investments: high yield, emerging-market debt, and private credit. (Bloomberg free)

• Why It’s a Tough Time for House-Flippers: It seems like a pretty easy way to get rich quick. But for every success story, there are many tales of flips gone bad. (Wall Street Journal)

• How Japan Built a Rare-Earth Supply Chain Without China: The 15-year effort by Japan is a model for countries now scrambling to reduce their dependence on Beijing’s critical metals. (New York Times)

• New York’s Golden Handcuffs: Why the City Has a Special Hold on the Rich: Of the world’s 500 wealthiest people, 23 call New York City home, with a combined net worth of nearly $450 billion, according to the Bloomberg Billionaires Index, and many more come through town as often as time and their tax situations allow. Depleting this resource could devastate the city. (Businessweek)

• States Are Raking In Billions From Slot Machines on Your Phone: Online casinos have proved to be a much stronger source of tax revenue than sports betting apps. They may be coming to a state near you. (New York Times)

• What if Our Ancestors Didn’t Feel Anything Like We Do? The historians who want to know how our ancestors experienced love, anger, fear, and sorrow. (The Atlantic)

• Will AI make research on humans…less human? It’s been a long road to ensure that testing on human subjects is ethical. AI could send us backward. (Vox) see also Anthropic is all in on ‘AI safety’—and that’s helping the $183 billion startup win over big business: Founders Daniela and Dario Amodei have made Anthropic and its Claude models the AI many companies prefer over rivals OpenAI and ChatGPT. (Fortune)

• Robot smaller than grain of salt can ‘sense, think and act’ With solar cells and its own propulsion system, the device is a step toward sending robots into the human body. (Washington Post)

Be sure to check out our Masters in Business interview this weekend with Stephen Cohen, BlackRock Chief Product Officer and Head of Global Product Solutions. He is a member of BlackRock’s Global Executive Committee. Previously, he was Global Head of Fixed Income Indexing (iShares); and Chief Investment Strategist for International Fixed Income and iShares. Blackrock manages $13.5 trillion in AUM; its iShares division is over $5 trillion.

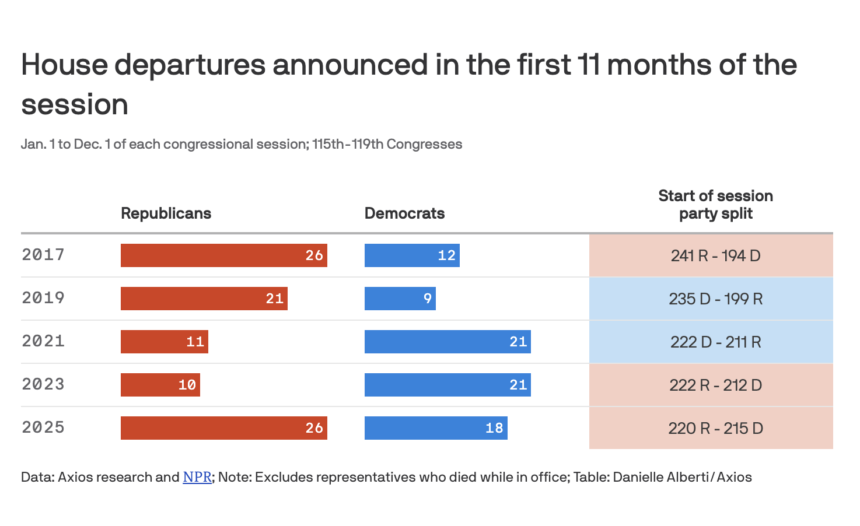

House departures announced in the first 11 months of the session

Source: Axios

Sign up for our reads-only mailing list here.