My morning train WFH reads:

• The Myth of the Stock-Picker’s Market: Investors, be warned: Hope springs eternal, but outperformance is rare. (Morningstar)

• Brokerages Battle to Win Over Active Investors. Trading Platforms Are the New Arms Race. They’re launching more-powerful trading tools and surprising new features in hopes of attracting more of these highly profitable customers. (Barron’s)

• Trump says inflation is dead. Most data says: Not quite. The White House points to a seven-month snapshot showing low inflation, but economists say prices are closer to 3 percent. The shutdown delays fresh data. (Washington Post)

• How China Took Over the World’s Rare-Earths Industry: Beijing used bare-knuckle tactics in multidecade effort to consolidate control over supplies. (Wall Street Journal)

• Down and Out on the Crypto Frontier: In Wyoming, the Delaware of cryptocurrency, industry players celebrated their fortunes and said everyone will benefit. But workers haven’t seen it. (The American Prospect)

• What it looks like in the world’s data center capital: Among cemeteries, baseball fields and homes, these Northern Virginia buildings power the internet. (Washington Post) see also Renewable Energy Is Booming Despite Admin’s Efforts to Slow It: With federal subsidies ending or becoming hard to claim, companies are racing ahead with solar, wind and battery projects. (New York Times)

• Brains Remember Stories Differently Based on How They Were Told: Telling the same story in different ways can change the brain networks that the listener uses to form memories (Scientific American)

• Will Trump Do It? It Pays to Bet ‘No’: Polymarket data shows wagers against Trump taking action would have yielded returns similar to the S&P 500. And gambling that he’ll actually follow through was a losing proposition. (Bloomberg)

• The most (and least) entertaining NBA teams to watch this season: Before the new NBA season tips off, we ranked all 30 teams to help you decide who is worth tuning in to see. (Washington Post)

• How Kevin Costner Lost Hollywood: On-set brawls. Courtroom battles. Epic bombs. Why the world’s most bankable cowboy is suddenly shooting blanks. (Hollywood Reporter)

Be sure to check out our Masters in Business interview this weekend with Liz Ann Sonders, Chief Investment Strategist, Charles Schwab & Co. Named “Best Market Strategist” by Kiplinger’s Personal Finance, she is also on Barron’s “100 Most Influential Women in Finance” every year since the list’s inception.

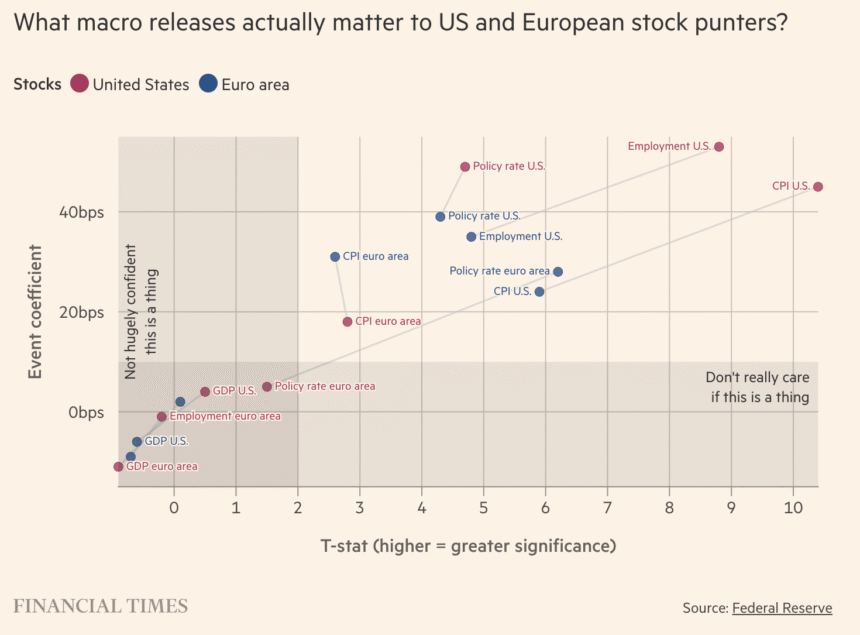

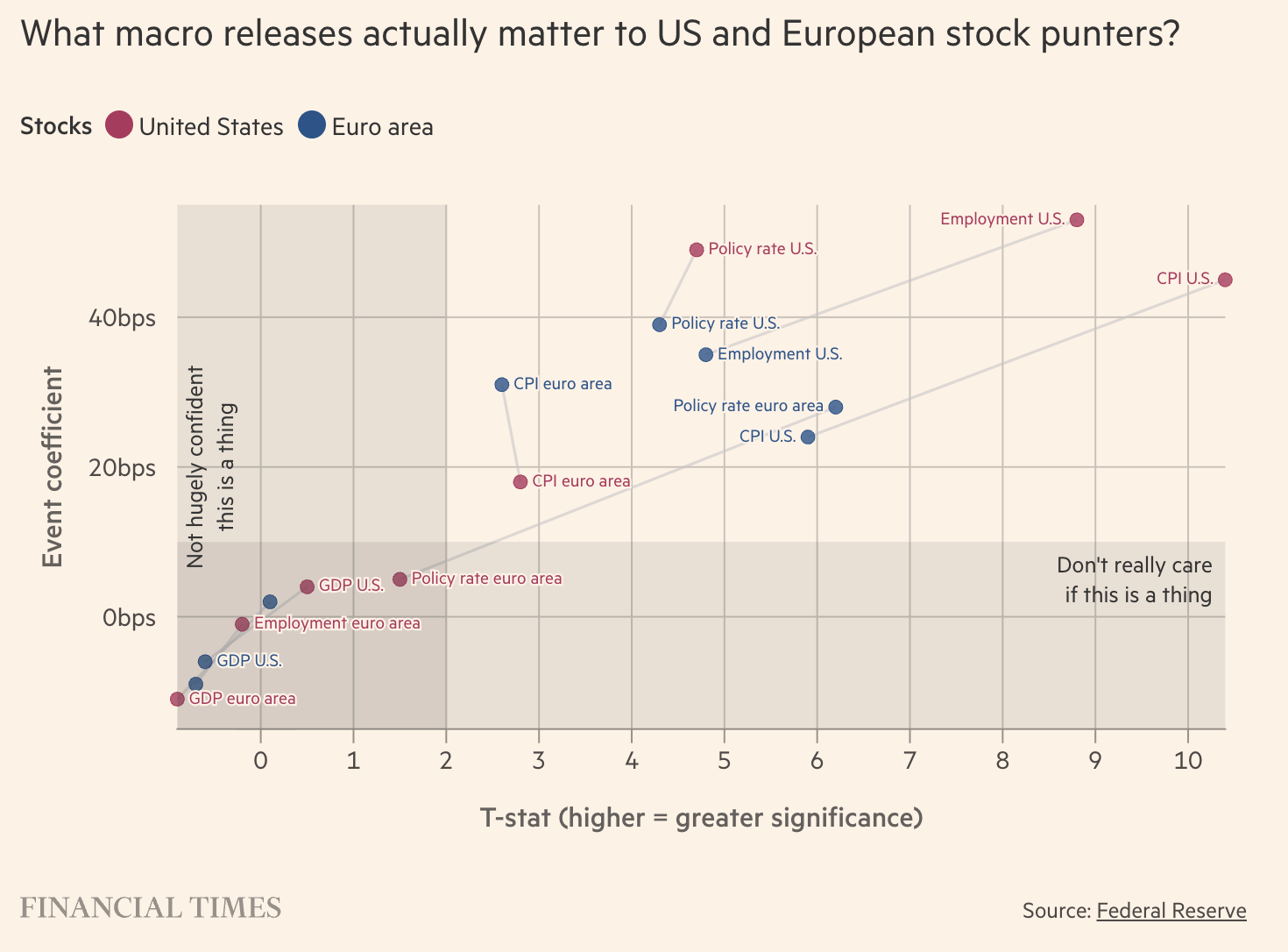

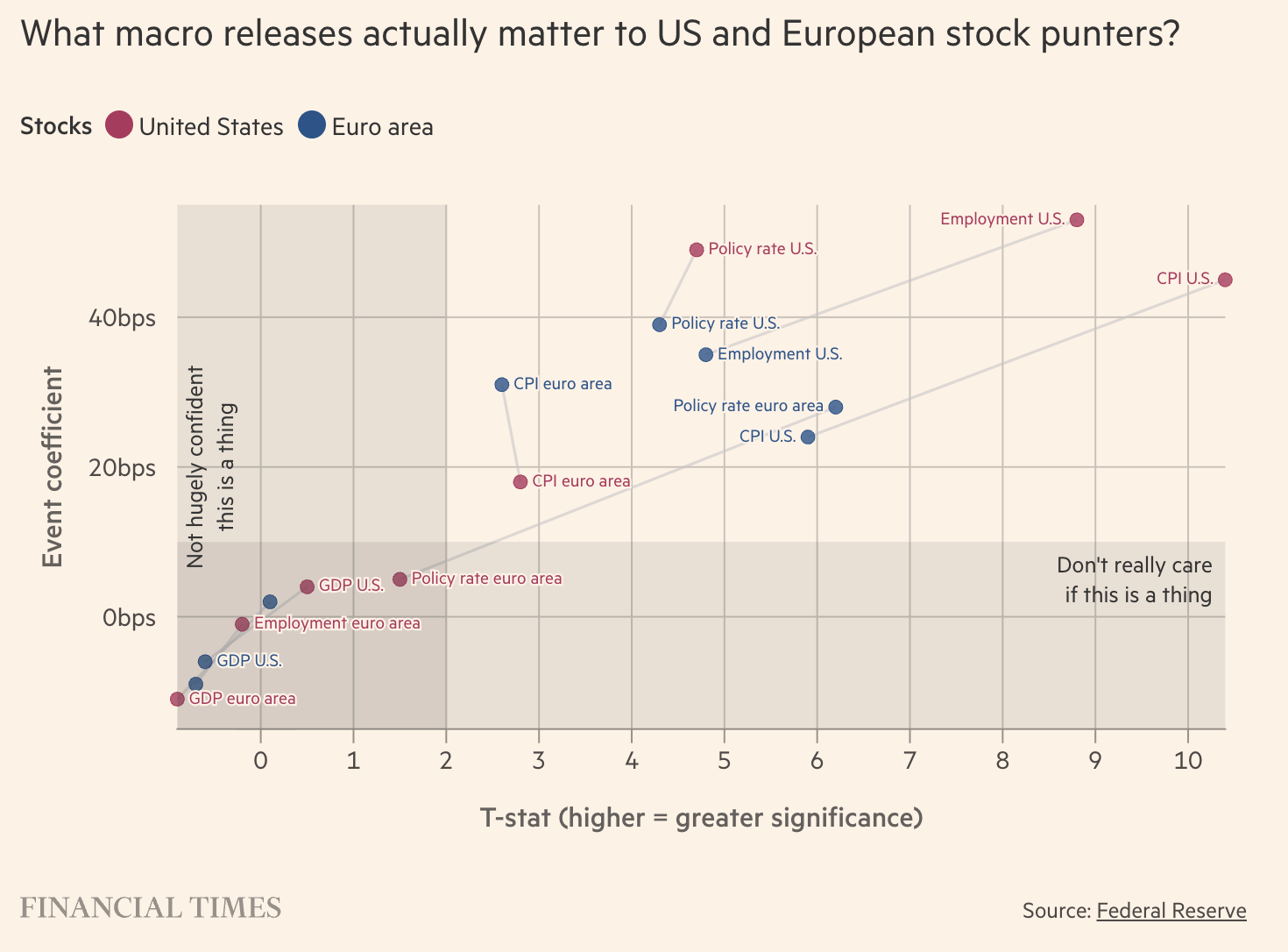

Turns out economic data *does* matter for stock traders

Source: Financial Times

Sign up for our reads-only mailing list here.