My morning train WFH reads:

• Hedge Funds Have a Reputation for Ruthlessness. Dmitry Balyasny Took a Different Approach. The Soviet immigrant and former day trader is competing head-to-head with bigger multistrategy rivals. (Institutional Investor)

• The Two-Speed Economy Is Back as Low-Income Americans Give Up Gains: High-earners and older Americans are faring better than ever, while fortunes are sliding again for low-wage and young workers. (Wall Street Journal) see also Thinking About the Role of Rich People: What is the specific role of the stock market itself as an engine driving growth and consumption. To what degree is spending sustained because there is some upper tranche of consumers sitting on huge financial market gains that are separate from their nominal income? To what degree does the US economy literally need the stock market to go up in order to keep growing? (Bloomberg)

• Prediction markets are booming. Oversight is barely there. Prediction markets once lived on the academic fringe. Now they’re trading billions on politics, sports, and celebrity gossip — under rules never designed for retail gamblers. (Citation Needed)

• Why is TikTok dangerous? Consider this scenario. The White House has granted another reprieve. Every day the app continues operating is a threat. (Washington Post)

• Lilly’s Obesity Pill Will Have Far-Reaching Effect, Doctors Say. Eli Lilly & Co.’s obesity pill achieved weight loss of 11.2% in adults with obesity and had side effects in line with the shots available today, doctors said. The tablet will make it possible to treat many more patients because it will be easier to produce, easier to use, and eventually perhaps also cheaper, the doctors said. Lilly’s pill is a small molecule that can be made quickly and cheaply and can be taken with less regard to food and drink, unlike Novo’s pill which is a version of the same peptide as its shots. (Bloomberg)

• The old SF tech scene is dead. What it’s morphing into is far more sinister. Column: San Francisco’s absurd, redundant startups are a relic of the past, features reporter Ariana Bindman writes. (SF Gate)

• How Trump’s Provocative Economist Crashed the Federal Reserve: Stephen Miran is poised to become first sitting White House official to join modern Fed’s board. (Wall Street Journal)

• Moon helium deal is biggest purchase of natural resources from space. The feasibility of moon mining is not yet proven, but the future of supercomputing may depend on the ability to extract Helium-3 from the lunar surface. (Washington Post)

• AI Startup Founders Tout a Winning Formula—No Booze, No Sleep, No Fun: To reach the dream of creating a trillion-dollar company, the 20-somethings flocking to San Francisco give up everything but their laptops. (Wall Street Journal)

• He is the best pitcher in baseball. He wants to be even more. Pittsburgh Pirates right-hander Paul Skenes is poised to win his first Cy Young Award at 23. At a pivotal time for the sport, his impact will extend beyond the field. (Washington Post) see also The Batting Champion Who’s Barely Hitting .300: Ted Williams, Tony Gwynn… Trea Turner?! The Phillies shortstop leads the NL in batting average despite hitting just .305 this season. (Wall Street Journal)

Be sure to check out our Masters in Business this week with Jaime Magyera, Head of U.S. Wealth & Retirement Business at BlackRock. She has driven the firms adoption of alternatives as a fast growing part of the Blackrock platform for advisors and RIAs. The firm manages over $11 trillion in client assets, and Magyera is a Wealth and Retirement divisions are a substantial portion of that.

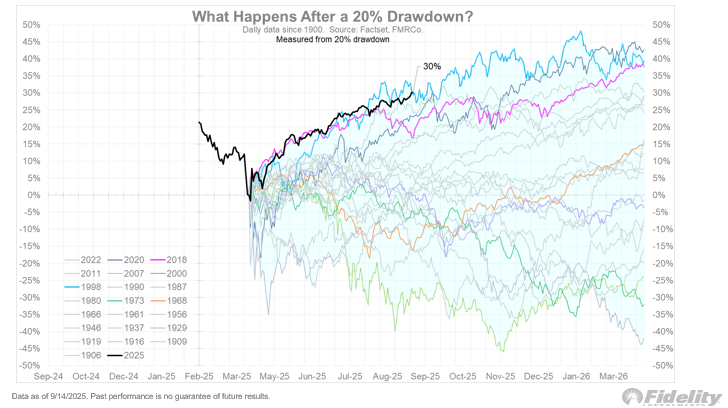

Fed cutting rates while animal spirits are rampant brings to mind the post-LTCM easing cycle in late 1998

Source: @TimmerFidelity

Sign up for our reads-only mailing list here.