My back-to-work morning train WFB reads:

• What Does ‘Financial Independence’ Mean, Anyway? Money Pros Weigh In. The definition of financial independence is a little different for everyone. Here’s what financial advisors say. (Barron’s)

• Trump Said Trade Deals Would Come Easy. Japan Is Proving Him Wrong. Difficult talks with many nations cast doubt on next week’s deadline; ‘We can do whatever we want,’ Trump said. (Wall Street Journal)

• The Whole Country Is Starting to Look Like California: Housing prices are rising fast in red and purple states known for being easy places to build. How can that be? (The Atlantic)

• China snaps up mines around the world in rush to secure resources: Dealmaking hits highest level since 2013 as groups seek raw materials that underpin global economy. (Financial Times)

• This Is Why High-End Electric Cars Are Failing: There’s a simple reason why high-end EVs have failed to spark the imaginations of auto buyers. To remedy this, manufacturers need to revisit the days of the Model T. (Wired)

• Microsoft claims AI diagnostic tool can outperform doctors: Research is first initiative from Big Tech group’s AI health unit formed by ex-DeepMind co-founder Mustafa Suleyman. (Financial Times)

• How Two Neuroscientists View Optical Illusions: The Best Illusion of the Year contest offers researchers, and participants, an opportunity to explore the gaps and limits of human perception. (New York Times)

• America Has Pulled Off the Impossible. It Made Getting a Passport Simple. Washington isn’t known for tech innovation. How did a team of bureaucrats put their stamp on a process that hadn’t changed in 50 years? (Wall Street Journal)

• Hurricane Science Was Great While It Lasted: The U.S. is hacking away at support for state-of-the-art forecasting. (The Atlantic)

• He’s Ringo. And Nobody Else Is. As he turns 85, one of the last surviving Beatles is still musically curious, dispensing his signature wisdom, and preaching the gospel of peace and love. (New York Times)

Be sure to check out our Masters in Business next week with Kate Moore, Chief Investment Officer of Citi Wealth; responsible for overseeing investments, portfolio strategy and asset allocation for the trillion dollars Citi Wealth manages. Previously, she was Head of Thematic Strategy and PM for the Global Allocation Fund at BlackRock.

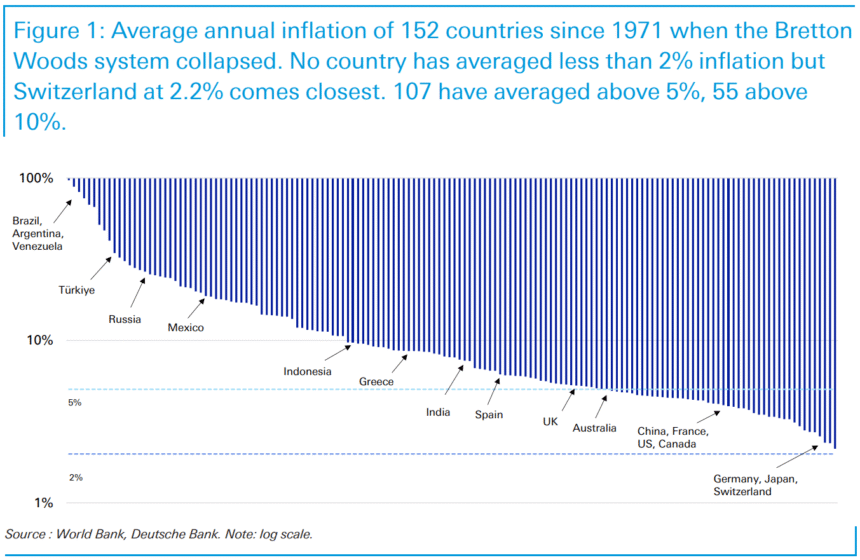

Since the Bretton Woods system collapsed in 1971, none of the 152 countries we have global data for have managed to keep average annual inflation below 2%.

Source: Jim Reid, Deutsche Bank

Sign up for our reads-only mailing list here.