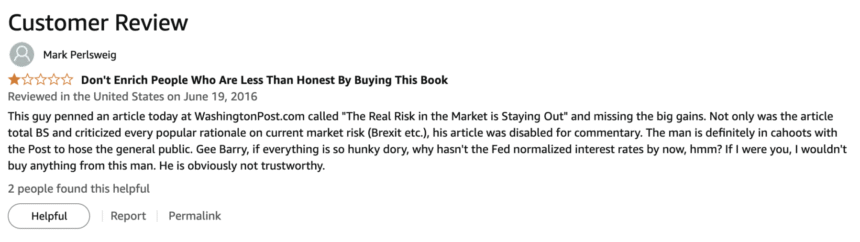

Nick’s Tweet sent me hunting to track down what eventually became my favorite negative review of “Bailout Nation.” My first book was published on May 26, 2009, but the review in question came seven years later in 2016, in response to a Washington Post column I had written: “The real risk in the market is staying out of it.”

My Fave 2016(!) Review of Bailout Nation (2009!):

Initially, I was outraged.

But soon after, I came to recognize something else that was going on. This transition from anger to annoyance to an “Aha!” moment occurred soon after I stopped to ask what motivated this person.

Ultimately, it became a teachable moment for me.

It forced me to (eventually) consider what was going on inside this person’s emotional state, their psychology, to say nothing of their portfolio. It made me think about the (not so) obvious pain they must have been in. Eight years after the Great Financial Crisis, seven years after the market bottomed and the publication of Bailout Nation, and three days after a Washington Post column, this person took the time out of their day, found my first book, and gave it a 1-star review.

What I first mistook for pettiness, I soon came to recognize as frustration, anger, and FOMO. I tried to imagine the post-Great Financial Crisis PTSD; perhaps they had sold in 2009 and never got back in. And along comes this jackass in the Washington Post telling people to STAY IN THE MARKET no matter what! No wonder this guy got so pissed off.

But I also could not help but wonder: Who did this affect? How often do we see something on TikTok, Twitter, or TV (or anything at random) that affects the reader personally and negatively?

How many people react emotionally to inputs like this? How much junk is everywhere, contributing to unhealthy changes in portfolio allocations?

~~~

I have been writing in public for over 25 years — I try my best to be thoughtful about who might read what I put out and how it might affect them. The Hippocratic Oath should apply to financial writers also: First, do no harm.

Too many people who publish market opinion and commentary veer into recklessness. Writers occasionally fail to consider how their words may affect others.

I spill a lot of ink in How Not To Invest discussing the many silly things people believe about investing, and how these “earworms” get into our heads. Bad ideas refuse to die, misinformation is everywhere, and a very profitable industrial complex has arisen to spread outrageous, inflammatory ideas — their business model IS clickbait. The mainstream media may be problematic, but social media is oh so much worse.

You can add Amazon reviews to the list of places where bad information circulates. For whatever reason, my 2016 WaPo discussion of the advantages of compounding and the dangers of market timing upset this person so much that they felt compelled to lash out.

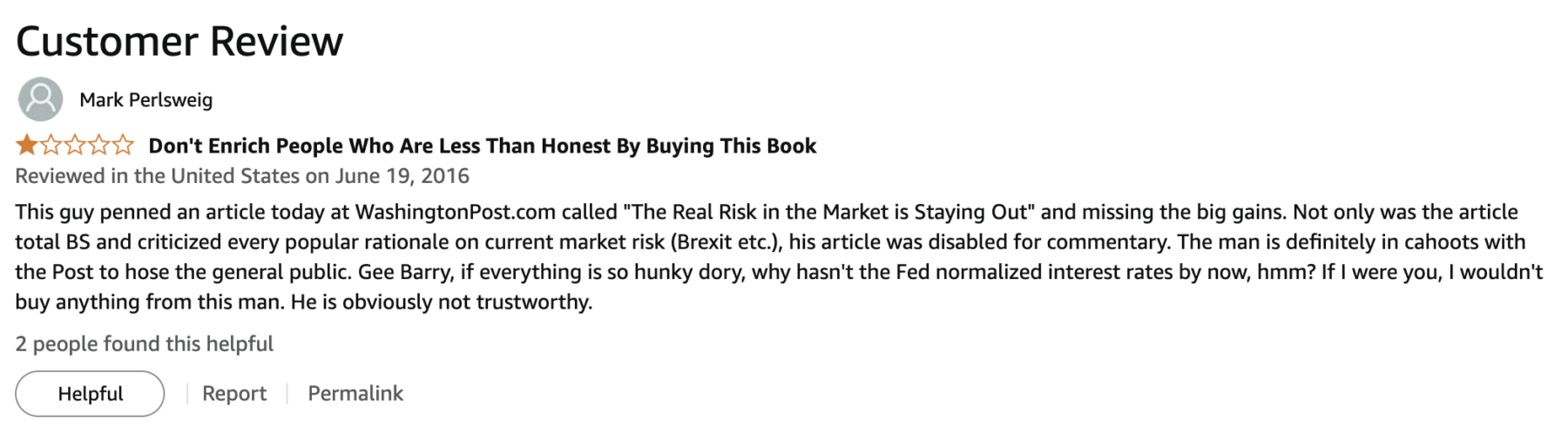

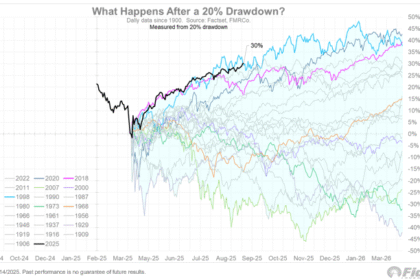

I feel bad for this guy,1 and whatever he was dealing with in 2016. But his problematic belief system and lack of understanding of news headlines seemed to have kept him from participating in equities. If he stayed with his beliefs that Brexit and other risks meant the market was too risky, it led him to miss a run that (as of today) is 202% in the S&P 500, and 421% in the Nasdaq 100:

All bull markets eventually come to an end, as this one surely will also. Make sure your investments don’t suffer from your attempts to time that, or for your fundamental misunderstanding of what drives prices over time…

Previously:

Priming Your Portfolio for a Crisis? You May Miss Out on Big Gains (June 25, 2016)

Never Take Candy from Strangers (June 9, 2025)

Nobody Knows Anything, The Beatles edition (September 26, 2024)

Nobody Knows Anything (Full archive)

Sources:

The real risk in the market is staying out of it (free mirror)

Barry Ritholtz

Washington Post, June 18, 2016

__________

1. Marc Perlsweig, please reach out at HNTI -at-RitholtzWealth.com