‘Where the hell is the market risk?’

– Scott Bessent, United States Secretary of the Treasury

Whenever I hear policymakers point to rising markets as proof that their “policies are working,” it makes my Spidey-sense tingle. It should do the same to yours.

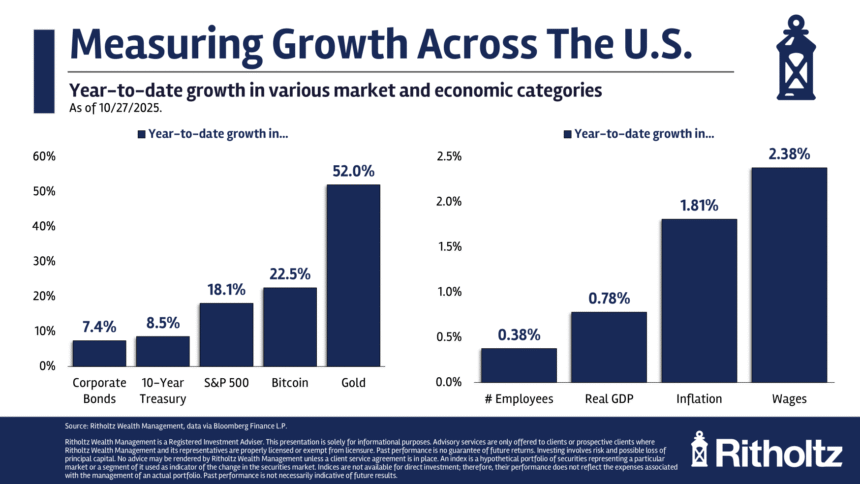

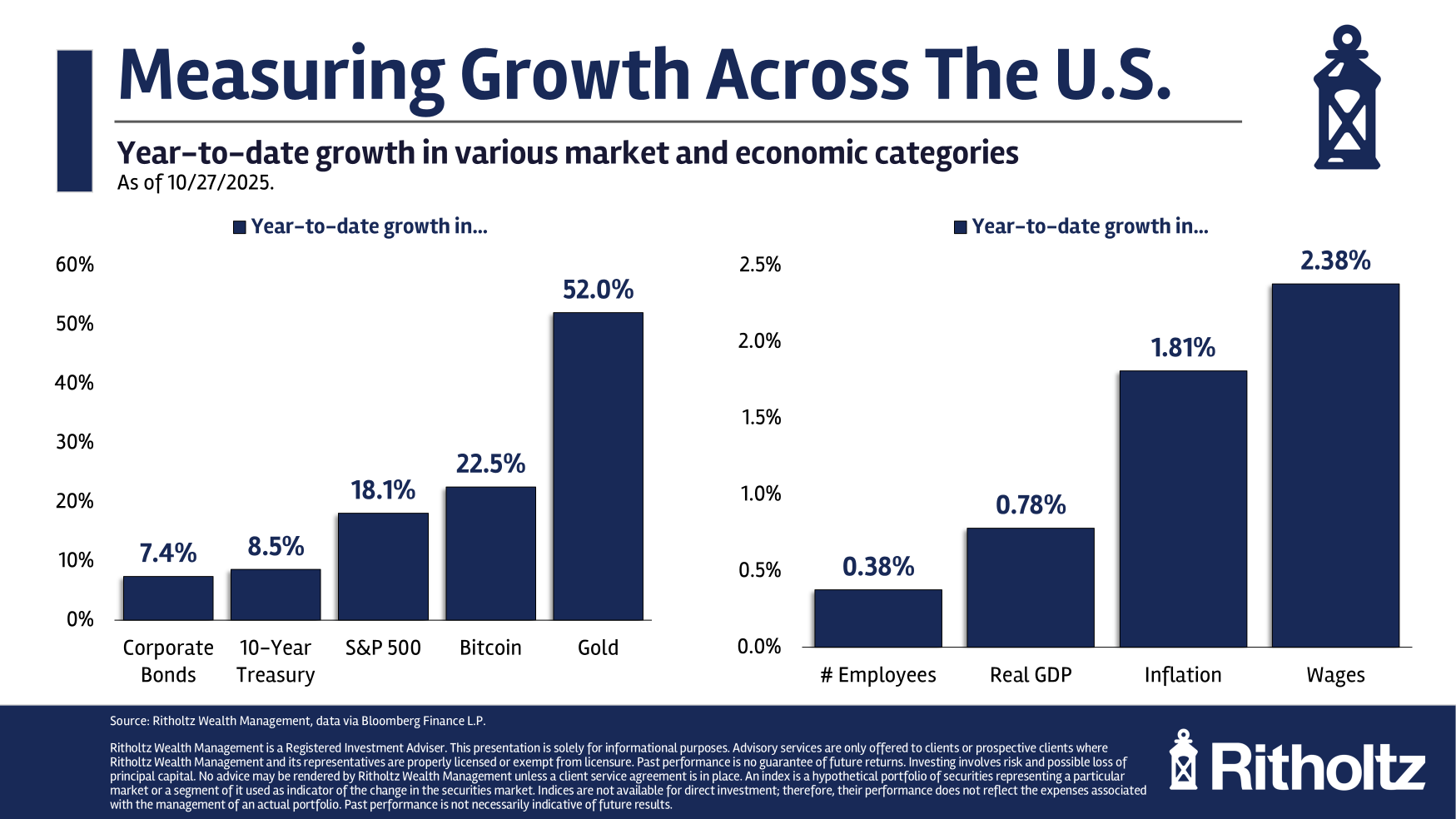

The current moment in time feels especially confusing. Crosscurrents of all-time highs in stocks, gold, Bitcoin, and real estate are offset by a range of aggressive – and potentially problematic – policies.

What’s an investor to do amongst all of these conflicting drivers?

My advice: Think about this moment in the broadest terms. Understand that where we are today is dependent upon where we came from and the route we took to get here. Recognize that two seemingly contradictory things can be true at the same time – markets can hit all-time highs in the face of policy decisions that are risky, but have worthy goals, while simultaneously seeming increasingly reckless, or raising the possibility of a recession, market crash, or worse.

Think back to January 2025:

-Markets had been enjoying a robust move upwards since bottoming in March 2009, with all indices breaking out to new all-time highs in 2013. The 2020 pandemic brought a 34% crash and an immediate “V-bottom” Q1 and Q2 of 2020.

-Massive fiscal stimulus during the pandemic (and afterward) on top of ZIRP’s ultra-low rates (until 2022) was highly constructive to higher equity and real estate prices.

-Artificial intelligence had been around for decades, grew rapidly in the 2010s, but it exploded after the introduction of ChatGPT in November 2022. That saw a massive surge in AI-related CapEx.

Oh, and the newly elected president, known as a fan of deregulation and tax cuts. Of course, the market entered 2025 hot as a pistol. The circumstances at the start of this year were so robust that well-regarded economists claimed there was a “0% chance of recession in 2025.”

Boiling the Frog: Since the year began, both the substance of policy and the implementation style have given investors pause. Liberation Day was a disaster, sending stocks into freefall. The only thing that halted the crash was the 90-day pause. That gave investors time to get used to a fairly radical tariff policy, unlike anything seen since the 1930s. The impact was muted (so far) because imports of goods are a relatively modest share of the overall economy.

There are lots of positives occurring, and these include:

Positives

All-time Highs Stocks, Crypto, Housing and Gold

Robust Economy

Tax Cuts

Lots of Capital availability

Mortgage Rates are falling

S&P500 Profits at all-time highs

Deregulation

Artificial intelligence will make companies more efficient

Private credit is broadly available

Inflation has off its 9% highs to 3%

The Federal Reserve is Cutting (ST) Rates

But there seems to be just as many negatives, and they are accumulating:

Negatives

Tariffs are an inflationary drag on economy;

They Alienate Allies and Trading Partners

Deficits continue to widen

Inflation remains sticky above 2% target

On/Off Policies Discouraging (Non-AI) Capex

Non-farm payrolls have fallen to barely positive

Firing Head of BLS (Kinda Legal?) and Fed Governor (Not Legal?)

Rollout of Tariffs was sloppy and poorly planned

Sending troops into cities divisive (perhaps illegal?)

Exec Branch Tariffs are unconstitutional (Article I, Section 8)

Challenge to Judicial Review and Rule of Law

US Population to have annual decrease for 1st time in history

Shut down amid political paralysis

Sentiment is extremely negative

I continue to see strong market gains and robust profits, even as economic activity decelerates and signs of stress appear.

As I noted in February of 2025, the odds of an avoidable, self-inflicted policy error continue to rise. For now, all-time highs in prices and profits outweigh all my other concerns.

But at a certain point, the frog will be boiled, and despite all of the positives, eventually, a mistake will lead to the trend cracking. Until then, we can only watch the data and wait…

Previously:

Might Tariffs Get “Overturned”? (July 31, 2025)

The Muted Impact of Tariffs on Inflation So Far (July 17, 2025)

Are Tariffs a New US VAT Tax? (March 31, 2025)

All Time Highs Are Bullish (June 26, 2025)

7 Increasing Probabilities of Error (February 24, 2025)