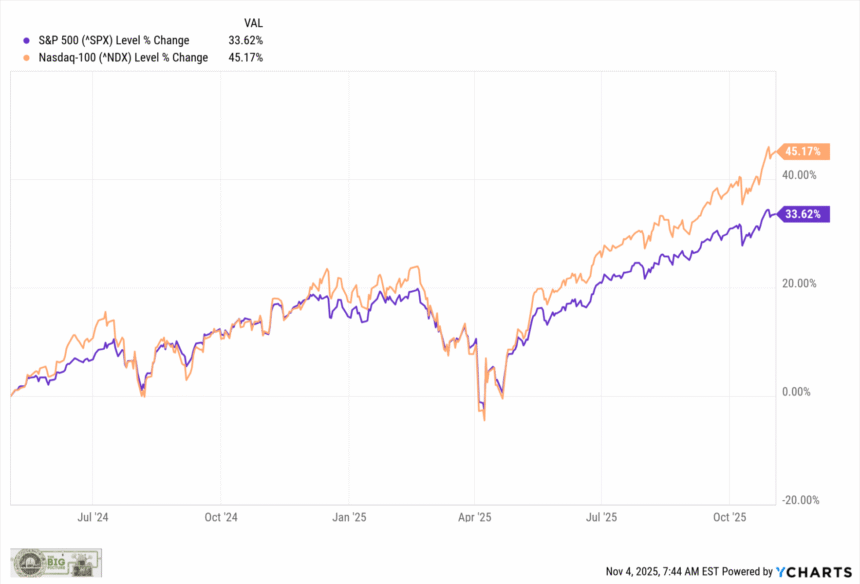

October, far from being the scariest market month, was strong pretty much anywhere you looked. There are signs that the economy is slowing, but equity markets shrugged that off — Rate Cuts! — and racked up their sixth straight month of gains. The 10-year Treasury yield fell to just above four percent at 4.08%. Precious metals also hit new all-time highs; Year-to-date, GLD shares were up 66% before pulling back 8.5%. And the US Dollar was strong in October relative to the rest of the G10 currencies.

If you want to find reasons to be concerned, there are plenty: Valuations are extended, AI bubble chatter is everywhere; the market is concentrated at the top and gains are increasingly narrow; there are some credit concerns and minor blow-ups; sentiment is ugly.

If today’s pullback has you concerned, be aware of your bias towards action: You want to do something — Anything! — in response.

This Action Bias is a cognitive foible that pushes you to act instead of think. You should be strategic in your planning, not tactical in your reactions. The goal is always to enhance your portfolio with high-probability decision-making.

That is not the result you derive from the bias towards action. Instead, it acts as a salve to reduce your anxiety as it gives you the illusion of control. Doing something makes you feel like you have influence over random events, which you decidedly do not.

If you have a plan and you follow it, you should be just fine. But be aware, this goes against millions of years of evolution that wants you to take action. We dislike inaction because it looks lazy and/or incompetent. The thinking is, doing something is better than nothing, even if that something is ill-considered and low-probability.

You probably shouldn’t do anything, but if you must do something, then consider these five things you can do that will satisfy your urge to action, but not affect your actual long-term investments:

1. Sell your speculative holdings. Many of us hold a few flyers, microcaps, and ill-advised tip stocks from our brothers-in-law. If you are truly concerned, consider raising cash in your Cowboy account, but leave your main portfolio untouched.

2. Look at Individual Stock Holdings: Even indexers sometimes accumulate single stocks. We buy these for a variety of reasons, including on rare occassions, ones that actually come true. But I bet a lot of your single stock holdings were purchased with specific catalysts in mind that have failed to materialize. If you bought something a while ago waiting for a new CEO, an analyst upgrade, FDA drug approal, M&A, a hot new product, or some other magic bullet — and it has yet to occur — then cut it loose. You can revisit it if you need to in the New Year.

3. Crypto: Sell your shitcoins now; if that doesn’t alleviate your concerns, consider reducing your Bitcoin/Eth holdings. I sold my Bitcoin last week; this wasn’t a market call or verdict on BITC, rather, I wanted some dry powder in case some opportunities opened up.

4. Sell Physical Gold: My wife has decades’ worth of broken bracelets, single earrings, clasps that no longer work, and jewelry she no longer wears. Over the past few months, we twice took a haul to our favorite local shop; we received one credit of $7,200, and another of $4,100. (Note to spouses: there is no free ride, and this will probably cost you more money.)

5. Update Your Plan: After run-ups of 16.5% in the S&P 500 and 23% in the Nasdaq 100, a down day of 1 to 2% should not make you nervous. Are you close to retirement, paying for College, or some other large financial expense? Perhaps your upset stomach is alerting you to the fact that your risk you have assumed and your immediate needs are not aligned. Consult with your advisor and review your long-term plan to determine if any adjustments are necessary. Note, this is not in response to market volatility but instead, your calendar and timing.

Making these modest changes will alleviate your desire to do something, but without having a major impact on your long-term plan.

To paraphrase the old line, “Don’t just do something, sit there.”

I discuss many of the biases we suffer from, and proffer suggested work-arounds, in How Not to Invest: The ideas, numbers, and behaviors that destroy wealth―and how to avoid them.”

It’s on sale at Amazon for -36% off: $21.19.

“Investment book of the year” –Stock Traders Almanac

“A thoroughly entertaining collection of short chapters that skewer experts, forecasters, the media and financial pundits.” –WSJ