My back-to-work morning train WFH reads:

• Want to Be a 401(k) Millionaire? Start With These Fixes. The stock market gains about 10% a year, but your savings may be falling behind. Here’s how to make the most of your 401(k). (Barron’s)

• Investors Are Flocking to the Stock Market’s Discount Rack: Pricey tech heavyweights send some individuals in search of bargains. (Wall Street Journal) see also Investors See Few Alternatives to U.S. Treasuries. Could Europe Make One? As President Trump’s chaotic economic policies provoke questions about U.S. stability, a proposal for European countries to issue joint debt has drawn attention. (New York Times)

• She Gave Away Her Inheritance. Now What? Austrian heiress Marlene Engelhorn started giving away her money in her 30s, but she’s finding that exiting the 1% is about more than just wealth. (Bloomberg)

• Third Point Is Not the Firm You Think It Is: Once famed for Dan Loeb’s blistering activist letters, Third Point is now quietly reshaping itself into more of a credit-driven manager. (Institutional Investor)

• Sales Are Down While Mortgage Applications Are Up: “Existing home sales are down, but prices are up. New home sales are up, but new home prices are down. Renters in the suburbs have doubled over the past 5 years. Mortgage applications have been increasing, yet cash sales are also rising.” (Housing Notes)

• They’re rich. They’re anti-Trump. And they don’t want their big tax cut. Affluent voters have become more Democratic in recent years — and are also some of the biggest winners in the GOP tax bill. (Washington Post)

• ‘If I switch it off, my girlfriend might think I’m cheating’: inside the rise of couples location sharing: Many apps like Find My allow us to follow our loved ones at all times. But just because we can, does it mean we should? (The Guardian)

• Humanlike? Interpreting the emotional lives of animals requires a subtler and more nuanced understanding of anthropomorphism. (Aeon)

• Driving Cross Country? Here Are the Apps You Want Riding Shotgun: On a road trip from New York to Los Angeles (and back), a writer found digital tools that helped her navigate and find a cornucopia of “weird attractions.” (New York Times)

• Pamela Anderson Forever: Alert the incels! The rest of us love her, and we will always love her. (The Atlantic)

Be sure to check out our Masters in Business interview this weekend with Sonal Desai, Chief Investment Officer of Franklin Templeton Fixed Incomem, managing $215 billion in AUM in Multi-Sector, Global, Corporate Credit, Securitized Products, Municipal Bonds, Stable Value, and ST Liquid Markets Fixed Income. She has been named to Barron’s annual list of the 100 Most Influential Women each year since 2020.

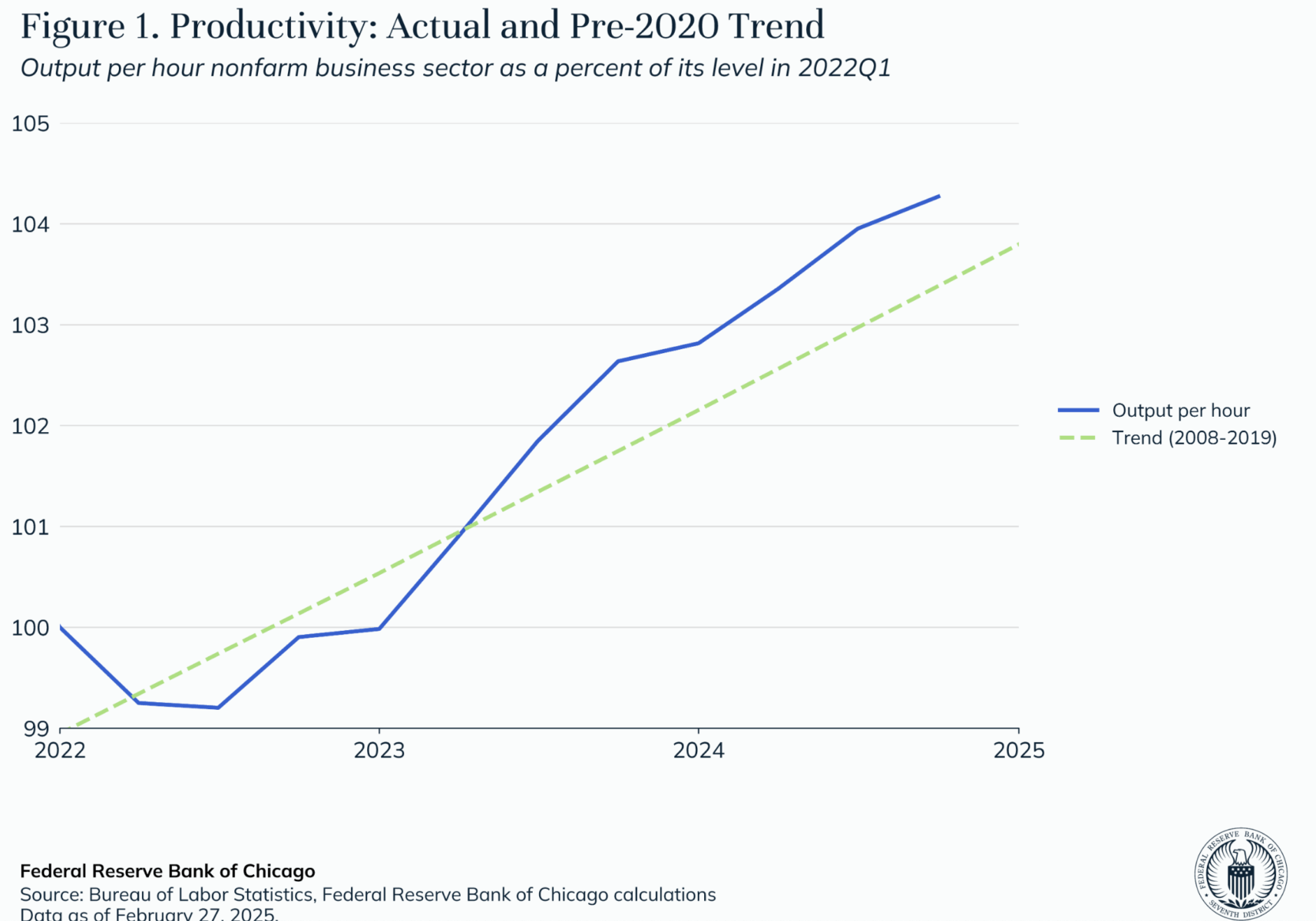

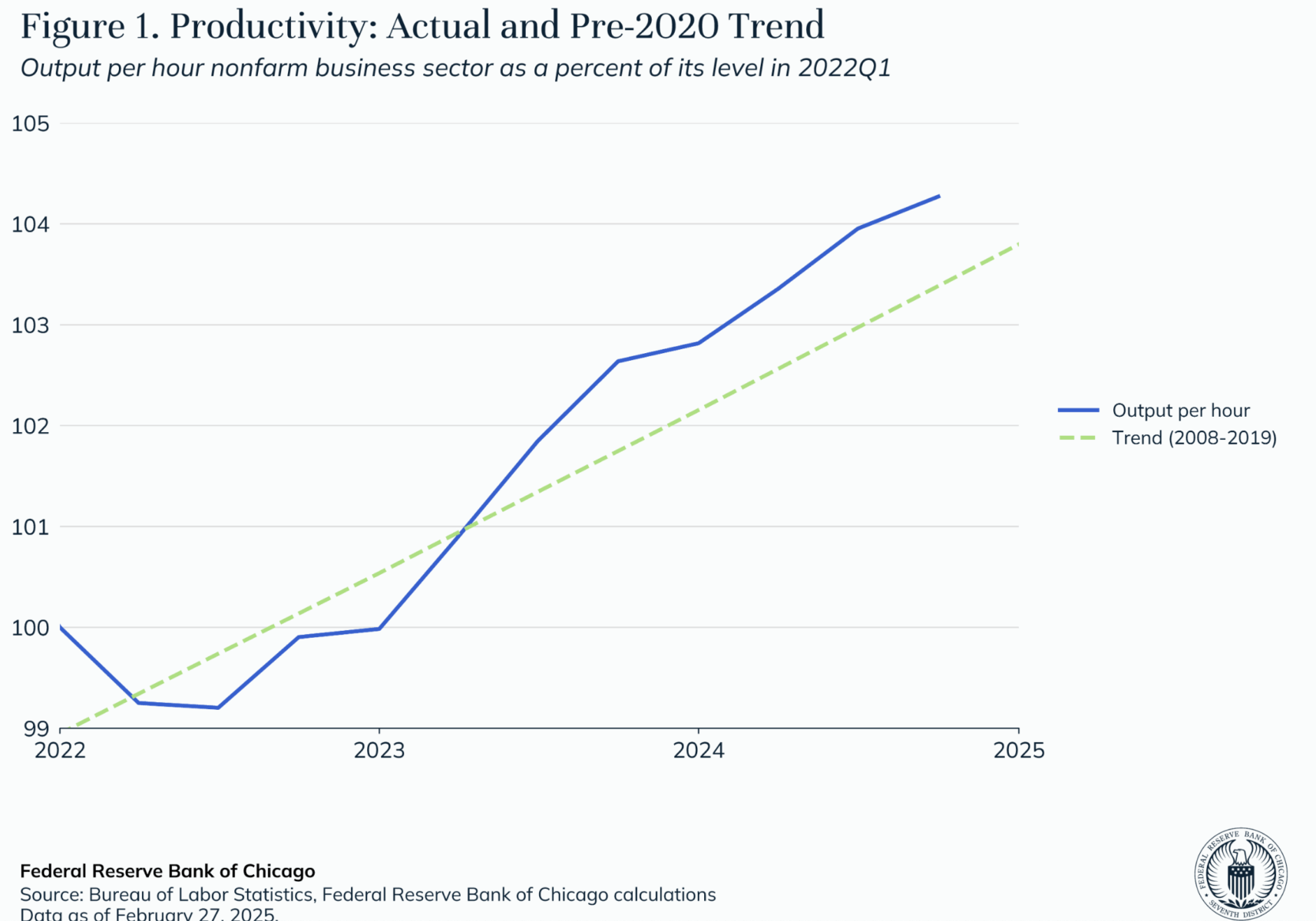

Productivity Growth and Monetary Policy

Source: Federal Reserve Bank of Chicago

Sign up for our reads-only mailing list here.