The weekend is here! Pour yourself a mug of Danish Blend coffee, grab a seat outside, and get ready for our longer-form weekend reads:

• Why Doesn’t Anyone Trust the Media? Anatomy of a credibility crisis: Trust in the press is at a record low, with only a quarter of Americans aged 18 to 29 expressing confidence in media organizations. Jobs in journalism, meanwhile, are declining fast: since 2005, the United States has lost more than one third of its newspapers and three quarters of its newspaper journalism positions. Significant professional failures—from the flawed coverage of the COVID-19 pandemic to inadequate reporting on President Biden’s cognitive health — have sent audiences into ever-narrower silos of Substacks, podcasts, livestreams. (Harper’s)

• Boomers Are Passing Down Fortunes — And Way, Way Too Much Stuff: As the $90 trillion Great Wealth Transfer begins, millennials and Gen X aren’t just inheriting money. They’re being buried under an avalanche of baseball cards, fine china and collections of all sorts. (Bloomberg free) but see also Will Trump’s Trade War Break America’s Addiction to Cheap Stuff? The president has said American children should be content with two dolls instead of 30. But the country’s shopping habit has been built over decades of abundant imports from Asia. (Wall Street Journal)

• Big Tech Wants Direct Access to Our Brains: As neural implant technology and A.I. advance at breakneck speeds, do we need a new set of rights to protect our most intimate data — our minds? (New York Times Magazine)

• The Slop Cycle—How Every Media Revolution Breeds Rubbish and Art: The popularization of the term “slop” for AI output follows a centuries-long pattern where new tools flood the zone, audiences adapt and some of tomorrow’s art emerges from today’s excess. (Scientific American)

• Gold, guns and cartels: The battle for a billion-dollar mine: A gold mine in Mexico was taken over by the sons of the drug lord Joaquín “El Chapo” Guzmán. Mexican officials and generals said they would help an American businessman reclaim the mine — but demanded hefty bribes. For one man, reclaiming the mine was more than a business proposition. It was a reckoning with his past and a chance to pay back the orphanage that raised him. (Los Angeles Times)

• A Jane Street Alum Teaches Trading: Adverse selection is the concept that, conditional on getting to do a trade with someone, your trade might be worse than you’d previously thought it would be – that the world that you are looking at is one that has lots of different models that will explain different systems, and you can make predictions of what those models would output for numbers. But as soon as you are putting an order into a market, you need to think about the profitability of your trade, if it gets traded with, versus if it doesn’t. If it doesn’t, it profits zero. (Party at the Moontower)

• Michael Mauboussin on Capital Allocation: An essential part of creating value, and one of management’s prime responsibilities. Not all senior executives know how to allocate capital effectively. We review capital allocation alternatives in detail, including a novel discussion of intangible investments, and offer a guide for thinking about the prospects for value creation. We finish with a framework for assessing a company’s capital allocation skills, which includes looking at past behavior, calculating return on invested capital, an evaluation of incentives, and five principles of effective capital allocation. (Morgan Stanley)

• Private Equity/Credit: The Bubble and its Implications. The golden age of PE – at least from the standpoint of investor returns (AUM and fees to sponsors were significantly lower) – was during 1980-2000. During this era, PE delivered legitimately good returns – in some cases outstandingly so. What enabled it was that it was still a niche industry where there was a limited amount of capital chasing deals, while the backdrop was conductive. Asset prices were cheap after the savage inflationary 1970s bear market – a period that concluded with very high interest rates, depressed multiples, and much in the way of undervalued tangible assets (due to years of cumulative high inflation understating book values). The opportunity was ripe, competition was limited, and everything subsequently went right. (The LT3000 Blog)

• How to tolerate annoying things: Hassles are part of life, but the way we react often makes them worse. ACT skills can help you handle them with greater ease. (Psyche)

• How a ‘Bridesmaids’ star is channeling the ‘incendiary’ rage of Gen X moms: Rose Byrne rose to fame playing uptight women who are actually hot messes. Her latest role finds her spiraling into the existential terror of motherhood. (Washington Post)

Be sure to check out our Masters in Business interview this weekend with Bankim “Binky” Chadha, Chief US Equity & Global Strategist and Head of Asset Allocation at Deutsche Bank Securities, a role he has held since 2004.

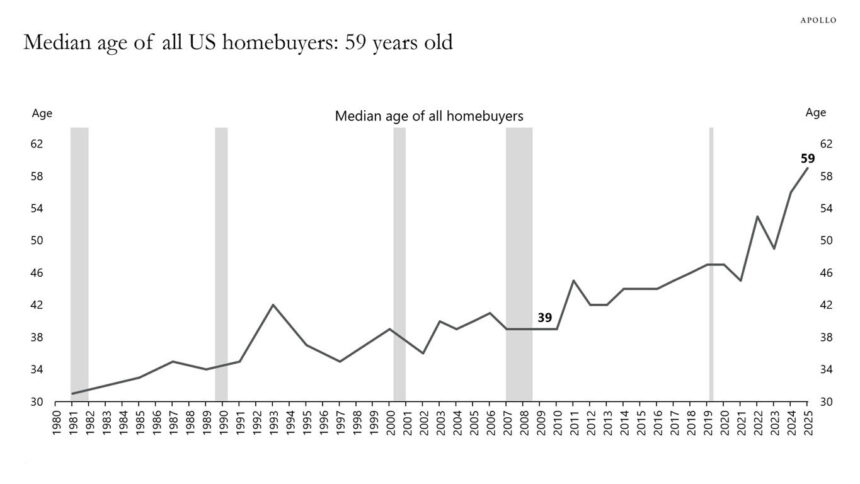

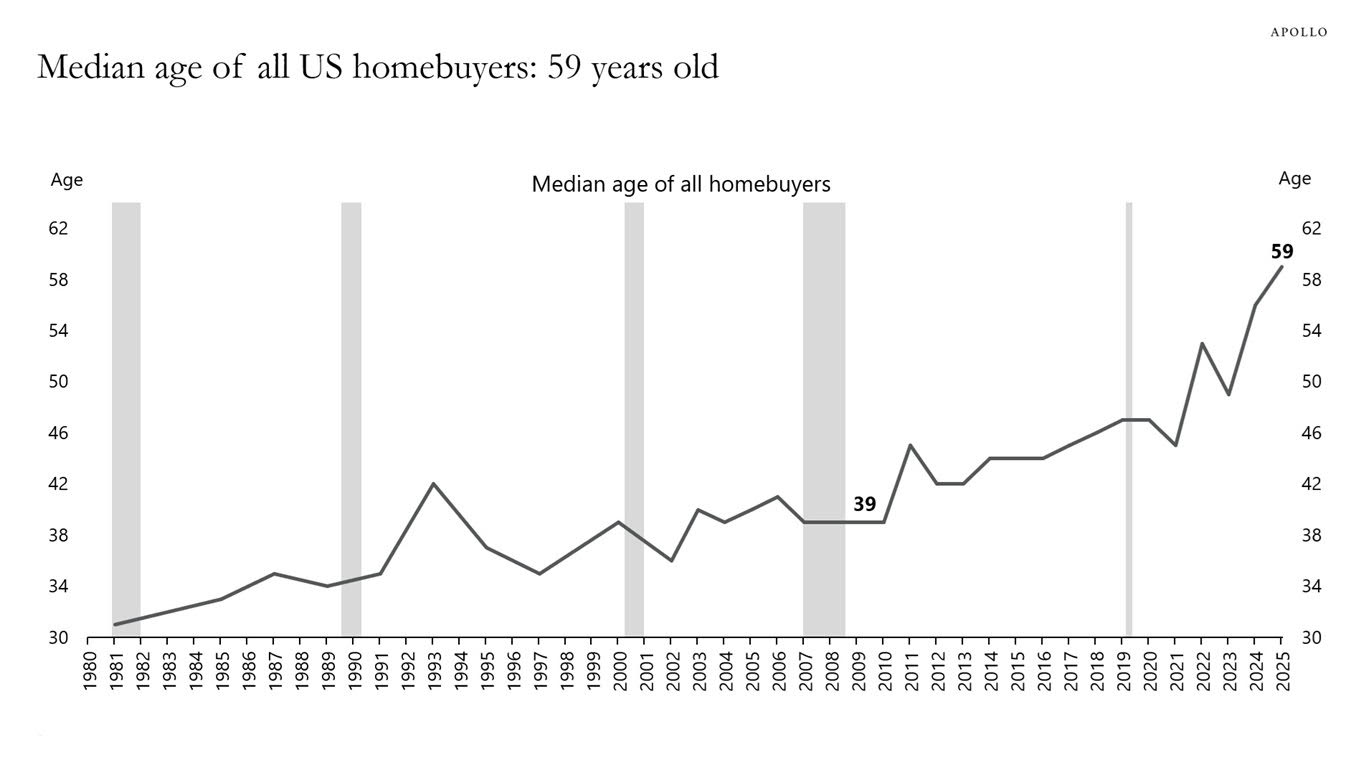

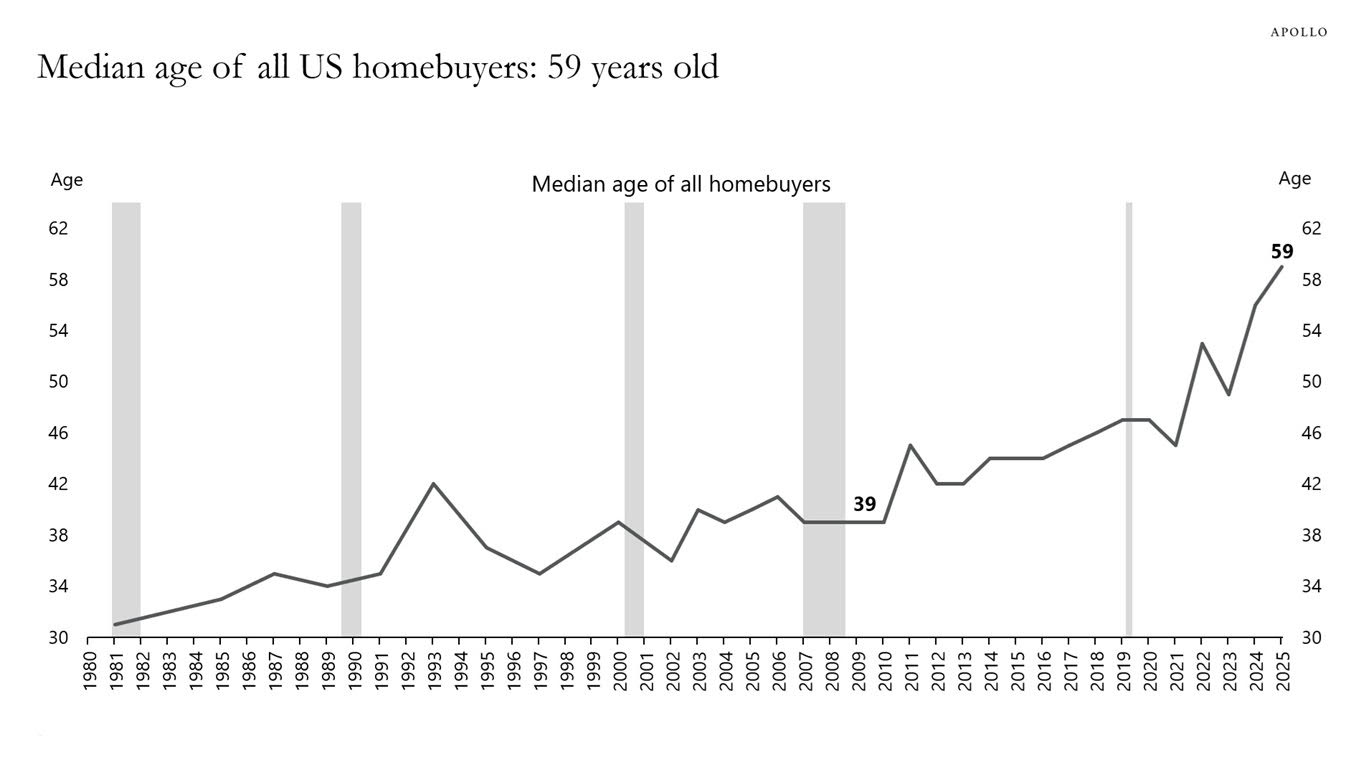

In 2010, the median age of all US homebuyers was 39 years old. Today, it is 59, see chart below

Source: Apollo

Sign up for our reads-only mailing list here.

~~~

To learn how these reads are assembled each day, please see this.